Most of us think of "disability" as something that happens to other people. You might be surprised by just how common disabilities are—and by the types of disabilities that sideline Canadian lawyers. You've invested so much in your career. Invest in insurance that will work for you when you can't.

1. DISABILITIES ARE MORE COMMON THAN YOU MAY THINK

1 in 4 working-aged Canadians has a disability, and the fastest-growing categories are disabilities related to pain and mental health.1

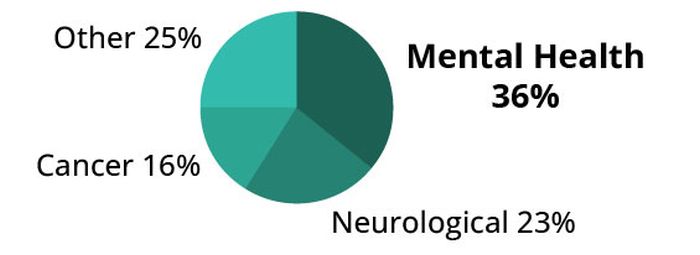

2. DISABILITIES AMONG CANADIAN LAWYERS ARE OFTEN RELATED TO MENTAL HEALTH

Few careers are more stressful, and the types of disabilities that impact Canadian legal professionals are often related to mental health disorders, including anxiety and depression.2

3. A SIGNIFICANT AMOUNT OF INCOME IS AT RISK

Paycheques have a way of adding up over the course of your career—and disability insurance doesn't retire until you do.

This estimate assumes a starting salary of $95,000 that increases by 2.5% every year throughout the course of a 35-year career.

4. PROTECTING YOUR PAYCHECK COSTS LESS THAN YOU THINK

If someone gave you $100 a day, every day, would you pay a dollar and ten cents to keep that money coming in? That's the cost of income protection for many of Canada's median-aged, average-income earning lawyers.3 There's nothing average about you. Connect with a Lawyers Financial advisor to learn exactly how much it will cost to protect your biggest asset: your ability to earn an income.

WE CAN HELP.

Talk to a Lawyers Financial advisor about protecting your income with disability insurance that works as hard as you do.

Disability insurance is underwritten by The Manufacturers Life Insurance Company (Manulife).

Footnote

1. Source: Statistics Canada, "New data on disability in Canada, 2022," published on December 1, 2023. 2. Source: Manulife and CBIA/Lawyers Financial, reasons for disability claims among clients of Lawyers Financial in 2023, as of December 31, 2023. 3. This estimate is for disability insurance with a 60-day elimination period and a retirement age of 65; the quote is as of April 5, 2024, and assumes the insured individual is 45-year-old non-smoker with an annual salary of $167,000, which is the average salary for senior-level Canadian lawyers, according to careerinlaw.net.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.