Retailers relied on pricing to solve a lot of their problems last year. Staggering input costs, including those related to energy, transport, and raw materials, were only manageable because they could be passed on to customers. However, as economic growth slows and the Federal Reserve continues its aggressive rate increases to tame inflation, consumer buying power is diminishing as well. This means that retailers will have to look elsewhere to combat rising costs as they try to maintain margin dollars.

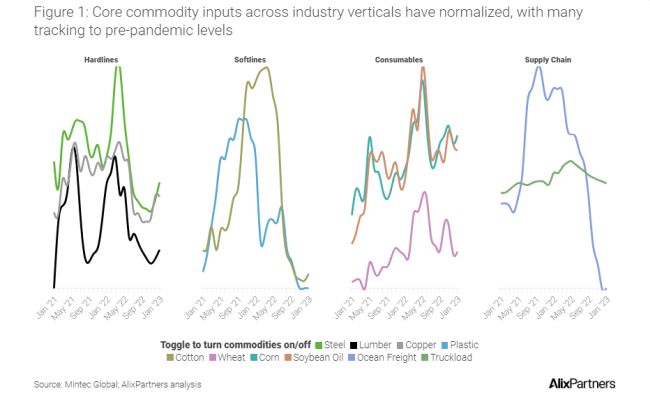

Despite measurable declines in the price of core input commodities, including freight, plastic, steel, cotton, etc., pushing back on suppliers has proven to be harder than anticipated given continued labor scarcity and the resulting higher input labor cost. Manufacturers have been steadfast: While prices went up like a rocket, they are coming down like a parachute.

For retailers to be successful in the current environment, they need to transition their mindset from reactive and defensive to proactive and offensive by identifying and tracking underlying cost drivers and accurate should-cost models for all sets of product types. These should be used to quantify clawback opportunities based on the key movements of raw material, freight, and production input costs levied over the last two years.

Over the last few months, retailers had understandably been focused on driving a strong holiday season while managing inflated inventories. However, this is the time to pay close attention to the shifting power dynamics governing supplier relationships.

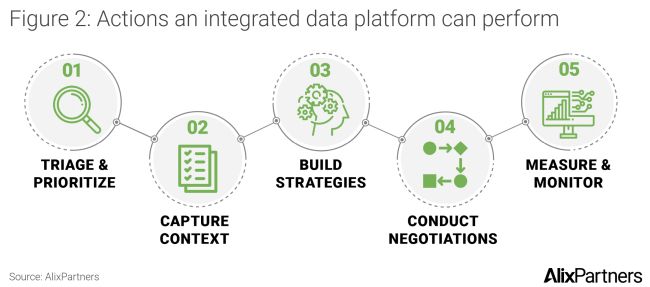

As retailers try to play offensive during this uneven inflationary environment (some commodities are up, but most are down), an integrated data analytics platform will help analyze and highlight clawback opportunities and empower successful negotiations with suppliers. Inputs into the platform can include historical and future cost-change data and criticality of the brand and supplier, among others. This helps tailor individual approaches for each supplier, develop custom negotiation asks and areas of leverage, assess supplier responses, finalize associated decisions, and monitor cost/price change impacts. It also allows for continued tracking of relevant indices for future opportunities.

Proactively engaging in margin management and clawback discussions should be at the forefront of retailers' priorities in the first half of this year. Here's how to get started:

Utilize the downward shift in input costs: Nearly all core commodities are down significantly from their peaks set during the pandemic and its aftershocks, with most forecast to trend further downward. While cost increase levies came fast and furious from suppliers at the time, you likely have not seen many cost concessions even as markets trend the other way. Now is the time to focus on should-cost, accounting both for raw material and freight and production inputs and gear up for supplier negotiations.

Create a plan for supplier negotiations: Preparing for and scheduling discussions with suppliers should be at the forefront of your planning. These should occur irrespective of if the meetings fit within the normal course of business, be it line reviews or transition discussions. Remain flexible in the potential levers utilized within negotiations -- with direct cost concessions remaining the primary goal -- but also be open to incremental funding of all types as well as improved commercial terms. Proper communication is key, with goals and expectations for the meeting clearly outlined, along with timing for follow-up discussions and next steps.

Reduce barriers to sustaining results: Prioritize this within your organization by defining clear roles and responsibilities within both the merchandising/sourcing group as well as standing up a focused cost-control team. Transition responsibilities and align incentives as necessary to increase overall visibility and accountability to negotiation outcomes. Make the cost control team responsible for ongoing reviews of supplier product costing, tracking underlying commodity trend changes, and aligning on triggers for associated business actions.

The retail industry finds itself at yet another inflection point. Although it may be enticing to add this to-do to your merchants' already overflowing plates, there is risk that you will lose this opportunity if not done right. Retailers should be looking for 15-25% in savings driven largely by clawing back most of the cost increases taken over the past two years and rightsizing COGS. Those that do will put themselves in a much stronger position relative to competitors.

It's clear that digital transformation means different things to different people – even those at the same company. We are partnering with World Retail Congress to understand what actions retailers are taking as they assess their digital transformation and how these actions link to company performance.

Please fill out our short survey on digital transformation. It will take less than five minutes to complete, and we would be happy to provide a personalized report of your company performance benchmarked against the industry.

Your individual responses will remain anonymous, and we will share back our findings with you and the World Retail Congress in Barcelona this April.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.