On 18 June 2024, the State Administration for Market Regulation (SAMR), which includes the State Anti-Monopoly Bureau, released the China Antitrust Law Enforcement Annual Report (2023) (the "Report"). This article provides insights into the antitrust enforcement activities and legislative developments that took place in China in 2023 and offer a forecast of what we can expect in the year ahead, taking into account the Report and the developments observed in the first half of 2024.

I. ANTITRUST ENFORCEMENT IN CHINA: 2023 YEAR IN REVIEW

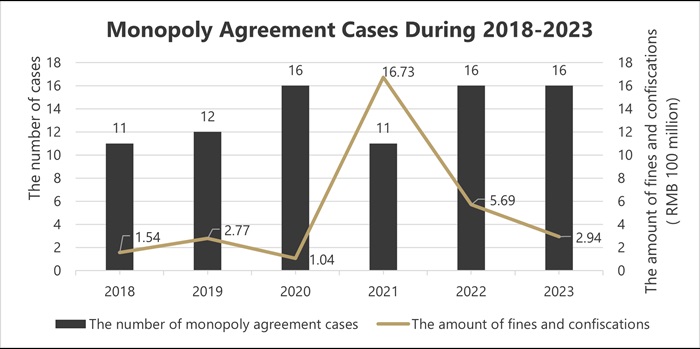

1. MONOPOLY AGREEMENTS

- In 2023, antitrust enforcement agencies concluded a total of 16 cases involving monopoly agreements, imposing fines and confiscations totalling RMB 294 million.

- The cases included various types of anti-monopoly behaviours, with horizontal price fixing (seven cases) and combinations of price fixing and market sharing (four cases) being prominent.

- Trade associations were frequently involved, with six cases, while the building materials sector saw four cases, highlighting a focus on these areas.

- The other enforcement actions spanned multiple sectors, including liquefied petroleum gas, insurance, and pharmaceuticals, reflecting a broad regulatory scope.

These cases reflect SAMR's continued focus on cracking down on cartel behaviour, particularly those organized by trade associations, and safeguarding consumer welfare and market competition in key industries.

Data resources: the statistics are sourced from the China Antitrust Law Enforcement Annual Reports (from 2019 to 2023).

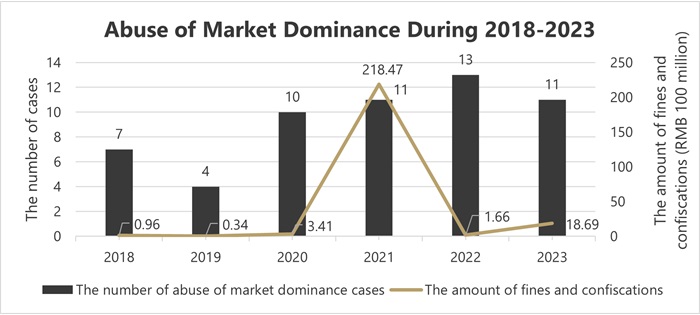

2. ABUSE OF MARKET DOMINANCE

- The year 2023 saw 11 cases addressing abuse of market dominance, with fines and confiscations totalling RMB 1.869 billion.

- The pharmaceutical sector and public utilities, such as water and gas supply, were the primary focus, with five and four cases respectively.

- Various forms of abuse were penalized, including charging unfairly high prices and imposing unreasonable transaction conditions or restrictions to deal, tying, and differential treatment.

These cases demonstrate SAMR's sustained efforts to curb the abusive behaviour of dominant market players, particularly in the pharmaceutical and public utility sectors where market competition is relatively weak and public interest is at stake.

Data resources: the statistics are sourced from the China Antitrust Law Enforcement Annual Reports (from 2019 to 2023).

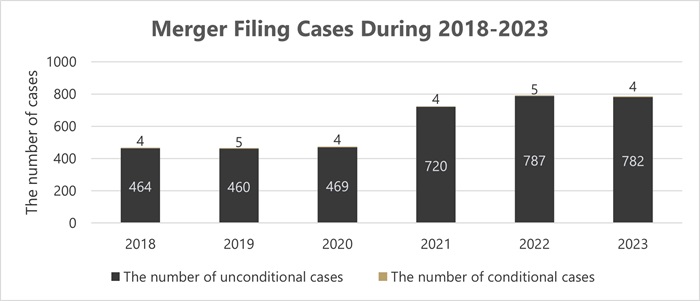

3. MERGER CONTROL

- A substantial number of merger filing cases, 797 in total, were processed, with the vast majority receiving unconditional approval.

- The average review period was slightly reduced to 25.7 days.

- The majority of the cases were simple cases and were concluded at the first phase of review.

- The cases involved both domestic and overseas undertakings, with domestic mergers and acquisitions being more active.

- The manufacturing sector (including chemical products, automobiles, computers, electronic equipment, and pharmaceuticals) was particularly active in mergers and acquisitions, followed by other sectors such as wholesale and retail, transportation, water, electricity, gas and heat production and supply, finance, real estate, and information technology services.

