Concern over sluggish economic growth in the United States has tech dealmakers feeling less optimistic about the M&A market today than they were six months ago, according to a key finding from the latest M&A Leaders Survey issued by global law firm Morrison & Foerster and 451 Research, a technology research firm. The October 2012 survey charts the sentiments of players across the tech dealmaking community, including CEOs, CFOs, business development executives, in-house counsel, venture capital and private equity firms, and investment bankers.

MoFo and 451 launched the inaugural survey in April 2012. The second survey, distributed in early October 2012 and detailed below, sought respondents' views on:

- the level of M&A activity over the past six months, as compared to the previous two years;

- their expectations of M&A activity over the next six months, as compared to 2012 to date; and

- deal structures, including term sheets, letters of intent, exclusivity agreements, and post-closing indemnity agreements.

I. Market Analysis and Outlook

When comparing deal activity over the past six months with similar periods in the past two years, the sentiment of respondents is decidedly mixed. An almost equal number report that deal activity is less active (33%) as compared to those who say it is more active (35%). Looking forward, however, the outlook appears brighter, with 49% predicting that their M&A activity will increase over the next six months. Still, any optimism associated with that figure needs a caveat: the number is a full 10 percentage points lower than the figure reported in our April survey.

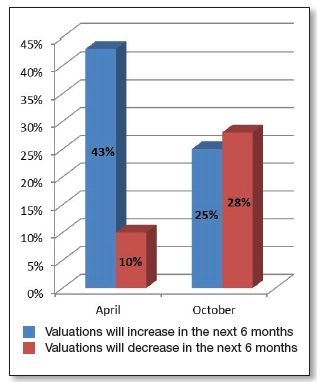

Similarly, when it comes to prospective M&A valuations, respondents are about evenly split, with 25% saying valuations will go up and 28% saying they will go down in the coming sixmonth period. The significance of those numbers, however, is again to be found in the marked decline in expected valuations from the last survey. In April, about 43% believed valuations would increase and only 10% thought they would decrease.

What's behind the waning optimism? In descending order of importance, the respondents found the following macroeconomic factors to be "somewhat strong" or "very strong" factors contributing to the decline in 2012 M&A spending: doubts about the sustainability of U.S. economic growth (70%), uncertainty about the resolution of the European debt crisis (58%), lack of clarity about the so-called "fiscal cliff" - the automatic triggering of tax hikes and spending cuts scheduled to take effect in the United States in January if alternatives are not put in place (53%), and uncertainty about the outcome of the U.S. presidential election (46%).

Reflecting the range of industries represented in the survey (see Section III below), the respondents' written comments to this question reveal a variety of alternative or additional factors to explain the slowdown - ranging from energy prices to changes in leadership in China to the impact of Obamacare to government procurement policies.

Explaining the character of the M&A activity that is occurring, one respondent points to the activity of forward-looking buyers. "In our view, uncertainty has produced somewhat countervailing results," says this respondent. "Some enterprises have seized the choppiness of the recovery in the United States opportunistically and are pursuing aggressive acquisition plans to position themselves for future growth."

A few other respondents note in written comments appended to their survey responses that while overall activity may be down, there is an increased focus on companies with "unique niche positions and growth."

At the microeconomic level, the overwhelming response is that the prices of targets are too high, with 66% rating this as a factor inhibiting activity. Other significant factors are a lack of qualified targets (45%) and due diligence issues at targets (36%). Respondents only rarely cited insufficiency of cash reserves (18%), target companies' complex capital structures (14%), and competition with IPOs (12%) as deal inhibitors. So much for the Facebook effect. Comments about microeconomic factors affecting deal flow run the gamut, with one respondent highlighting the importance of "the transformation of the software market towards the [everything as a service] model, and a huge re-calibration of performance indicators, plus a fairly consolidated traditional enterprise software market," while another says, "The valuations paid for recent large [software as a service] acquisitions are just plain ridiculous and shareholder value is being hurt. Somebody needs to hit the reset button."

II. Deal Structure

The M&A Leaders Survey also seeks the views of tech dealmakers and their advisors on certain "inside baseball" aspects of the tech deal market. These include questions about term sheets/letters of intent, exclusivity ("no shop") agreements, and post-closing indemnity agreements.

Letters of Intent "Critical" Almost 70% of respondents see Letters of Intent as mission critical, agreeing that "most of the major business issues are won or lost at this stage." As for their composition, 82% of respondents believe they should contain a timeline and terms. Still, 67% say those terms should not be binding, with the exception of terms related to exclusivity or confidentiality. As one respondent writes, "These are extremely important documents, and lawyers should be involved. With instructions from their clients not to be deal killers. AND there must always be flexibility. That's the key to creativity, too."

Exclusivity Agreements Change the Playing Field More than 61% of respondents agree that exclusivity (no shop) agreements immediately tilt the playing field in favor of the buyer. One respondent went so far as to comment that he or she has seen "WAY too many deals where the bidder drags things along until the target has no other alternative other than to roll over and give up." Adding nuance to the analysis, only a quarter of respondents say targets should not agree to an exclusivity agreement at all, while more than three quarters (82%) believe targets should not agree to a no-shop clause until the buyer has committed to a price and positions on most of the material terms of the deal.

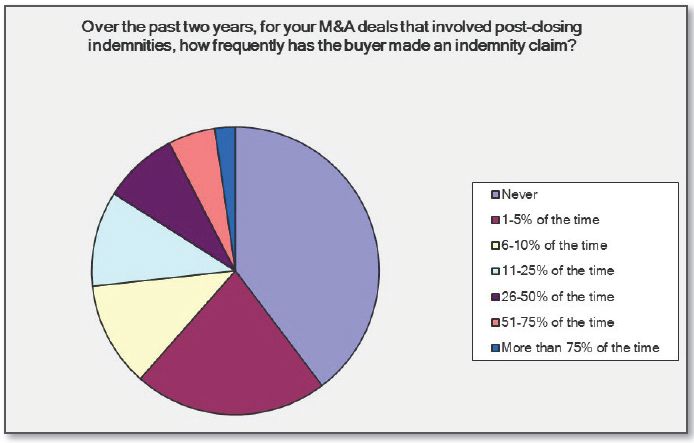

Post-closing Indemnity Agreements Rarely Triggered

Interestingly, it seems that the amount of time and attention devoted to post-closing indemnity agreements - most of which (70%) are between 6% and 15% of the deal value - may be out of sync with how often the agreements are actually triggered. More than 60% of the respondents indicate that such agreements were triggered in 5% or fewer of their deals over the past two years, including 40% who report that such agreements were not been triggered at all.

More than 77% of the dealmakers say a buyer has never sought or threatened a claim "beyond the escrow" or "beyond the holdback" directly against former shareholders of the target company. Similarly, almost 75% report that, in cases involving third-party litigation that led to an indemnity claim against the escrow, the representative of the former shareholders of the target company never controlled the litigation. For the two litigation-related questions, however, the comments indicate that respondents may have lacked experience with claims against escrow in the first place.

III. Respondent Demographics

The second edition of the MoFo-451 M&A Leaders Survey enjoyed a strong response rate - more than 300 tech dealmakers and advisors from a variety of company types and sectors weighed in with their sentiments and predictions. This includes 40% working for public companies, 34% working at investment banks and in other financial advisory roles, 25% in business development and other corporate positions, and 19% who indicate they are C-level executives.

Investment bankers are well-represented in the survey (34% of respondents), as are those who tag IT as their business type, including business segments such as infrastructure software, applications software, and semiconductors.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved