ASIC Regulatory Guide 247

Effective disclosure in an Operating and Financial Review

ASIC RG 247 assists Directors in complying with obligations under Section 299A

- operations

- financial position

- business strategies and prospects for the future"

Broadly, ASIC requires...

- Information that brings together past market announcements

- Clarity, Conciseness, Effectiveness, Quality over Quantity

- Contextualising the information in the financial statements

Information about an entity's..... operations and performance

- Material transactions and events

- Factors and drivers underlying the results and financial position for the period (new business, new products, new competition etc)

- Explanation of the entity's business model and key dependencies and their effect on operations

- Types of markets and position within each market for significant products and services

Information about an entity's... business strategies and prospects (Pt 1 of 3)

- Key strategies

-

- Intentions to develop/discontinue products or services

- Entering new markets

- Expansion of capacity

- Raising capital

Information about an entity's... business strategies and prospects (Pt 2 of 3)

- Prospects

-

- Narrative explaining financial performance and financial outcomes the entity expects to achieve overall (based on strategies)

- Generally non-financial information

- Should include acknowledgement and discussion of accompanying risks

Information about an entity's... business strategies and prospects(Pt 3 of 3)

Unreasonable Prejudice Exemption

- Is it likely?

- Would it give competitors, suppliers and buyers a commercial advantage over you resulting in material disadvantage?

- If the information is 'confidential', you may have grounds to omit disclosure

- Don't omit information that the market could reasonably otherwise obtain or deduce

- ASIC recommends a high level summary of the type of information omitted

"It would be rare to disclose no information at all....."

ASIC Surveillance

ASIC Surveillance Areas

Large Pty Ltd's

- 200 sets of financial statements reviewed

- Majority were SPFR's - claims of being nonreporting entities 'eye-raising'

- Boiler plate disclosures not reflective of company

- Accounting policies generic and/or unclear

- Absence of impairment and associated disclosures despite generating losses or negative cash flows

ASX Listed Entities – December 2012 outcomes

- 150 December reporting entities

- Minimal disclosure of impact assessment of new accounting standards applicable from 1 Jan 2013

- Impairment of PPE and Intangibles (only about 20 companies had recognised any impairment)

- Insufficient disclosure around valuation assumptions, inappropriate discount rates in use, aggressive cash flow projections

- Indefinite vs finite useful lives of intangibles

ASX Listed Entities – December 2012 outcomes (cont'd)

- Issues with prominence non-IFRS financial information and inconsistencies in reconciliation (see ASIC RG 230)

- Rights to future revenue are intangible assets not financial instruments

- Inappropriate expense deferral (capitalising such items as training, research, relocation costs)

- Going Concern issues – absence of disclosure about how directors consider entity remains solvent

ASX Listed Entities

- All of the above....plus

- Operating and financial review (RG 247)

- Related party disclosures

- Financial Instrument measurements

Update on Lease Accounting

Update on Leases (ED 242)

- Continues to propose the removal of the Finance Lease vs Operating Lease accounting distinction

- Why? Increase the transparency of an entity's leverage and eliminate guesswork of off-balance sheet financing

