Swiss securitisation is constantly developing with new issuances launched in the first half of 2013. At the beginning of 2013, another Swiss auto lease asset-backed security (ABS) and a Swiss credit card ABS followed the securitisation transactions launched in 2012. This seems to prove that the landmark transactions of 2012 have been a breakthrough for Swiss auto lease securitisation and Swiss credit card securitisation transactions as well as Swiss ABS more generally.

1. TYPICAL STRUCTURES IN SWISS ABS

Auto lease ABS

The first Swiss auto lease ABS is a private conduit transaction arranged by Lloyds TSB Bank plc through an asset-backed commercial paper (ABCP) conduit-funded receivables purchase facility backed by a Swiss auto lease portfolio originated by the Swiss subsidiary of an international auto finance company.

The second Swiss auto lease ABS is a public term transaction of GE Money Bank AG with notes listed on the SIX Swiss Exchange (SIX) in early 2012. A portfolio of auto lease assets originated by GE was transferred to a newly set-up special purpose vehicle (SPV) in Switzerland, Swiss Auto Lease 2012-1 GmbH (the GE Issuer). The GE Issuer issued CHF1200m asset-backed senior notes due 2015 to the Swiss capital market.

The third Swiss auto lease ABS is a public term compartment transaction of BMW (Schweiz) AG with notes partially listed on SIX. A portfolio of auto lease assets originated by BMW was transferred to Bavarian Sky Europe S.A. (the BMW Issuer Swisscard), a limited liability SPV incorporated under the laws of Luxembourg. The BMW Issuer issued asset-backed CHF220.5m Class A Compartment 1 Fixed Rate Notes, CHF57.9m Class B Compartment 1 Fixed Rate Notes and CHF21.6m Class Z Compartment 1 Fixed Rate Notes via a separate compartment within the meaning of the Luxembourg Securitisation Law. The Class A Compartment 1 Notes, which are listed on SIX, rank senior to the Class B Compartment 1 Notes and the Class Z Compartment 1 Notes, while the Class B Compartment 1 Notes rank senior to the Class Z Compartment 1 Notes.

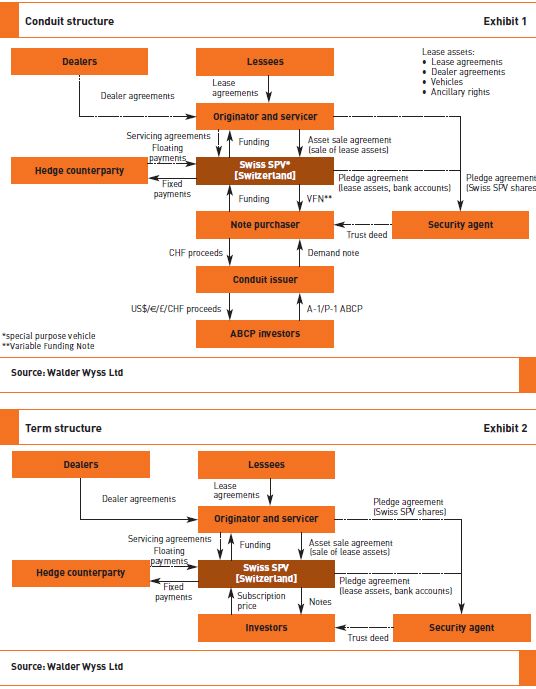

The three structures used is further summarised in Exhibits 1, 2 and 3 respectively.

Credit card ABS

The first Swiss credit card ABS is a transaction of Credit Suisse and Swisscard. The collateral backing the notes comprises of Swiss Visa, MasterCard and American Express credit card receivables originated by Credit Suisse and Swisscard – a joint venture between Credit Suisse and American Express.

