Introduction

The "variable interest entity" structure (the "VIE Structure") has been the investment structure of choice for foreign investors to navigate through the grey areas of PRC law on foreign direct investment ("FDI") for over a decade. The VIE Structure was first made famous by Sina.com in its 2000 listing on NASDAQ as a workaround structure in the value-added telecom services sector ("Class II Telecommunications Services"),1 where FDI is subject to substantial PRC regulatory restrictions. Since then, foreign investors have replicated the VIE Structure in many other sectors of China's economy where FDI is either restricted or prohibited under PRC law.2

The VIE Structure has once again come into the spotlight with recent headlines such as the Alibaba-Yahoo dispute, the GigaMedia vs. Wang Ji case, and Buddha Steel's unexpected U.S. IPO withdrawal. Foreign investors have become increasingly apprehensive over the presence of any underlying defects in their existing VIE Structures, as well as the general validity of, and risks associated with, the VIE Structure going forward. In light of this backdrop, this memorandum (1) presents a fundamental overview of the VIE Structure, (2) addresses the necessary elements of a properly constructed VIE Structure, as well as the interplay between the VIE Structure and some key regulations, and (3) shares our views on the aforementioned recent developments.

Understanding the VIE Structure

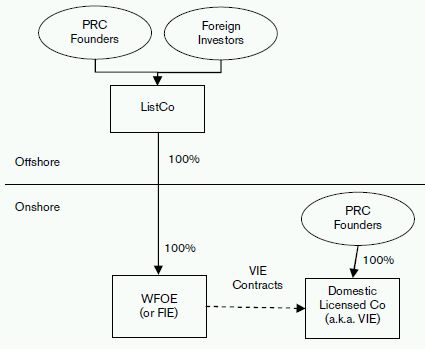

The VIE Structure is designed to allow foreign investors to hold a controlling interest in a business that operates in one or more of China's many restricted or prohibited sectors. The VIE Structure is also used as a method for Chinese domestic entities to gain access to international capital markets through offshore listings. Typically, the VIE Structure is used in China's restricted internet or e-commerce sectors. The VIE Structure is a workaround structure where one or more foreign investors, together with one or more PRC natural or legal persons ("PRC Founders"), form an offshore entity ("ListCo") that owns or controls an onshore wholly foreign-owned enterprise ("WFOE"),3 or similar foreign-invested enterprise ("FIE") in China. This foreign-controlled WFOE (or FIE) has control over the ownership and management of a domestic licensed company that holds the necessary license(s) to operate in a sector where FDI is restricted or prohibited (the "Domestic Licensed Co", also commonly referred to as the variable interest entity or VIE). The key concept that underpins a VIE Structure is that control over the Domestic Licensed Co is obtained through various service agreements (the "VIE Contracts"), rather than through share ownership. Through the VIE Contracts between the WFOE (or FIE) and the Domestic Licensed Co, the foreign investors are able to obtain de facto control over the ownership and management of the Domestic Licensed Co. The VIE Contracts also enable the ListCo to consolidate its financial statements, as well as participate in the economic gains and losses of the Domestic Licensed Co. These features are crucial for the purposes of (1) any future listing of the ListCo on an international stock exchange, and (2) achieving tax efficiency for cross-border transactions. An illustration of a typical VIE Structure is set forth below.

The equity ownership of the Domestic Licensed Co should be held by the PRC Founders or, at the very least, by other entrusted nominee shareholders. As illustrated by the recent developments discussed below, it is critical that the VIE Structure and its constituent agreements effectively align the interests of the investors of the ListCo and those of the PRC Founders or other entrusted nominee shareholders of the Domestic Licensed Co. This alignment of interests will minimize the temptation for the legal domestic owners of the Domestic Licensed Co to seize or transfer the operating licenses and other valuable assets of the Domestic Licensed Co, or take other self-interested actions to the detriment of the foreign investors.

Although there is currently no clear general prohibition against the VIE Structure in China, the PRC regulators have not expressly endorsed the VIE Structure either. Leading industry practitioners, however, look to the success of Sina.com's VIE Structure, as well as many other thriving VIE Structures in the heavily regulated internet, information, and technology sectors in China as evidence of the PRC regulators' tacit approvals.