- Requires recognition of a Right of Use asset and liability for ALL leases

- Off-balance sheet leases prohibited unless < 12 months long

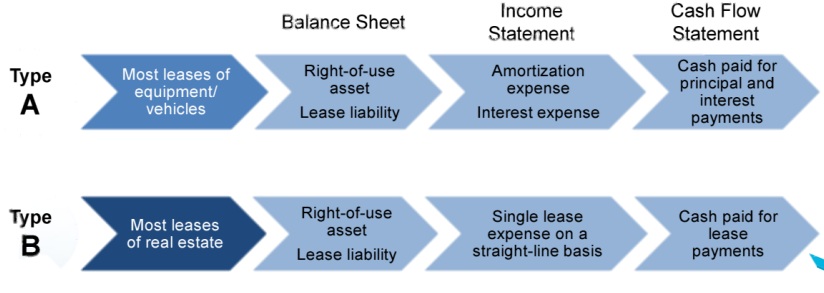

Dual Approach model

Lessee Accounting

Update on Leases

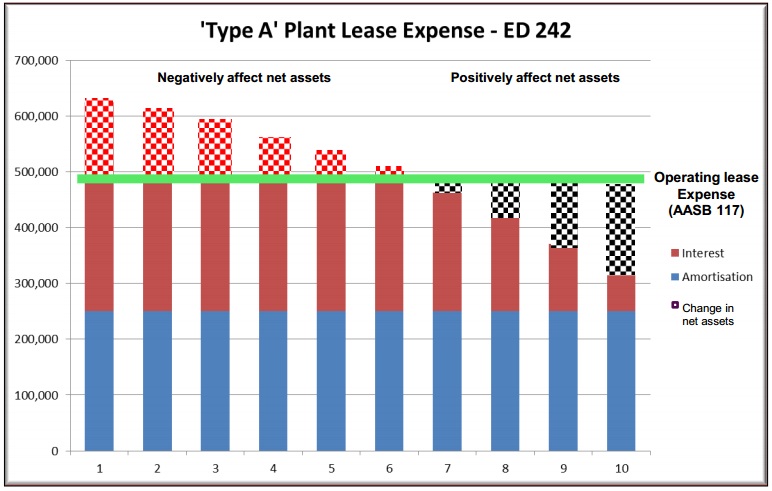

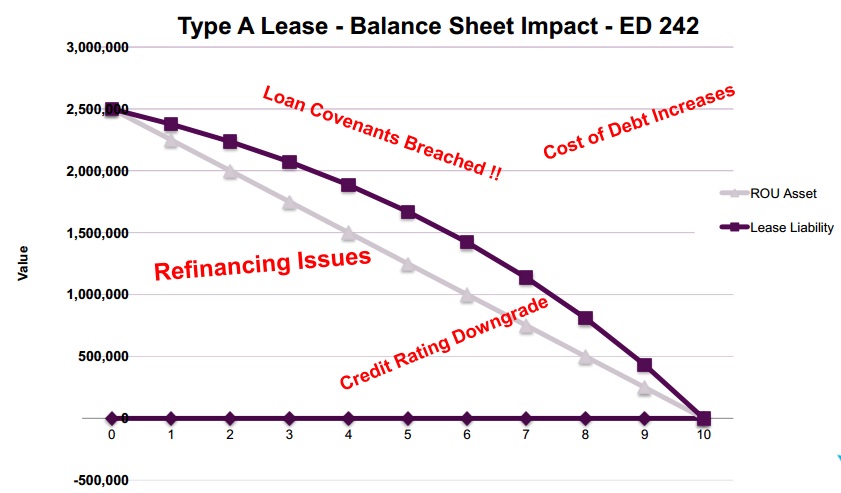

Type A Lease - Balance Sheet Impact - ED 242

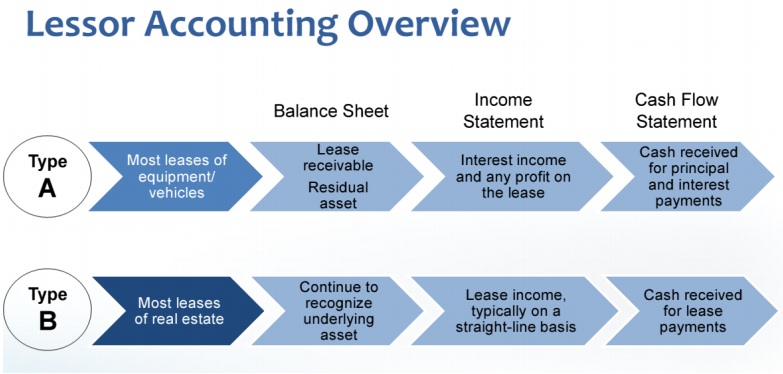

Update on Leases

Update on Revenue Accounting

Revenue Accounting Update

- Final standard due by September 2013

- Application from 1 January 2017

- Retrospective accounting required

- Proposes single model of revenue recognition (replaces AASB 118 and AASB 111)