On the closing date, Swiss Credit Card Issuance No. 1 AG (the Issuer) used the proceeds from the issuance of the CHF370m asset-backed notes due 2015 to acquire Issuer Certificate No. 1 (ICN1). ICN1 is a secured limited-recourse note, entitling the Issuer to a share of the proceeds from receivables held by Swiss Payments Assets AG (the Asset SPV) along with any investment proceeds on the amounts held in its accounts. The Asset SPV used the ICN1 proceeds to acquire receivables from the Originators. The structure allows for issuance of further series. The Asset SPV can acquire further accounts during the revolving period from any originator designated as a selling originator. In consideration for the right to the receivables arising under the designated accounts, the Asset SPV will pay the Originator a purchase price equal to the principal purchase price and the initial and deferred finance charge purchase price.

The structure used is summarised in Exhibit 4. During the second quarter of 2013, Swisscard launched a second issuance using the same structure as the one summarised in Exhibit 4.

2. SELECTED SWISS LEGAL ASPECTS

Future receivables

In general

Typically, the receivables generated under the underlying agreements are the subject of the securitisation transaction. While the contractual relationship that generates the receivables remains with the originator, the receivables (comprising of a pure monetary claim and no obligations) will be transferred and assigned to the SPV. As an example, as customary in international credit card securitisation transactions, the credit card agreement with the cardholder will remain with the originator, while the receivables arising thereunder will be transferred and assigned on an ongoing basis to the SPV.

Existing and future receivables (e.g., receivables that have not yet come into existence and still must be earned) can both be validly assigned as a matter of Swiss law. However, in certain circumstances, such an approach presents a number of issues from a Swiss insolvency perspective. Also, Swiss value added tax (VAT) considerations will impact the structuring of such assignment as an assignment or sale of only the receivables could lead to the acceleration of Swiss VAT due on the underlying taxable supplies (e.g., future receivables).

On the insolvency point, the Swiss Federal Supreme Court has ruled that future receivables (at the moment they arise) are owned by the assignor (i.e., the originator) prior to any transfer to the assignee (i.e., the SPV), even though transfer sale is 'immediate' and automatic. Thus, future receivables may be assigned today. However, they arise with the originator and will be automatically assigned the very second thereafter. Accordingly, notwithstanding any transfer, future receivables will not be removed from the insolvency estate of the assignor in the event it became insolvent before the relevant future receivable has come into existence. Although there is no clear criteria by which one can determine what should be characterised as a future receivable, the Swiss Federal Supreme Court confirmed that future receivables include receivables arising out of contracts not yet concluded and claims for payment under a rental agreement which only come into existence once, and to the extent that the rental object is made available to the lessee.

This analysis would not appear to be problematic for most asset categories as the transaction would only fund the sale and purchase of receivables once they came into existence. This appears to be the case for credit card securitisations (with some few exceptions), trade receivables securitisation and mortgage loans securitisations.

Future receivables under the lease agreements

However, the analysis is problematic in relation to lease agreements as the transaction would fund the lease instalments to be paid during the term of the underlying lease agreement and the Swiss Federal Supreme Court ruling suggests that rental streams are likely to be characterised as future receivables. While a lease is not a rental agreement per se, Swiss jurisprudence indicates that leases are regarded as close cousins to rentals and the courts regularly look to tenancy law provisions in cases concerning the rights and obligations of lessees (especially with respect to any protective measures for the benefit of the lessees). This analysis would have to be done on a case-by-case basis by carefully assessing the underlying sample agreements. Given that future instalments under lease agreements risk being characterised as 'future receivables' which would not escape the insolvency estate of the assignor, it can be anticipated that a sale of the lease receivables only may have a detrimental impact on the quantum of debt available at the desired rating of the notes to be issued under the transaction.

In order to address the concerns in relation to the assignment of (future) lease receivables, most recent Swiss auto lease securitisation transactions provided for a transfer of the entire lease agreements and the vehicles to the SPV (by way of transfer and assumption of agreement (Vertragsübertragung/Vertragsübernahme)) rather than just the assignment of the receivables. As a consequence, future receivables would arise (originally) with the SPV regardless of any insolvency in relation to the originator. In order to avoid contractual obligations of the SPV, lease agreements are to be transferred only once the lease vehicles have been properly delivered to the lessor, the lease agreements are no longer subject to any right of withdrawal under the Swiss Credit Consumer Act (if applicable) and the lessor has paid a certain number of instalments under the lease agreement.

