PwC's POINT OF VIEW

"Where have all the cowboys gone..."

Juniors are echoing the lyrics of Paula Cole's 1997 Grammy nominated hit with their own cry: "Where has all the financing gone..." Regrettably, for many juniors their search is far less romantic and lyrical; instead, their search is much more tragic, for some a matter of life or death. Dramatic – yes – but it's a sentiment which packs a lot of truth.

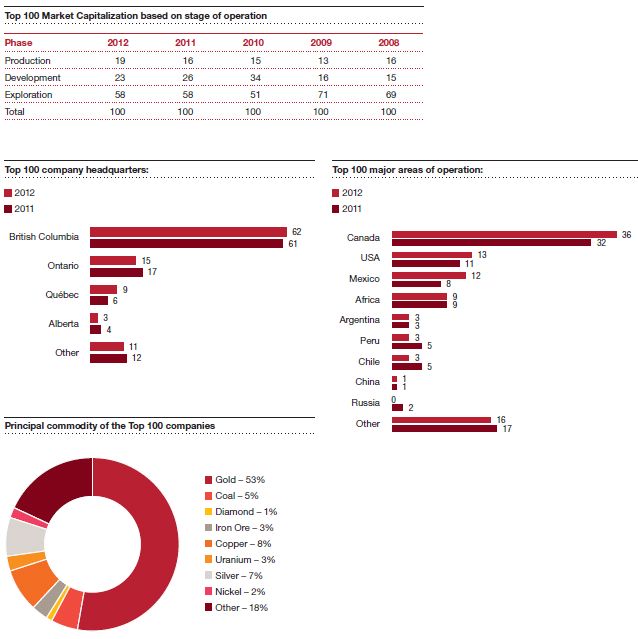

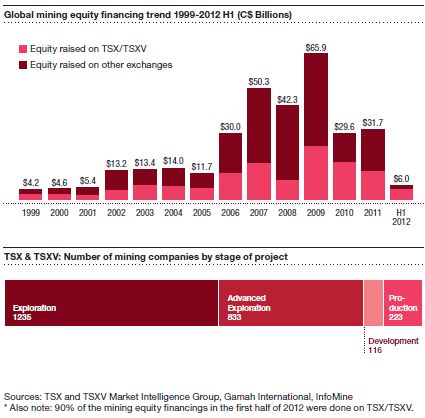

This year's Top 100 TSXV mining companies saw a 52% decrease in debt and equity financing compared to 2011's Top 100 junior mining companies. Investors are skittish; wary of the volatile market. They aren't looking to add more risk to their portfolios; instead, they are risk adverse and shying away from investments with a high risk-reward ratio. Unfortunately for juniors, this is their "sweet spot".

Investors are also demanding more, seeking to get more out of their investments. And we literally mean more – they're showing investment bias toward companies who have strong dividend policies or are announcing creative ways to give shareholders increased exposure to high commodity prices. This is another strike against juniors. Juniors don't pay dividends. Only one company in this year's Top 100 paid a dividend.

The market capitalization of 2012's Top 100, which declined 43% compared to 2011's Top 100, reflects a volatile market, populated with skittish investors who want greater returns. On average, producers were the only ones in the Top 100 not to face a significant decline in market capitalization.

So what does 2013 have in-store for juniors?

Due to low valuations, we may see juniors get gobbled up by mid-tiers or seniors hoping to acquire junior miners at discounted prices. While there may be willing buyers in the market, willing sellers will prove tough to come by. With memories of their company's 52-week high still fresh in mind, many CEOs won't stomach the valuations offered up by interested buyers. To get juniors to bite, mid-tier and senior mining companies will have to increase their premiums – partially defeating the upside of depressed valuations – or engage in a robust game of chicken. Who will blink first, buyers hungry for a good deal or sellers watching their cash deplete? We see the best opportunities for juniors mining gold. We have seen a recent bout of deals completed with juniors in the gold sector – drawing above average deal premiums. This doesn't necessarily mean we can expect this spell to continue; instead, with elevated expectations for high deal premiums, matched with marching orders to conserve cash – mid-tier and senior miners may not be able to meet the optimistic expectations of gold juniors.

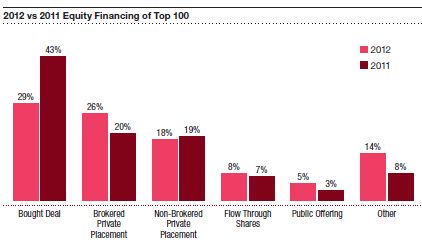

Bought deals, which were by far the most popular form of financing for 2011's Top 100, totalling 43% of all equity raised, only accounted for 29% of equity raised in 2012. Giving up on conventional forms of financing, in 2013, expect to see more and more companies start to aggressively chase alternative forms of financing.

For juniors able to raise financing, anticipate foreign investment continuing to be an important part of many junior's growth strategies in 2013. Look for an increase in "toehold" investments – investing in slightly less than 10% of issued and outstanding shares, foreign investors are able to avoid being labelled an "insider" under applicable Canadian securities laws. As a result, investors don't need to publically disclose their investments. We can also look forward to an increase in investments by foreign non-mining companies. Recently, many of the large vertical integration arrangements have specifically involved Asian steel companies. These deals are typically structured to account for less than 20% of the issued and outstanding shares of junior miners, and when married together with a joint venture interest, bring the economic investment to 50%.

