Sophisticated funds and UCITS III

Sophisticated funds - that's the name for Undertakings for Collective Investments In Transferable Securities (UCITS) which invest directly in Financial Derivative Instruments (FDIs) or use sophisticated investment strategies. UCITS originates from the 85/611 Directive of the European Union.

Whilst the investment fund industry is bracing up for the UCITS IV package and for new regulations on the alternative investments fund managers there are still unturned stones regarding the UCITS III framework.

The 2001 Product Directive made FDIs eligible investments by UCITS and enabled portfolio managers to access different investment strategies which have been associated to Alpha return managers - the so called convergence between hedge fund strategies and UCITS.

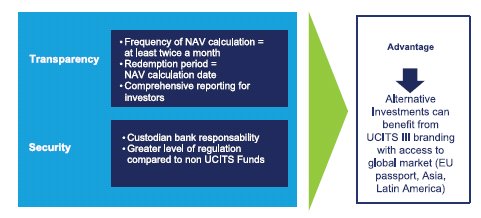

Sophisticated funds under the UCITS brand name bring a series of advantages such as strict investor protection, regulated framework and notoriety for cross border distribution beyond the European Union in regions such as Asia and Latin America.

In this document we bring you an expert's eye view of the sophisticated funds.

Overview of sophisticated funds

UCITS III enables investment managers to structure alternative investment strategies within the framework of UCITS investment funds. To achieve this, managers are allowed to use a broad range of FDIs in a sophisticated manner including leverage, short positions... Classification as a sophisticated fund is based on a self-assessment and criterias defined by the regulatory framework.

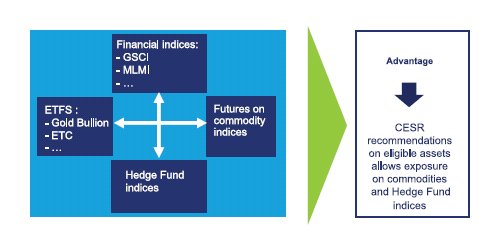

Sophisticated funds have access to all kind of FDIs as long as their underlying assets are considered as being eligible. Currently, nearly all derivatives can be used by sophisticated funds, including hedge funds indices or commodities (as explained in CESR guidelines).

Therefore, sophisticated funds can replicate nearly all hedge fund strategies offering performance and riskdiversification to investors under the UCITS branding. This is seen as a proof of security and transparency by investors.

Due to the use of more complex products and strategies, strong Risk Management framework has to be set up for sophisticated funds in order to ensure that the funds' Board of Directors has a clear view on funds' risk profile and how risks are mitigated.

Convergence with Hedge Fund Strategies

- Use of FDIs

Compared to non sophisticated funds, FDIs are considered as an asset class for the UCITS sophisticated funds. The prospectus of funds should detail the type of instruments and investment objectives that will be used. FDIs may be dealt on a regulated market or dealt on overthe- counter ("OTC derivatives"). The main criteria used for the eligibility of FDIs underlyings will be driven by the CESR guidelines of March 2007 (example: CDS on loans).

- Replication of Hedge Fund strategies

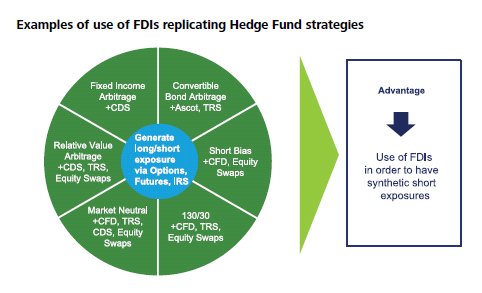

With the use of FDIs in order to have synthetic short exposure, sophisticated funds can replicate strategies such as Convertible Arbitrage, Fixed Income Arbitrage, Long/Short Equity, Market Neutral... and can offer their investors opportunity to a broader risk diversification by combining different asset classes with lower correlation.

- Leverage

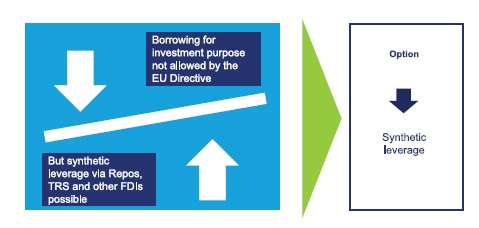

Under the UCITS framework, it is not possible for UCITS to borrow for investment purposes. Nevertheless, through the use of FDIs, a sophisticated fund can do synthetic leverage using among others Repos or Total Return Swaps. As an example, in order to replicate a 130/30 strategy, UCITS can be 100% long by investing directly in securities and 30% long/30% short via Total Return Swap.

- Strong Risk Management framework for sophisticated

funds

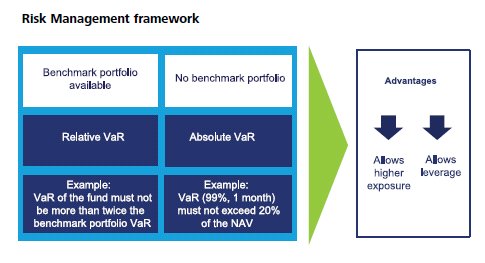

Extensive use of FDIs implies a strong and robust Risk Management to be set-up in order to capture all the risks exposure of the sophisticated funds. The Risk Management has to be skilled (sufficient number of qualified people with the necessary knowledge and IT tools) and independent from the front-office of the fund manager (can be delegated to a third-party). Value at Risk (VaR) has to be applied in order to assess the global exposure the fund is undertaking. The VaR models used can be either Variance Covariance, Historical or Monte Carlo methodology and must be combined with stress-testing and back-testing.

- UCITS brandings - security and transparency for

investors

UCITS legal framework offers wide reaching investor protection rules and investor information requirements. UCITS IV will bring new rules under the key investor information package.

Why Deliotte

Audit services

Deloitte acts as external auditor to a large number of sophisticated and non sophisticated funds domiciled and/or administered in Europe. We firmly believe that an audit starts at the launch stage of a fund and this has proved to be of utmost importance to management. Addressing operational and accounting issues at this early stage will contribute to a seamless service from Deloitte and from your service providers.

Registration

Deloitte offers the initiation and completion of the initial fund registration process and provide regulatory guidance throughout. Moreover, we can help our clients ensure fund compliance with ongoing regulatory obligations. Furthermore, we can conduct strategic distribution studies to identify and assess costs and benefits of distribution arrangements. Moreover, as UCITS are designed to be marketed to retail investors, there is an obligation to provide risk profile to investors. Besides, with the implementation of the MiFID Directive, requirements have been increased with regard to the adequacy of the product and the investor's profile. Deloitte can bring expertise on these points thanks to its strong expertise.

Financial Instruments cross valuation

FDIs and structured products must be independently valued on each NAV calculation date. This could be an operational challenge for industry participants not used to deal with OTC products. Moreover, following the current credit crunch, strong difficulties arise for the valuation of illiquid assets. We offer independent portfolio cross valuation including OTC FDIs on any underlying asset (interest, FX, commodity, equity, credit). Deloitte also performs review of valuation methodologies in particular Mark-to-Model used for valuing investments.

Risk Management

Deloitte offers expertise in the understanding of the VaR methodology and performs gap analysis of Risk Management framework. Deloitte also designs, implements and reviews Risk Management procedures in particular when implementing VaR models. Deloitte also offers expertise in the measurement and reporting of key risks indicators.

Performance attribution/measure

Deloitte performs implementation and verification of Global Investment Performance Standards (GIPS). Besides, Deloitte brings expertise in the review and implementation of pooling and globalization techniques including multi-class structures and hedged class. Deloitte also brings expertise in the set-up and review of performance fees models and provides with latest state-of-the-art mechanisms (equalization factors, series of shares...).

Financial reporting

Deloitte assists in the compilation of financial reports in several GAAP formats and/or coordinates the submissions to regulatory authorities as per our clients' specific needs. Deloitte's system deals with the major fund accounting systems and can manage complex fund structures. Tax advisory

Deloitte's tax team provides expert services for various jurisdictions on many levels including tax structuring at fund and management company level, tax reclaim procedures, VAT impact minimization as well as tax opinions and reviews of the tax section of investment funds offering documents. Deloitte also provides custodian, fund administrators and fund managers with tailor made advice covering all tax aspects that need to be considered when setting up or reorganizing cross border distribution including taxation aspects associated with risk assessment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.