History of the VIE Structure

Sina.com was the first company to successfully use the VIE Structure. A similar workaround was attempted before in China, but it failed horribly. It was China Unicom's disastrous use of the China- China-Foreign structure ("CCF Structure") in 1994, aimed to directly circumvent the Ministry of Information Industry's (the "MII")4 prohibition of FDI in the telecom services sector.5 The MII declared that China Unicom's CCF Structures were illegal as FDI in the basic telecom services sector ("Class I Telecommunications Services") was, and still is, prohibited.

Sina.com's VIE Structure is often cited by leading industry practitioners as an indicator of China's loosening grip on its restricted and prohibited sectors. Although FDI in all basic telecom services, or Class I Telecommunications Services, is still strictly prohibited, it has not yet been made clear whether or not FDI in the value-added telecom services sector, or Class II Telecommunications Services, is also prohibited. Sina.com falls within Class II Telecommunications Services, as it is an internet portal operator. It is widely accepted that Sina.com's VIE Structure has been operating under tacit approvals of the PRC regulators given that details of its structure were made publicly available at the onset of the structure's creation, yet it managed to obtain various levels of regulatory approvals without government obstructions. At the time of its birth, the success of Sina.com's VIE Structure seemed to foreshadow China's commitment to gradually open up its markets to FDI, coinciding with its entry into the World Trade Organization (WTO). If regulations continue to ease, foreign investors may one day be able to exercise the equity option in their VIE Contracts and legally acquire equity interests in the Domestic Licensed Cos in their VIE Structures.6

Necessary Elements of a Properly Constructed VIE Structure

Sina.com's successful VIE Structure and NASDAQ listing of the ListCo, as well as other similarly successful cases in the restricted internet, information, and technology sectors, have led many foreign investors to attempt to replicate the VIE Structure in other restricted sectors, sometimes in the absence of, or with defects in, one or more of the necessary elements of a properly constructed VIE Structure.

A properly constructed VIE Structure must contain the following necessary elements:

- Achieve tax efficiency for the purposes of cross-border transactions;

- Comply with all PRC central and local regulations, including and without limitation, regulations by the State Administration on Taxation, the State Administration of Foreign Exchange ("SAFE") and the Ministry of Commerce ("MOFCOM");7

- Comply with all applicable U.S., Hong Kong and/or other international laws to permit for the future public listing of the ListCo on an international stock exchange;

- Enable the ListCo to obtain and maintain de facto control over the Domestic Licensed Co, directly or indirectly via the VIE Contracts;

- Allow for consolidation of financial statements under the U.S. Generally Accepted Accounting Principles (U.S. GAAP), the International Financial Reporting Standards (IFRS) and the International Accounting Standards (IAS); and

- Structurally align the interests of the investors of the ListCo and the PRC Founders or other entrusted nominee shareholders of the Domestic Licensed Co.

A VIE Structure will suffer and likely fail over time if any one of the foregoing elements is absent or flawed. Given the complexity of the factual and legal analysis required to construct each of the foregoing elements, investors should engage sophisticated and experienced legal counsel when establishing new structures or evaluating the soundness of existing structures. On a macro level, investors should consult with legal counsel who has the requisite regulatory familiarity when entering into a sector that is subject to FDI restrictions or prohibition. It is our view that the structures in the recent developments discussed below have failed, at least partly, due to the lack of sufficient legal counsel and knowledge of the many risks and factors involved in designing a successful VIE Structure.8

The VIE Structure and the 2006 M&A Rules

The Provisions on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the "2006 M&A Rules") require central government approvals from MOFCOM and China's Securities Regulation Committee (CSRC) for cross-border acquisitions of Chinese assets or equity. Previously, it was common for an offshore holding company to purchase onshore assets as part of a roundtrip investment ("Roundtrip Investment").9 Following the 2006 M&A Rules, it became necessary to set up the ListCo, Hong Kong Intermediary, and WFOE prior to any onshore acquisition. Failure to set up and the aforementioned entities in the correct order risks violating the 2006 M&A Rules.

