Welcome to the July issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The Fall Economic Statement Implementation Act (Bill C-59) receives royal assent enacting sweeping changes to the Competition Act.

- The Bureau obtains court orders to advance investigations into deceptive marketing practices and abuse of dominance.

- Minister Champagne releases a statement on future net benefit reviews of Canadian critical minerals companies.

Merger Monitor

June 1 – June 30 Highlights

- 18 merger reviews published, 17 merger reviews completed

- Primary industries of completed reviews: finance and insurance (24%); wholesale trade (18%); professional, scientific and technical services (18%); mining, quarrying and oil and gas extraction (18%)

- 5 transactions received an Advance Ruling Certificate (29%), 11 transactions received a No Action Letter (65%)

- One consent agreement (remedy) filed; zero judicial decisions filed

January – June 30 Highlights

- 89 merger reviews published, 92 merger reviews completed

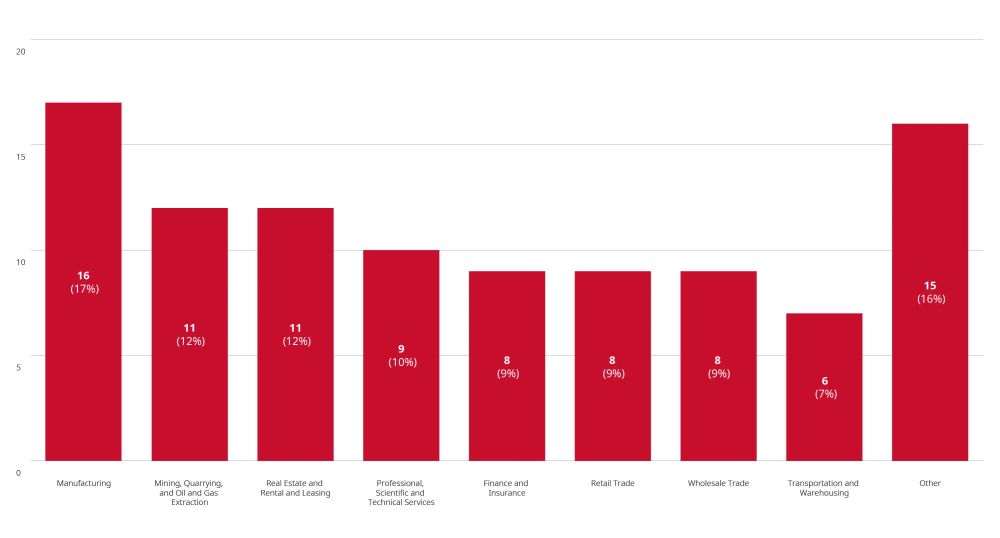

- Primary industries of completed reviews: manufacturing (17%); mining, quarrying, and oil and gas extraction (12%); real estate and rental and leasing (12%); professional, scientific and technical services (10%); retail trade (9%); finance and insurance (9%); wholesale trade (9%)

- 52 transactions received a No Action Letter (57%), 35 transactions received an Advance Ruling Certificate (38%) and two transactions were resolved through other means

- Two consent agreements (remedies) filed; one judicial decision filed

Merger Reviews Completed Year to Date Through June 30, 2024 by Primary Industry

Legislation Update

Sweeping Changes to the Competition Act Become Law

- On June 20, 2024, the Fall Economic Statement Implementation Act (Bill C-59) received royal assent. The third set of broad changes to the Competition Act since 2022, Bill C-59 significantly expands the ability of private parties to pursue matters before the Competition Tribunal and introduces important amendments to the merger review, misleading advertising, civil collaboration and other provisions of the Competition Act. For more information regarding these important changes, see our June 2024 Blakes Bulletin: Canadian Competition Law Changes Now in Force or visit the Blakes Competition Act Amendments page for our collection of Insights covering all of the amendments to the Act.

