Respondents to our annual survey are optimistic about market growth, show strong interest in digital economy properties, and see significant potential for AI in property management.

The sentiment among commercial real estate investors remains largely positive according to Goodwin's 2025 Outlook for Commercial Real Estate Survey. The survey was conducted at our annual Real Estate Capital Markets (RECM) Conference, which brings together leading real estate and investment professionals to discuss industry trends and the outlook for coming years.

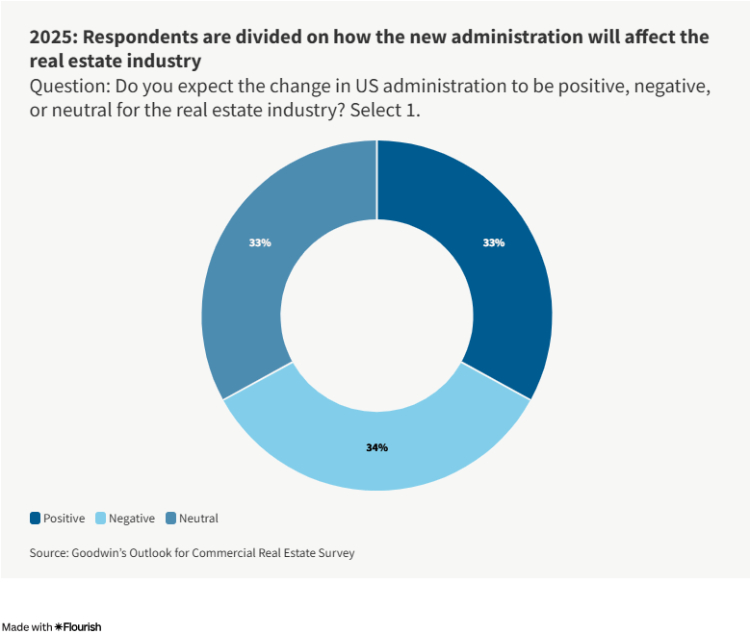

Compared to 2024 results, however, our 2025 survey reveals a tempered optimism across several categories, despite the overall positive outlook. A divided response regarding the expected impact of the new administration may signal uncertainty related to potential policy shifts that could affect the sector.

Among the findings, 61% of respondents expect the commercial real estate market to be stronger 12 months from now (compared to 67% in 2024). Other highlights include:

- Transaction activity will increase in the next 12 months, according to 73% of respondents, as will availability of capital (58%) and cost of capital (52%).

- Digital economy properties, particularly datacenters, are viewed as the most promising asset class, with 67% of respondents identifying them as the best opportunities in the next year, followed by downtown office assets (with 39% saying they would be the second best opportunities, up from 14% in 2024) and multifamily assets (30%).

- Private equity firms are expected to be the most active investors in the commercial real estate market over the next 12 months by 58% of respondents.

- AI's most valuable use case in real estate will be in property management and operations, according to 31% of respondents, with risk assessment and due diligence (24%) ranking as the second most valuable use case.

- Climate risk assessment has been incorporated into investment strategies to a moderate or great extent by a majority of respondents (55%).

See the following charts for more details from the survey.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.