The Vie Structure and the SAFE 75 Registration

The SAFE 75 Registration (the "SAFE 75 Registration") is a required registration application by which the Chinese government regulates the shareholding arrangements, foreign currency flows, and tax issues involved in VIE Structures and Roundtrip Investments. SAFE successively promulgated three circulars to clarify the SAFE 75 Registration, namely, Circular Notice No. 75 (Notice of the State Administration of Foreign Exchange on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents to Engage in Financing and in Return Investments Via Overseas Special Purpose Companies) ("Circular 75"), and its two ancillary circulars, Circular 106 and Circular 77 (together, the "Ancillary Notices"). The Ancillary Notices are SAFE's internal notices that are usually issued and addressed to SAFE's local counterparts as guidelines for implementing a ministry level rule. In accordance with the Ancillary Notices, each Chinese founder (or other Chinese shareholder) must complete his or her SAFE 75 Registration prior to the establishment of an offshore holding company. A Chinese founder's (or other Chinese shareholder's) failure to complete the SAFE 75 Registration creates a flawed VIE Structure that prevents an offshore company from repatriating profits generated by the onshore operating entity, and consequentially, prevents such offshore company from successfully listing offshore. Cadwalader's Clients & Friends Memo titled "Memorandum on SAFE Circular 75 and Circular 78" provides a more detailed analysis of the SAFE 75 Registration.

Recent Developments

Alibaba-Yahoo Dispute – the PBOC Payment Business Permit Question

The recent dispute between Alibaba Group Holding Limited ("Alibaba") and its largest shareholder, Yahoo Inc. ("Yahoo") highlights the risk that, although there may be no express prohibition against the VIE Structure in certain sectors, relevant PRC regulatory authorities may still regulate the use of the VIE Structure through the exercise of discretion in their application of the law,10 such as refusing to issue an operating license to a Domestic Licensed Co.

Alibaba recently spun off its online payment company, Alipay, allegedly without the necessary board approval (where Yahoo has a seat after it acquired a stake in Alibaba in 2005). Alibaba restructured Alipay as a purely domestic operating entity without actual or contractual foreign ownership. As Alibaba's business activities have expanded from Class II Telecommunications Services to the online payment sector, Alipay is required to obtain a payment business permit ("Payment Business Permit")11 from the People's Bank of China (the "PBOC"). Jack Ma, Alibaba's founder and CEO, claimed that Alipay was spun off to facilitate the application for its Payment Business Permit. He claimed that the spin-off was necessary because of the PBOC's requirement to disclose the use of a VIE Structure when applying for a Payment Business Permit, and the relevant government officials have allegedly stated that they will not issue Payment Business Permits to online payment companies that have foreign ownership, whether directly through equity interests or indirectly through the use of the VIE Structure. To find out more about the online payment industry in China, please inquire about Cadwalader's forthcoming Clients & Friends Memo titled "Application for Payment Business Permits for Online Payment Companies."

Following the spin-off, Alipay received its Payment Business Permit from the PBOC. Subsequently, after months of feuding over the media, Alibaba and Yahoo have just announced that they have settled their dispute. Alibaba and Yahoo have agreed to allow Yahoo to share in the future gains of Alipay through the payment of intellectual property licensing fees and technology fees to Alibaba.12 In addition, if Alipay is ever listed publicly, Alibaba will be paid at least USD 2 billion but no more than USD 6 billion.13 However, analysts are not convinced that this settlement is enough to compensate Yahoo for the loss of Alipay's value to Alibaba's portfolio.14

In any event, it is still unclear whether the PBOC would have denied Alipay's application for its Payment Business Permit if it were not spun-off. Some commentators speculate that Jack Ma used the statements from the PBOC as a pretext to take control of one of Alibaba's most valuable assets, to the detriment of the foreign investors. While the actual reasons for the Alipay spin-off remain unknown to the public, the validity of the use of the VIE Structure in the online payment sector has been brought into question. The PBOC's alleged statement illustrates a plausible scenario where the PBOC will ban the use of the VIE Structure in the online payment sector by refusing to grant operating licenses to a Domestic Licensed Co in a VIE Structure.

In light of the foregoing, investors should be aware of the risk that the PRC relevant regulator may prohibit or restrict the use of the VIE Structure in a particular sector through the exercise of its discretionary powers. For example, a regulator may refuse to grant an operating license to (or may revoke the existing operating license of) a Domestic Licensed Co because it is (or has become) part of a VIE Structure. Hence, investors should stay informed on what are the operating licenses required for the Domestic Licensed Co's current and prospective business activities, from which regulatory authorities such operating licenses are obtained, and what are the prerequisites for obtaining such operating licenses. Also, when establishing a VIE Structure, consideration should be given to the scenario where the Domestic Licensed Co becomes unable to maintain or acquire certain operating licenses because of its VIE Structure.

Gigamedia vs. Wang Ji – Need for Pre-Acquisition Due Diligence on Target VIE Structures

GigaMedia Limited ("Gigamedia") is a NASDAQ listed company whose recent troubles with its domestic executive director illustrate the risk of investing into a VIE Structure without securing sufficient control of the Domestic Licensed Co.