While in the last two years the major Asian investment story for juniors was steel companies investing in the Labrador Trough, we expect that in 2013 we will see Asian investment in Canadian gold companies. We also expect to see platforms being developed so smaller Chinese state owned entities can invest in TSXV listed mining companies. Finally, significant suppliers to the mining industry could make investments in juniors in return for supply contracts.

Other juniors with multiple projects with excellent potential may look to divest one project to raise cash to allow them to move their other project(s) forward. Also, keep an eye out for mergers-of-equals. Companies looking to get more reasonably priced financing may join forces with another miner to increase their overall valuation via a boost in the total ore in the ground.

Whatever the scenario, recent IPO successes, deal activity and improving trading volumes point to a financing turn-around for junior miners in 2013. So hold-on, don't give up. If you can survive this tough financial market, chances are you'll thrive. The long-term fundamentals for mining remain strong, providing miners with many promising years to come.

John Gravelle

Mining Leader for the Americas

PwC

TOP 100 HIGHLIGHTS REEL

Canada, Gold, British Columbia and Production Companies increase their lead`.

FINANCIAL HIGHLIGHTS

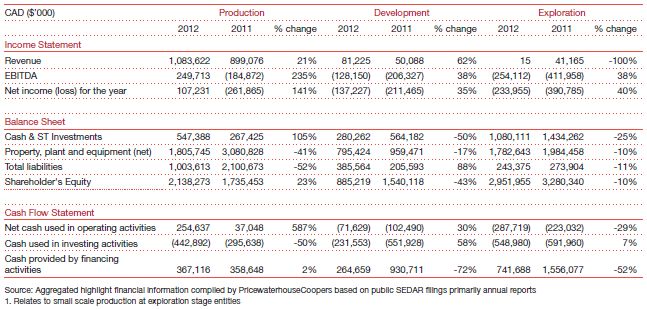

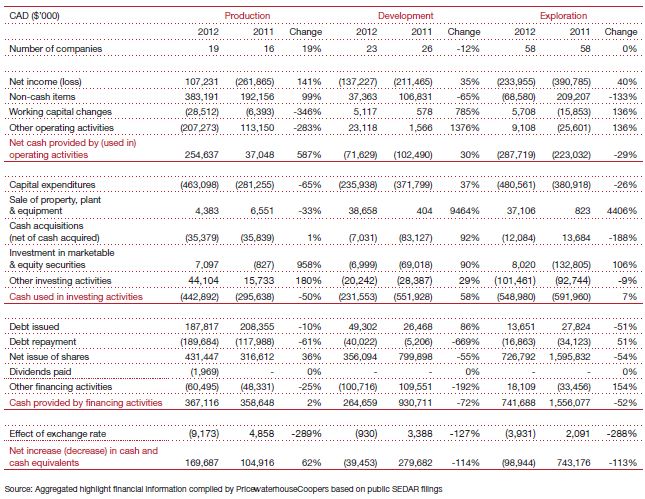

The financial highlights for the Top 100 companies included in our analysis are summarized below.

Contraction across the junior sector...

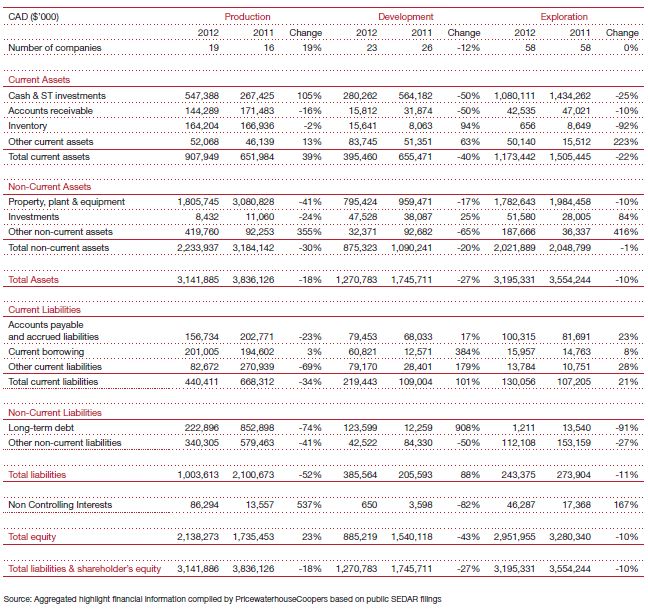

Property, plant and equipment – In 2011, Anooraq Resources accounted for almost $1 billion in PPE and total liabilities. In 2012, they're no longer one of the Top 100, contributing to the significant decline in PPE across all phases – production, development and exploration.

Total liabilities – Significant contributors to the decline in total liabilities include Anooraq Resources ($973 million), Rusoro Mining ($307 million), and Dia Bras Exploration ($236 million).

Cash flow – In 2012, cash flow from financing experienced a significant decline, which is in line with the slump in the overall financing market. Equity financing, raised by 2012's Top 100, decreased by a troubling 41% totalling $1.6 billion compared to $2.7 billion raised by 2011's Top 100 juniors.

