Your volume of work is increasing and the long-term outlook is cautiously optimistic. All you need to do is make sure the equipment holds up and your crew can squeeze the best out of it. The question is—how can you get your lender or financial institution to understand that you could be doing even better if you had newer equipment?

If you are thinking along these lines you are not alone. The issue is a real one when deciding when and how you are going to make significant equipment upgrades. How do you re-capitalize equipment and acquire new and more productive equipment after you've had a few tough years of operations? If you take a step back, the real issue to consider is what your bank or financial institution is looking for from you and from your company. There is no simple answer, and there is no one-size-fits-all set of guidelines.

Sound operating history

A number of operational considerations must be considered. David Durante, Caterpillar Financial, states that a key lending consideration for him is a good work plan and a go-forward strategy. Operators can't just put their heads down and go to work; they need a direction, a plan and strategy. Similarly, Ron Forster, Commercial Account Manager for RBC, relies on past history and an understanding of operational performance and structuring of financing to assist with lending decisions. Both Dave and Ron stress the need to review operational factors when considering lending: your work plan, profitability and past experiences. However, key questions remain. How does the company's balance sheet look? And how much equity does the business owner have in the company?

What is equity?

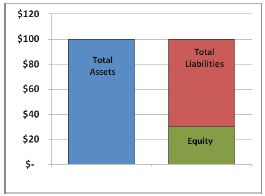

In order to understand what equity is, it is important to describe what is on your balance sheet: assets, liabilities and shareholder equity.

Assets are anything with value that your business owns. These are current assets, property, plant and equipment (PP&E) and other assets. A key issue is that PP&E will decrease in value (depreciate) over time due to wear and tear. The financial statements attempt to reflect this reduced value by showing a net asset value after amortization. It is important to note that this estimated book value does not reflect the true market value of your assets. Anyone currently owning a Madill 124 grapple yarder will be well aware of this fact.

Liabilities are company debts or obligations to outside parties and may also include shareholder loans, which represent monies the company owes the owners for their contributions. If the shareholder postpones repayment of any shareholder balances, the bank will often consider these amounts as equity, effectively considering it your direct investment in the company.

Equity: one's total assets always equals the total liabilities plus equity.

Figure 1: Balancing a company's 'balance' sheet

In other words, your company's equity is equal to the value of its total assets minus its total liabilities. If the business assets are greater than the liabilities, then the equity of the business is the positive difference between the two numbers. If your total liabilities exceed assets, a deficit is created. Another way to look at equity is what you own versus what you owe. This equity could represent cash built up from operating profits, or it could represent the portion of equipment assets that are debt-free.

A key point is that your balance sheet and the equity position shown are based on book values and not market value. For example, used logging equipment may have a market value that is higher than what is shown on the company's books. As a result, companies may have more equity to lend against than the balance sheet indicates.

I need new gear! Why do I care about equity?

The answer is easy. The person lending you money cares about equity! When looking to purchase a new piece of equipment the perspective that matters most is that of the lender. It might seem like banks will never lend money unless you already have enough money that you don't need it, but can you fault them for not wanting to take all the risk in a transaction? One of the bank's primary concerns is managing its risk. It is, after all, their money. If things go wrong and your company cannot make loan payments, will the bank get any of its money back?

In a way, equity is a measure of risk management for the bank. The more equity that your company possesses, the less risky it is for the bank to lend to you. As well, the more equity you have accumulated in the business the more likely you are to be committed to making the venture work and ultimately pay the bank back.

Can I borrow against equity that is not on the balance sheet?

The answer to this question comes down to the quality of your relationship with your lender. Mike Low, Director of Forest Industry Business for Scotiabank, stresses the importance of companies having a good relationship with the bank. Inevitably "things" will happen but if a relationship is established and a track record exists, it is much easier to assist. And with a history and an understanding of operations, it is much easier for the bank to make decisions around its risk tolerance.

So the question is, will banks lend on equity that is not on the balance sheet? In the case of the Madill 124, where the market value of an asset can be justified through an appraisal, lenders will be willing to lend against the asset. Will all lenders be interested in this, for all clients? No. Dave Durante, Caterpillar Finance, has indicated that they will entertain these types of deals as Caterpillar is committed to working with the forest industry. However, they will only entertain this option in select relationships. Again, a focus on trust and history.

Of note for some is the Bill – 13 contract which may or may not sit on the balance sheet. This is referred to as an intangible asset. It supports the existence of operations and ability to generate cash flows. However, the benefits arise from the contractual or legal rights it confers to the holder. In most cases lenders will not be willing to lend against the contract value; however, they will take it into consideration when evaluating the overall financial condition of the company.

Lease or buy? Both are good options if done right.

When it comes to getting new equipment, both leasing and buying are good options and have benefits. What you should choose depends on your situation and the timing of the acquisition. The reversion back to GST from HST on April 1, 2013 complicates things further for those looking to acquire road building equipment or logging trucks.

Leasing may potentially offer easier access to financing, but you must consider the impact to your financial statements. Are you building equity in your equipment or simply making payments? If you're able to get into equipment leases with a minimal down payment it is often a good fit to keep things moving. However, owners should be careful of depending on leases when there is a minimal build-up of equity. Ron Forster of RBC cautions that growth fuelled by operating leases or highly financed equipment often leads to balance sheets with nominal equity. This leaves little financial flexibility to restructure debt or provide working capital financing and makes the company vulnerable to any unforeseen challenges. If leases are structured well, a capital lease offers similar tax and cash flow benefits as a straight financed purchase. Leasing and financing are both good options as long as they are structured well and provide you with flexibility.

Final thoughts

Recapitalizing your equipment as it gets older presents challenges. Ensuring that you are taking into account long-term impacts as well as current cash flow considerations will be an ongoing challenge. Maintaining a good working relationship with your financer is part of the challenge and ensuring that your cost structure for operating takes into account long-term replacement costs is crucial.

This article was initially published in the Fall 2012 issue of Truck Logger BC Magazine.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]