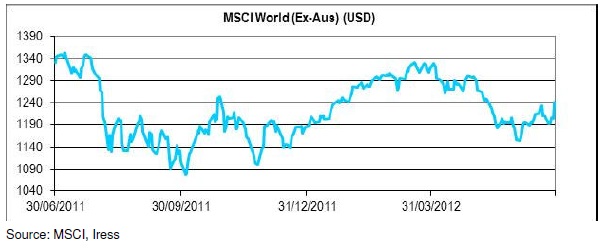

Over the year ending 30 June 2012, the MSCI World (ex-Aust) Index USD$ fell by -4.73%.

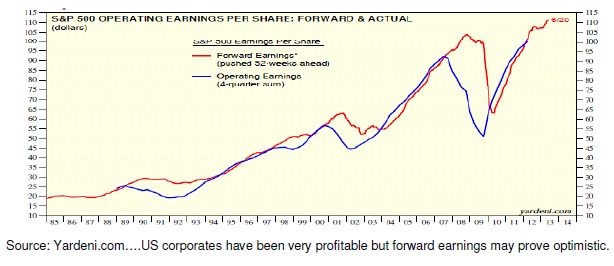

The global share index outperformed the local market. This occurred, despite the relative strength of the Australian economy as against most of the developed world, for two main reasons. Firstly, local shares were dragged lower by moderate falls in the resources sector as growth in China slowed and commodity prices fell (albeit off a very high base). Secondly, corporate earnings in the largest index constituent, the United States, continued to rise as manufacturers continued to benefit from the low US dollar, declining real wages (in inflation adjusted terms), and a modest improvement in employment and consumer spending.

Outlook

According to Thomson Reuters, consensus earnings estimates for the US market's main index, the S&P 500, for 2012 calendar year now stand at $105.31. Using the long term Price/Earnings multiple average for the US market of 15.48, we derive an estimated value for the S&P 500 by calendar year end of 1630, which is 20% higher than the 30 June close of 1362. While in theory this augurs well for US markets, and hence global markets, there are several reasons why we do not share the same optimism. This is because June data shows that the US economy has begun to slow somewhat. Intuitively, this makes sense given that employment has begun to stagnate, real wages are falling and exports are stalling. Furthermore, ascribing the average PE multiple to derive fair value for the S&P 500 in a period where global risks are high remains inappropriate.

In conclusion, US growth is likely to remain tepid at best (certainly well below trend), China is slowing and the Eurozone remains on the verge of a serious recession that has the potential to become much worse. As a result, we continue to recommend a moderate underweight position to international equities.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2011 Moore Stephens Australia Pty Limited. All rights reserved.