JUNIORS HAVE PROVEN TO BE RESILIENT

Interview with John McCoach, President of TSX Venture Exchange

Last year, when we asked him to share his thoughts on the venture market for mining in Canada, John McCoach, President of TSX Venture Exchange (TSXV) stated, "Perhaps most significant is the strength in financings," noting that in the autumn of 2011 mining financings on TSXV far exceeded numbers for the same period in 2010. "At this rate we may see a record year for mining financing on TSXV that will exceed the almost $5.3 billion raised in 2010." And he was indeed correct, as financing for 2011 reached a total of $5.9 billion. However, in today's global economy, things can change very quickly: thus far in 2012, equity financing raised by this year's Top 100 decreased by a troubling 41%.

Macroeconomic pullback is driving investors to hold on to or cash in their investments, leaving junior miners feverishly looking for new sources of financing. Recently, Michael Cinnamond, PwC's British Columbia Mining Leader, sat down with John for a 2012 update and to discuss the vastly changed financing market and how TSXV is responding to the needs of miners in this challenging market.

"Junior mining companies have proven to be resilient," says John. Despite the troubling financing headlines populating newspapers, John is optimistic. Whether demand for precious and base metals decelerates a bit or continues on the growth trend we've seen in the last several years, John fully believes mining is still an attractive business to be in – especially within Canada.

That's a statement you might expect from the president of an exchange that, combined with its sister exchange, TSX, is home to 58% of the world's publicly listed mining companies. But to be fair, while John is not shy to discuss the efforts taken by TSXV to promote the Canadian markets internationally, it's the regulatory environment in Canada and strong base of industry leaders whom he points to as the main reason Canadian companies have fared so well during this economic downturn. "We have a significant advantage in Canada. For example, when it comes to securities regulation, we have a well-respected and appropriate balance between providing companies access to capital while protecting investors," shares John. The Canadian mining sector has gained a lot of credibility thanks to National Instrument 43-101, which became effective February 1, 2001. "If you asked mining companies, I believe they would say our policies set a high standard, but they wouldn't have it any other way – they want to be in a market that has credibility," says John. Even though we're going through a consolidation cycle, John believes our capital markets are well positioned for when the next cycle comes back.

But what is being done to help juniors until the markets turn around? When your balance sheets are bleeding, actions speak a lot louder than words. TSXV fully acknowledges this, and as a result has instituted some temporary relief measures. "We recognize that mining companies are having a difficult time raising capital and we are taking steps to ease some of the pain," says John. TSXV has introduced policy waivers that allow for companies to have a little more latitude in accessing capital. "In certain circumstances, companies can now do a financing at less than a nickel," says John. For example, the exercise price on warrants financings have been a minimum of ten cents, but in the recently released relief measures, TSXV has reduced the minimum to five cents for the first year of a warrant. The relief measures also address the exercise price on convertible debentures. "We acknowledge that it's not a silver bullet and it's not going to help every company, but the feedback we're getting from miners is that it's helping, and that they really appreciate it," shares John. "It is important that we be responsive to existing market conditions. We need to work with customers to find the right solutions in given situations."

The overall message to junior miners is an optimistic one. "I think trading volume is as good a leading indicator as any for future financing activity and new listing activity," says John. Deal activity is starting to pick-up and the mining IPO market is beginning to unlock. As an example, Ivanplat's recent listing has set the tone for mining executives itching to pull the trigger on IPOs that have been waiting in the queue for some time now. While a dramatic turn-around is not expected anytime soon, TSXV continues to show it will work with its clients in all market conditions to balance access to capital, while protecting investors.

MARKET CAPITALIZATION TRENDS

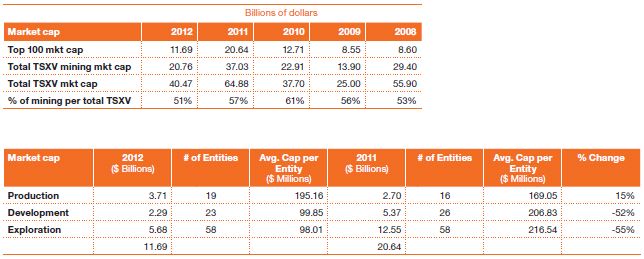

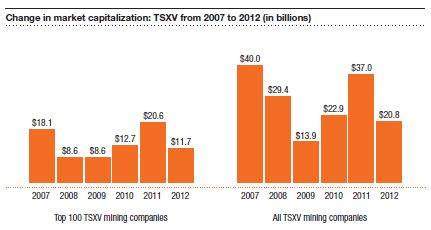

The mining sector represents 51% of TSXV $40.5 billion market capitalization, as at June 30, 2012. While in 2011, the market capitalization headline was all about increases; the story in 2012 unfortunately is decline.

