Brian Dillon looks at where the promoters of Irish Regulated Funds are from and where they are distributing their Funds?

Since its establishment, almost a quarter of a century ago, there has never been such focus on and optimism surrounding the Irish funds industry. Funds industry stakeholders have worked since its inception to develop the sector and there has been a recent wider acknowledgement that the funds industry can, if properly resourced and supported, be an engine to drive the Irish economy.

The 2010 appointment of Mr John Bruton as IFSC Chairman (now President), the publication of the Strategy for the International Financial Services Industry in Ireland 2011-2016 by the Department of the Taoiseach, the 'Green IFSC' initiative, and the opening of multiple overseas offices by the Irish Funds Industry Association (IFIA) in partnership with the Industrial Development Authority (IDA Ireland) are four tangible examples of the effort being made to harness the potential of the industry.

The government is targeting the creation of in excess of 10,000 jobs in the financial sector over the next 5 years. Currently some of Ireland's largest employers are in the funds sector and if the jobs target is to be achieved a significant proportion of these new jobs will have to be created within the funds sector. In order for this to materialise asset managers will need to select Ireland as the domicile for their regulated fund products thereby creating jobs servicing the funds.

Promoters of Irish Funds

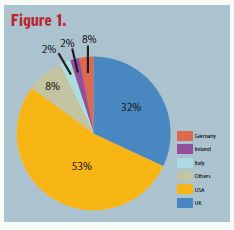

There are 850 promoters from over 50 countries in Ireland with 70 new fund promoters having established Irish funds during the past year. You can see from figure 1 below that the majority of the funds domiciled in Ireland are promoted by asset managers who are regulated in the United States or the United Kingdom .The similarities of culture, legal structure and language allied to the strengths mentioned below continue to attract the asset managers from these two markets. The IFIA nurtures the markets providing regular information seminars in both countries. The continued activity at our New York representative office and the recent establishment of an Irish presence by the US Fund administrator SS&C Fund Services to support their US clients would indicate that US promoters continue to favour Ireland.

Figures available show that as at the end of June 2011, there were almost 5,000 funds administered here in Ireland with total assets closing on €2 trillion. The principle Irish regulated fund products are the Qualifying Investor Fund (QIF) and the UCITS. These Irish products account for approximately half the total assets administered here.

Foreign asset managers have been attracted to Ireland because of the competitive cost, selection of and expertise offered by service providers, innovative fund product offering and the distribution channels open to Irish funds.

Looking closely at figure 1 "Others" represent only 8% of the funds here. "Others" include promoters from Japan, Australia, Canada, Singapore, China, Hong Kong, South Africa, India, Russia, Brazil and the Middle East. Industry members continue to travel to develop our share of these markets. In addition, nascent markets such as Vietnam, Malaysia, Taiwan and closer to home Poland, need to be cultivated. The primary focus of our own Tokyo and Hong Kong representative offices is to assist Asian promoters with their Irish fund ranges. Ireland needs to continue competing aggressively with other EU Member States such as Luxembourg and Malta to develop our market share in these countries.

Distribution of Irish Fund

Ireland is also a platform from which to distribute funds internationally. Promoters distribute Irish funds to over 70 countries around the world. Ireland's ever expanding tax treaty network, includes 66 countries is one of the most developed and favourable tax treaty networks in the world. Ireland has also signed bilateral memoranda of understanding with 20 jurisdictions, including China, with a view to extending the countries in which funds domiciled and serviced out of Ireland may be distributed.

Irish UCITS are registered for retail sale in every EU Member State and in the continued absence of a pan Asian retail product are the product offering of choice for promoters selling in many Asian countries. The familiarity of many Asian regulators with Irish regulated funds continues to assist the registration process.

Amendments to the criteria applicable to QIFs have greatly enhanced the attraction of the QIF. The minimum initial subscription has been reduced from €250,000 to €100,000 and the criteria in order to be considered a "qualifying investor" have been relaxed. These amendments represent a very significant development in the context of Ireland's fund offering not least because there had been a view that distribution to some institutional investors, pension funds, family wealth offices, corporate and individuals being professionally advised were excluded from the QIF product because of the high net worth requirements in particular.

Conclusion

Ireland's fund industry needs to maintain its share of its exiting markets, grow its share in the "Others" market and expand into new markets while maintaining and where possible improving the jurisdiction's core competencies. We need to anticipate and adapt to the ever changing needs and requirements of global fund promoters and investors to ensure that Ireland continues to successfully develop as the leading service centre for the international funds market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.