- Introducing comparability across industries

- Multi-element contracts will particularly be affected

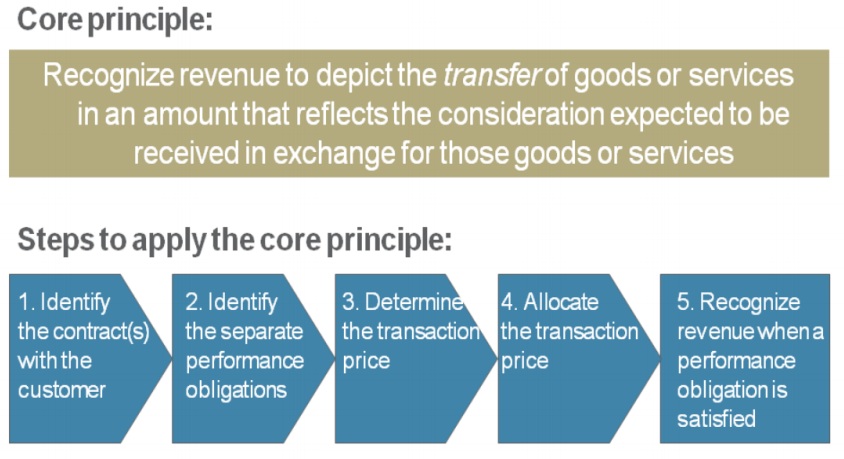

Revenue from Contracts with Customers

- Industries consulted:

-

- Automotive

- Construction & Engineering

- Energy and utilities

- Financial services

- Franchisors

- Health care

- Pharmaceutical & Life sciences

- Industrial Products and Manufacturing

- Media and entertainment

- Real estate

- Software and technology

- Telecommunications

Possible implications on financial statements

| Revision | AASB 111/118 | |

| 1. |

Timing of revenue recognition Contracts for asset development will result in continuous revenue recognition only when the customer controls the asset in development |

Revenue recognised on stage of completion basis. Diversity in practice exists |

| 2. |

Unit of Account Entity may be required to divide contracts into smaller components of distinct performance obligations that are delivered at different times |

Essentially account for delivery of the overall asset or overall project if priced as a package |

| 3. |

Capitalised expenditure Certain contract costs are capitalised as an asset if of value to the contract overall in future periods |

May have been expensed depending on industry. Diversity exists |

| 4. |

Amount of revenue Recognise revenue to the extent entitlement is reasonably assured (gives rise to refund liabilities and adjustments to COGS) |

Revenue recognised on transfer of risks and benefits associated with good or service |

| 5. |

Contingent revenue For variable pricing, need to estimate the most likely outcome and adjust subsequently |

Variable revenue generally recognised when contingency resolved. Divergent practice. |

| 6. |

Licensing and Rights Recognise revenue upfront when selling right of use of IP on given day; over period when selling access to fluid IP. Make sure other distinct goods and services are separated out |

The weightings of upfront vs. deferred revenue may alter. Divergent practice |

Business process issues to consider

- Consider the need to restructure of supply contracts and when control is delivered to customer.

- Does there need to be change in the way goods and/or services are delivered or in the nature of what is delivered (e.g. can they be bundled differently)

- Where are the areas where judgement is required in determining whether and when a performance obligation has been satisfied.

- How will we track revenue for multi-deliverable contracts? How do we assign a price to each element?

- Can current accounting systems pick up the necessary information? IT developers may be needed

Business process issues to consider

- Disclosure and presentations have increased. What information do we need to capture?

- Will the effects on the balance sheet impact covenants

- Is there separate performance obligations that will result in onerous performance liabilities?

- There is likely to be more use of significant estimates and judgements. How do I formulate and disclose these?

- Expected Refunds must be accounted for from Day 1

- Extended Warranties are a separate performance obligation

Developments in Corporations Law

- Closure of Financial Reporting Panel (Amendment to ASIC Act – effective September 2012)

- Corporations Legislation Amendment (Remuneration Disclosures and Other Measures) Bill 2012 (Draft Bill Only)

-

- No Remuneration Report for unlisted disclosing entities

- Remuneration Governance Frameworks disclosure added

- Additional KMP remuneration disclosures

- Actions taken against KMP if any of past 3 years financial statements proven to be misstated

- Clarification to dividend payment test

- Corporations Legislation Amendment Regulation 2013 (No. A) (Draft only)

-

- Introduce the individual KMP remuneration disclosures taken out of AASB 124 into Remuneration Report

