- within Compliance topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Healthcare industries

Edited by

Paul Harricks ![]()

China Gets FIT - China Implements Solar Feed-In Tariff Program

By: Heather Cohen and Thomas J. Timmins

Last month, China's National Development and Reform Commission (NDRC) announced the implementation of a nationwide solar feed-in tariff program. This plan consolidates China's previous solar energy programs and offers greater certainty to China's bourgeoning solar energy industry sector.

How It Works

Those systems which began construction in July of this year and will be completed by the end of the year are entitled to a tariff of 1.15 Yuan (about the equivalent of 18 cents US) per kwh. Those projects approved after July 1, 2011 or approved prior to that date but which cannot be completed before the end of the year, can claim a tariff of 1 Yuan (about 16 cents US) per kwh.

Solar Power in China

The growth of China's solar market has been particularly interesting to watch as it has developed in line with China's vast geography and its unique needs. China is already the world's largest solar panel manufacturer. Following the country's 2009 feed-in-tariff for wind (which led to explosive growth in that industry), this new program consolidates the array of incentives which were previously available in the country. The solar feed-in tariff program gives a clear signal to industry participants that the Chinese government will support its domestic industry, which has previously been heavily export-reliant.

Key details regarding the new feed-in tariff have yet to be released and there have been some contradictions in reports describing the program (which was quietly announced in the back-pages of a government gazette). The government has reserved the right to alter the program in accordance with changing market conditions. There has also been some criticism to the effect that the tariff rate is inordinately low. (It is, in fact, the lowest national tariff in the world.)

Solar Power and the Chinese Market

China currently leads the world in the production of solar panels. With this new feed-in tariff program, it could also become a world leader in consumption of solar panels – an important change for the local industry in light of recent economic developments. Solar panels currently account for only 0.8 GW of energy in a grid of almost 1,000 GW.

Analysts predict that this new tariff will bring developers an annual rate of return of as much as 10 percent over a period of 15 to 25 years.

China's demand for the installation of solar energy systems in 2011 is estimated to be between 1 and 2 GW. IMS Research predicts that China will be the fourth most important solar market this year. With the implementation of the feed-in tariff program, estimates for installation demand for 2012 range from 1.7 GW to 3 GW, increasing worldwide demand by 5 percent. The Chinese government has set a target installation goal of 10 GW by 2015, at which point China is expected to rank amongst the top three global solar markets.

Some analysts have expressed cynicism as to how profitable projects developed under the new program will be, but most are clear that a) the program illustrates China's commitment to the solar industry and b) the program represents a significant shift away from exclusive reliance and export-driven growth in the industry.

Ontario Clarifies Property Tax Rules with Respect to Solar Energy Generation

By: Christopher Collenette, Thomas J. Timmins and Andrew Zed

Along with other initiatives which were announced during the week of August 1st, the Province of Ontario is attempting to add greater clarity to the property tax treatment of solar energy generation facilities by introducing regulatory amendments to the Ontario Regulation 282/98 under the Assessment Act.

The stated objective of the proposed amendments are to clarify the property tax treatment of renewable energy installations for property owners, municipalities and the Municipal Property Assessment Corporation in addition to ensuring that property tax does not act as a disincentive to renewable energy generation, particularly in situations where small-scale generation facilities are owned by persons who are not normally in the business of generation. For a number of years, the property tax treatment of solar farms has been a matter of some uncertainty. Unlike wind energy, where $40,000 of value is attributed for each installed mega-watt of capacity, solar energy developments previously lacked clear assessment rules.

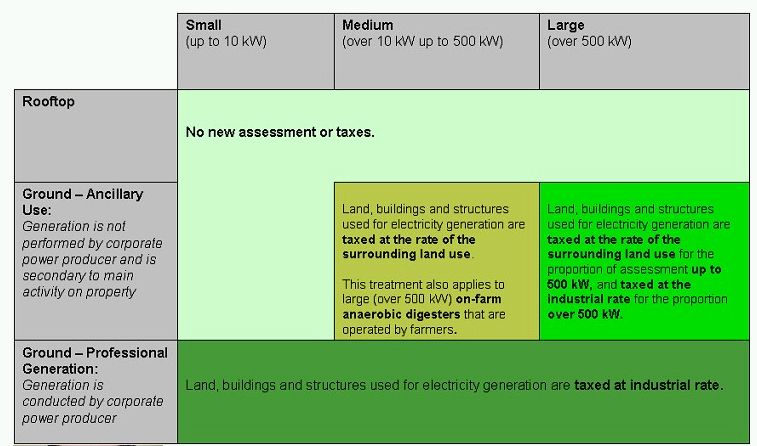

The amendments affect or clarify several categories of renewable energy facilities, including:

First, for rooftop installations will not result in a reassessment - this is very good news for the property owner.

Second, with regard to ground installations, the value for assessment purposes will depend on the size of the facility and the entity involved in the electricity generation.

Third, for individual persons who generate, transmit or distribute energy as an ancillary activity to their main activity on their property, there are now three classifications outlined by the regulations: (a) small-sized ground installations, up to 10kW, will not see an increase in assessment or a change in tax measures. (b) medium-size ground installations, over 10 kW and up to 500 kW, will be taxed based on the surrounding land use, whether that be residential, commercial or farm, etc; (c) Large-size ground installations with a generation capacity over 500 kW will also be taxed based on the surrounding land use for the first 500 kW produced and thereafter at the industrial rate for production.

Fourth, consistent with current treatment, ground mounted generation facilities that are operated by entities whose primary business is the generation, transmission or distribution of electricity, will be taxed at the industrial rate.

The Government has also circulated the table to illustrate the changes under Regulation 282/98:

Announcment

We are pleased to announce that, effective September 6, 2011, Alireza Rafiee has joined Gowlings as the new manager of our Energy, Infrastructure & Mining Industry Group. Alireza will be based in the Toronto office but will be working with the professionals in all of our offices in Canada and internationally.

Alireza has more than 10 years of international experience in business development, investment, sales and project management.

Before joining Gowlings, Alireza worked for the Australian Trade Commission (Austrade) for eight years in Tehran, Calgary and Toronto. His last position was Director, Market Development – Mining & Energy based in Toronto where his focus was to assist Australian businesses engage in the Canadian market and Canadian firms to invest in Australia's energy, mining and environment sectors.

Alireza worked for the private sector with responsibilities in the international market development, investment and export of goods and services in oil & gas, mining, education, IT, and infrastructure in North America, Europe and Middle East markets.

Alireza has a Bachelor of Science in Textile Engineering from Azad University and MBA from Curtin University (Perth, Australia).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.