US Venture Capital Market Review and Outlook Review

After a seesaw year in which quarterly deal volumes were relatively stable but quarterly proceeds varied widely, the venture capital market ended 2010 on a high note, topping 2009's results by a comfortable margin. Liquidity performance was even more impressive in 2010, with the number of VC-backed IPOs soaring and M&A transaction activity posting solid gains.

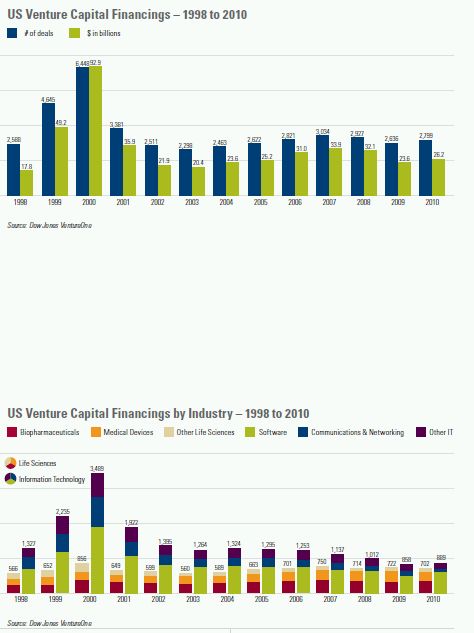

In 2010, 2,799 reported venture capital financings raised total proceeds of $26.2 billion, compared to the 2,636 financings that raised $23.6 billion in 2009. Financing activity in 2010 reflected the robust capital market and economic conditions that generally prevailed throughout the year. Deal volumes were fairly level in 2010, producing quarterly totals of 629, 762, 673 and 735 transactions. Quarterly proceeds were uneven, however, jumping from $4.7 billion in the first quarter to $8.1 billion in the second quarter, and slumping to $5.9 billion in the third quarter before rebounding to $7.6 billion in the fourth quarter. Some of the variability in quarterly proceeds may reflect reporting delays.

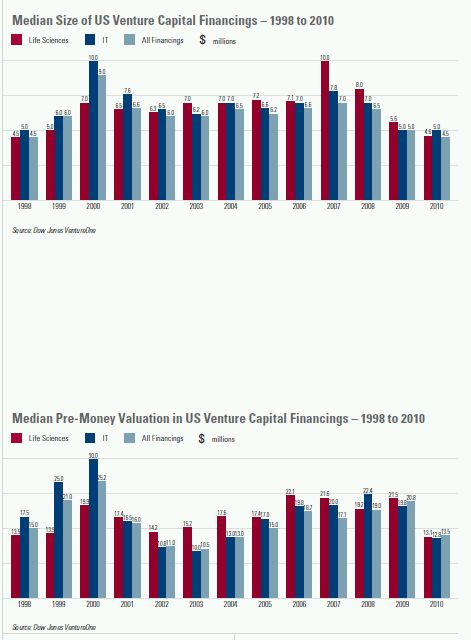

The median size of all venture capital financings dipped from $5.0 million in 2009 to $4.5 million in 2010, representing the third consecutive annual decline and the lowest figure since 1998. The median financing size for life sciences companies decreased from $5.6 million in 2009 to $4.6 million in 2010, while information technology companies saw their median financing size hold steady at $5.0 million.

Overall, valuations of venture-backed companies declined from 2009 to 2010. The median pre-money valuation for all venture financings was $13.5 million in 2010—the lowest figure since 2004—compared to $20.8 million in 2009. Among life sciences companies, the median pre-money valuation decreased from $21.5 million in 2009 to $13.1 million in 2010. Information technology companies saw a similar drop in median pre-money valuation, from $19.8 million to $12.8 million.

Seed and first-round venture capital financings represented 35% of the total number of venture financings in 2010 (compared to 33% in 2009) and 17% of the total amount of venture capital investment (compared to 18% in 2009). Seed and first-round financings have constituted between 29% and 41% of the total number of all venture financings in each year since 2001. The proportion of seed and first-round investing activity over the past decade, however, is significantly lower than the proportion prior to 2001. This relative decline in early-stage investing activity is due, in part, to the fact that more rigorous investment criteria are being applied by investors, and in part to the longer average time from initial funding to a liquidity event, which increases the relative amount of money needed for investment in later-stage companies.

The breakdown of venture capital financings by industry sector in 2010 exhibits a continuation of longer-term trends. The gap in the number of financings between life sciences companies and information technology companies has been narrowing for a decade. In 2010, IT companies represented 32% of all venture capital financings, while life sciences companies constituted 25%. In 2010, for the second consecutive year, the amount invested in life sciences companies exceeded the amount invested in information technology companies.

