Terms of Art.

The term money laundering applies to the diverse and evolving methods by which proceeds of crime or fraud are rendered capable of enjoyment as legitimately sourced funds. The term is actually misleading. The concept is arguably more accurately captured by reference to the phrase – "asset provenance and ownership concealment." The subjects of the activity of asset concealment are twofold – namely (a) the history of the wealth sought to be hidden, and (b) the identity of its true beneficial owner.

Sophisticated hiding techniques abound. These techniques are used by professional asset secretion advisors in Switzerland, Liechtenstein, the Cayman Islands, and like jurisdictions. Their language of hiding includes:

- The starburst — the bursting

of substantial tranches of wealth into multiple fragments. A

single sum of money is moved into a bank, divided into dozens

of fragmentary pieces, and credited to multiple pre-existing

dummy accounts. Starbursts end where the fragmented

wealth is brought together again into an aggregate, normally

at a third or fourth bank on the hiding chain.

- The hopscotch — this is a

simple method, designed to confuse asset tracers. Money is

hopscotched from one pre-existing bank account to

the next, around the world, occasionally moving from 10 to 20

banks in the course of two months. It ultimately comes to

rests in what is called a holding account, in

Liechtenstein, Switzerland, the Cayman Islands, or the like.

The hopscotched accounts are called

pass-throughs.

- The ricochet — money ricochets

at lightning speed, through electronic funds transfers,

bouncing off a singular bank account to an ultimate end

deposit point.

- The boomerang — money moves by

electronic funds transfer, seemingly moving away from one

country for a few months. However, by design, it floats,

ultimately, backwards, and comes to rest at its point of

beginning.

- The sausage machine —

misappropriated funds are shoved into the intake valve of a

sausage machine. The intake valve is an offshore

bank. The funds are then moved to another bank, offshore, in

a different jurisdiction. The machine starts to

transform the money stuffed into it. Such machine

takes raw, misappropriated onshore wealth, runs it offshore

through a series of accounts, changes its form and the

identity of its apparent ownership, and yields a seemingly

innocuous sum of value, available for legitimate investment

or consumption back home, in the very jurisdiction from which

it was unlawfully taken in the first place.

- Banking off-line — extreme

groups with cultural and religious affinities have, for

centuries, used their own private, off-line banking systems,

for the holding and movement of money, or money's

worth. The Chinese have referred to money that moves

secretly, as flei chin (flying money).

Private off-line banking systems subsist within special

regions of the Chinese, Vietnamese, Indian, Italian,

Japanese, and Orthodox Jewish communities. An example would

be the keren chesseds — private,

apparently philanthropic, orthodox Jewish organizations, most

of which having been established for legitimate purposes.

However, some keren chesseds have developed a

private system of banking and of moving money across

international boundaries. This permits abuse within what

would otherwise be a perfectly legitimate organization. For

instance, assume there is a keren chesedic safe

house in Brooklyn, New York, where a person can deposit $2

million. The cash will be put into a box in the basement of

the Brooklyn house. The depositor is given a paper chit,

representing $2 million of value. This little chit of paper,

coded, can then be transported to, say, Tel Aviv, to another

safe house, where it can be presented, yielding $2 million of

cash, in the absence of any record of the conveyance of this

sum of value across international boundaries. These private

banking systems can provide unlawful dealers with the

opportunity to hide and move money without detection.

- Smart cards and cyberpayments

— value can now be placed onto a credit card-sized

piece of plastic. This value can be put into a wallet and

transported around the world in a seemingly innocuous state,

off-line.

- Multiple nominees and strawmen (also known as

'The String') —

represent one of the most effective methods of obscuring the

identity of ownership of hidden wealth. An example. A

Liechtenstein asset secretion counsellor will, on behalf of a

client, design, in the City of Vaduz, a system of controlling

a bank deposit beneficially owned by his client in, say, a

bank in the Bahamas, through a series of three or four

strawmen or nominees, each of whom is located in a different

jurisdiction. Normally, the third or fourth strawman down the

line does not know the identity of either the ultimate

instructing fiduciary in Vaduz, Liechtenstein, or of the

underlying client.1 Thus, to prove that there is a

hard ownership link between the funds held in the Bahamas,

and the beneficiary of the Liechtenstein asset secretion

counsellor requires sophisticated legal and investigative

techniques.

Knowledge of current money laundering techniques is an invaluable tool for professionals involved with concealed asset recovery. The report of the FATF called "Report on Money Laundering Typologies 1999-2000, 3 February 2000," makes for interesting reading in this context. This report was prepared as part of the FATF Typologies Exercise which provides a forum for law enforcement and regulatory experts to identify and describe current money laundering methods and heads, emerging threats, and potentially effective counter-measures. The report recognises, in addition to a number of the above described money laundering methods, the following emerging trends:-

- Use of On-Line Banking – where there exists no

real or independent means of verification of the identity or

location of the individuals accessing an e-account.

