Introduction

The Executive Chairman of the Federal Inland Revenue Service (FIRS) and the Minister for Budget and Planning recently alluded to a proposed increase of Value Added Tax (VAT) rate from 5% to 6.5% -7.5% while addressing the Senate Committee on Finance on the Federal Government 2019 - 2021 Medium Term Expenditure Framework.1 Although the FIRS Chairman refuted the reports on the basis of being misquoted, he maintained that there is a need to increase the VAT rate to raise government revenue as Nigeria's VAT rate is currently one of the lowest in the world when compared to other comparable economies. In addition, he stated that the FIRS is committed to raising a revenue of ₦8.3 trillion from taxes in 2019 and it expects ₦3 trillion to come from VAT.2/p>

The need for an increase in government's revenue is rather apparent. The National Tax Policy, the Economic Recovery and Growth Plan (ERGP) and the 2018 International Monetary Fund (IMF) Report on Nigeria3 all stress the need for an increased focus on revenue generation from VAT in Nigeria. While the dwindling oil prices is no longer news, the weakness of the naira against the United States Dollars (dollar) and other foreign currencies largely contributes to the need to increase revenue. Although the FIRS' revenue collection of ₦5.3 trillion in 2018 is quite commendable, a critical analysis of the collections in dollar terms would reveal the imbalance and the weakness in collection when compared to previous years' collections when the Naira was not as weak as it is today. No doubt, the fragile nature of the Nigerian economy is largely connected to the Country's poor balance of trade owing to the import-based predicament.

Consequently, the FIRS' efforts to increase revenue collection is a response in time to bridge Nigeria's growing fiscal deficit. In fact, the 2019 Appropriation Bill, which is currently before the National Assembly projects an 11% increase in revenue from VAT when compared to 2018 projections. However, while an increased revenue from VAT may be a necessity, the pertinent question becomes whether there is a need for a 35% - 50% increase in VAT rate to achieve the projected 11% increase in VAT collection to meet the National budget. Perhaps, the proposed increment in the VAT rate may just be a tool by the government to stir the economy in a different direction through VAT rather than just increasing collection.

This newsletter seeks to discuss the possible implications of an increase in VAT rate and proffer alternative modes of increasing the government revenue through taxation.

VAT and its contribution to revenue generation in Nigeria

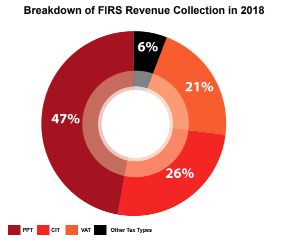

VAT currently contributes a significant percentage of Nigeria's revenue from taxes as the FIRS reported a total VAT collection of ₦1.1 trillion of the total sum of ₦5.3 trillion it generated in the 2018 fiscal year. The FIRS also indicated that it is committed to raising ₦3 trillion from VAT in 2019 which is an increase of over 200% from the 2018 collections.

VAT in Nigeria is a consumption tax levied at every stage of production and ultimately borne by the final consumer of a good or service. VAT is charged on most goods and services provided in Nigeria as well as goods imported into Nigeria. The VAT Act 1993 provides for a recoverability system whereby VAT, which is paid during the course of production, is recovered by the taxpayer in form of input VAT and ultimately passed down to the final consumer.

However, the current VAT system in Nigeria disallows input VAT claims on capital goods and services. The effect of this is that the VAT paid by such manufacturers and service providers would be incurred as a business cost since they cannot be recovered. This makes the Nigerian manufacturing and related sectors uncompetitive when compared to some other foreign jurisdictions. For example, the United Kingdom (UK) VAT system provides for the recovery of input VAT rate in Nigeria in cases of supply of services.4 Thus, an increase in VAT rate in Nigeria may be counter-productive to companies that cannot recover input VAT already paid. This is because the increased input VAT that is not recovered would result in an increase in the cost of doing business and a reduction in the profitability of such companies.

While the progressive increase in revenue generation is commendable, there are still several factors hindering the FIRS from optimizing the revenue that could be generated from VAT collection in Nigeria. The issue of tax evasion raises a major concern, as a number of taxpayers that should ordinarily remit VAT are not captured within the tax net. In addition to this, the lack of sufficient database and information poses a huge challenge to proper taxation of the informal sector. Also, there still exists some inefficiencies and leakages which hamper the amount of revenue that could be realized from tax sources even though several measures are being put in place to plug the leakages.

Thus, an increase in VAT rate may not be very effective in improving revenue, if the foregoing concerns are not addressed. This is because an increased rate may not generate the projected amount of revenue in the face of a likely increased level of non-compliance that could result from an increased tax burden and other factors impeding effective tax collection and administration as earlier mentioned.

An increased VAT rate may also have a detrimental impact on the country's economy as its reductive effects on consumers' disposable income can lead to a contraction in general economic activities. While some may argue that the minimum wage of public servants will be increased, there is also an argument that the increase in VAT rate will simply deplete the value of the increased minimum wage. Moreover, it is only a marginal proportion of the working population that may be positively impacted by the increase in minimum wage.

To read the full article click here

Footnote

1. Vanguard News "FG Plans 50% increase in VAT, other taxes", 20 March 2019

2. Ibid

3. National Tax Policy 2017, Economic Recovery & Growth Plan 2017 – 2020, IMF Country Report No. 18/64 on Nigeria, March 2018

4. https://www.gov.uk/guidance/vat-guide-notice-700#section10

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.