In December 2024, the NSW Government amended the Electricity Supply (General) Regulation 2014 to set the penalty rate for non-compliance with the Renewable Fuel Scheme for 2025 to 2036.

This step marks an important development towards the pending implementation of the Renewable Fuel Scheme (RFS) next year, compliance with which is mandatory for certain actors in the energy market.

In this update, we take a brief look at the RFS and what it means for energy producers and users in NSW.

What is the Renewable Fuel Scheme?

The RFS is a NSW Government initiative which was introduced in 2021 under the Electricity Supply Act 1995 (NSW), designed to incentivise the production of green hydrogen and other renewable fuels to support Australia's shift towards net-zero.

The RFS was established under the Energy Security Safeguard (Safeguard) and the NSW Hydrogen Strategy, with the Safeguard itself introduced to 'reconstitute' the then existing scheme by giving the NSW Government power to create schemes that promote specific energy consumption, contracting or supply methods. Those powers were then exercised to introduce the RFS.

Green hydrogen is produced using only renewable energy sources and is therefore seen as a key driver for the 'deep decarbonisation' of industries across NSW. The NSW Government's 'Hydrogen Strategy' highlights hydrogen's versatility as a fuel, with its wide range of uses including industrial and residential heating, electricity generation and the production of synthetic fuels for aircraft and ships. It can also be used as a replacement for coking coal in steel manufacturing and to transport energy over long distances.

Despite hydrogen's potential as an energy source, it has recently been criticised as uneconomical in the current energy market, with various major players deeming previously planned hydrogen projects too risky.

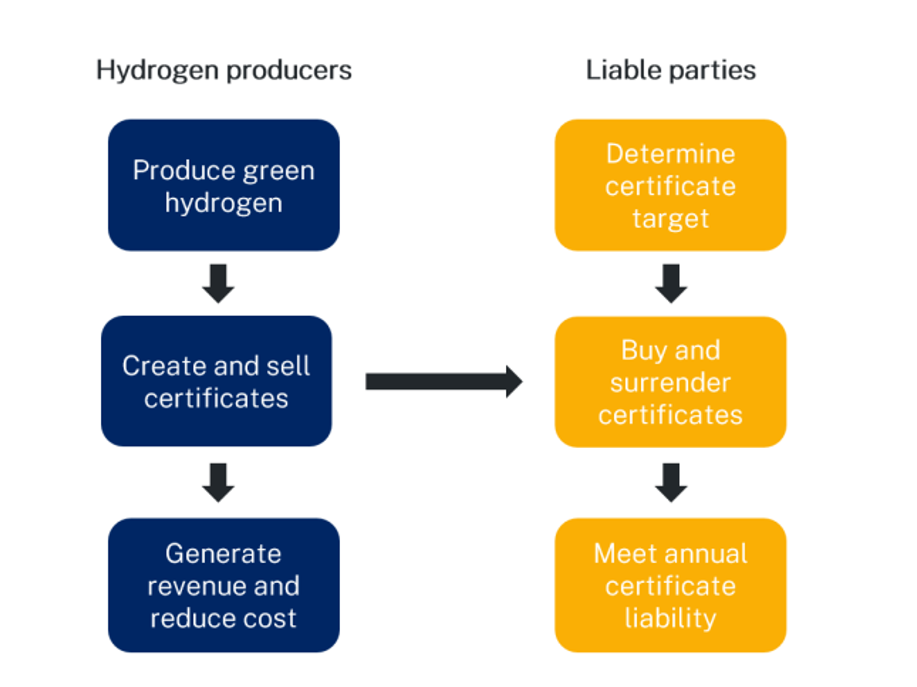

The RFS hopes to assist in bridging this divide between the current economics of investment and the environmental benefits of green hydrogen by creating financial incentives to produce this touted 'fuel of the future'. The following graphic, produced by the NSW Office of Energy and Climate Change, demonstrates the intended effect of the RFS:

Graphic credit: NSW Office of Energy and Climate Change, NSW Treasury, Renewable Fuel Scheme: Rule 1 consultation paper, December 2023.