- Overall, total TSXV market cap declined by $24.4 billion – representing a 38% decline from 2011

- Market cap for the Top 100 fell from $20.6 billion in 2011 to $11.7 billion in 2012, representing a 43% decline in market cap. This year's Top 100 market cap is even lower than 2010's Top 100 market cap of $12.7 billion, but up from the lows of 2009 of $8.6 billion

- In 2012, the number of mining companies in the Top 100 with market cap of more than $200 million decreased to 13 – falling from 2011's record high of 36 companies, but up ever so slightly from 2010's 12 companies

- Average market cap of the Top 100 dropped from $206 million in 2011 to $117 million in 2012

- Highest market cap of the Top 100 in 2012 was $582 million and the lowest market cap was $44 million

- Compared to the prior year, only 39 companies in 2012's Top 100 held or increased their market cap – 61 companies lost market cap

BALANCE SHEET

Aggregated balance sheets for the Top 100 companies as at June 30

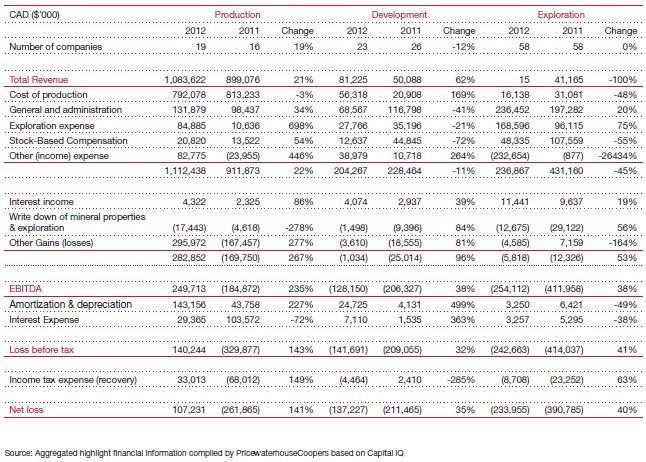

INCOME STATEMENT

Aggregated income statements for the Top 100 companies for the year ended June 30

Highlights:

- Top 100 total revenues increased 18% ($174 million increase) in 2012

- Margins improved year over year moving from 7% to 11%, due to strong commodity prices

- Exploration expense overall increased 98% or $139 million:

- Production companies up 698%

- Development companies down 21%

- Stock based compensation was down 51% in 2012, compared to 2011

- Producers saw an increase of 54%

- Developers saw a decrease of 72%

- Explorers saw a decrease of 55%

CASH FLOW STATEMENT

Aggregated cash flow statements for the Top 100 companies for the year ended June 30

Highlights:

- Net issue of shares decreased by 44% totalling a decline of $1.2 million, which highlights the dry-up of liquidity in the junior market

- Total net loss for the year improved by 64% – largely due to strong commodity prices

- Capital expenditures increased 14% year over year with the major increases in production offset by a decrease in development capital expenditures

- Investment in marketable securities decreased by 104% – mainly due to companies spending less on investment in marketable and equity securities in order to preserve cash for core operations

A PERFECT STORM THAT SWEPT A COMPANY TO TOP SPOT

Interview with Nolan Watson, President & CEO, Sandstorm Gold

The office of Sandstorm Gold Ltd is reflective of the company's young CEO, Nolan Watson: calm and quiet, but not without a well-deserved dose of self-assurance. It all makes sense, considering the streaming company is currently sitting on top of a recently secured $150 million in bought deal financing, and as at June 30, 2012 had a market capitalization of $582 million. Said market capitalization secured Sandstorm Gold the top spot in this year's Top 100 Junior Mine list. On the heels of this success, PwC's British Columbia Mining Leader, Michael Cinnamond, met up with Nolan Watson to discuss Sandstorm's aggressive growth goals for 2013, the evolving streaming model and what Sandstorm Gold looks for in a streaming partner.

Michael: Due to challenging financing conditions, it seems to be a "perfect storm" for streaming companies interested in providing much needed financing to miners. The streaming business model is still relatively new to the mining sector. Can you explain the role you play in helping mining companies grow?

Nolan: We view ourselves as strategic partners with mining companies. A mining company will come to us when they need to secure capital to build a mining project, refinance their obligations, or complete an acquisition. We'll provide the mining company with an upfront payment in exchange for a portion of the gold produced from their mine, for the life of the mine, at a fixed per unit cost.

Michael: Compared to other larger streaming and royalty companies in the marketplace - who are announcing deals approaching a billion dollars - what is your competitive advantage?

Nolan: One of our competitive advantages right now is our size. We have the ability to do a $50 million deal and have it be meaningful to us. Currently, many of the other streaming and royalty companies are much larger than us and, like you mentioned, are completing deals in the $750 million range. They aren't as interested in closing a deal in the range of $20-$100 million. As a result, we are not competing as heavily to complete a deal.

Michael: Do you expect to see the streaming business model change or evolve in the next few years?

Nolan: At the end of the day, a stream is just a contract so it can be whatever you want it to be. We're starting to see agreements ebb and flow. Each streaming company seems to be adding their own flavour to deals. For example, one of the things we added to a recent agreement was the ability to buy back a partial percentage of the contract at a 30% premium for a finite time period. This is an example of a new type of streaming that's never been done before.

Michael: As we have discussed, you are competing with other streaming companies for prime financing opportunities, but you're also competing with more traditional forms of financing. What strategic advantage does a mining company gain partnering with a streaming company over, say, a bank?

