A Introduction

These summary tables are only intended as a general overview of the proposals outlined in the Assistant Treasurer's press release of 25 November 2011 and the associated material released on that day. Therefore, it is important to note that:

- significant changes may be made by the Government or the Parliament prior to the enactment of these proposals;

- the material released contains some ambiguities which may be reflected in this material;

- the following information should only be seen as a general summary, and therefore before any actions or decisions are taken it is essential that the actual material released by the Assistant Treasurer be considered in detail and specific advice be obtained.

If you have any queries or require any assistance, please contact either Ken Spence (ken.spence@gf.com.au, 03 9288 1451) or Richard Hendriks (richard.hendriks@gf.com.au, 02 9225 5971).

B Outline

The following table provides a very high level outline of the proposed changes, with more detailed summaries contained in tables E, F and G. As is apparent from the following table, outcomes can vary significantly depending on the period to which the joining time relates, with C below covering this aspect in more detail.

| Joining time | Key points |

| Pre-12 May 2010 |

|

| 12 May 2010 to 30 March 2011 |

|

| Post-30 March 2011 |

|

A number of refinements to the interaction between the consolidations and taxation of financial arrangements (TOFA) regimes are also announced, which will have both retrospective and prospective application (refer table H).

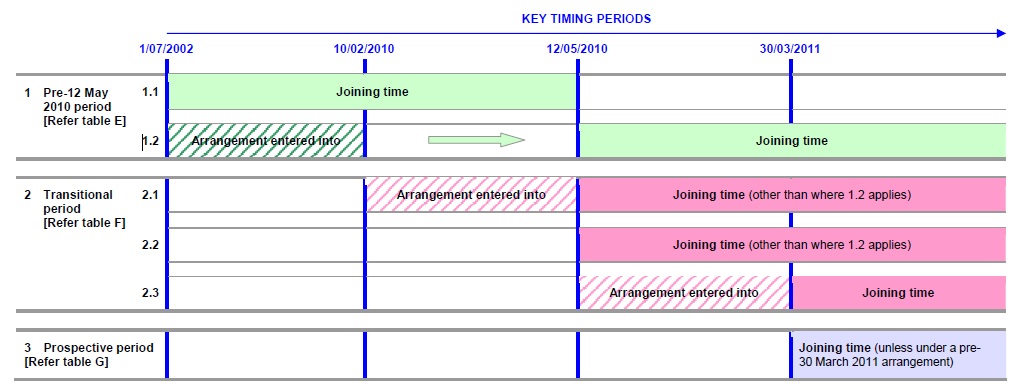

C Key timing periods

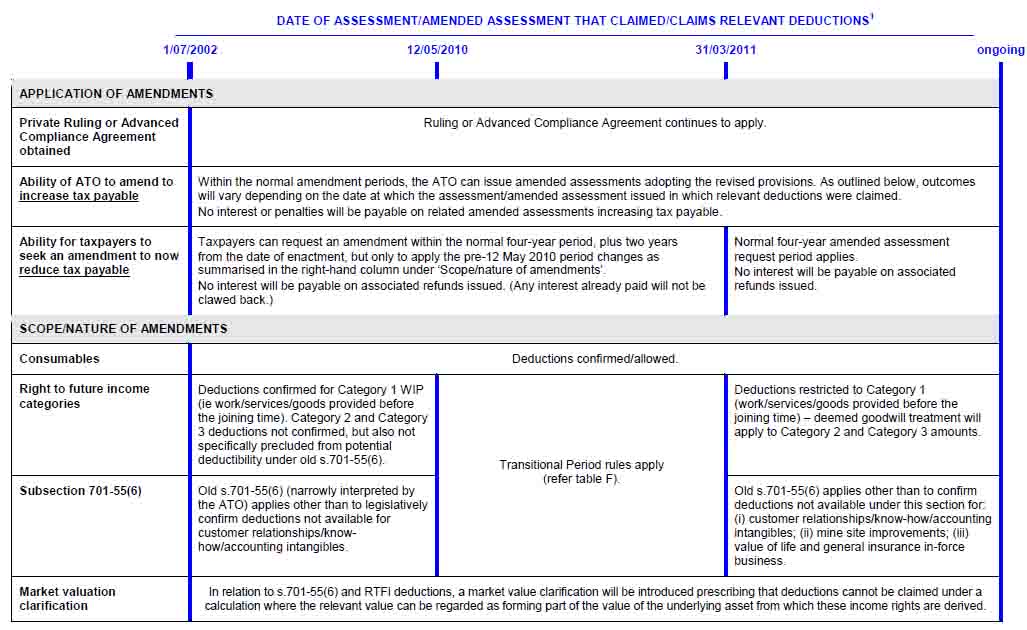

As noted above and outlined in the following tables E, F and G, outcomes vary significantly depending on what 'period' classification (as outlined below) will apply. Therefore, it is essential to establish what period classification is likely to be relevant to any particular joining entity. In respect of the pre-12 May 2010 period classification, outcomes can also vary significantly depending on the date on which relevant assessments and amended assessments that include associated deduction claims have issued. Importantly, more restrictive deduction criteria will apply in the context of pre-12 May 2010 joining entities where assessments/amended assessments claiming relevant deductions have yet to issue.

D Categories of rights to future income

The material released breaks rights to future income into three broad categories, with different tax outcomes potentially applicable to each of them. The categories as described in the material are as follows.