New Requirements for 30 June 2013

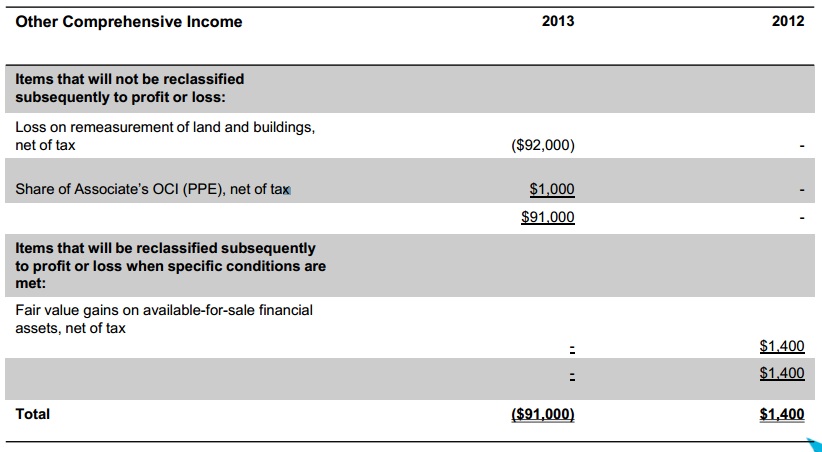

Presentation of OCI

- Separately present OCI items that:

-

- will be reclassified ('recycled') in future to P/L when specific conditions are met

- will never be reclassified to P/L

Also disclose reclassifications during the period from OCI to P/L

- Option to present OCI items on the face of the financial statements:

-

- net of related tax

- gross of related tax with aggregate tax relating to OCI in single line

Apply (ii), allocate tax between OCI items classified into (a) and (b)

Example Presentation of OCI

Deferred tax on PPE or Investment Property

- Previously - measure tax amounts with regards to way carrying amounts recovered (either use or sale)

- Now – for non-depreciating assets measured under revaluation model in AASB 116 or AASB 140:

-

- rebuttable presumption that carrying amounts will be recovered through sale

- presumption rebutted if investment property held in business model where objective is to substantially consume benefits over time rather than sell

New Requirements for Future Reporting Periods

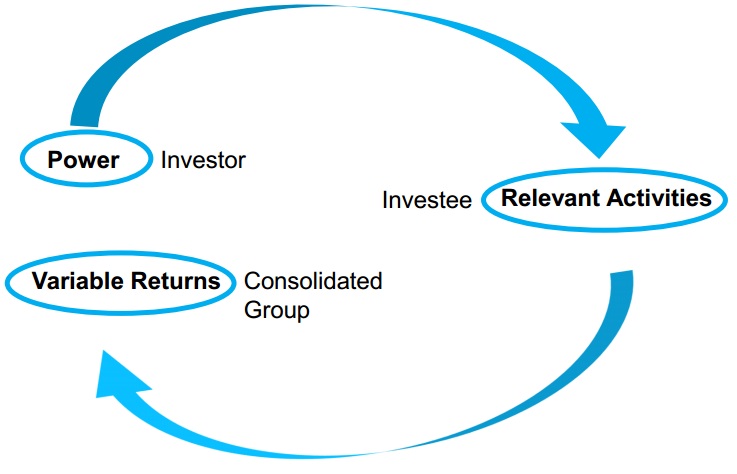

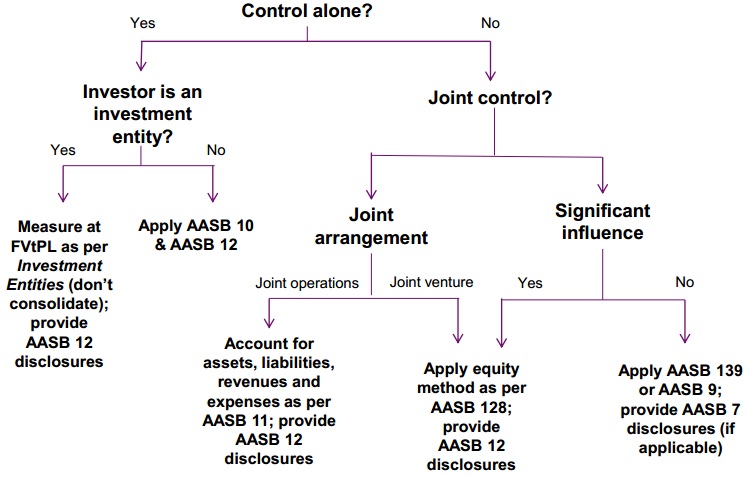

AASB 10: Consolidated Financial Statements

- New definition of 'control'

- No change to consolidation (accounting) process

- Mandatory application by FPs from 1 Jan 2013 and NFPs from 1 Jan 2014

Summary of 'Control'