- Use of Alternative Remittance Systems such as the Black

Market Peso Exchange ("BMPE") – where it

is impossible to trace financial transactions back to the

original fund depositor owing to the use of a

"broker" (generally consisting of a bureau de

change, small business or other non-bank financial

institution – noting that the hawala

system of off-line banking has received much publicity in the

context of such system's successful facilitation of

Middle Eastern terrorists in moving their money around

without trace.)

- Use of international trade in goods and services as a

cover for money laundering or as an actual money laundering

mechanism – whereby it is difficult to determine

whether illegal activity is involved and therefore the nature

of that activity.

The Money Laundering Cycle.

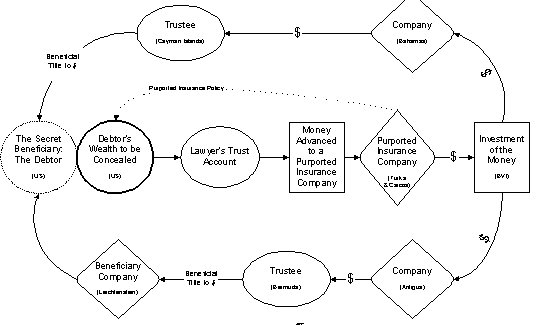

Money laundering refers to the process where 'dirty' money is rendered clean. The duration of the wash cycle ordinarily depends on the level of cleansing required, or rather the degree of 'dirt' attendant upon the money (or in respect of the suspicion attaching thereto). The techniques and language used to launder the proceeds of crime are very similar to – and in fact substantially overlap – the methods used by recalcitrant debtors to avoid having to honor a debt – and yet keep their assets intact (albeit cocooned within a complex structure). The following diagram illustrates an example of how money might be fraudulently concealed or 'protected'. The ways and means are endless and can be tailored to suit the task at hand.

Plan of Fraudulent Concealment of Value.

The above diagram illustrates the various stages or layers which may be introduced to launder or fraudulently conceal value. While there are exotic terms used in the trade for each different method, eight of which having been described in ¶ 3.1.2 above, the process of laundering value may be divided into three main phases – each of which performs a different function. The three widely recognized phases of money laundering (or, more accurately, of the 'concealment process'), are placement, layering and integration.

Placement, Layering and Integration.

Placement involves the channeling of ill-gotten funds into the legitimate commercial sphere of the world's financial systems. This process may be represented by (a) the carefully planned making of deposits of funds with financial institutions, (b) the acquisition or disposition of assets (frequently at a cost well over or under prevailing market values), or (c) the purchase of spurious enterprises that can hide the truth behind a multitude of dummy transactions (such as the manufacturing of false invoices and receipts).

Layering involves the further obfuscation of the money's history by employing a series of complex, second-level transactions. These transactions are designed to further separate proceeds from their illicit origins. The aim is to place more challenging barriers along the paper trail that must necessarily be penetrated to link assets with their underlying illicit source. Layering transactions may, and typically do, involve the use of trusts, shell corporations and a multiplicity of accounts in the names of multiple persons or shell companies.

At both the Placement and Layering stages, the traditional banking sector appears to remain the primary repository for criminal proceeds. Accounts used for receiving and transferring dirty money are frequently held in fictitious names or aliases, in the name of nominees who operate on behalf of other beneficiaries, or in the names of companies in order to conceal financial transactions made by natural persons. Additionally, in some venues, representative offices of foreign banks can accept deposits in their home country and then transfer the funds into a master (or 'correspondent') account held with a bank in a second country. Under this arrangement, the identity of the depositors in the home country, and the beneficiaries in the second country, are not disclosed to the bank where the funds have been ultimately deposited.2

Non-bank financial institutions and non-financial businesses continue to gain favor with money launderers as a channel for introducing tainted funds into the financial system. The many products and offerings available from the insurance and re-insurance industries (such as single premium insurance bonds), provide vehicles for disguising the source of funds and then placing or layering them in multiple jurisdictions. Securities broker - dealers, due to their international structure, are being increasingly exploited by money launderers as a vehicle that can accept, move and convert value on a worldwide basis. Fraudulent transactions within the industry can disguise illicit proceeds by making them appear to be proceeds of equity, bond or commodities sales.

Integration represents what is effectively the final stage of the money laundering process. It is the term used to describe the placement of funds in such a way as to make them available to the wrongdoer, free of suspicion. Thus, the so-called integrated funds can be spent with impunity because they have the appearance of having been acquired lawfully. In this stage, funds originating from an underlying offense may be stored in pure financial investments, such as stocks and bonds, converted into real investments, such as properties, metals, precious stones, and art, or integrated into legitimate businesses.