Rights to future income categories

| Category 1 | Rights to receive income where the work has been done, or the goods or services have been provided, by the joining entity before the joining time. |

| Category 2 | Rights to receive income where the work will be done, or the goods or services will be provided, after the joining time under a contract that was entered into before the joining time, excluding any rights to income that are contingent on the renewal of the contract (such as rights under a renewal clause which may give rise to the extension of an existing contract, or to a future contract, under which income would be receivable). |

| Category 3 | Right to receive income arising from an expectation of future work or future provision of goods or services (due to, for example, existing customer relationships), including any rights to income that are contingent on the renewal of the contract. |

It is important to note that there is some ambiguity as to whether Category 2 or Category 3 is intended to apply in the case of an existing non-cancellable contract where the level of expected work to be done under that contract is known and anticipated but not contractually determined. This aspect is under consideration by Treasury.

E Pre-12 May 2010 joining times (plus post-12 May 2010 joining times where the relevant arrangement commenced before 10 February 2010)

F Transitional period: 12 May 2010 to 30 March 2011 joining times (also includes post-30 March 2011 joining times where the relevant arrangement commenced between 12 May 2010 and 30 March 2011, but excludes joining times where the relevant arrangement commenced before 10 February 2010)

| APPLICATION OF AMENDMENTS | |

| Private Ruling or Advanced Compliance Agreement obtained | Ruling or Advanced Compliance Agreement continues to apply. |

| PPLICATION OF AMENDMENTSA | Normal four-year amended assessment period applies (ie no special protection from the amendments where an assessment has already issued). No interest or penalties will be payable on amended assessments resulting from these changes. Interest will, however, be payable to taxpayers on any associated refunds issued. |

| SCOPE/NATURE OF AMENDMENTS | |

| General position | The provisions enacted on 3 June 2010 will continue to apply, subject to the following restrictions. (Note: it is confirmed that deductions in respect of consumable stores will continue to apply.) |

| Non-contractual assets akin to goodwill | Deductions under s.701-55(6) will be precluded in respect of customer relationship assets, know-how, and other accounting intangible assets that are not regarded as separate CGT assets but are akin to or form part of goodwill. Deemed 'goodwill' treatment will apply. |

| Right to future income categories | Deductions will be disallowed, and deemed goodwill treatment will apply to rights to future income where the value is contingent on the renewal or extension of the contract or the contract can be unilaterally cancelled without penalty by the customer. However, deductions will be confirmed in respect of Category 1 and Category 2 rights to future income. |

| Market valuation clarification | In relation to s.701-55(6) and RTFI deductions, a market value clarification will be introduced prescribing that deductions cannot be claimed under a calculation where the relevant value can be regarded as forming part of the value of the underlying asset from which these income rights are derived. |

| Mine improvements | To be excluded from deductions under s.701-55(6) (but it is noted that the ATO is currently determining whether a number of such mine improvements might more correctly be regarded as depreciating assets, and hence deductible under other provisions). |

G Prospective period: post-30 March 2011 joining times (unless relating to an arrangement that commenced between 10 February 2010 and 30 March 2011)

| APPLICATION OF AMENDMENTS | |

| Ability to amend assessments by either the ATO or taxpayers | Normal four-year amended assessment period applies (ie no special protection from the proposed provisions where an assessment has already issued). As there is currently no statement regarding interest and penalties, presumably it is intended that they could apply to amended assessments increasing tax payable. |

| SCOPE/NATURE OF AMENDMENTS | |

| Limiting application of tax cost setting rules | The tax cost setting rules will be limited to apply only to assets otherwise recognised for tax purposes (ie excludes s.40-880 deduction outcomes). |

| Consumables | Deductions allowed (on an acquisition or usage basis, depending on taxpayers' circumstances). |

| Right to future income | Deductions only to be obtained through a modified application of s.25-95, being 'work (but not goods) that has been partially performed ... but not yet to a stage where a recoverable debt has arisen'. In other circumstances, the right to future income asset will be taken to be a retained cost base asset – ie it will normally only have a low tax value. |

| Subsection 701-55(6): other applications | In otherwise applying s.701-55(6), outcomes will be determined as if the relevant asset was being acquired directly as part of a business acquisition in determining whether such amounts are deductible, and if so over what period. Assets that cannot be separately sold by the joining entity (such as non-contractual customer relationships, knowhow and other accounting intangibles) will be specifically deemed to be goodwill. |

H Consolidation/TOFA interactions (with retrospective application)

| Clarifying that the head company is deemed to have acquired financial arrangements that are assets or liabilities from the joining entity at the joining time. |

| For TOFA liabilities of the joining entity the liabilities will be deemed to have been assumed for their accounting values (rather than original value). This will be the case irrespective of what TOFA methods the head company is subject to (i.e.accruals/realisation, financial reports, fair value, FX retranslation and hedging methods). The fundamental consequence of this change is to potentially deny the acquiring group deductions in relation to the TOFA liability assumed (i.e. up to the amount of the accounting value of the TOFA liability at the joining time). The consequences of this change are significant in relation to any corporate acquisitions from the commencement of the TOFA regime. |

| In calculating TOFA transitional balancing adjustment amounts (i.e. when a taxpayer enters TOFA) in relation to financial arrangements previously acquired as a result of a corporate acquisition only the "long-form" method will be able to be utilised (i.e. the "short-form" DTA/DTL method that is generally available to taxpayers that have elected to apply the financial reports method will not be available in relation to these financial arrangements). Furthermore, it is proposed that the various TOFA/consolidation interaction provisions will apply as part of calculating the transitional balancing adjustment amount under the "long-form" method. These changes have potentially significant implications in relation to pre-TOFA acquisitions for taxpayers that have elected to un-grandfather their existing financial arrangements. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.