IP analysis enables companies to create a technology landscape of their specific market sectors, from innovation hotspots to major industry players. Using Questel's IP landscaping tools, Senior Business Intelligence Consultant Steven Nindorera-Badara examines key technologies and forces at work in precision medicine, notably new entrants from associated technological spheres.

What is Precision Medicine?

Precision medicine (also referred to as personalized or individualized medicine) is an approach to disease treatment and prevention that considers individual variability in genes, environment, and lifestyle to design specific and adaptive treatments and/or patient support.

Its emergence is correlated to improvements in diagnostic tools, informatics development, and a better understanding of genomic and proteomic interactions.

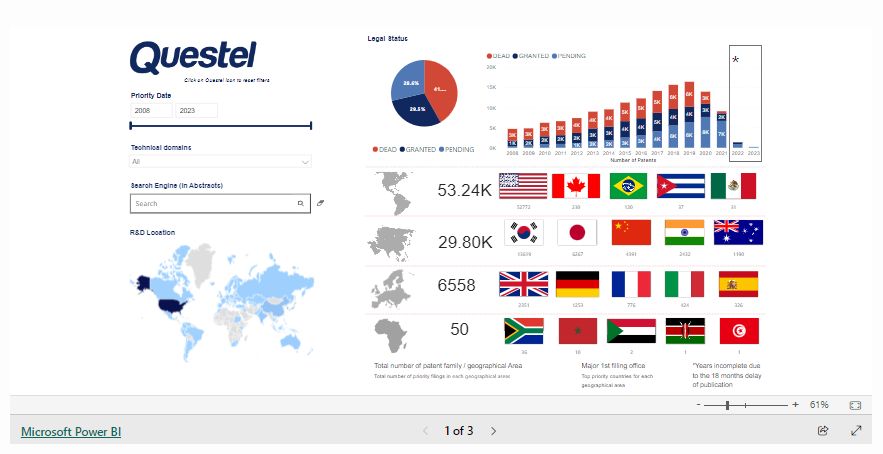

Precision medicine takes advantage of accurate, in-depth diagnostics tools, including DNA sequencing and medical imaging, and often involves powerful calculating tools to weigh the results. All of this led to biomarker identification and, as a second step, the design and development of tailored medical intervention to impact physio-pathological mechanisms associated with targeted diseases (see Figure 1).

The major application categories involve oncology/pedo-oncology, pharmacogenomics, inherited diseases, and prognosis and prevention.

The integration of new technologies and approaches has created new markets and seen the emergence of new players in the healthcare industry. By charting the field's technology landscape using IP analysis, we can provide a clear picture and powerful business intelligence of the technological environment, as well as identify key insights about forces at play.

Charting the Technology Landscape of Precision Medicine: Trends and Targeted Applications

IP filing dynamics reveal that precision medicine technologies were already in place at the turn of the 21st century (Figure 2).

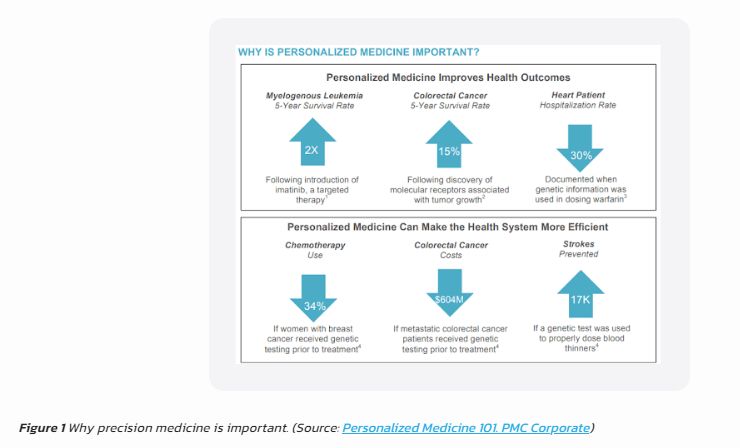

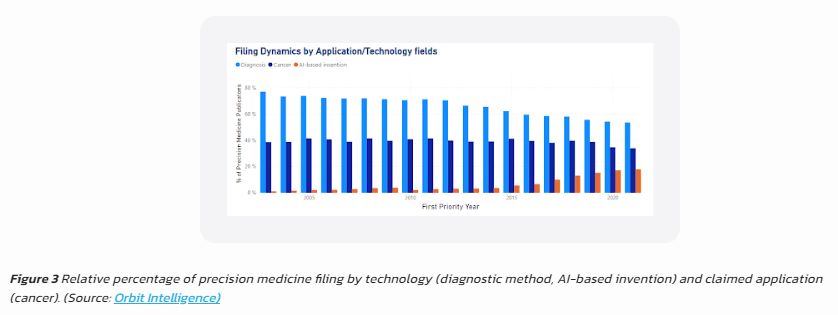

More than 2,000 patent applications were filed in 2003, mostly related to diagnostic/prognosis methods (75% of patent applications – see Figure 3).