Nolan: On the debt side, it is a lot less risky. Think of what a bank is. A bank is an entity that might only own 10% of every dollar it lends out, the rest is borrowed capital. As a result, they can't afford to lose that money, as it would wipe out their equity. In turn, they aren't able to be as flexible – they call in default of covenants right away or force the mining company to raise equity at a time that may not be ideal for the company's share price. But Sandstorm Gold, for example, is completely debt free. As a result, we can be patient and can afford to take some risks. We understand that mining is a long-term investment and that returns are not necessarily realized right away. We work with mining companies, not against them. Our goal is to make a mining company successful. For us to be successful the mine we have invested in has to be successful, and sometimes that takes patience.

Michael: What hurdles do you need to overcome when doing a deal with a mining company?

Nolan: Convincing the other side to do the deal. Streams are for the life of a mine and for companies completing their first ever streaming arrangement it can be a large mental hurdle to overcome. Initially, companies feel as though they are giving all the upside to the price of gold away. To help companies make it over this hurdle we complete detailed financial analysis and modelling to explain the advantages. There are cases where we have been able to provide a mining company with 100% of the capital needed to build a mine, while they are trading at 0.2 or 0.3 times Net Asset Value (NAV). We provide them with capital at NAV. The deal, therefore, is three times as accretive over the life of the mine.

Michael: What about the innumerable accounting and tax implications that must be worked through when completing a streaming deal. How do you overcome those hurdles?

Nolan: You are absolutely correct. It is incredibly difficult to create a tax structure, that also works with the accounting structure, and that also works within the legal framework of the country of operation. It gets very complicated. As a result, we have seen some streaming companies try to get off the ground, but can't, as they aren't able to figure out how to structure the accounting, tax and legal portion of the deal.

Michael: What do you look for in a partner? Do you have "deal breakers"?

Nolan: One of the things we've always been very forthright about with our investors is that we're only going to invest in low political risk jurisdictions, until we are large enough and diversified enough to handle taking small, higher level risk assets into our portfolio. The deals we've completed as-to-date are located in Canada, United States, Mexico and Brazil. Of the deals that we are currently considering, 80% of them are in similar regions. But we definitely have a current 'do not go list' including Venezuela, Bolivia, Middle Eastern countries and unstable African countries.

Michael: What about a mining company's management team – how much weight do you place on seasoned, experienced management teams?

Nolan: What we are wary of is a management team, specifically a CEO, who's never put anything into production. In such cases, at the moment, we will not complete the deal – even if it is a strong asset. There are enough mining companies out there interested in financing that have promising assets, experienced teams and are in low political risk regions that we don't need to take on unnecessary risk. Currently, we are working on numerous promising deals that meet our investment criteria. I think you're going to see us do some smart deals in the next six months or so. Stay posted.

TOP 5 ANALYSES – 2012 vs 2011

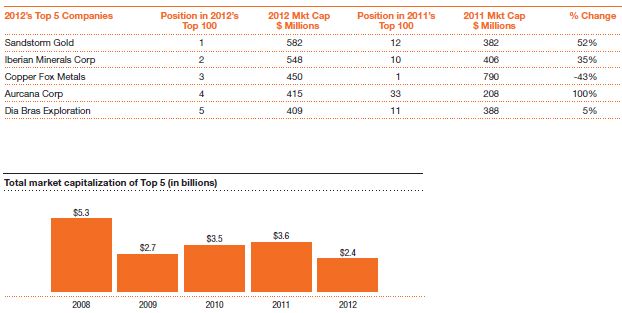

Four of this year's Top 5 experienced an increase in market capitalization, with two companies more than doubling their market capitalization.

Even with these positive statistics the total market cap of the Top 5 mining companies in 2012 was only $2.4 billion – 33% decline from $3.6 billion in 2011. This year's top junior, Sandstorm Gold, accounts for 24% of the Top 5's market cap – notable, as Sandstorm Gold was not even included in last year's Top 5 – they came in at #12.

Overview of 2012's Top 5

1. Sandstorm Gold

Phase: Streaming and royalties

Mkt Cap: $582 million

Head office: Vancouver, Canada

Primary commodity: Gold

Sandstorm Gold focuses on completing gold purchase agreements with gold mining companies that have advanced stage development projects or operating mines. As at June 30, 2012 they held a portfolio of 7 gold streams and 3 royalty agreements.

2. Iberian Minerals Corp

Phase: Production

Mkt Cap: $548 million

Head office: Toronto, Canada

Primary commodity: Base metals

Iberian Minerals engages in the exploration, development, and mining of base metal deposits in Peru and Spain. In Peru, Iberian Minerals has operations producing 2.2 million tonnes of copper concentrate in 2012. In Spain, it has operations producing 2.2 million tonnes in 2012 of copper, zinc and lead concentrates.

3. Copper Fox Metals

Phase: Development

Mkt Cap: $450 million

Head office: Calgary, Canada

Primary commodity: Copper

In 2011, Copper Fox was the top ranked junior mining company, winning the TSX Venture 50®. TSX Venture 50® is a ranking of strong performers on TSXV with equal weighting assigned to each: share price appreciation, trading volume, market capitalization growth and analyst coverage.

