INTRODUCTION

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxation in India and across the globe for the month of July 2019.

The Indian taxation system has always witnessed a high volume of litigations. With the transition to GST, a need was felt to remove the burden of protracted litigation under the erstwhile indirect tax laws and to migrate to the GST regime in a complete sense.

- The 'Focus Point' section explains the nittygritty of the Sabka Vishwas Legacy Dispute Resolution Scheme announced in the Union Budget 2019 to do away with indirect tax litigations of the pre-GST regime.

- Under the 'From the Judiciary' section, we provide in brief, the key rulings on important cases, and our take on the same.

- Our 'Tax Talk' provides key updates on the important tax-related news from India and across the globe.

- Under 'Compliance Calendar', we list down the important due dates with regard to direct tax, transfer pricing and indirect tax in the month.

FOCUS POINT

Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

An opportunity to end protracted litigations

The Finance Minister vide Union Budget 2019 has proposed a dispute resolution cum amnesty scheme called the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 ('the Scheme') for resolution and settlement of legacy cases of Central Excise, Service Tax and other indirect taxes subsumed under GST. The Scheme is a significant step by the Government to put an end to protracted litigation under the erstwhile indirect tax laws, which may otherwise take substantial time for closure.

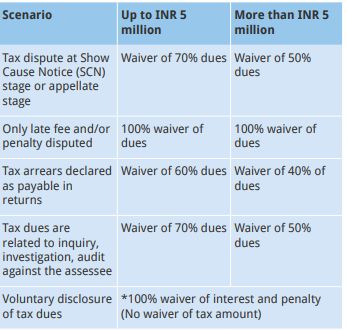

The relief under the Scheme varies from 40% to 70% of tax dues, plus waiver from interest and penalty, providing taxpayers a lucrative alternative for quick closure of litigation. The Scheme will become applicable from a date to be notified by the government. The procedural details and rules regarding the Scheme will be notified in due course.

Relief available under the Scheme

The relief under the Scheme varies from 40% to 70% of tax dues based on the varied circumstances:

*Clarity is awaited whether full interest and penalty waiver would be available.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.