Each of the three phases of money laundering consist of many smaller, varied transactions. Recognition of the types of transaction used by the launderer and the circumstances that render those suspicious is largely a matter of knowledge and understanding. The ability to look at each transaction afresh and to remain "on guard" is crucial to the effective monitoring of the money laundering phenomenon.

One must develop an awareness of money laundering resources and mechanisms at a typical obligor's disposal. The following is a list of tools or media which may be used by a fraudster and his money laundering compatriots;

- the availability of expert advisory services such as

asset obscuring counsellors and tax consultants;

- access to ready-made corporations or off-the-shelf

companies, especially where the governing legislation permits

ownership through nominees or bearer shares and management

through men of straw;

- jurisdictions benefiting from rigid bank secrecy

legislation, especially where there is no meaningful facility

for penetration by authorised law enforcement

agencies;3

- minimal or ineffective identification requirements to

establish bank accounts or to conduct significant financial

transactions;

- lack of effective monitoring for large or suspicious cash

transactions;

- jurisdictions where banking legislation allows nominee or

numbered accounts, or do not require disclosure of the

beneficial owner of an account or the true beneficiary of a

transaction;4

- lack of effective monitoring of foreign currency exchange

transactions;

- jurisdictions which have limited procedures for

disclosure of confidential information, asset freezing,

seizure or confiscation;

- limited or weak bank regulatory controls;

- limited or ineffective "all-crimes" money

laundering monitoring or of law enforcement and investigative

capabilities;

- access to offshore or tax haven banking systems;

and

- extensive foreign banking operations, especially where

there is significant wire transfer activity and/or multiple

branches of foreign banks.

The Laundering Cycle – Conclusion.

As can be seen from the above, there are many methods available to the professional or career money launderer which play their part in the money laundering cycle. While increased supervision and disclosure have resulted in many of such facilities being less favored or available in recent years, such scrutiny is not universal and what may pose a risk in one jurisdiction may provide an opportunity in another depending on the extent of fiscal regulation and enforcement applicable there. Those who employ and rely upon the laundering cycle are not just criminals. Many hardened and recalcitrant debtors use the same or similar asset secretion methods as organized criminals do – when very substantial amounts of value are involved.

There will always be facilities to hide cash, and there will always be those who will assist. It is a global problem. The current trends must be followed and understood and the primary goal of the phenomenon kept in mind throughout. For those who seek to unravel or wind-back the cycle and strip away the layers, these key propositions are central.

Footnotes

1. Because of the recent work of the FATF in persuading and cajoling 'black-listed' offshore jurisdictions to enact and enforce mandatory rules requiring full disclosure of the beneficial owner of assets and asset holding devices (such as companies and trusts), this highly effective laundering method involving the establishment of a string of anonymous nominees strewn across the globe in many locales is becoming very difficult to set-up. Today, for instance, company formation and administration concerns in the British Virgin Islands (and nearly all other offshore locales), must obtain numerous documents and pieces of information before a new offshore company can be incorporated. This is a major development. Thus, clients wanting to establish a new offshore company (or 'International Business Corporation' as they are sometimes referred to in the relevant statutes or ordinances), ordinarily must provide a myriad of items including (a) a statement of the nature of the business that the company being incorporated is to undertake, (b) a statement of the nature of the business that the beneficial owners of the proposed company are currently engaged in, (c) an undertaking on behalf of the beneficial owners to promptly inform the offshore company formation agent should the activities, or beneficial ownership, of the company ever change, and (d) 'original,' notarized' or 'certified' versions of numerous documents – including (i) a "reference from a bank of high repute... stating that the beneficial owner has had an account in good standing with the bank for at least two years" – and noting that "the reference may not be more that six months old," (ii) a written reference from a lawyer, accountant or tax advisor of high repute and who has known the beneficial owner for not less than the prior two years, (iii) a Certificate of Identity showing full names, dates of birth, nationalities, physical addresses, occupations and specimen signatures of all beneficial owners, (iv) a copy of a valid passport for each beneficial owner, and (v) objective evidence of the purported physical address of each beneficial owner (i.e., a copy of a utility bill which must not be more than three months old). (See, by way of example, the 'Requirements for Incorporation' section of the web page of CCP Financial Consultants Ltd. of the British Virgin Islands at (www.ccpbvi.com ).

2. However, recently, the FATF has sought to clamp-down on the problematic notion of 'correspondent' banking relationships, as per the FATF's newly revised Forty Recommendations to combat laundering world-wide. (www.oecd.org/fatf/NCCT_en.htm ).

3. Although, again, the FATF is undertaking significant work to change this position through 'coerced' law reform.

4. Ibid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.