The geographic breakdown for venture capital investing has remained fairly constant since 1996 (the first year for which this data is available). Californiabased companies accounted for 40% of all venture financings in 2010, and have led the country in this regard in each year since 1996. Massachusetts, home to 10% of the companies receiving venture financing in 2010, again finished second in this category, as it has in each year since 1996. New York, Texas and Pennsylvania rounded out the top five positions for 2010.

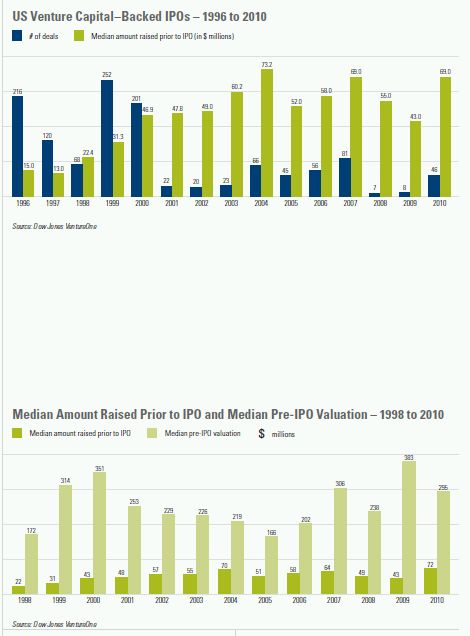

After all but disappearing in 2008 and the first half of 2009, due to the global economic crisis and declines in the capital markets, the IPO market for VC-backed companies bounced back in 2010. A total of 46 venture-backed companies went public, up from just eight in 2009. The largest VC-backed IPO of 2010 belonged to FXCM, an online provider of foreign exchange trading and services. The median amount of time from initial funding to an IPO was 8.1 years in 2010, up from 2009's median of 7.9 years but below the record 8.7-year median recorded in 2008.

The ratio of pre-IPO valuations to the median amount raised prior to IPO by venture-backed companies going public dropped from 8.9:1 in 2009—the highest since at least 1996—to 4.1:1 in 2010. (A higher ratio means higher returns to pre-IPO investors.) The ratio for 2009 reflected higher IPO valuations coupled with the lowest level of pre-IPO financing of venture-backed IPO companies in 10 years, while the ratio for 2010 was consistent with recent historical levels. This ratio was between 3.1:1 and 5.3:1 for each year from 2001 to 2008. In contrast, this ratio ranged from 7.7:1 to 10.0:1 from 1997 to 2000, due to outsized pre-IPO valuations by younger companies.

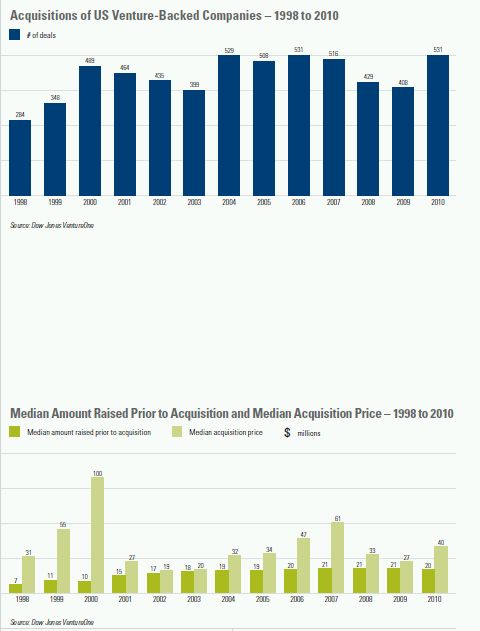

The M&A market for venture-backed companies was stronger in 2010 than in 2009, reflecting the availability of large cash balances by strategic buyers and positive economic conditions. There were 531 reported acquisitions of venturebacked companies in 2010, compared to 408 in 2009. Purchase prices also jumped, with the median acquisition price for venture-backed companies increasing to $40.0 million in 2010 from $27.0 million in 2009, which had been the lowest figure since 2003. The median amount of time from initial funding to acquisition was 5.2 years in 2010, down from 5.5 years in 2009.

The largest VC-backed company acquisition of 2010 was Ascent Media's purchase of Monitronics International for $1.2 billion. This was the first billiondollar transaction since 2008, when EqualLogic was acquired by Dell for $1.4 billion and MySQL was acquired by Sun for $1.0 billion. There were a total of eight VC-backed company acquisitions of more than $500 million in 2010, compared to four in the prior year.

The ratio of median acquisition price to median amount raised prior to acquisition was 2.0:1 in 2010, compared to 1.3:1 in 2009 and 1.6:1 in 2008. (A higher ratio means higher returns to pre-IPO investors.) The 2008 and 2009 ratios were in line with the ratios of between 1.1:1 and 1.8:1 that prevailed each year between 2001 and 2005. In 2006 and 2007, strong acquisition prospects propelled the ratios to 2.4:1 and 2.9:1, respectively. At the peak of the dot-com craze, the ratio was a staggering 10.0:1.