4. Aurcana Corp

Phase: Production

Mkt Cap: $415 million

Head office: Vancouver, Canada

Primary commodity: Silver

Aurcana Corporation engages in the exploration, development, and operation of silver properties in Mexico and the United States. Aurcana recently increased ownership in their La Negra mine from 92% to 99%.

5. Dia Bras Exploration

Phase: Production

Mkt cap: $409 million

Head office: Toronto, Canada

Primary commodity: Base metals

Dia Bras Exploration engages in the acquisition, exploration, extraction, production, and sale of mineral concentrates with silver, copper, lead, zinc, and gold contents in Mexico and Peru.

What happened to 2011's Top 5?

1. Copper Fox Metals

Phase: Development

Mkt Cap: $450 million

Mkt Cap change from 2011: -43%

Head office: Vancouver, Canada

Primary commodity: Copper

Copper Fox Metals ranked #3 in 2012's Top 100 – they continue to develop their Porphry Schaft Creek project in British Columbia.

2. Rainy River Resources

Phase: Exploration

Mkt Cap: $358 million

Mkt Cap change from 2011: -54%

Head office: Toronto, Canada

Primary commodity: Gold

Rainy River Resources graduated to TSX on September 28, 2011. They continue to advance the Rainy River Gold Project of $1.2 million ounces measured.

3. ATAC Resources

Phase: Exploration

Mkt Cap: $232 million

Mkt Cap change from 2011: -67%

Head office: Vancouver, Canada

Primary commodity: Gold

ATAC Resources ranked #9 in 2012's Top 100 – ATAC is focused on developing Canada's only Carlin-type gold discoveries at its Rackla Gold Project in the Yukon.

4. Canaco Resources

Phase: Exploration

Mkt Cap: $69 million

Mkt Cap change from 2011: -90%

Head office: Vancouver, Canada

Primary commodity: Gold

Canaco ranked #59 in 2012's Top 100, and recently Canaco announced it received an Environmental Impact Assessment (EIA) certificate from the Tanzanian government for the Company's 100-square kilometre Handeni property in Tanzania, including the Magambazi project area.

5. Trelawney Mining and Exploration

Trelawney Mining and Exploration was acquired by IAMGOLD in a transaction completed on June 21, 2012 for $608 million. IAMGOLD is listed on the TSX and NYSE and market cap of $4.5 billion, as of June 30, 2012.

TRANSITIONING FROM EXPLORATION TO DEVELOPMENT: ONE COMPANY'S FINANCING JOURNEY

Interview with Peter Cashin, President & CEO, Quest Rare Minerals

This year's Top 100 houses more juniors transitioning to the development and production stage than we have seen over the past 6 years. In our first Junior Mine report in 2007, 86 companies of the Top 100 were in the exploration phase. Roll forward to 2012, and 42 of the Top 100 are either in the development or production stage.

In an interview with Peter Cashin, CEO of Quest Rare Minerals, Nochane Rousseau, PwC's Montreal Mining and Plan Nord Initiative Leader, discusses Quest's financing journey, as Peter seeks to move the company from exploration to development.

Dual listing on NYSE MKT

Nochane: In 2011, Quest Rare Minerals successfully listed on the NYSE MKT. What spurred this decision?

Peter: We are defining an asset - we wanted to expand our investor asset base and knew many of our initial seed investors were American. We had to satisfy and cater to a much larger market, because I was looking past the current window and saying we will need American investors and investment houses down the road once we start getting into project financing. A lot of US money managers - big money managers - won't touch a foreign issuer.

Nochane: What advice do you have for junior mining companies looking to pursue a dual listing?

Peter: If you go to the US markets you have to make darn sure the asset you bring to bear is solid and it has appeal to US investors. Quest Rare Minerals' differentiator is our exposure to heavy rare earths. Our property is world class and in a low geo-political risk region. You have to balance costs and governance considerations with what you know will have a physical impact on liquidity. There is a lot of due diligence requirements in the listing process, and that provides the additional level of satisfaction and comfort to American investors. As a result, we decided a dual listing was a reasonable move on the part of the corporation.

I think most companies make the decision to list on a foreign exchange on the basis of liquidity, and broadening their scope and exposure. Certainly from our perspective, the United States market has a vested interest in rare earth opportunities, because their high tech industries and military are extremely dependent on rare earths.

Graduating from TSXV to TSX

Nochane: You made the decision in 2012, to move Quest Rare Minerals to the main board – TSX – before you were in the development stage. What was the motivator behind this decision?

Peter: After having listed on the NYSE MKT, it was natural to evolve and graduate from the Venture to the major board. Even Canadian money managers, as well as international investors, view very favourably the graduation effort required by companies who list on the main board, such as the additional corporate governance requirements and due diligence expectations.

Liquidity was important, the expansion of our shareholder base and the additional support we have from the principal markets were important drivers behind our decision to graduate.

Nochane: Have you been able to observe those benefits?