In 2007, Gigamedia acquired control over T2CN (the "Gigamedia ListCo"), a holding entity formed in the British Virgin Islands. The Gigamedia ListCo owns 100% of a WFOE, T2 Technology (the "Gigamedia WFOE"), which has entered into VIE Contracts with various Domestic Licensed Cos (the "Gigamedia VIEs"). According to Gigamedia's Form 6-K filing with the SEC,15 after Gigamedia's attempt to remove Wang Ji from his managerial positions at the Gigamedia WFOE and the Gigamedia VIEs, Wang Ji has been refusing to turn over the PRC registration certificates, licenses and corporate chops of the Gigamedia WFOE and the Gigamedia VIEs.

These certificates, licenses and chops are essential for the Gigamedia WFOE and the Gigamedia VIEs to enter into contracts, conduct banking activities, or take any official corporate action. As a result, the Gigamedia WFOE has not been able to declare dividends and the Gigamedia VIEs have not been able to approve the service fee payments under their VIE Contracts with the Gigamedia WFOE. This means that Gigamedia has not been able to share in the profits of the Gigamedia VIEs. In addition, without these certificates, under PRC law, Gigamedia is not legally able to register the resolutions removing Wang Ji from his managerial positions at the Gigamedia WFOE and the Gigamedia VIEs. This means that Wang Ji is still currently the registered directors of these entities and still has control over their operations.

In response, Gigamedia has filed several lawsuits against Wang Ji in the courts of various jurisdictions, including in a PRC court. Gigamedia is asserting claims such as breach of fiduciary duty and conversion, and seeking to recover the PRC registration certificates, licenses and corporate chops of the Gigamedia WFOE and the Gigamedia VIEs.

However, we think it may be difficult for Gigamedia to do so due to the existing flaws in Gigamedia's VIE Structure. In a properly constructed VIE Structure, the Domestic Licensed Co should enter into one or more pledge agreements with the WFOE (or FIE), where the Domestic Licensed Co should pledge all of its equity interests to the WFOE (or FIE) as security for its performance to pay the servicing and/or licensing fees to the WFOE (or FIE) under the VIE Contracts. This pledge of equity interests must be a valid pledge under PRC law to be enforceable. As disclosed by Gigamedia in its Form 6-K,16 the equity pledge agreements between the Gigamedia WFOE and the Gigamedia VIEs were not registered with the relevant governmental authorities as required by the Property Law of the People's Republic of China. Therefore, we believe it is unlikely that Gigamedia will be able to enforce these pledges in a PRC court. Adding insult to injury, Gigamedia will not be able to register the equity pledge agreements now without Wang Ji's cooperation, given that Wang Ji currently has control over the operations of the Gigamedia WFOE and the Gigamedia VIEs.

In our view, Gigamedia could have avoided or mitigated the troubles discussed above had it taken precautionary steps to ensure of its control over the Gigamedia VIEs. At the very least, with the help of sophisticated legal counsel, Gigamedia would have obtained (or at least cured the registration defect before it was too late) valid and enforceable pledges over the equity interests of the Gigamedia VIEs.

The Buddha Steel Withdrawal

Buddha Steel, Inc.'s ("Buddha Steel") withdrawal of its U.S. IPO listing has raised concerns among investors over the general validity of the VIE Structure, as certain statement made by the Hebei local government may be viewed as a signal of a shift towards stricter regulations on the use of the VIE Structure by the central government.

In March of 2011, Buddha Steel, in midst of its IPO listing process on NASDAQ, suddenly withdrew its S-1 Form.17 It was disclosed that the local authorities in Hebei province determined that the VIE Structure "contravenes current Chinese management policies related to foreign-invested enterprises and are against public policy."18 Consequently, Buddha Steel withdrew its S-1 Form.

Some commentators argue that this interference by Hebei local authorities is a signal of a shift towards stricter regulations against the VIE Structure by the central government. Others believe that this is an isolated incident where the local authorities used their influence for their own benefit. Though Buddha Steel's withdrawal is wrapped in mystery, we are inclined to agree with the latter view and suspect that this is a case of a local government using China's legal grey areas surrounding the VIE Structure to further its own self interest.

