With the due date for business activity metrics to be lodged approaching, and industry funding invoices to follow in the new year, it's pertinent to look at the action ASIC can take if you fail to pay your industry funding invoice.

In July 2024, ASIC cancelled Accumulus Capital Pty Ltd's Australian Credit Licence for:

- failing to pay the ASIC Industry Funding Levies and the late payment penalties within 12 months after the due date for payment; and

- not engaging in credit activities since ASIC granted the licence.

Section 8 of the ASIC Supervisory Cost Recovery Levy (Collection) Act 2017 ("the Act") states that companies, financial services entities and credit services entities are required to pay the levy each financial year.

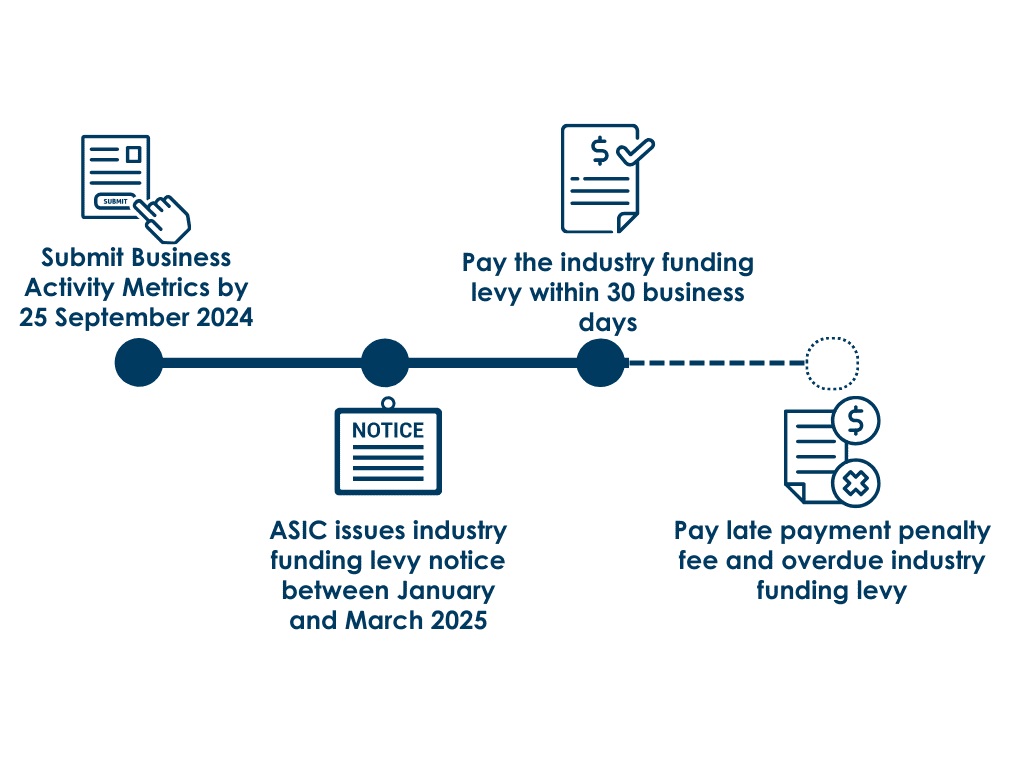

In order for ASIC to determine how much you are required to pay, you must submit your business activity metrics using the ASIC Regulatory Portal by 25 September 2024. ASIC will use these metrics to issue your Industry Funding Levy notice between January and March in 2025. The industry funding levy will need to be paid within 30 business days after the levy notice is issued, using BPAY, electronic funds transfer or credit card.

ASIC Industry Funding Levy

What happens if you don't submit the business activity metrics or pay the industry funding levy?

It is a criminal office under the Act if you fail to submit the business activity metrics without a "reasonable excuse".

If you fail to pay the industry fund levy by the due date, ASIC will impose a late payment penalty which is 20% of the overdue levy amount per annum.