Enforcement Activity

Bureau Reaches Agreement with Sirius Following Drip Pricing Investigation

- On June 5, 2024, the Bureau announced that it had reached an agreement with SiriusXM Canada (Sirius) following an investigation into Sirius' subscription price representations. The investigation related to additional mandatory administrative fees and music royalties for monthly plans for satellite radio and streaming subscriptions that resulted in prices 10% to 20% greater than the represented price. To resolve the Bureau's concerns, Sirius agreed to pay a C$3,300,000 penalty and to enhance its compliance program to avoid future drip pricing violations.

Bureau Continues Investigation into Amazon's Marketing Practices

- On June 12, 2024, the Bureau announced that it had obtained a second court order concerning its ongoing investigation into alleged false or misleading claims made by Amazon.com.ca, Inc. (Amazon), requiring Amazon to produce records and information relevant to the Bureau's investigation. The investigation into Amazon's marketing practices relates to alleged claims made by Amazon regarding its reviews and ratings, which can affect how products are ranked and displayed on its website and mobile app. In June 2023, the Bureau obtained an order requiring Meta to provide information relevant to its investigation into Amazon.

Bureau Obtains Court Orders in Connection with Investigation Into the Use of Property Controls in the Grocery Sector

- On June 11, 2024, the Bureau announced that it had obtained court orders requiring Empire Company Limited (Empire) and George Weston Limited, the parent companies of Sobeys and Loblaw, the largest grocery chains in Canada, to produce records and information in connection with the Bureau's investigation into the use of property controls (e.g., exclusivity provisions and restrictive covenants in leases) in the grocery sector. The Bureau is investigating whether the use of property controls by Sobeys and Loblaw constitutes an abuse of dominance by, for example, restricting or excluding competitors from opening grocery stores in certain locations. The investigation is currently focused on the use of property controls in the Halifax Regional Municipality.

Non-Enforcement Activity

Bureau Releases Update on Key Statistics for 2023-2024

- On July 5, 2024, the Bureau released its Update on Key Statistics for the

2023-2024 fiscal year ended March 31, 2024. Highlights of this

update include:

- The Bureau received 200 filings (including pre-merger notifications pursuant to section 114(1) of the Act and Advance Ruling Certificate (ARC) requests pursuant to section 102 of the Act), representing a 3% increase from the 2022-2023 fiscal year (194 filings).

- The Bureau concluded 190 merger reviews in 2023-2024, a slight

(5%) decrease from the 200 merger reviews completed in 2022-2023.

Of the concluded merger reviews:

- 124 (65%) were non-complex while 66 (35%) designated complex.

- 89 mergers received an ARC, a slight increase from the 87 ARCs issued in 2022-2023, but significantly below the 145 ARCs issued in 2021-2022.

- 35 mergers received a No Action Letter (NAL) , a decrease from the 41 NALs issued in 2022-2023 and a slight increase from the 34 NALs issued in 2021-2022.

- 8 supplementary information requests (SIR) were issued, the lowest number of SIRs over the past five years and a decrease from the 13 issued in 2022-2023 .

- The Bureau entered into 4 consent agreements, a decrease from 7 in 2022-2023.

- 98% of the 124 non-complex merger reviews were completed within the Bureau's 14-day service standard, the same percentage as in 2022-2023. The average review period for non-complex reviews was 9.4 days.

- 92% of the 66 complex merger reviews were completed within the Bureau's service standard (45 days or, where a SIR is issued, 30 days after responses are provided), the same percentage as in 2022-2023. The average review period for complex reviews was 36.31 days.

Bureau Will Develop Guidance on Interpretation of New Greenwashing Provisions

- On July 4, 2024, the Bureau announced that following the passage of amendments to the Competition Act on June 20, 2024, it would prioritize developing guidance on new greenwashing provisions that will require companies to be able to substantiate environmental claims in promoting a product or business interest. The Bureau intends to launch a public consultation in the coming weeks to assist it in preparing this new guidance. For more information on this, see our June 2024 Blakes Bulletin: Canada's New Greenwashing Laws Enacted.

