The much anticipated 2009/10 Federal Budget has introduced some significant changes that should have a mostly positive impact for small business and families, however has failed to deliver for large corporates and high net worth individuals.

Treasurer Wayne Swan stated that the Government had a strong aim to provide a nation building budget that aims to boost the economy through investment in small business, and major spending on infrastructure in an aim to capitalise on the economic recovery when the time comes.

In light of the Rudd Government's efforts to boost the economy, we welcome some of the announcements made in the Federal Budget:

1. Small Business Initiatives

1.1 Investment allowance for small business increased to 50%

This is a fantastic outcome for most small businesses

with an annual turnover of less than $2 million. The Tax Break has

been expanded to allow a bonus deduction of 50% (from 30%) with an

extended time period until 31 December 2009 (instead of 30 June

2009) to acquire an asset.

However, all other businesses (i.e. annual turnover of more than $2 million) do not get the benefit of the increased 50% deduction or the extended time period that applies to small businesses.

For further details, please refer to the following Treasurer's Media Release: http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/061.htm&pageID=003&min=wms&Year=&DocType=0

1.2 Research & Development Tax Credit

From 2010/11, the Government will replace the complex and outdated R&D Tax Concession with a simplified R&D Tax Credit which cuts red tape and provides a better incentive for business to invest in research and innovation.

The new Tax Credit will provide a 45% refundable credit for businesses with an annual turnover of less than $20 million, which is equivalent to a Tax Concession of 150%. This means that businesses will receive a tax refund of 45% of their R&D spending when they lodge their tax return.

Businesses with a turnover of more than $20 million and companies undertaking R&D in Australia where the intellectual property is held offshore, will also benefit from the new scheme, with access to a 40% nonrefundable credit, which is equivalent to a tax concession of 133%.

This seemingly generous measure will specifically encourage both small businesses and startup businesses to undertake R&D activities as the refundable credit means money in the bank available to fund activities. However, the sting for businesses may well be that certain existing R&D activities may become ineligible for the Tax Credit as the definition of R&D is foreshadowed to be tightened.

For further details, please refer to the following Treasurer's Media Release: http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/062.htm&pageID=003&min=wms&Year=&DocType=0

2. Initiatives Affecting Corporates

2.1 Tightening the non-commercial loan rules in Division 7A

The Government will extend the operation of the non-commercial loan rules in Division 7A of the Income Tax Assessment Act 1936 to cover circumstances where a shareholder (or their associates) is permitted to use a company asset such as real estate, a car or boat for free or at a discounted rate.

The measure will ensure that the shareholders pay tax on the non-cash benefits provided to them by the company.

For further details, please refer to the following Treasurer's Media Release:

2.2 Off-market Share Buy-backs

The Government will implement the Board of Taxation's recommendations to improve the taxation treatment of off-market share buybacks. Off-market share buy-backs are a mechanism for companies to return surplus capital to shareholders.

Implementation of these recommendations will provide more certainty and flexibility for companies undertaking off-market share buybacks and their shareholders, while reducing administration costs.

For further details, please refer to the following Assistant Treasurer's Media Release: http://assistant.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/048.htm&pageID=003&min=ceb&Year=&DocType=0#AttachmentB

2.3 Non Commercial Business Losses

Rules surrounding the application of non-commercial business losses will be subject to additional restrictions. Currently, all individuals are able to apply the losses from their business activities against their income from other sources provided they have satisfied the applicable tests. With the proposed changes, individuals earning more than $250,000 adjusted taxable income will no longer be able to rely on the tests and use the losses. However, existing rules remain unchanged for individuals earning $250,000 or less. The Commissioner's discretion for relieving taxpayers from the new rules will continue to be available.

This measure is intended to close a loophole which allows high income earners to minimise their taxes and improve fairness and integrity in the tax system.

3. Superannuation

3.1 Reduction in Contributions Cap

The Government has announced that it will reduce the cap on concessional superannuation contributions from $50,000 to $25,000 from 1 July 2009. The amount of the cap will be indexed annually thereafter.

The existing transitional cap for concessional contributions for those aged 50 years and over will also be reduced, from $100,000 to $50,000 from 1 July 2009. This reduced transitional cap will apply for the next three financial years starting in 2009/10, after which the cap will revert to the lower $25,000 cap (or applicable indexed amount). The transitional cap will not be indexed.

3.2 Non-concessional Caps

The non-concessional contributions cap will remain unchanged at $150,000 for the 2008/09 year and will remain at that level in 2009/10.

Thereafter, the non-concessional cap will be calculated as 6 times the level of the indexed concessional cap.

Under the "bring forward" arrangements applicable from 1 July 2007, the annual non-concessional cap can be averaged over 3 years to allow people under age 65 to accommodate a larger one-off contribution. This cap is effectively 3 times the non concessional cap, and will remain unchanged at $450,000 for the 2008/09 year and in 2009/10. Thereafter, the "bring forward" amount will be 3 times the non concessional contributions cap.

