This article looks at what Type "B" Reorganizations are and provides diagram examples that you can reference. You will find a standard Type B reorganization diagram example and a Rev. Rul. 79-4 diagram example. We also reference IRC § 368(c), point to relevant revenue rulings, and provide helpful tips regarding mergers of this kind.

What is a Type "B" Reorganization?

Under § 368(a)(1)(B) of the Internal Revenue Code, a Type B reorganization involves the acquisition of stock of a corporation in exchange solely for voting stock of either the acquiring corporation or its parent. A Type B reorganization can be effected either by exchanging existing stock or by issuing new stock of the acquiring corporation directly to the target corporation in exchange for the target corporation's newly issued or treasury stock.

Additionally, the acquiring corporation must have "control" of the acquired corporation immediately after the acquisition. Control is defined under § 368(c) as possession of at least 80 percent of the total combined voting power and at least 80 percent of the total number of shares of each class of nonvoting stock.

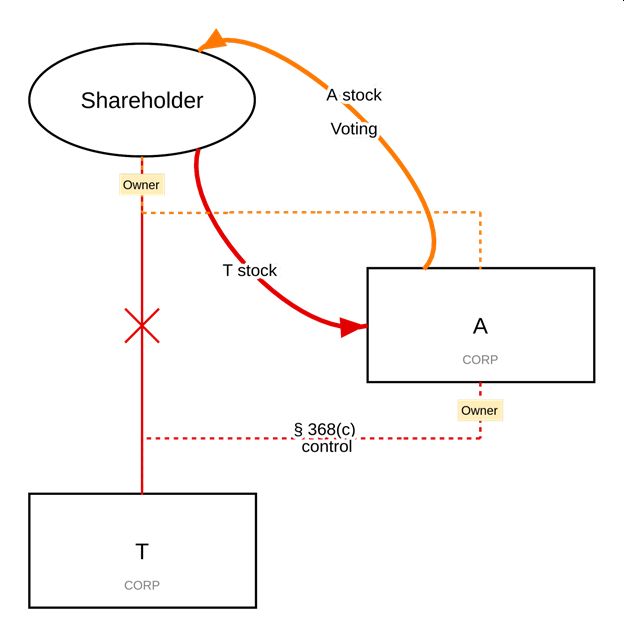

Type "B" Reorganization Diagram Example

This diagram illustrates a basic Type B reorganization involving the exchange of the stock of the target (see red arrow) solely for voting stock of the acquiror (see orange arrow). Notice that the acquiror has control as defined under § 368(c) after the acquisition.

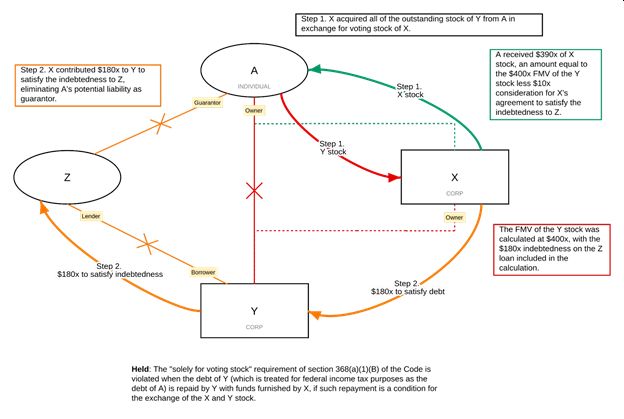

Rev. Rul. 79-4 Diagram Example

Type "B" Reorganization Best Practices

In structuring a Type B reorganization, practitioners must pay close attention to the "solely for voting stock" requirement. The question of whether certain types of transactions violate that requirement have been the subject of multiple revenue rulings and cases. Here are just two examples:

- An acquiring corporation may pay other consideration for the target corporation's non-stock interest without violating the requirement. See Rev. Rul. 98-10 (involving debentures).

- A target may also redeem stock of some shareholders for cash or other property to buy out minority or dissenting shareholders, where the cash is not provided by the acquiring corporation. See Treas. § 1.368-1(e)(8), Example 9; Rev. Rul. 68-285. By extension, dividends that are paid by the acquiring corporation contemporaneously with the tax-free acquisition in the ordinary course also should not necessarily be considered disguised boot.

Blue J's diagramming tool provides a convenient way to collaborate on a shared diagram with colleagues to visually represent any reorganization, including multi-step transactions to which the step transaction doctrine may apply. We host example diagrams in our Blue J Folios, which may be easily edited to depict any transaction–or build your own. Blue J Folios provide a starting point for your research, with an outline that summarizes the topic and contains references from the Code and Treasury Regulations, common leading authorities on each topic, and a visualization of certain authorities using our Diagramming tool.

Originally published 31 August 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.