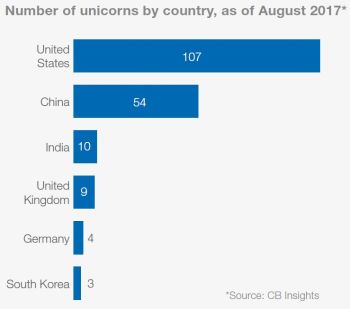

A recent publication by Mergermarket and Toppan provides useful data on unicorns. The United States is home to the largest number of unicorns and is, according the respondents, likely to remain so in the next twelve months.

The publication also addresses valuation issues, considering M&A exits, as well as valuations reported by cross-over funds as well as valuations of unicorns that undertook public offerings among other factors. Respondents surveyed for the publication believe that the valuations of unicorns will decline in the next twelve months. Many respondents predicted an increase in M&A activity, especially among companies in the fintech and e-commerce sectors. E-commerce companies do represent the largest segment of unicorns, so that may not be surprising.

For more, access the report here.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved