NEW YORK, July 22, 2024 – Proskauer, a leading international law firm, today announced the results of its quarterly Private Credit Default Index ("Default Index" or the "Index"), which showed an overall default rate of 2.71% for the period of April 1-June 30, 2024. The index, which includes 922 active loans representing approximately $150.7 billion in original principal amount, tracks senior-secured and unitranche loans in the United States.

This is the third consecutive quarter in which defaults have risen. The rates in Q1 2024, Q4 2023 and Q3 2023 were 1.84%, 1.60% and 1.41%, respectively.

"Defaults are not necessarily indicative of distress; instead they provide managers with the ability to take steps to reduce their risk," said Stephen A. Boyko, partner in Proskauer's Private Credit Group and co-chair of its Corporate Department.

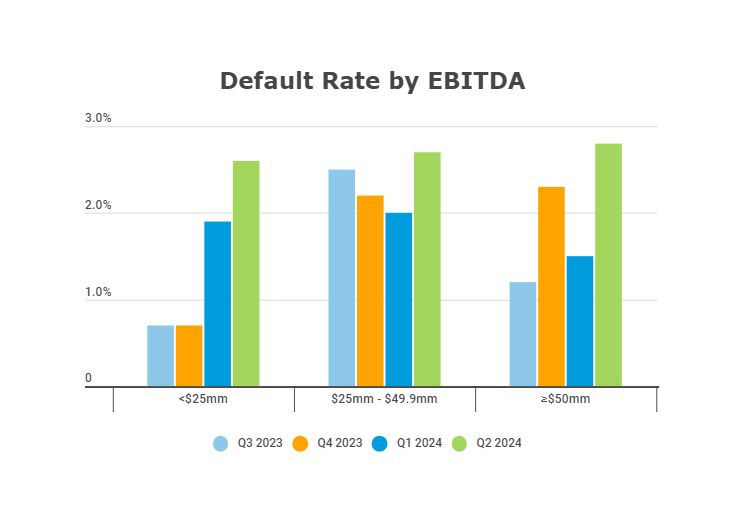

According to Proskauer's Default Index, which breaks down the default rate by EBITDA band, the default rate for companies all three bands – less than $25 million in EBITDA, $25 million to $49.9 million EBITDA and greater than $50 million EBITDA – all rose from Q1 to Q2 2024. The default rate for companies in the smallest band increased from 1.9% to 2.6%, while mid-sized organizations' default rate climbed from 2.0% to 2.7%. Companies with more $50 million in EBIDTA had the largest increase in defaults, with the rate increasing from 1.5% in Q1 to 2.8% in Q2.

"It is clear that defaults are rising. However, the overall default rate for broadly syndicated loans remains considerably higher than those in private credit. For the twelve-month period ending May 31, 2024, Fitch Ratings reported a default rate of 4.33%. Using a similar definition of default, Proskauer's corresponding default rate for the second quarter was 0.9%," noted Stephen.

He added: "We believe that there are structural differences between the products that explain the difference in default rates – stricter underwriting standards, tighter documentation (including financial maintenance covenants), regular access to information/management, and loans that are typically held to maturity and not distributed."

The full Default Index contains a comparison to default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by default type, defaults in cov-lite loans and defaults by year of origination. It is available only to the Firm's direct lending clients.

Private Credit Defaults Rise To 2.71% According To Latest Proskauer Index

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.