- within Energy and Natural Resources topic(s)

Sheppard Mullin has produced and made available this HyBuildTM North America Contracts Workstream – Consumption Profiles Working Group Report for informational purposes only. This document does not constitute legal advice. Sheppard Mullin is not acting as legal counsel through the use or provision of this document. No attorney-client relationship is created due to or otherwise in connection with the distribution or receipt of this document. Future changes in regulations, authorities or other matters may alter the applicability of information contained in this report, and no attempt is made to address or account for such future changes.

A Note From Sheppard Mullin:

Green hydrogen is recognized as a key component of energy transition and reduced reliance on fossil fuels, especially in hard-to-electrify sectors. Among the elements necessary to develop a functioning hydrogen economy, green hydrogen offtakers and their counterparties need to advance their understanding of issues, risks and conditions to facilitate green hydrogen procurement. To that end, the Green Hydrogen Coalition, as part of its HyBuildTM North America Initiative, organized the Contracts Workstream. Sheppard Mullin is proud to have worked with the Green Hydrogen Coalition to lead this effort. The Contracts Workstream process and results are summarized in the report that follows.

With over 100 attorneys on our Energy, Infrastructure and Project Finance Team, Sheppard Mullin is a nationally renowned leader in renewable and clean energy. We look forward to continuing to work with the Green Hydrogen Coalition and industry participants to realize the potential of green hydrogen, and we hope this report is a useful tool for analyzing the present to build the future.

HyBuildTM North America Initiative

The Green Hydrogen Coalition's HyBuildTM North America Initiative seeks to bring together key ecosystem stakeholders to plan and develop the competitive, high-volume supply chain necessary to achieve low-cost, mass-scale green hydrogen to large offtakers. Success of the initiative is dependent on enabling offtakers in strategically targeted locations to sign precedent contracts.

Green Hydrogen Coalition Contracts Workstream

Through the Contracts Workstream, the Green Hydrogen Coalition seeks to establish a shared understanding of the issues, risks and high-level terms and conditions that must be addressed to facilitate green hydrogen procurement.

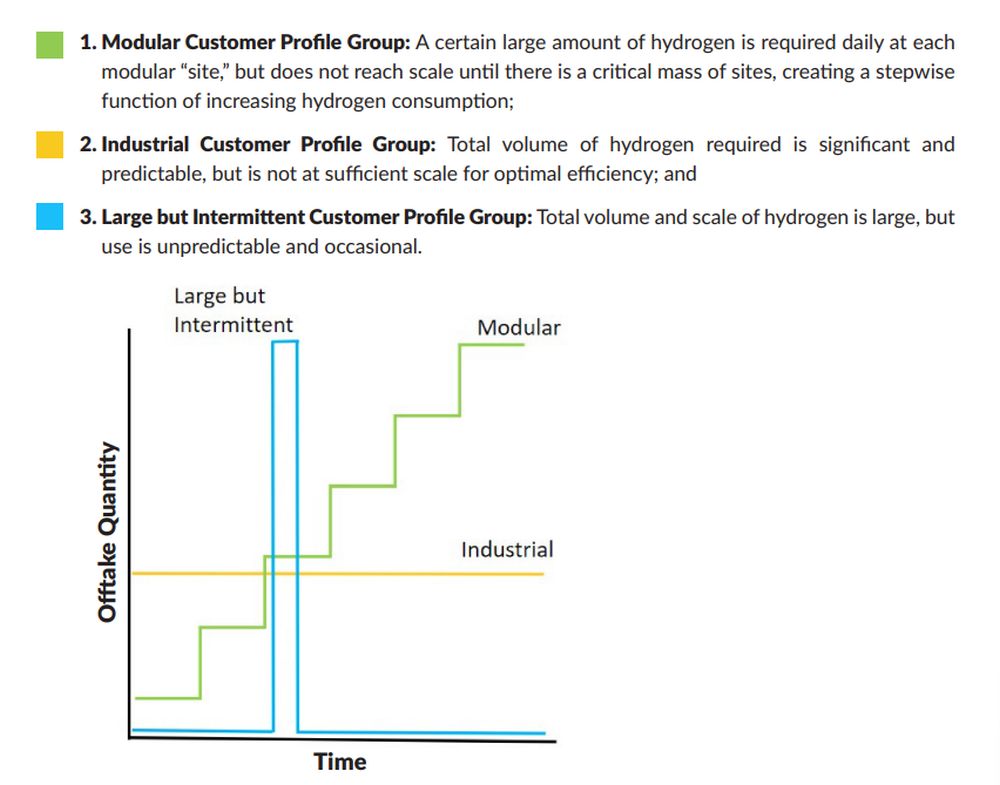

Confidential interviews were conducted with nine potential green hydrogen offtakers, which led to the identification of three early green hydrogen consumption profile groups, listed and described below:

Figure 1: Graphical representation of the offtake quantity of each customer profile over time

Working Groups

The Green Hydrogen Coalition hosted three working group meetings focused on discussing the stakeholder needs, challenges and solutions for each consumption profile. These working group meetings were attended by organizations across the value chain, including current and potential green hydrogen sellers, equipment suppliers, offtakers and others (including legal, financial, engineering, environmental and software advisors and service providers to both potential buyers and sellers of green hydrogen).