- The transactions involved horizontal, vertical, and hybrid concentrations. Specifically, there were 417 cases of horizontal concentration (53%) involving competitors in the same sector, 311 cases of vertical concentration (40%) involving upstream and downstream enterprises, and 191 cases of hybrid concentration (24%) without a horizontal or vertical relationship.

- Equity acquisitions were the prevailing transaction mode, constituting 56% of the total, followed by the establishment of joint ventures, which accounted for 34%.

These cases indicate that SAMR has been streamlining its merger review process, lowering the threshold for market entry, reducing transaction costs, and enhancing enforcement efficiency, while also paying attention to the potential anti-monopoly effects of certain transactions in key sectors.

Data resources: the statistics are sourced from the China

Antitrust Law Enforcement Annual Reports (from 2019 to

2023).

II. LEGISLATIVE DEVELOPMENTS IN 2023

In 2023, China made significant progress in improving its antitrust legal system and rules, as follows:

- Amendments were made to the Provisions of the State Council on Thresholds for the Declaration of Concentrations of Undertakings, aimed at facilitating market entry, reducing transaction costs, and fostering investment and mergers and acquisitions.

- Five antitrust regulations were revised, covering a range of

prohibitions from monopoly agreements to the abuse of intellectual

property rights. These five regulations are:

- the Provisions on the Prohibition of Monopoly Agreements;

- the Provisions on the Prohibition of the Abuse of a Dominant Market Position;

- the Provisions on the Prohibition of the Abuse of Administrative Power to Exclude or Restrict Competition;

- the Provisions on the Prohibition of the Abuse of Intellectual Property Rights to Exclude or Restrict Competition; and

- the Provisions on the Review of Concentrations of Undertakings.

- The Antitrust Guide for Industry Associations was introduced, providing clarity on compliance expectations for industry associations.

III. LOOKING AHEAD TO THE SECOND HALF OF 2024

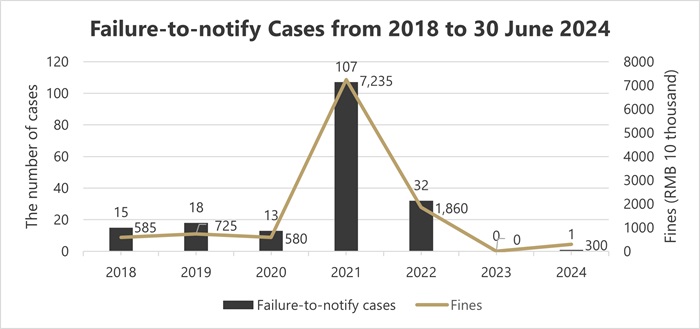

In terms of antitrust enforcement, during the first half of 2024 (as of 30 June 2024), antitrust enforcement agencies handled the following cases:

- Monopoly Agreements: Four cases were investigated and addressed, resulting in fines and confiscations totalling RMB 7.18 million. Among these cases, three involved industry associations, while one was related to the building materials sector.

- Abuse of Market Dominance: Two cases of market dominance abuse were dealt with, leading to fines and confiscations amounting to RMB 1.75 million. These cases were observed in the pharmaceutical and water supply sectors.

- Failure to Notify: One case involved the failure to notify the establishment of a joint venture between Shanghai Highly (Group) Co. Ltd. and Qingdao Haier Air Conditioner Co. Ltd. SAMR imposed fines of RMB 1.5 million on each of the two parties involved. Notably, this case marked the first instance of punishment following the increased fine amount introduced after the amendment of the Anti-Monopoly Law (AML) in 2022.

Data resources: the statistics are sourced from the China

Antitrust Law Enforcement Annual Reports (from 2019 to

2023).

Regarding the legal system and rules, there have been recent developments:

- On 17 June 2024, SAMR issued the Guidelines for Review of Horizontal Concentration of Undertakings (Draft for Comment), signalling a move towards enhancing the rules, regulating the process, and increasing transparency in merger filing reviews.

- On 24 June 2024, the Supreme People's Court released the Interpretation of Several Issues Concerning the Application of Law in the Trial of Civil Cases Concerning Anti-Monopoly Disputes (the "Interpretation"). The interpretation, effective from 1 July 2024, provides crucial guidelines for antitrust civil litigation, covering both procedural and substantive aspects.

Looking ahead, it is anticipated that antitrust law enforcement agencies will continue to strengthen their enforcement efforts in sectors such as medicine, building materials, and public utilities. Special attention will be given to the monopolistic practices of industry associations, with a focus on guiding these associations and enterprises to enhance their antitrust compliance measures.

In transactions involving the concentration of undertakings, the proportion of transactions triggering the new thresholds is expected to decrease. Additionally, antitrust enforcement agencies will prioritize key sectors and relatively larger transactions.

Against the backdrop of the ongoing reinforcement of antitrust law enforcement and the continuous improvement of institutional rules in China, enterprises are encouraged to establish proactive antitrust compliance systems tailored to their revenue scale and sector characteristics. Such systems should help regulate the conduct of both enterprises and employees, mitigate legal risks, and promptly engage external lawyers for assistance when necessary.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.