Entities most likely to be impacted by AASB 10

- Hold significant, but not majority, equity interests in another entity

- Hold significant equity and debt interests in another entity

- Undertake asset and/or fund manager roles

- Provide KMP or critical services/assets to other entities

- Use special purpose ('structured') entities

- Have power over specified assets ('silos') of an investee

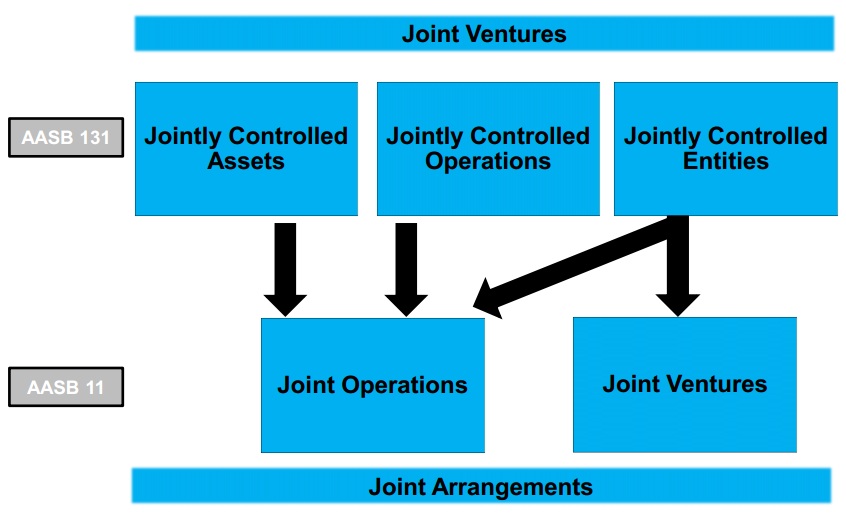

AASB 11: Joint Arrangements

- Joint operations

-

- operators have rights to assets and obligations for liabilities of arrangement

- account for shares of individual assets, liabilities, revenues, expenses

- Joint ventures

-

- venturers have right to net assets of venture

- equity method

- Mandatory application by FPs from 1 Jan 2013 and NFPs from 1 Jan 2014

Categories of Joint Arrangements

Entities most likely to be impacted by AASB 11

- Participate in joint arrangements but do not share joint control

- Have old joint arrangements with limited documentation detailing the terms of the arrangement

- Have multiple joint arrangements operating under the same documentation

- Currently apply proportionate consolidation

AASB 12: Disclosure of Interests in Other Entities

- Provide information that helps users evaluate:

-

- nature and risks associated with interests in other entities

- effects of interests on financial position, performance and cash flows

- Minimum disclosure requirements to meet objective

- Mandatory application by FPs from 1 Jan 2013 and NFPs from 1 Jan 2014

Investment Entity Proposals

- Prohibited from consolidating subsidiaries

- Required to account for all subsidiaries except those that provide investment-related services at fair value through profit or loss (FVtPL)

Accounting for Interests in Other Entities - Summary

AASB 13: Fair Value Measurement

- Clarifies the definition of fair value and related guidance

- Provides a single source of guidance for fair value measurement

- Requires consistent and enhanced disclosures about fair value measurements

- Mandatory application from 1 Jan 2013

Entities most likely to be impacted by AASB 13

- Measure numerous items at fair value

- Measure liabilities or own equity at fair value

- Did not previously consider the 'highest and best use' of a non-financial asset when determining its fair value

- Previously determined fair value on the basis of the market in which they transact most frequently without considering, when applicable, other markets with greater volume and liquidity

Employee Benefits

- New definition of 'short-term benefits'

-

- benefits expected to be settled wholly within 12 months of the reporting date

- implications for measurement (not classification/presentation)

- New recognition requirements in relation to DB plans:

-

- service cost and interest expense/income on net DB liability/asset recognised in P/L

- remeasurements, including actuarial gains/losses and 'non-interest' component of return on plan assets in OCI