If you continue to fail to pay the industry fund levy and the late payment penalties, ASIC can take action to cancel your licence and deregister the entity as it has in the case of Accumulus Capital Pty Ltd.

What happens if you can't pay the industry funding levy?

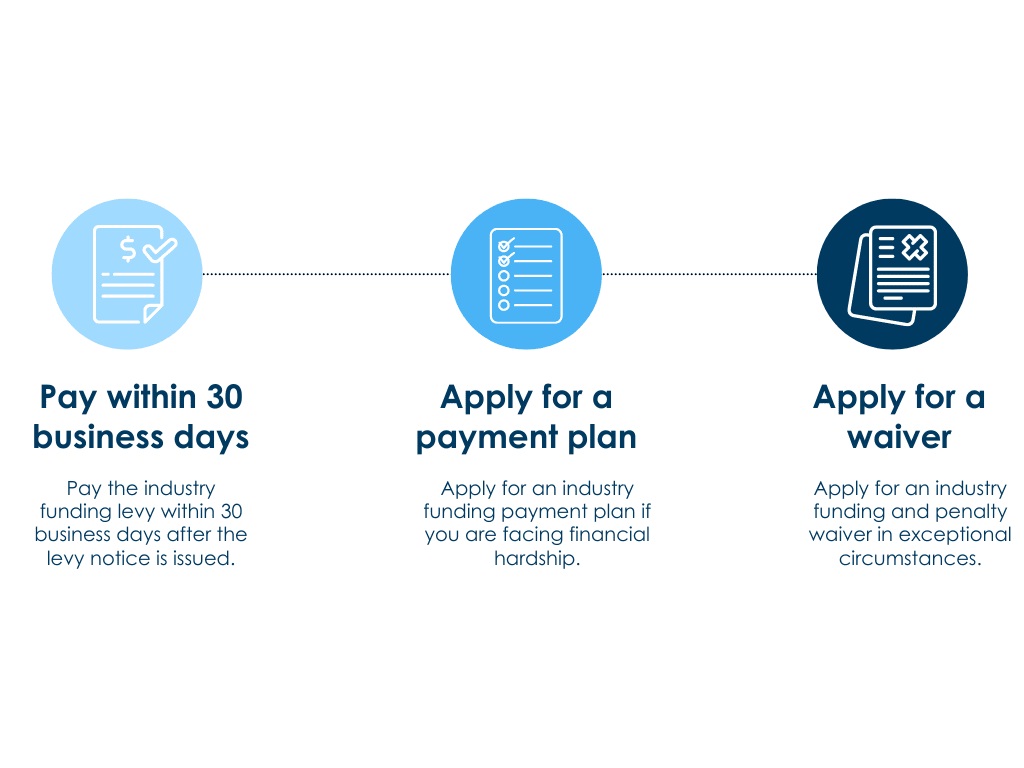

You can request that ASIC waive your levies and penalties in exceptional circumstances only. These circumstances may include natural disaster, delays caused by the court, serious illness or death of an officeholder. In order to make a request for a waiver, you will need to log into your ASIC Regulatory Portal account and complete the relevant form. You will also be required to support your request with evidence of the exceptional circumstances.

If you are facing financial hardship, you can apply for an industry funding payment plan. Similar to the waiver request, you will need to log into your ASIC Regulatory Portal account to complete the request for a payment plan. ASIC will determine if you are eligible for a payment plan based on the reasons provided in the request and the supporting documentation used to substantiate your financial hardship.

Three ways to pay your industry funding levy

Further Reading

- Section 7 of the ASIC Supervisory Cost Recovery Levy Act 2017

- Section 7, 8 and 11 of the ASIC Supervisory Cost Recovery Levy (Collection) Act 2017

- Section 54 of the National Consumer Credit Protection Act 2009

- ASIC's Video guide on how to submit your business activity metrics

- Industry Funding Business Activity Metrics

- Accumulus Capital Pty Ltd Media Release

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.