As the above graphic demonstrates, the RFS aims to incentivise sustainable energy production and usage by encouraging the:

- reduction of gas usage by end users, to reduce certificate liability

- development of green hydrogen by gas producers/users to reduce certificate liability, and

- production of green hydrogen by third parties, who can create and sell certificates which need to be surrendered by scheme participants to meet their liabilities under the RFS.

Who does the Renewable Fuel Scheme apply to?

The RFS is a compulsory scheme, meaning that those who fall within its scope must either comply with its requirements or face the prescribed penalty. The scheme will be administrated by the Independent Pricing and Regulatory Tribunal (IPART), which will oversee its implementation for 2 groups:

1.end users – this is not all end users, but rather persons who:

- acquire gas for their own consumption

- are not retail customers (i.e., they don't buy gas from a retailer)

2.retailers – holders of retailer authorisations under the National Energy Retail Law.

Importantly, intermediaries, being those further down the gas supply chain but who are not the end user, are not liable under the scheme.

When will the Renewable Fuel Scheme commence?

The RFS is scheduled to commence in 2026 and has established 'targets' for upcoming 'compliance periods', as follows:

While targets for 2024/25 are included in the Supply Regulations, IPART has indicated that it does not intend to enforce compliance with the scheme for those periods.

Those participating in the RFS should note the following key dates:

- 30 September 2026 – scheme participants to report their 'liable gas use' for 2025

- 15 November 2026 – publication of the total 'NSW liable gas use' for 2025

- 1 March 2027 – scheme participants to lodge annual statements and surrender certificates, where required.

How can scheme participants achieve compliance?

Under the RFS, liability is allocated based on each participant's share of the total liable gas use in NSW in the previous year. For end users, the relevant 'usage' for which they are liable under the RFS is the gas conveyed to them, while for retailers, it is the gas they supply to retail customers.

The NSW Government gives the following example of how a scheme participant might comply with the RFS:

"[I]f total liable gas use in NSW in 2026 was [1,000,000 GJ] and a gas retailer sold [100,000 GJ] of gas that year, its liability would be 10% of the 2026 scheme target (i.e. 89,000 certificates, being 10% of 890,000 GJ target)".

In other words, the scheme participant's share of the total usage as a factor of the relevant target will be their 'certificate target'. As the example demonstrates, 1 certificate is equal to 1 gigajoule of energy usage.

Currently, 'accredited certificate providers' (such as producers of green hydrogen) can create, issue and sell the certificates needed to offset liability. While the exact eligibility requirements for production are yet to be finalised, the draft scheme rule provides some guidance.

If a scheme participant cannot surrender enough certificates to meet its certificate target, it will have a 'certificate shortfall', and will need to pay a penalty. For the 2025-26 period, this penalty is $17.50 for each certificate it fails to surrender. Where the shortfall is substantial, the penalty can add up. In the example above, a failure to comply with the RFS would lead to a $1.56 million penalty ($17.50 x 89,000 certificates).

A new environmental product market

Another notable feature of the RFS is the ability to trade certificates. Indeed, a major component of the RFS is the production of certificates by third-party green hydrogen producers, and so it can be expected that the trading of certificates will play a large part in the scheme's operation.

For a certificate to be tradable, it must be registered on IPART's online Registry of Certificates, TESSA. Like other schemes for trading intangible renewable products, the RFS has its own specific technicalities that must be followed for legal title to pass. One of these requirements is that "[t]he transfer of a certificate does not have effect until the transfer is registered by the Scheme Administrator".

The requirement that the regulator give effect to the transfer before legal title can pass, and the precarious position this places a purchaser in – where title in the certificate for which the purchaser has paid valuable consideration is contingent on the actions of the regulator – is very similar to the position of purchasers of Australian Carbon Credit Units (ACCUs) under the Carbon Credits (Carbon Farming Initiative) Act 2011, which we discuss in our earlier article on what happens when an ACCU transaction falls apart.

What's next?

The NSW Government has foreshadowed further changes to improve the RFS, including:

- limiting the penalty rate for projects that can start producing green hydrogen by 2028

- expanding the RFS to include other renewable fuels.

The potential scope of these changes are scheduled to be announced by mid-2025.

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.