- Mandatory application from 1 January 2013

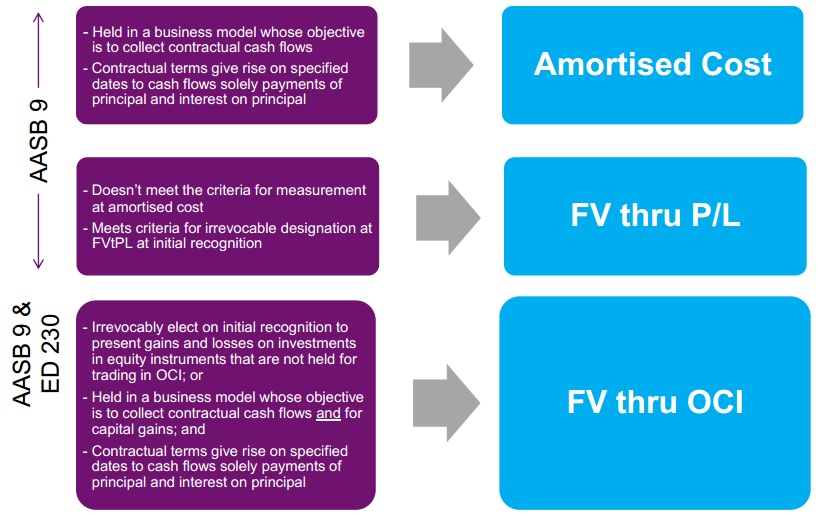

AASB 9: Financial Instruments

- Mandatory application deferred to 1 Jan 2015

- Three accounting models for financial assets:

-

- amortised cost

- FVtPL

- fair value through OCI

- Measurement requirements for liabilities the same, except that entities can choose to present effects of credit risk on liabilities designated at FVtPL in OCI

Other Proposed Changes to AASB 9

- Classification and measurement amendments

-

- factors to consider when evaluating a business model for managing financial assets

- 'FV through OCI' classification for financial assets held for cash flows and capital gains

- Expected credit loss model proposals

-

- recognised based on relevant information

- measured at the present value of probability-weighted estimate

- simplified approach for trade and lease receivables

Summary of AASB 9 Requirements and Proposals

Stripping Costs Arising from Mining Activities

- Accounting for 'overburden' that is removed during production phase to provide access to mineral deposits

- Stripping activities can produce:

- ore that can produce inventory

- non-current asset - 'stripping activity asset'

- Non-current assets accounted for:

- initially at cost

- subsequently at cost or revalued amount

Differential Reporting Project

- Phase I - Reduced Disclosure Requirements (Tier 2) mandatorily apply from 1 July 2013

- Phase II – Implications of moving from 'reporting entity' to 'GPFS':

-

- AASB tentatively decided to remove SAC 1 but retain guidance in another form

Not - for - Profit Specific Matters

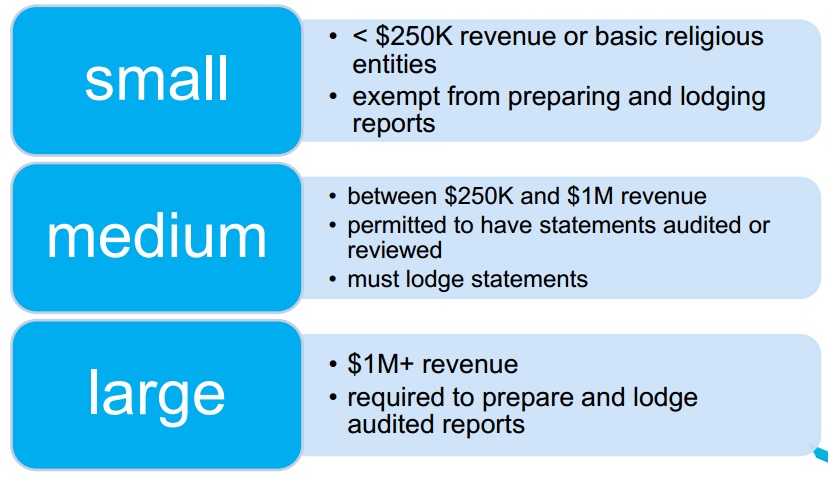

ACNC Proposed Differential Reporting Framework

Proposed Financial Reporting Framework

- Full set of financial statements

- A declaration by the responsible entity regarding solvency and compliance

- Applicable accounting framework determined on the basis of entity's:

-

- reporting entity status (GPFS or SPFS)

- public accountability (Tier 1 or Tier 2)

AASB NFP-Specific Projects

- ED 238 – control in the NFP sector:

-

- principles in AASB 10 can be applied in a NFP context using professional judgement and NFP-specific guidance

- comments due to AASB by 30 June 2013

- Income from transactions of NFP entities:

-

- replace AASB 1004: Contributions

- to be issued as part of the revised revenue recognition requirements

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2011 Moore Stephens Australia Pty Limited. All rights reserved.