The Tax Cuts and Jobs Act ("T.C.J.A.") brought many changes for non-corporate taxation, changing tax rates and repealing many popular deductions. Several changes in the partnership provisions corrected what lawmakers considered to be loopholes.

INDIVIDUAL TAX REFORM

Individual Rate Reform The individual tax brackets have been reduced and modified up to the year 2025. The personal exemption has been temporarily suspended, and the standard deduction has been temporarily increased to $24,000 for married individuals filing jointly, $18,000 for heads of households, and $12,000 for all other individuals. The standard deduction is not available to nonresident aliens.

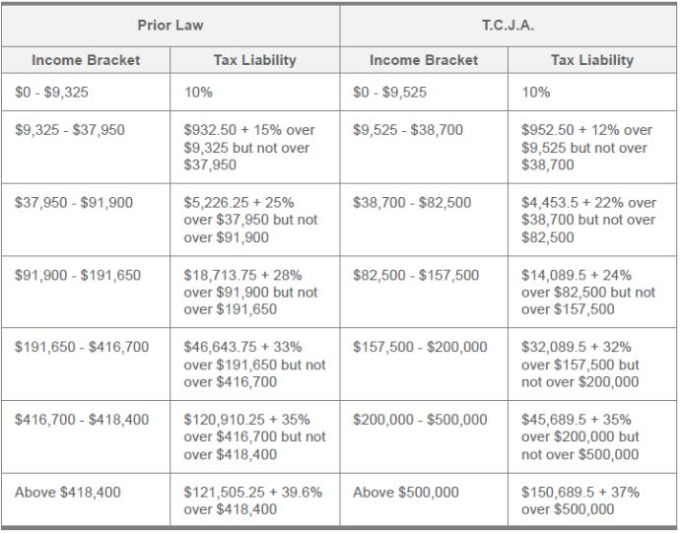

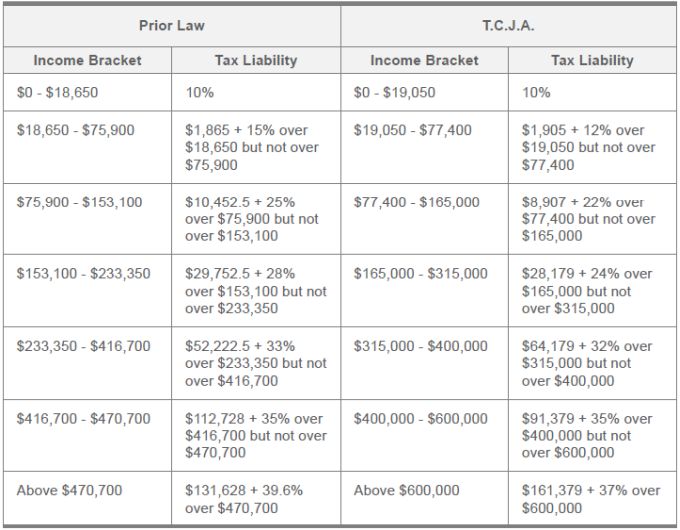

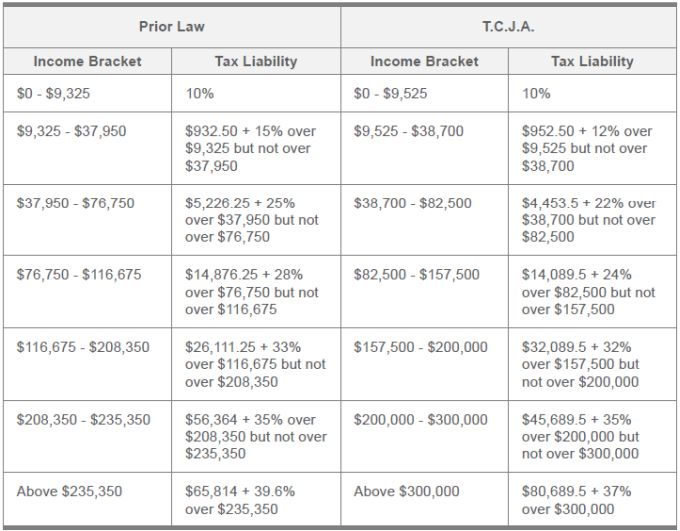

Here is a comparison of the old and new individual income tax rates:

Single Taxpayers

Married Individuals Filing Jointly

Married Individuals Filing Separate Returns

To view the full article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.