Illinois Governor Pat Quinn recently approved amendments to the state's campaign finance law intended to address independent campaign expenditures by so-called "Super PACs." The law, Public Act 97-766 (the "Act"), took effect on July 6, 2012.

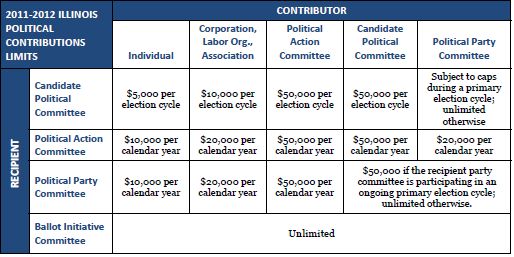

Illinois's current campaign finance system, which took effect on January 1, 2011, requires political committees to register with, and disclose campaign finance activity to, the Illinois State Board of Elections. The law also imposes limits on campaign contributions, which are summarized in the table in Appendix A. The law generally applies to elections for state and local office in Illinois and to Illinois referenda, but not to elections for federal office.

The Act creates a new type of political committee, known as an "independent expenditure committee" (and commonly referred to as a "Super PAC"), which makes campaign expenditures—such as public advertisements advocating for or against particular candidates—that are not coordinated with any candidate in that election. Consistent with the US Supreme Court's decision in Citizens United v. FEC, independent expenditures are protected by the First Amendment. Earlier this year, the US District Court for the Northern District of Illinois ruled that Illinois's campaign finance limits cannot be applied to independent expenditure committees.

Under the Act, an independent expenditure committee must register with the Illinois State Board of Elections whenever it makes expenditures in an aggregate amount exceeding $3,000 in any 12-month period in support or opposition of a candidate for state or local office or a public referendum. As a registered political committee, the independent expenditure committee must file periodic disclosure reports with the Illinois State Board of Elections. An independent expenditure committee is not subject to any fundraising or expenditure limits. It may not, however, hold joint fundraisers with any Illinois candidate or political party committee.

In addition, a natural person acting alone may personally fund independent expenditures without forming a committee. That natural person must, however, report all expenditures to the Illinois State Board of Elections, continuously in $1,000-increments.

The Act also lifts the general fundraising limits applicable to candidates if there are significant independent expenditures made in that race. Specifically, the Act provides that if a natural person or an independent expenditure committee makes independent expenditures totaling $250,000 or more in connection with any statewide election (such as for Governor), or $100,000 or more in connection with any other Illinois election (such as for the Illinois General Assembly or for local offices), then all candidates in that election may accept contributions in excess of the otherwise applicable limits. This follows a similar exemption for elections involving "self-funded" candidates who make large contributions to their own campaigns.

The Act also provides for a number of enforcement mechanisms:

- An independent expenditure committee may not make any contributions to a candidate, political party or political action committee. If it does, the Illinois State Board of Elections may assess a fine equal to twice the amount by which contributions received by the independent expenditure committee during the prior two years exceeded the fundraising limits applicable to political action committees (i.e., as if the independent expenditure committee were required to have complied with such limits).

- The Illinois State Board of Elections may assess a fine ($500 for the first instance and $1,000 for each subsequent instance) for the failure by an independent expenditure committee to file notice that its spending in a particular race exceeds the thresholds described above that result in lifting limits otherwise applicable to candidates.

- The Act authorizes the Illinois Attorney General, Illinois state's attorneys and other Illinois political committees to seek injunctions to restrain a person, group or entity from engaging in independent expenditures without first registering with the Illinois State Board of Elections.

The Illinois Campaign Finance Task Force, which was created in 2011 to study the implementation and effect of the new Illinois campaign finance system, is directed to examine and make recommendations regarding the provisions of the new Act to the Governor and the Illinois General Assembly by February 1, 2013.

Finally, the Act made certain other changes to the campaign finance laws. The Act clarifies that an existing provision that exempts transfers between federal and state political committees from the campaign finance limits applies only to transfers between related political party committees, and not to transfers between federal and state candidate committees or political action committees. The Act also requires political action committees that receive contributions through dues or levies collected by conduit corporations, associations, or labor unions (the amounts of which may otherwise be reported in aggregate) to itemize contributions by individuals or entities that exceed $500 per quarter.

Appendix A

Originally published August 6, 2012

Keywords: Illinois, campaign finance law, Super PACs, state board of elections

Learn more about our Infrastructure practice.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2012. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.