Change in practice by the Federal Supreme Court improves taxpayers' chances of taking action against intercantonal double taxation

In practice, the question sometimes arises as to whether intercantonal double taxation must be accepted or how it can be tackled. The following ruling by the Federal Supreme Court dates back to last year. Nevertheless, it is worth taking a closer look at it, as the Federal Supreme Court has changed its previous practice on intercantonal double taxation in favor of taxpayers. Taxpayers who are affected by the threat of double taxation can now successfully defend themselves against it in many cases.

Previously, even in the event of effective intercantonal double taxation, taxpayers forfeited the right of appeal or the right to challenge the (legally binding) cantonal assessment of the first canton of assessment if they unconditionally acknowledged their tax liability in the first canton of assessment in the knowledge of the competing tax claim of the second canton of assessment. This applies, for example, to companies that have moved their registered office under civil law and thus formally also their main tax domicile from one canton to another canton and then allowed the assessment by the canton of relocation to become legally binding, although the canton of relocation had already questioned the transfer of the center of effective management and thus the registered office to the company prior to the assessment by the canton of relocation. If, following in-depth clarification by the canton of departure, the effective centre of effective management was still located in the canton of departure, this could lead to effective double taxation of the company - once in the canton of departure and once in the canton of destination. However, as the company allowed the assessment by the canton of relocation to become legally binding or did not inform the canton of relocation of the competing claim of the canton of departure, it forfeited its right of appeal against this effective intercantonal double taxation (see BGE 137 I 273, E.3.3.3). In its ruling of August 17, 2023 (9C_710/2022), the Federal Supreme Court has now significantly restricted the previous practice on forfeiture.

Facts of the case

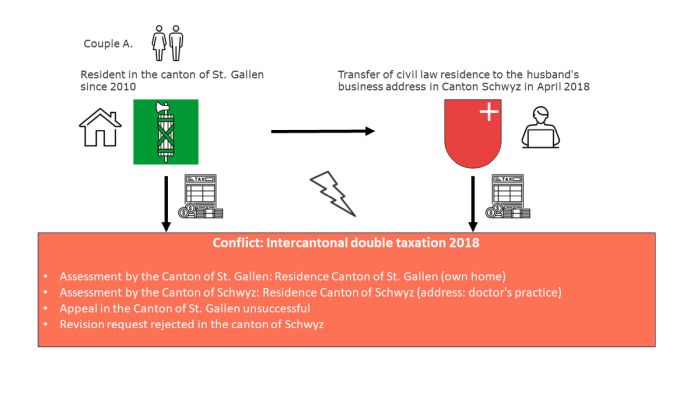

The ruling is based on the following facts: The married couple A. had been living with their two daughters in their own home in the canton of St. Gallen since 2010. The husband had been working as a self-employed doctor in the canton of Schwyz since 2011. Until the 2017 tax period, the assessment was carried out by the canton of St. Gallen. In April 2018, the couple deregistered in the canton of St. Gallen and gave the husband's practice address in the canton of Schwyz as their place of residence under civil law. In July 2020, the tax administration of the canton of Schwyz assessed the couple for the 2018 tax year at the couple's registered domicile in the canton of Schwyz. In January 2020, i.e. before the final assessment by the tax administration of the Canton of Schwyz, the tax administration of the Canton of St. Gallen informed the couple that the couple's tax domicile for 2018 would be clarified. At the same time, the tax administration requested additional information and documents. On August 24, 2020, a meeting finally took place between the couple, their representative and the responsible tax commissioner. In September 2020, the tax administration of the Canton of St. Gallen issued the final assessment decision and taxed the couple as residents of the Canton of St. Gallen. The change of residence to the canton of Schwyz could not be proven - only the address was changed, but not the place of residence. This resulted in effective intercantonal double taxation: the couple was taxed once in the canton of St. Gallen and once in the canton of Schwyz as having unlimited tax liability. The couple subsequently lodged various unsuccessful appeals against the St. Gallen assessment decision. At the same time, the couple submitted a request for a revision of the 2018 tax assessment in the canton of Schwyz. The tax authorities in the canton of Schwyz refused to consider the request.

Previous case law

According to previous case law, a taxpayer forfeits the right of appeal or the right to contest the (legally binding) cantonal assessment if he unconditionally recognizes his tax liability in one canton in the knowledge of a competing tax claim in another canton. Unconditional recognition is deemed to exist in particular if the taxpayer expressly or tacitly submits to the assessment (unconditional submission of a tax return), pays the required tax amounts without reservation and waives any objections or further legal remedies.

In a leading ruling from 2020, the Federal Supreme Court clarified that a forfeiture of the right of appeal in accordance with the prohibition of double taxation as a constitutional right should only be accepted with caution, namely if the taxpayer's conduct constitutes an outright abuse of rights or is contrary to good faith (BGE 147 I 325 E.4.2.1).

New case law

The Federal Supreme Court has now come to the conclusion that the forfeiture of the right of appeal can no longer be considered a proportionate measure to counter conduct contrary to good faith on the part of a taxable person in an intercantonal relationship. The previous practice on forfeiture is thus abandoned or restricted (E.2.5).

The elimination of unconstitutional intercantonal double taxation will now only be refused if the conduct of a person subject to double taxation proves to be a qualified abuse and the canton concerned also has a legitimate interest in withholding taxes received, even though it has no tax claim under intercantonal double taxation law or even under harmonized tax law (E.4.4.2). Unfair conduct on the part of the taxable person only leads to the imposition of the costs incurred (E.5.3).

Unfortunately, the ruling does not contain any specific indications as to when a legitimate interest of the second taxing canton exists that would justify intercantonal double taxation. The extent to which a canton can claim a legitimate interest at all will therefore have to be seen in the future.

Recommendations

In order to prevent possible intercantonal double taxation, taxpayers should regularly compare the tax domicile or registered office of the company with the actual situation. In particular companies with few employees and a low requirement for office space, such as holding, license and patent exploitation companies, should ensure that the tax domicile corresponds to the place where the operational decisions are made and the management is concentrated (see 9C_675/2021, where the place of management was used for a patent or license rights collecting company with little operational activity). If letterbox companies are used, tax authorities are lied to or documents are falsified, double taxation may not occur, but there is a risk of proceedings for tax evasion (see Steuerhinterziehung bei Sitzgesellschaften? - VISCHER (only available in German language)).

However, if effective double taxation has already occurred, taxpayers now have significantly improved chances of avoiding or eliminating impending or existing intercantonal double taxation due to the Federal Supreme Court's change in practice. The prerequisite for this is that they take the necessary legal action in good time.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.