Bureau Invites Input on its Review of its Guidance Following Recent Changes to the Competition Act

- On June 25, 2024, the Bureau published a summary of the recent changes to the Competition Act introduced by Bill C-59 and noted that it would engage in consultations in connection with its review of its guidance to ensure that it provides clarity and predictability. The Bureau has invited comments and suggestions from interested parties regarding the Bureau's guidance documents.

Immunity and Leniency Programs Updated

- On June 19, 2024, the Bureau and the Public Prosecution Service of Canada issued updated Immunity and Leniency programs to reflect the Competition Act's new wage-fixing and no-poaching provisions. The criminal prohibitions against employers agreeing to fix, maintain, decrease or control salaries, wages or other terms or conditions of employment or to refrain from soliciting or hiring each other's employees were adopted in June 2022 and came into force on June 23, 2023.

Investment Canada Act

Ministerial Statement on the Investment Canada Act Review of Glencore's Acquisition of Teck's Coal Assets

- On July 4, 2024, the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry, released a statement approving Swiss commodity trading and mining company Glencore plc's acquisition of Teck Resources Ltd.'s metallurgical coal business, B.C.-based Elk Valley Resources (EVR). This Ministerial approval also follows an extensive net benefit review under the Investment Canada Act and months of discussions with both parties, the B.C. provincial government and federal departments. Glencore has made binding commitments and undertakings to ensure a strong Canadian operation of EVR and to maintain Teck's leading commitments to First Nations.

Ministerial Statement on Future Net Benefit Reviews of Canadian Critical Minerals Companies

- On July 4, 2024, Minister Champagne released a statement on how net benefit reviews will be conducted for large Canadian mining companies engaged in significant critical minerals operations. The Minister states that such transactions will only be found of net benefit in the most exceptional of circumstances.

Non-Cultural Investments

May 2024 Highlights

- 116 notifications filed (91 filed for acquisitions, 25 for the establishment of a new Canadian business)

- Country of ultimate control: United States (63%), China (6%); France (6%)

January – May 2024 Highlights

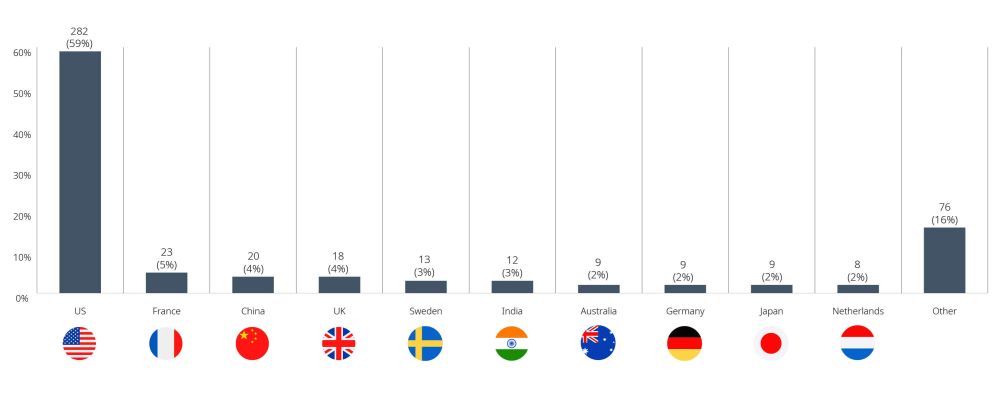

- Two reviewable investment approvals and 477 notifications filed (359 for acquisitions and 118 for the establishment of a new Canadian business)

- Country of ultimate control: United States (59%); France (5%); China (4%); United Kingdom (4%); Sweden (3%); India (3%)

Blakes Notes

- On June 25, 2024, Blakes hosted an online event with the Business Council of Canada where we discussed the recent amendments to the Act. A recording of the session is now available for clients on Blakes Business Class: The Brave New World of Competition Law: Understanding the Latest Changes to Canada's Competition Act.

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.