After a stable period (2003-2010), we observed a boom in precision medicine innovations, with an increase of patent filings to more than 6,6K patent families in 2020, and a compound annual growth rate (CAGR) of 8% from 2010-2020. Over this period, the percentage of inventions related to tailored therapy increased, while the percentage of prognostic/diagnostic methods decreased, representing less than 50% of patents filed in 2022.

Over the years, oncology has been the main targeted application, with 34 to 51% of published inventions claiming application related to cancer. Disclosed innovations mainly aimed to:

- Screen and identify tumor biomarkers

Profile the tumor to identify cancer driver variants and understand tumor heterogeneity. - Develop targeted therapies that will specifically direct

identified features

Therapies include cell therapies (car-T cells), immunotherapies (antibodies and variants), and molecules that will address molecular pathways.

Patent filings associated with AI-based technologies began to rise in 2015, reaching 20% of patent applications filed in 2022 (see Figure 2). Mainly associated with diagnostic/prognosis devices or systems, the targeted pathologies are diverse, with areas of application including oncology, mental illness, cardiovascular disease, and rare diseases.

Technology Landscape of Precision Medicine: From Well-known Specialists to Big Tech

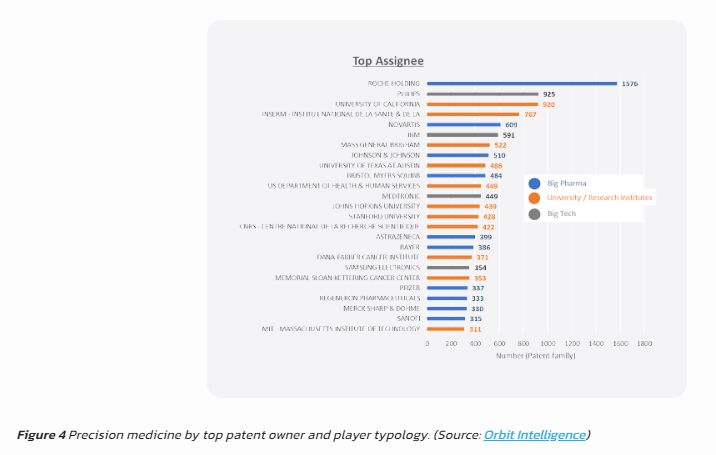

An analysis of the largest patent holders in the field gives an indication into the main players and driving forces (Figure 4).

image

As is the case in the medical industry in general, large pharmaceutical companies and research institutes are the main actors in the field. Of the top 25 assignees, 21 are big pharma companies and universities/research institutes.

Interestingly, the importance of tech innovation (hardware/software) for acute precision medicine is reflected in the presence of Big Tech corporations in the top players, with Philips in second place, IBM in fifth, and Samsung in 19th.

These companies notably played major roles in the development of diagnostic/prognosis tools, such as DNA sequencers or data analytic tools for decision support and patient monitoring, which are essential for the delivery of personalized care. For instance:

- Philips developed a diagnosis and monitoring system for variable applications, including cancer prognosis (EP3303616), antibiotic resistance (EP3426799), and cardiovascular disorder (EP3673493).

- IBM is using an AI-based process to predict drug and food interaction or provide medical risk evaluation (US10892057).

Further analysis of the patent data at a macroscopic level provides more detailed information on the key technological areas of precision medicine, the targeted application, and the main players in place.

Acute segmentation is required for such an in-depth analysis, which must be conducted according to the technological area of interest (immunology, diagnostic tools, AI-based systems) and/or the targeted application (rare diseases, neurological disorders, solid tumors, etc...).

Gathering data from additional sources, Questel's IP consulting business intelligence specialists can identify and provide our clients and partners with:

- Acute technological mapping and/or white space analysis to support strategic/R&D orientation and product development,

- Competitive intelligence report to support due diligence or business development, and

- Additional insights for IP roadmap, IP valuation, or out licensing and technological transfer.

Contact our specialist IP Consulting team to find out more about what IP analysis can reveal about your industry's technology landscape, from innovation white spaces to competitor activity, IP value, licensing, and technological transfer.

Steven Nindorera-Badara is a Business Intelligence Senior Consultant at Questel.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.