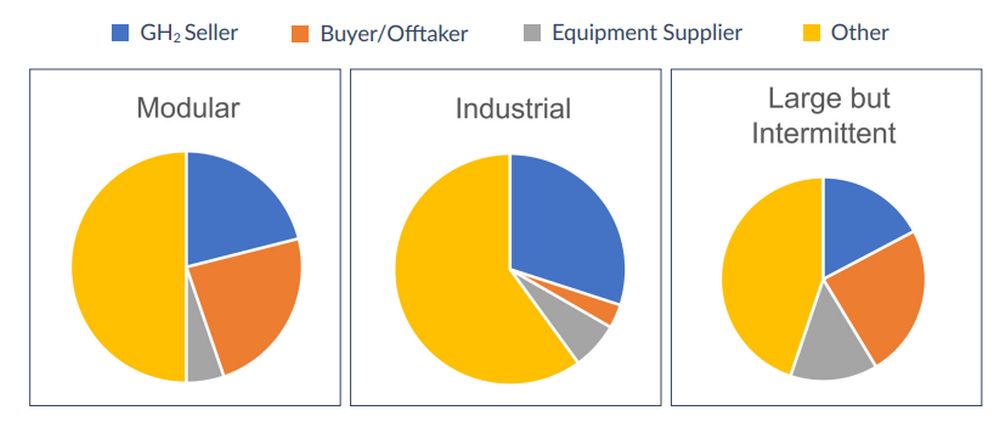

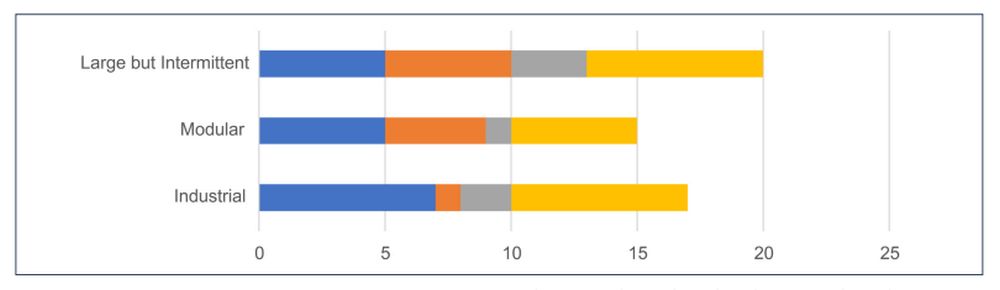

The Modular Profile working group was attended by 37 individual participants representing 15 organizations. The Industrial Profile working group was attended by 30 individual participants representing 16 organizations. And the Large but Intermittent Profile working group was attended by 32 individual participants representing 19 organizations. The figures below show how the participating individuals and organizations were broken-down by their role in the value chain.1

Figure 2: Proportion of individual participants representing different roles in the value chain at each working group.

Figure 3: Proportion of participating organizations representing different roles in the value chain at each working group.

Key Topics of Discussion

The seven topics listed and described below were raised frequently across working groups, demonstrating their importance to participants in the green hydrogen ecosystem:

1. Renewable energy supply: Renewable energy supply was discussed by all three working groups. Green hydrogen is dependent on renewable energy supply, and discussions described that offtakers need not only low-cost (preferably less than $60/MWH) reliable supply, but high capacity factor supply. Discussions also described that contracting parties must deal with complexities in modeling storage, renewable energy contracts (which offtakers may want to be extended) and intermittency depending on the fuel source.

2. Infrastructure (transportation and storage): Infrastructure was discussed by all three working groups in connection with parties across the value chain. Issues relating to transportation and storage are intertwined and will need to be discussed between green hydrogen suppliers and offtakers. The importance of storage, and backup storage (by the supplier or at the offtaker's site) was discussed. If green hydrogen suppliers are not able to provide reliable supply, then it was described that offtakers looking to switch may have to maintain or renegotiate existing contracts to ensure back-up supply. Shared infrastructure, like pipelines, could reduce this risk.

It was discussed that the way parties deal with these issues will likely change over time as initial solutions may not be the ideal long-term solutions at scale. This may lead to stranded investments down the road. For example, investments in trucking and above-ground storage may be necessary to start-up the market. With some offtakers, storage will initially be mandatory, but may not be needed as the market stabilizes. For other offtakers, storage will continue to be needed even if and once pipeline systems are put in place. In terms of pipelines, participants predicted that midstreamers will look at green hydrogen like natural gas, and only build pipelines when and where there are enough offtakers. In the near-term, then, short pipelines connecting to an industrial park with several colocated applications were discussed as being more likely. Whereas longer pipelines may be cheaper, they require greater scale. Participants discussed how borrowing from other industries – including potentially using existing pipelines – may be a solution. This is an important reason for exploring the process of blending H2 in existing natural gas pipelines – to solve the near-term transport and storage challenge.

