The last five years have seen several shipping and shipping- related companies incorporate in Bermuda and go on to list on the Oslo Stock Exchange. A key step along the route for a number of them has been the use of the Norwegian over-the-counter market as a fast-track way to access fresh capital. Avance Gas, Flex LNG, and Borr Drilling all took this route prior to an Oslo listing, whilst GoodBulk and 2020 Bulkers listed on Norway's OTC just last year, highlighting the enduring appeal of the Bermuda-Oslo nexus.

Bermuda Incorporation

Bermuda has long been a jurisdiction of choice for ship owners and investors in shipowning structures. As an island nation, shipping is part of Bermuda's heritage and it has a thriving and respected ship registry — a Category One member of the prestigious Red Ensign Group — which presently boasts 160 commercial ships grossing over 11 million tonnes.

Shipping industry participants choose to incorporate in Bermuda because investors are comfortable with the island's reputation as one of the world's premier offshore jurisdictions and an established international finance centre. Bermuda offers a tax-neutral, business-friendly environment, with a robust regulatory framework that protects investor and creditor rights. The use of Bermuda vehicles, with recognized ownership and corporate governance structures, can enhance opportunities for international companies to access highquality capital efficiently.

Shipping industry participants choose to incorporate in Bermuda because investors are comfortable with the island's reputation as one of the world's premier offshore jurisdictions and an established international finance centre.

Norwegian OTC

A newly-incorporated Bermuda shipping company is typically looking for capital to grow. Potential investors are more likely to show interest in an equity offering where there is some immediate liquidity for their investment. Norway, where shipping is in the country's DNA, is the obvious place to turn to raise funds quickly. One option is a private placement of shares to investors, whilst simultaneously agreeing to list the shares on the Norwegian over-the-counter market (N-OTC), which is often described as a 'fast-track listing.'

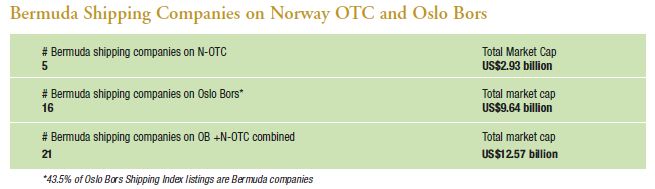

A substantial number of the companies listed on the NOTC are shipping or shippingrelated companies (including oil and gas drilling and transportation companies) and, of those, over 20% are Bermuda incorporated – second only to Norwegian companies. The most recent examples of Bermuda companies listing on the N-OTC are GoodBulk in April 2017 and 2020 Bulkers in December 2017.

Oslo listing

Many companies have used the N-OTC as a stepping stone to a full listing on the Oslo Stock Exchange or elsewhere. Over the past five years, several Bermuda companies have followed this route, including Avance Gas in 2014, Flex LNG in July 2017, and Borr Drilling in August 2017.

As of September 2018, there were 16 Bermuda companies listed on the Oslo Børs, with a market capitalization of over US$9.64 billion. This number could well continue to grow, given the number of Bermuda companies currently listed on the OTC market. Indeed, a surprising 43.5% of the Oslo Børs Shipping Index is comprised of Bermuda companies.

Of course, Bermuda companies have been known to list directly on the Oslo Stock Exchange without going via the Norwegian OTC. BW LPG and Odfjell Drilling, for instance, both launched IPOs on the Oslo Børs in 2013 without prior OTC listings and in 2015 Team Tankers International was listed following a successful exchange offer for shares of Eitzen Chemical. However, challenging market conditions seem to have made the step by step approach to raising capital a more favoured approach in recent years.

On to New York?

A number of Bermuda shipping and shipping-related companies maintain New York listings, including Ship Finance International (NYSE) and Pangaea Logistics Solutions (Nasdaq), while Frontline (NYSE), Golden Ocean (Nasdaq) and Seadrill (NYSE) all have primary listings on New York exchanges in addition to an Oslo listing.

Of these companies, it is interesting to note that Frontline first listed in Oslo in 1997, and then on the NYSE in 2001.

Frontline formed Ship Finance International Ltd in 2003, which subsequently listed on the NYSE in 2004. When Frontline spun off its interest in Golden Ocean to shareholders in 2004/5, Golden Ocean went on to list in Oslo; following its merger with Knightsbridge in 2015, the combined company was also then listed on Nasdaq.

In Norway, meanwhile, with its historically strong relationship with the shipping sector, there are still plenty of investors willing to commit their equity, based on a solid understanding of the industry and individual companies' potential.

When Frontline was in difficulties in 2012, Norway's OTC provided a life-line: the company restructured, forming Frontline 2012, which listed on the N-OTC and raised $285 million. Frontline 2012 merged back as a subsidiary of Frontline three years ago, with Frontline continuing the company's three listings on the NYSE, Oslo Stock Exchange and the London Stock Exchange. However, there has not been a successful mainstream shipping IPO on a major US exchange in over three years, despite some potentially good candidates. Accordingly, it appears that some companies utilizing the Oslo markets for growth capital, and that are not content with having either an N-OTC or Oslo Stock Exchange listing, may be finding it increasingly difficult to move their listings to New York exchanges.

Despite some discussion in the trade press of an "OTC bug" and references to companies getting "stuck" in Oslo, it seems to be generally acknowledged that the difficulty may lie in the New York markets, which continue to run shy of the shipping sector and are, perhaps, simply not attracted by companies below a certain market cap. In Norway, meanwhile, with its historically strong relationship with the shipping sector, there are still plenty of investors willing to commit their equity, based on a solid understanding of the industry and individual companies' potential.

A smooth passage to accessing capital

The ever-growing number of shipping and shipping-related companies to take the Bermuda-Oslo route to growth means that the path is increasingly well-defined and underscores not just the benefits of the N-OTC, but investor confidence in Bermuda as a base for incorporation. The island boasts a strong body of expertise in shipping-related capital markets and capital finance. Bermuda's extensive relationships with Norwegian law firms and financial institutions help to ensure a smooth passage to accessing capital in Oslo, and the jurisdiction also has a wealth of experience with New York IPOs, should a NYSE or Nasdaq listing beckon.

Originally published in Marine Money – October/November 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.