Peter: It is a double-edge sword, in that in good times when you have got a very broad investor base it is beneficial. On the positive side it provides you with lots of liquidity. When the markets dry up, there is the discomfort of seeing people saying, "I am up on the equity position it's time to sell". The human reaction is to sell the things that you are ahead on, and hold on to your bad performing stocks. So you see a lot of selling pressure, but then you have liquidity on the sell side, which is not discomforting.

What I think happened in our case is the fact we had a significant amount of capital on our balance sheet. Our working capital position was very strong. It allowed me the comfort that we could take the long-term view of developing the asset without having to go to the equity markets.

Strategic Partnerships

Nochane: What about strategic partnerships? Do they factor into your strategy for acquiring the financing needed to develop your project?

Peter: We are open to strategic partners, but looking still for independence to add value. Higher purities are where a lot of the value lies, in terms of our project.

In Quest's situation, we have to go and market a commodity that is not traded transparently. Rare earths are nonmarket tradable. This means we have to break in through the marketing network to try to sell our product. We can either do it ourselves and assume all the risks along the way or we can partially de-risk the project by getting a strategic partner. The strategic partner would have separation technology in their business model and have their marketing networks well established.

Ultimately, a strategic partner would be able to enhance our efforts, accelerate it, and optimize what we are currently trying to do on the basis of their experience.

Foreign investors

Nochane: The Canadian mining industry has seen an increased interest from foreign investors, specifically Chinese investors. What's your advice for juniors looking to strike a financing arrangement with Chinese investors?

Peter: China is a very old, mature, well developed society. You have to be patient. They don't operate in the same fashion as North Americans, in that deals have to happen quickly. You have to take a much different approach when working with Asian partners.

Just take your time, and be prepared to invest heavily. It is expensive to go over there and market. I find that they are very honest business people and I would look forward to have Asian investors associated with this project.

Government partnerships

Nochane: With the caveat that the new Quebec government will not substantially change the terms of Plan Nord, do you see this initiative significantly benefiting the development of your project?

Peter: As you stated, it all depends what the new government will do with Plan Nord. When it was originally presented to us, I questioned if it would have a role in our development. However, that being said, I distinctly remember John Charest, during PDAC (Prospectors and Developers Association of Canada) last March saying, Plan Nord is for opportunities North of the 49th parallel but there will be some value shared in the south.

We would be interested in the shared value in the south if we were to develop a separation facility. Location is an important consideration for any separation facility. Separation facilities are run by highly technical staff— scientists, PhDs, technicians—it would be very difficult attracting that type of person into the far north of Quebec.

A separation facility and associated spin-off business would generate many more jobs than the mine itself—it would be advantageous for the Quebec government to have the separation facility located in Quebec. My sales pitch to Quebec would be, "I can give you 200 jobs at the mine site or we can develop a processing plant, which could stimulate manufacturing and new expertise that would lead to many, many more jobs in Quebec".

Quebec sees the value of the mining industry and that mining contributes to 20% of Canada's GDP—do you really want to push that investment away with stricter guidelines or by not listening to the needs of miners interested in investing in Quebec?

Nochane: Is there anything else that you would like to share about your company's growth story or the rare earths sector?

Peter: Rare earths is a brand new sector. It's all new and very complex. I think the complexity of the sector makes it that much more exciting than convention metals. I truly believe everything that we are doing ourselves and that the rest of the players in the rare earths sector is— well—we are all trail blazers. We are creating a brand new economic sector and that is exciting.

FINANCING OVERVIEW

Financing: Making it out of this financing slump alive...

It all starts at the top. Senior and mid-tier mining companies are really feeling the heat from investors – even getting labelled by some fund managers as "serial capital misallocators". Shareholders are calling for greater rewards in such forms as dividends and share buybacks. They also want miners to institute tighter capital spending policies. At the extreme end of things, risk adverse investors are looking for ways to distance themselves from the rash of issues currently effecting miners including strikes, capital project delays and increasing nationalistic sentiments by investing in streaming companies or Exchange Traded Funds (ETFs), as opposed to investing directly in mining companies.

As a result, a tidal wave of spending cuts and project delays have been announced by mining companies, as they try to respond to investor demands. Producers are also giving their dividend policies a healthy booster shot – looking for creative ways to increase investors' exposure to high commodity prices.

So where does this leave juniors – a group perceived to be a higher risk investment? How will juniors attract investors and secure the needed financing to grow if investors are skittish and have a declining risk tolerance? Equity financing, raised by 2012's Top 100, decreased by a troubling 41% totalling $1.6 billion compared to $2.7 billion raised by 2011's Top 100 juniors. The juniors' struggle to raise equity corresponds with their overall decline in market cap.

The equity is just not there. This is reflected in the IPO market, which fell silent in 2012. Only 4 mining IPOs on TSXV were completed in Q3 2012, compared to 14 in Q3 2011. In total, on TSXV there have been 25 mining IPOs from January 2012-September 2012, down from 34 during the same time period in 2011.

The recently announced initial public offering for Ivanplats Ltd. will be a litmus test for whether the market is ready for a comeback. Dean Braunsteiner, PwC National IPO Services Leader believes, "The slow pace of new issues could all change in the fourth quarter of 2012, if a few of the current market roadblocks are cleared. There are some very significant IPOs in the pipeline that could revive the total IPO market and turn around the year, but it will require the resolution of some thorny economic issues beyond our borders," says Braunsteiner." What companies can find encouraging is the size of the IPOs we see coming, and the diverse nature of the issuers.