An important consideration that the groups discussed is how parties will own and integrate storage and transportation infrastructure. For example, an offtaker with an above-ground storage tank or fueling station may want the supplier to provide refilling services. Participants predicted that offtakers may be willing to pay a premium for turnkey supply and integrated service to avoid building, owning and operating the infrastructure, along with the associated risks and investments. NASA contracts were brought up as an example, where the winners of the contract were also expected to dispose of old storage units and bring in new ones, adding a cost to the contract. Having the supplier, or another entity familiar with green hydrogen and safety, involved could also assuage concerns of the adjacent community.

3. Policy and regulation: Participants discussed the importance to all contracting parties of a flexible regulatory framework with the right incentives (like the ability to separate renewable energy attributes from physical delivery) with broad enough eligibility to allow different business models to flourish. Because some regulatory schemes include clawbacks of incentives based on carbon intensity, participants discussed the importance of regulations clearly defining what green hydrogen is and what feedstocks qualify. Discussions also noted that suppliers should consider that offtakers may be located in countries with different regulatory schemes and how that impacts their decisions for sourcing, tracking and blending exported hydrogen.

While policy can solve many issues, it was discussed that private parties must also consider how they can deal with risks in the absence of regulation. For example, while regulations may assist with standardization, suppliers and offtakers of green hydrogen will need to define and clarify quality specifications, delivery pressure, safety procedures and other factors.

4. Network effects: Another topic that was discussed across all three working groups was how anchor customers, hubs and aggregated demand can be leveraged to produce favorable network effects. Hydrogen hubs are already facilitating the aggregation of demand at the project level and have the potential to seed the market.

The working groups also discussed how upstream market participants can identify demand in locations with first movers and where they can economize on infrastructure development due to co-location at industrial parks. Since current prices for green hydrogen may be higher than alternatives, suppliers may consider targeting anchor tenants with discounted pricing. Suppliers also need to understand offtakers' customer contract cycles in order to predict changes in demand.

5. Education and marketing: The idea behind a hydrogen hub is to set up an ecosystem, which requires identifying and working with private industries that want to decarbonize. Participants identified target offtakers as corporations that either (1) want to decarbonize because they understand that the market and their customers are willing to pay a premium for clean fuel or (2) they need to decarbonize under an applicable regulatory scheme. The working groups discussed that target offtakers are generally focused on decarbonization, but technology agnostic, so education and marketing should be focused on comparing green hydrogen to other low carbon fuel sources and alternatives, rather than fossil fuels or grey hydrogen. Education is important for potential offtakers to understand how their high power goals can be aligned with decarbonization and to develop unique solutions for specific facilities.

Participants discussed the data center industry as an example of an industry with sustainability goals and high energy needs (specifically the need to be able to startup quickly after a blackout – which hydrogen combustion can provide more easily than other alternatives), but that may be wary about the reliability of hydrogen as a new industry.

Collaboration and education can also mitigate risks and promote ancillary benefits. Risks associated with the handling of hydrogen, for example, may be mitigated by drawing knowledge from existing plants with experience. And suppliers can leverage their influence and offtakers' existing commitments to values to encourage further decarbonization measures.

6. Financing: It was discussed that the financial community needs long-term models to gain comfort from a risk perspective, which can be a challenge for green hydrogen contracts where the supply is dependent on scientific variables and the offtake can be volatile and impacted by other unknowns. As with battery storage, financing parties need to understand lifecycles of use and degradation. Another challenge is that, due to the length of time to develop a green hydrogen project, there is a gap in the market between the early stage development and the final construction phase. This results in risk that a project may not be big enough (i.e. – the demand could exceed the planning) by the time a development is complete. Developers described working with tax investors as well as debt financing, but more education, confidence and firmer structures are still needed. It was described that offtakers often want to be investors, which can help to de-risk projects.

7. Equipment: Equipment was the final topic discussed across all three working groups. Participants discussed how offtakers are basing the term of contracts off of the lifecycle of the electrolyzer, but this is often short (around 10 years) because there is not yet a lot of perfomance data. An important consideration for suppliers, who must provide reliability to their customers, is obtaining performance guaranties on equipment. In the context of turbines using a certain percentage of hydrogen blended with natural gas as a fuel source, parties need to understand that there may be risks to the equipment due to variance of that percentage.

Footnote

1. Note that the charts do not align exactly with the total numbers of individual participants and organizations because not all participants were present for the introductions and some organizations may have more than one role in the value chain.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.