3.3 Temporary reduction in Government co-contribution

Currently the Government has a superannuation co-contribution scheme in place where every $1 contributed in to a complying superannuation fund is matched by a $1.50 contribution by the Government.

The Government has announced temporary reductions to this scheme and the co-contribution will be reduced as follows:

150 % to 100 % for contributions made in the 2009-10, 2010-11 and 2011-12 income years, and 125 % for contributions made in the 2012-13 and 2013-14 income years.

The maximum co-contributions payable will also be reduced accordingly to $1,000 for contributions made in the 2009-10, 2010-11 and 2011-12 income years. However this will be extended in the following tax years to $1,250 for contributions made in the 2012-13 and 2013-14 income years.

It is also proposed that the co-contribution matching rate and maximum amount payable will again return to 150 % and $1,500 for contributions made in the 2014-15 and following income years.

The co-contribution income thresholds will continue to be indexed in line with wage increases.

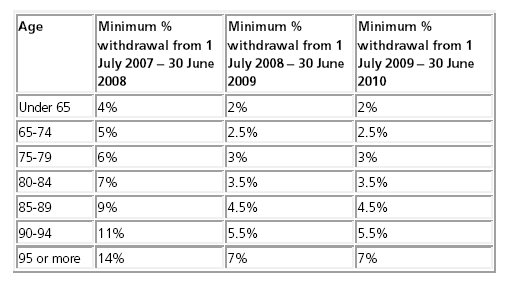

3.4 Minimum pension drawdown

From 1 July 2009, the Government will halve the minimum amounts self-funded retirees have to draw down from their account-based pensions for 2009-10.

This extends the drawdown relief provided by the Government for 2008-09, recognising the impact of the global recession.

3.5 Preservation age

The Government has released the report prepared by Australia's Future Tax System (AFTS) Review Panel into the strategic issues for the retirement income system.

One of the recommendations was gradually aligning the age at which people can access their superannuation savings (preservation age) with the increased Age Pension age.

The transition to the higher Age Pension age will commence in July 2017, with the qualifying age increasing by 6 months every 2 years, to reach 67 on 1 July 2023.

For further details, please refer to the following Treasurer's Media Release:

3.6 Trans Tasman Retirement Scheme

The Government has indicated again that it has agreed to a Trans Tasman Retirement Savings Account with New Zealand. The scheme will allow transfers of superannuation savings between Australian Superannuation Funds and New Zealand KiwiSaver Funds.

Under the existing Departing Australia Superannuation Payment regime, a New Zealand citizen cannot access their accumulated Australian superannuation benefits until they reach preservation age and trigger a condition of release.

4. Other Tax Technical Amendments

The Government has introduced what looks like promising proposed amendments to Australia's tax system. However, history has shown that announcements made in the past Budgets have not lived up to their expectations and the detailed legislation can often prove to not look as promising. The Government should ensure that the tax changes discussed are more than just rhetoric and close attention should be given to the detail when drafting the legislation.

4.1 CGT Limited Roll-Over for Fixed Trusts

The Government is introducing a limited capital gains tax ("CGT") roll-over which is designed to allow the restructuring of fixed trusts (trusts with the same beneficiaries and same entitlements with no material discretionary elements) without any immediate CGT consequence. The roll-over is available for assets transferred between fixed trusts effective from 1 November 2008 to defer CGT arising from a transfer until the receiving trust ultimately disposes the asset. Integrity measures will also be released to accompany these new rules.

For further details, please refer to the following Assistant Treasurer's Media Release: http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/048.htm&pageID=003&min=ceb&Year=&DocType=0

4.2 TFN Withholding and Closely Held Trusts

Under the current PAYG withholding arrangement, investment bodies such as banks, trust and companies are liable for Tax File Number ("TFN") withholding tax on the payment of interest and dividends where the recipient has not quoted their TFN. TFN withholding tax is applied at the top marginal tax rate of 46.5%. The exception applies if a TFN is quoted or the recipient is granted an exemption from providing their TFN. From 1 July 2010, these arrangements will extend to closely held trusts and family trusts except in circumstances where a trustee is liable for the income tax. The aim is to ensure that assessable distributions from closely held trusts and family trusts are reported in a beneficiary's tax return.

These new measures are designed to ensure that there is improved fairness and integrity in the tax system and also aligns with the Government's commitment to improve efficiency of the Australian Tax Office' income matching system.

For further details, please refer to the following Treasurer's Media Release:

4.3 Foreign Source Income Attribution Regimes

Based on the recommendations of the Board of Taxation, substantial changes are proposed to change the Controlled Foreign Company ("CFC"), Foreign Investment Fund ("FIF"), transferor trust and deemed present entitlement rules. The CFC provisions will remain the primary set of rules to counter tax deferral arrangements, but will be rewritten to be included in the Income Tax Assessment Act 1997. The FIF and deemed present entitlement rules will be repealed with the FIF rules to be replaced with targeted anti avoidance provisions. Amendments will also be made to the transferor trust rules to improve their integrity.