Set-off

Under Swiss substantive law, the SPV as assignee in relation to the receivables only acquires the same rights as the originator as assignor possesses. In particular, all defences to the receivables available to a customer may also be exercised by that customer against the SPV if they were already in existence at the time when the customer obtained knowledge of the assignment and, if a counter-claim of the relevant customer was not yet due at this time, the customer may set off the counter-claim if it does not become due later than the assigned receivable. Also, in circumstances where the Swiss Credit Consumer Act is applicable, additional considerations would have to be addressed in the documentation.

Preferably, the underlying agreements do contain a waiver of set-off and in situations where an obligor may have an independent claim against the originator, such as a bank depositor in the case of a mortgage loan or credit card securitisation, such waiver would even become more relevant.

Key elements of bankruptcy remoteness under Swiss law

The structural key elements for making the SPV bankruptcy remote are not very different from international standards and include, inter alia: (i) restrictions on its corporate purpose (Gesellschaftszweck) as reflected in its articles of incorporation; (ii) restrictive covenants in the transaction documents; (iii) restriction on hiring any employees; (iv) existence of independent directors that are not affiliated with the originator; and (v) provisions to all agreements containing limited recourse and non-petition clauses which are basically enforceable under Swiss law.

Also, in recent transactions, the SPVs were wholly-owned by independent shareholders that were not affiliated with the originator. It must be noted that there are no real orphan structures under Swiss law as known in other jurisdictions. In transactions where the SPV was to be held by the originator and to the extent that rating agencies did not get comfortable otherwise, golden share concepts have been introduced.

Public distribution of ABS

Issue prospectus

The Swiss legal and regulatory environment for the issuance of any debt securities (including ABS) is favourable from an issuer's point of view. Debt securities not listed on SIX but publicly offered in Switzerland can be offered on the basis of an issue prospectus only. The issue prospectus has to comply with the disclosure requirements under the Swiss Code of Obligations (CO) but will neither have to be registered nor is approval of any regulatory authority required. The disclosure requirements under the CO are basically limited to general information of the issuer and the terms and conditions of the notes.

In the event of a private placement of debt securities in Switzerland, the issuer does not have to prepare an issue prospect or any other offering documents.

Bondholder provisions

If (Swiss law governed) debt securities are issued directly or indirectly by public offer under uniform loan terms by an issuer domiciled or having a business establishment in Switzerland, the bondholders will form a community of bondholders.

Such a community of bondholders does not qualify as a legal entity and so has no legal capacity except to the extent provided for by applicable law. But the community of bondholders does have the power to take, within the limits of the law, all appropriate measures to safeguard the common interests of the bondholders, in particular if the issuer is in financial distress.

Regardless of the existence of a community of bondholders, each bondholder is entitled to independently exercise its rights against the issuer, except where:

- a contrary resolution has been validly passed by the bondholders' meeting, and approved by the higher cantonal composition authority where required; and

- certain rights of the bondholders have been transferred to a duly appointed representative of the bondholder (Anleihensvertreter).

If a representative is to be appointed, this appointment can be made either in accordance with the terms and conditions of a bond issue or by the bondholders' meeting, depending on applicable legal provisions.

The bondholder provisions under Swiss law will have to be considered while structuring the ABS transaction and it is advisable to reflect them in the terms and conditions of the notes.

Listing of the ABS on SIX

Publicly offered securities linked to Swiss (or foreign) assets can be listed on SIX in Zurich, the main debt exchange in Switzerland. The listing proceedings for ABS follow the general rules for the listing of debt securities set out in the SIX listing rules and the various additional guidelines. SIX is currently considering passing a special regulatory standard for the listing of ABS but no draft regulations have been published yet as of today. (Back in 1998, SIX published a booklet on the listing of ABS that supplemented the standard listing rules for debt securities. The booklet may still be consulted but does no longer form part of the applicable SIX regulations in force).