Deals market for juniors

In the first half of 2012, mining witnessed a sluggish pace of M&A activity as senior mining companies began to abandon the "growth-at-all costs" mantra that once pervaded the lips of mining executives. Seniors are being disciplined and strategic with their growth strategies – which often requires patience. This is having an adverse effect on juniors. Many junior miners, who are holding their breath, hoping to be acquired by a senior mining company, will either have to pursue other growth and financing options or be willing to accept much lower valuations. Opportunistic senior mining executives - looking to scoop up juniors at discounted prices before the market rebounds – are approaching junior executives with prices significantly lower than where juniors sat only a year earlier. While seniors are struggling to convince juniors to sell, we may see this change over the next few quarters as juniors get pressured by impatient shareholders, eager for returns.

To avoid selling at discounted prices, we may start to see a flurry of "mergers of equals" amongst juniors or juniors and mid-tiers. Juniors may believe selling-off assets or grouping like assets, in the form of collaboration with other mining companies, as their best chance to achieve long-term success. The obvious down-fall to this strategy is job redundancy... how do you decide which C-suite executives get to keep their jobs and which ones need to pack their bags and hit the road?

Dual listed companies

15 of 2012's Top 100 dual listed: (3 production, 5 development, 7 exploration)

- NYSE MKT: 8 dual listed

- London Stock Exchange: 1 dual listed

- AIM: 2 dual listed

- Australian Stock Exchange: 3 dual listed

- Frankfurt Exchange: 1 dual listed

* 12 of the 15 dual listed companies have properties in North America

** Dual listed companies raised on average $12.9 million in equity, less than non dual-listed companies who raised $16.5 million.

Flow-through shares

In 2012, ten companies completed flow-through share financing, raising $111 million in total. Of this ten, three of them also issued flow-through shares in 2011. On average, flow-through shares totalled 64% of companies' equity financing. Similar to 2011, gold companies most actively pursued financing through flow-through shares – 8 out of 10 in 2012 and 7 out of 10 in 2011.

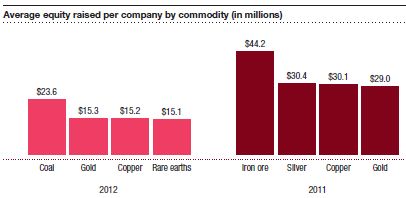

Financing activity by commodity

Coal experienced the highest average equity financing – raising $23.6 million – representing 35% of coal companies' June 30, 2012 market cap. Not close behind were gold, copper and rare earths. Gold raised the second highest amount per company totalling $15.3 million (14% of market cap). Copper companies raised $15.2 million (7% of market cap) and rare earths placed fourth raising $15.1 million (15% of market cap).

In 2011, gold didn't even rank in the top three. Instead, iron ore, silver and copper raised the most equity per company. Also, note the massive $20.6 million difference between 2012's commodity that raised the most equity (coal) and 2011's top commodity (iron ore), which raised $44.2 million.

Financing activity according to stage of growth

Production: Nineteen companies in this year's Top 100 were in the production phase, as at June 30, 2012. On average, these producing companies raised $23.0 million in equity representing 12% of their market capitalization. This is down only slightly from last year's overage of $22.6 million, which represented 13% of their market capitalization.

Development: 2012's twenty-three development stage companies raised on average $15.5 million in equity - 16% of their market capitalization. This is almost half the average raised by 2011's Top 100 companies in the development stage. In 2011, development stage companies on average raised $31.0 million – 13% of their market capitalization.

Exploration: Fifty-eight exploration stage companies raised only $13.8 million in equity in 2012 – 14% of their market capitalization. Again, this is almost half the amount raised by 2011's fifty-eight exploration stage companies who on average raised $27.0 million – 14% of their market capitalization.

During 2012, three companies in 2011's Top 100 progressed from exploration to development and three companies moved from development into production. The companies which moved from exploration to development on average raised $10.5 million in equity and $1.7 million in debt. As expected, the companies that moved from development to production raised significantly more on average – $34.5 million in equity and $5.5 million in debt.

As mentioned previously by John McCoach, President, TSX Venture Exchange, "The overall message to junior miners in an optimistic one. Deal activity is starting to pick-up and the mining IPO market is beginning to unlock. In general, trading volume is as good a leading indicator as any for future financing and new listing activity."

NOTES ON REPORTING

We made some estimates and adjustments in order to arrive at a common format and aggregation of financial information as at, and for the years ended, June 30. For the few companies who had yet to file their June 30, 2012 financial statements, we used the twelve months ending March 31, 2012. Consistent with 2011, the data was broken down into three categories of companies (exploration, development and production) in order to be comparable year over year.

For balance sheets, we converted foreign currencies to Canadian dollars using the closing exchange rate on June 30, 2012. For income and cash flow statements, we used the average exchange rate for the year ended June 30, 2012.

Some companies have elements of non-mining activities in their results. However, non-mining revenues are insignificant and have been included in our results and analysis.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.