These changes are expected to reduce compliance costs for businesses and ensure Australia's competitiveness in the managed funds market.

The Government has not yet stated when these amendments will take effect. They will consult on the implementation of these changes so it would be recommended to keep an eye out for further updates in the upcoming months.

For further details, please refer to the Assistant Treasurer's Media Release: http://assistant.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/049.htm&pageID=003&min=ceb&Year=&DocType=0

4.4 Uniform Capital Allowance ("UCA") Regime changes

A number of minor technical amendments have been proposed to the UCA regime. The changes are intended to apply in most cases from 1 July 2009 with the exception of certain changes applying from 1 July 2001.

The amendments are aimed at increasing certainty for taxpayers in several areas by covering situations not covered in the current legislation such as the interaction of the UCA rules and the hire purchase arrangements amongst others. With the retrospective application of some of the measures, taxpayers may be required to review their current treatment of assets subject to the UCA regime.

For further details, please refer to the following Assistant Treasurer's Media Release: http://assistant.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/048.htm&pageID=003&min=ceb&Year=&DocType=0

5. Employee share schemes Employers will now need to reconsider whether they will offer employee share schemes going forward in their current form as most are unlikely to remain tax effective. Under the new rules, employees will no longer be entitled to elect to defer taxation.

The new rules will apply to all qualifying shares and options acquired after 7.30pm 12 May 2009. The measures may still remain tax effective for low and middle-income earners (with taxable income less than $60,000) to access such schemes and will not affect shares or options already held by employees prior to the Federal Budget.

For further details, please refer to the following Treasurer's Media Release:

6. Individuals

6.1 Private Health

Effective 1 July 2010, the Government will introduce three new 'Private Health Insurance Incentive Tiers'.

Existing arrangements will remain unchanged for singles with an income of less than $75,000 per annum and families with incomes of less than $150,000 per annum. Income in this context refers to income for Medicare levy surcharge (the surcharge) purposes.

- Tier 1 will apply to singles with income of more than $75,000 (more than $150,000 for families), based on current projections;

- Tier 2 will apply to singles with income of more than $90,000 (more than $180,000 for families); and

- Tier 3 will apply to singles with income of more than $120,000 (more than $240,000 for families).

All income thresholds will continue to be indexed to wages.

The aim behind the incentive is to attempt to better balance the mix of incentives for people to take out private health insurance.

For further details, please refer to the following link to the Treasury website which summarises the changes with regards to the Private Health Insurance changes. http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/048.htm&pageID=003&min=wms&Year=&DocType=0

6.2 Medicare Levy From 1 July 2009, following increases will be implemented:

- Medicare levy low-income threshold will increase to $17,794 for singles and to $30,025 for couples;

- Additional amount of threshold for each dependent child or student will increase to $2,757; and

- Medicare levy low-income threshold for pensioners below Age Pension age will increase to $25,299.

This increase is in line with previous annual Medicare threshold increases.

6.3 Family Assistance

Family Tax Benefit and other family payments

From 1 July 2009, Family Tax Benefit Part A payment rates will be indexed by the Consumer Price Index consistent with other family payments such as Family Tax Benefit Part B and the Baby Bonus. Higher income thresholds for family payments will be paused at current levels for three years until July 2012. This will reduce the growth in family payments to those at the higher end of the income scale.

The Family Tax Benefit Part A lower income free threshold (currently $42,559) and the Family Tax Benefit Part B secondary earner income threshold (currently $4,526) will continue to be indexed annually.

For further details, please refer to the following Treasurer's Media Release: http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/059.htm&pageID=003&min=wms&Year=&DocType=0

Paid Parental Leave scheme

The Government will introduce a Paid Parental Leave scheme for parents in respect of births and adoptions that occur on or after 1 January 2011. The scheme will provide 18 weeks postnatal leave paid at the federal minimum wage (currently $543.78 per week). This amount will be paid by the Government, not individual businesses.

Superannuation payments will not initially be introduced for the Paid Parental Leave.

The scheme will help parents spend time with newborns, improving outcomes for parents and their child. It will also promote continued participation and contact with the workforce.

For further details, please refer to the following link to the Budget 2009-10 website which summarises the new Paid Parental Leave Scheme, including the eligibility criteria and the impact on other family payments. http://budget.australia.gov.au/2009-10/content/bp2/html/bp2_expense-13.htm

6.4 First Home Owners Boost

The First Home Owners Boost has been extended in full until 1 October 2009. All grant amounts currently in place will remain until 30 December 2009 (inclusive). From 1 October 2009 to 31 December 2009 the grant will be halved.

The extension of the grant for the purchase of new homes should help stimulate housing activity and construction.

For further details, please refer to the following Treasurer's Media Release: http://www.treasurer.gov.au/DisplayDocs.aspx?doc=pressreleases/2009/047.htm&pageID=003&min=wms&Year=&DocType=0

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.