The listing process before the SIX is not burdensome and can be divided in the following four steps:

First phase: For ABS transactions, it is advisable to obtain a preliminary decision from the SIX Regulatory Board on the compliance of the draft prospectus with the SIX listing rules. SIX requires a catalogue of additional information which will have to be included into the listing prospectus compared to the requirements of a mere issue prospectus but which does not derive from the international standard. The said process takes up to at least 20 trading days and ends with a confirmation from the SIX Regulatory Board that the prospectus would be compliant with the listing rules.

Parallel to this proceeding, the issuer will have to be approved and recognised by SIX as a new issuer. An issuer can be established as either a (Swiss or foreign) stock corporation or as limited liability company and has to follow the required accounting standards of SIX. A Swiss issuer will have to comply with International Financial Reporting Standards (IFRS), US Generally Accepted Accounting Principles (GAAP), Swiss GAAP FER2 or even the accounting standards stipulated in the Swiss Banking Act. Issuers that are not incorporated in Switzerland may even apply the accounting standards of their home country, provided that these standards are recognised by the SIX Regulatory Board.

Second phase: The debt securities can first be admitted provisionally to trading. An application for provisional admission must be electronically submitted via the Internet Based Terms (IBT), the internet-based listing tool of SIX (IBT is about to replace the tool Internet Based Listing (IBL) which has been used for the listing of debt securities). Debt securities can generally be provisionally traded once approved by SIX (usually three days after the receipt of the relevant application).

Third phase: The issuer must submit the written listing request. Provisional admission to trading will lapse automatically if the listing request is not lodged within two months from provisional trading. Together with the listing request, a signed prospectus and a confirmation of the issuer that it will comply with the SIX listing rules have to be submitted to SIX.

Fourth phase: The SIX Regulatory Board reviews the written listing request and attachments and approves the listing. Once approved, the securities are definitively listed.

During the listing of the ABS on SIX, the issuer will have to comply with the general (disclosure) requirements for maintaining the listing under the SIX listing rules (which do not derogate from international standards). In addition, SIX requires for only ABS transactions that reports on the portfolio are being made publicly available on a regular basis (on the issuer's website). It is noteworthy that SIX is currently reviewing whether further disclosure rules should apply for ABS. It can therefore not be excluded that additional listing rules will have to be followed for ABS transactions in the future – we would however expect to follow international standards (i.e., the recently published the Organization of Securities Commission (IOSCO) principles for ongoing disclosure for ABS).

3. SWISS TAX CONSIDERATIONS

Without going into any further detail in this chapter, there are a number of Swiss tax considerations to be taken into account when structuring a Swiss ABS, including corporate income and equity capital tax at the Swiss SPV level, Swiss withholding tax on interest payments and VAT. Generally, tax ruling confirmations can be sought from competent Swiss tax authorities at both the cantonal and the federal level to confirm tax treatment of the transactions in question in advance. From a VAT perspective, the Swiss Federal Tax Administration typically treats securitisation transactions as mere financing transactions with no VAT consequences. However, there may be some VAT leakage on any fees payable by the Swiss SPV (such as servicing fees, if any).

4. OUTLOOK

In the recent past, the Swiss ABS market has seen a number of interesting new transactions securitising new asset classes in Switzerland. Additional transactions are still in the pipeline and will come to market in the near future.

Structured finance is having a strong comeback in Switzerland. One of the reasons for the constant growth of Swiss securitisation is the more stringent capital adequacy requirements which continue to stimulate banks to reduce the risk-weighted assets (RWA) on their balance sheet. Securitisation transactions offer an attractive finance structure for both the banks and the originators.

This chapter was originally published in: The Euromoney Securitisation & Structured Finance Handbook 2013/14

Footnotes

1 Swiss franc

2 Fachempfehlungen zur Rechnungslegung.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.