The Future of the VIE Structure in China

As discussed above, there is currently no indication that the Chinese government will expressly ban the general use of the VIE Structure. As of April 2011, forty-two percent of Chinese companies listed in the United States have used the VIE Structure19 and thousands of unlisted companies continue to operate through the use of the VIE Structure. However, we do want to caution investors who are looking to make or have made investments through the VIE Structure in particularly sensitive sectors. While it may appear that the Chinese government has tacitly approved the use of the VIE Structure in the value-added telecom services sector, other sectors, such as education and pharmaceuticals, have been relatively untested. Like the online payment sector, the PRC government has a greater interest in overseeing these sectors. We believe that the VIE Structure remains valid when structured and used properly, and we hope that this memorandum has highlighted for you the perils of a flawed VIE Structure.

Footnotes

1 See Article 8 of the Telecommunications Regulations of the People's Republic of China regarding the classification of the telecommunications business in China into the basic telecommunications businesses and value-added telecommunications businesses.

2 FDI in specific sectors are categorized by the PRC regulatory authorities as "encouraged," "permitted," "restricted," or "prohibited." For further details, please see Cadwalader's Clients & Friends Memo entitled "A Primer on Foreign Investments, Investment Structures & Special Development Zones in China".

3 A Hong Kong intermediary is sometimes injected as a tax friendly intermediary between the ListCo and the WFOE.

4 Formerly the Ministry of Posts and Telecommunications.

5 The CCF Structure is a predecessor workaround structure to the VIE Structure. Like the VIE Structure, the CCF Structure consists of the ListCo (the "F" in "CCF"), a WFOE or a Chinese-foreign joint venture (the "C2" in "CCF"), and the Domestic Licensed Co (the "C1" in "CCF"). However, the interests of the legal equity owners of the C1 were not aligned with the interests of the investors of the F in each of China Unicom CCF structures. Consequently, foreign investors lost much of their original bargain when China Unicom declared its CCF Structures invalid in order to acquire the titles over the assets held by the C2 entities in preparation for listing on international stock exchanges.

6 As a developing country, China is permitted under WTO policies to gradually open up its markets. At this time, it is impossible to predict when and if the current restrictions or prohibitions on FDI in certain sectors will be lifted.

7 All foreign investments in China are subject to the approvals of various governmental agencies, even when the foreign-invested enterprise will not operate in a regulated business sector. For further details, please see Cadwalader's Clients & Friends Memo referenced in footnote 2.

8 For a more detailed analysis of the six necessary elements listed above, please inquire about Cadwalader's forthcoming Clients & Friends Memo entitled "Analysis on the Captive Company Structure in the PRC."

9 SAFE 75 defines a round trip investment as "direct investment activities carried out inside China by a domestic resident via a special purpose company, including but not limited to the following ways: acquisition or exchange of the stock rights of the Chinese party to a domestic enterprise, establishment of a foreign-funded enterprise inside China and acquisition or agreement-based control of assets inside China via this enterprise, agreement-based acquisition of assets inside China and investment with the acquired assets to establish a foreign-funded enterprise, and increase capital to a domestic enterprise."

10 A PRC regulator often has discretionary authority when applying the law to a set of specific facts. For example, a PRC regulator has the authority to approve or disapprove an application for an operating license based on that regulator's determination of whether certain conditions have been met.

11 For a general overview on Payment Business Permits, please inquire about Cadwalader's forthcoming Clients & Friends Memo titled "Application for Payment Business Permits for Online Payment Companies."

12 Dignan, Larry. "Alibaba, Yahoo, Softbank Settle Alipay Rift." CNET. 29 July 2011. Web 30 July 2011. (http://news.cnet.com/8301-1023_3-20085604-93/alibaba-yahoo-softbank-settle-alipay-rift/).

13 Id.

14 Rusli, Evelyn M. "Yahoo and Alibaba Resolve Dispute Over Alipay." DealBook-The New York Times. 29 July 2011. Web 30 July 2011. (http://dealbook.nytimes.com/2011/07/29/yahoo-and-alibaba-resolve-alipay-dispute/).

15 SEC Form 6-K for GIGAMEDIA LIMITED filed on November 15, 2010.

16 Id.

17 SEC Form RW - Registration Withdrawal Request of BUDDHA STEEL, INC. filed on March 28, 2011.

18 SEC Form 8-K for BUDDHA STEEL, INC. filed on March 28, 2011.

19 Mao, Debra. "Yahoo Bet on Alibaba Shows Risks in China's Legal Grey Areas." Bloomberg. 22 Jun 2011. Web 30 July 2011. (http://www.bloomberg.com/news/2011-06-21/yahoo-s-alibaba-spinoff-losses-show-dangers-of-china-s-legal-gray-areas.html).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.