The above comparison of the ratios of valuations to the financing amounts required to achieve liquidity events indicates that returns to venture capital investors are higher on IPOs than on M&A transactions. This is hardly surprising, since few underperforming companies are able to go public. The higher valuations ascribed to IPO companies are offset in part, however, by the fact that the median amount raised prior to liquidity event for M&A companies is generally less than half the amount for IPO companies, and the reality that venture investors generally achieve liquidity more quickly in an M&A transaction (which frequently yields the bulk of the purchase price in cash at closing) than in an IPO (which generally involves a post-IPO lockup period of 180 days and market uncertainty on the timing and prices of subsequent sales).

The 11:5 ratio of M&A transactions to IPOs for venture-backed companies in 2010 reflected dramatic improvement from the ratio of 51:1 in 2009 (and the even worse ratio of 54:1 in 2008) and the return to a level close to historical norms. This ratio was 8:1 during the period 2004–2007, 19:1 during the period 2001–2003, and a remarkable 2.1:1 during the Internet boom of 1998–2000.

Outlook

Venture capital investing and liquidity activity in the first half of 2011 was largely consistent with the comparable period of 2010. Growing concern over economic conditions, however, is tempering optimism for the balance of the year.

Nearly $15.0 billion was invested in approximately 1,500 venture capital financings in the first half of 2011, representing a 10% increase in proceeds compared to the first half of 2010. The number of deals increased only slightly during this period; the increase in total proceeds was primarily attributable to an increase in median financing size. These results are likely to be revised upward as additional data becomes available, but fullyear 2011 activity could fall short of 2010 results if economic conditions worsen.

The year-to-date liquidity picture is similar to the financing landscape. The number of IPOs by venture-backed companies increased from 23 in the first half of 2010 to 25 in the first half of 2011, including prominent IPOs by LinkedIn ($352.8 million) and HomeAway ($216.0 million). Reported acquisition activity edged downward during this period, from 236 to 215 deals, although delayed reporting probably explains much or all of the decline in volume. The first half of 2011 has already produced five VCbacked company acquisitions of more than $500 million, underscoring the willingness of strategic buyers to pay large amounts for attractive targets.

The level of venture capital financing activity over the next year will be significantly affected by general economic conditions, investor confidence and the health of the IPO market for VC-backed companies. Entering 2011, the outlook for the year was generally positive, but more recent developments—including the looming sovereign debt and banking crisis in Europe—have clouded the prognosis.

Investor interest in the consumer Internet sectors should remain strong, although valuations may undergo a correction from the recent levels that at times have seemed reminiscent of the dot-com era. Valuations in other sectors will also be under pressure over the coming year if conditions in the economy at large and in the capital markets worsen.

The clean technology and renewable energy sector should benefit from heightened environmental awareness, the availability of government funding, and the long-term trend in rising energy prices. Problems with distribution, larger numbers of competing technologies, and the need in many cases for significantly larger investment amounts than in traditional venturebacked industries may cause some investors to approach this market cautiously.

Ongoing globalization in venture investing is likely to continue. International markets such as China, India and parts of Southeast Asia, as well as portions of Eastern Europe and South America, are spawning increased entrepreneurial activity and innovation, and the regulatory environments in those countries are also becoming more hospitable to foreign investment. These factors are partially offset, however, by concerns about the political and economic environments in these regions and the somewhat undeveloped "ecosystems" in which these companies will have to develop. As a result, while investments in international-based companies should continue to increase, they are likely to do so at a measured pace.

The outlook for the IPO market for VC-backed companies is unclear at the moment, particularly for the smaller, emerging-growth companies that exemplify VC-backed company IPO candidates. The number of VC-backed IPOs surged from 2009 to 2010, and increased further in the first half of 2011, reflecting economic growth and relatively stable market conditions. However, extreme volatility in the capital markets—fueled by the downgrade of the US credit rating that followed the political brinkmanship of this past summer's debt cap increase debate and concerns about a "double dip" recession—is threatening to derail the IPO market. A large pipeline of pending IPOs, including widely anticipated offerings by high-profile Internet companies, should test the market this fall.

Deal activity and valuations in the M&A market also present a mixed outlook over the coming year. Strategic acquirers have large cash balances to deploy, but may pull back if the economy stagnates. Moreover, any softening of the venturebacked IPO market would negatively affect the M&A market because limitations on the IPO market as a credible alternative diminish the leverage of venture-backed companies in negotiating acquisition prices, and because any general economic concerns that dampen the IPO market will also adversely affect the valuations of target companies.

To view this document in its entirety please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.