Employment Law Briefing Winter 2008

The Employment team at FSI consider key developments in employment law in September and October 2008 in depth and the changes planned for the New Year.

REDUNDANCY

Length of service as a criterion for redundancy selection may not be unlawful

In the case of Rolls Royce Plc v Unite (The Union) the High Court held that using length of service as one factor for selecting employees for redundancy was not unlawful age discrimination.

This criterion was part of a broader assessment matrix contained in a collective agreement made with the Trade Union to facilitate peaceable restructuring and fair selection of affected employees in a redundancy situation. In this case, employees would receive 1 point for each full year of service. Rolls Royce preferred not to include this criterion when making selection and so argued that this length of service criterion was age discriminatory. The parties referred the issue to the High Court to decide. The High Court decided that the length of service criterion was not unlawful because it could be objectively justified as a proportionate means of achieving a legitimate business aim (here the fact that it was part of a collective agreement between Rolls Royce and the Trade Union to enable fair and peaceable redundancies, and also that it demonstrated respect for the loyalty and experience in the workforce).

The High Court also held that the use of the criterion was exempt under Regulation 32 of the Age Regulations because it conferred on a worker the benefit of retaining their employment, and in terms of awarding points for service beyond 5 years, it met the requirement of fulfilling a business need, because it was part of an agreed arrangement and was one of a number of criteria for consideration.

Our view

This is an interesting case in terms of the application of Regulation 32 and also confirms that a length of service criterion can be used in a selection process for redundancy without it being unlawful age discrimination so long as it can be objectively justified, and is not the only selection measure.

It is doubtful whether the Court would have made the same decision if length of service had been the sole criterion.

STATUTORY LEAVE

Businesses can require employees to take holiday during their notice period

Employers' costs of terminating employment are often increased by the requirement under the Working Time Regulations 1998 ("WTR") to pay employees for accrued, untaken holiday in addition to their notice pay.

A recent EAT case, Industrial & Commercial Maintenance Limited v Briffa, has confirmed that it is possible for this position to be varied by a "relevant agreement".

Mr Briffa was given one week's notice of termination of his employment on 10 August 2007. At the same time he was told that his employer did not require him to work his notice and that in accordance with the employer's contractual terms, Mr Briffa was required to take any accrued, untaken holiday during his one week notice period. This would mean that no outstanding holiday pay would be due to Mr Briffa.

Mr Briffa had accrued 4 days' holiday, and brought a claim in the employment tribunal in respect of his outstanding holiday pay. He claimed that his employer was required under the WTR to give him notice equivalent to double the length of the holiday to be taken, in this case 8 days' notice, if it wanted him to take his holiday at a specified time. The EAT confirmed that the WTR permit an employer to vary the rule about giving notice to take holiday by a "relevant agreement" and that a relevant agreement includes a contract of employment. Since in this case there was a contractual term allowing the employer to insist on the leave being taken without giving the notice under the WTR, Mr Briffa was not entitled to any outstanding holiday pay.

Our view

This case confirms that well drafted contracts of employment are required if businesses wish to have the flexibility to require employees to take holiday during their notice period. Without express contractual provisions to this effect, employers must give employees notice equivalent to double the length of the holiday they wish the employee to take.

The EAT case also highlighted that the policy behind the WTR is to ensure that workers take sufficient holiday with pay.

Managers should make sure that staff are taking at least their statutory minimum holiday requirements as much as a health and safety measure as to prevent claims for unpaid holiday pay.

How to approach an employee's request to take time off because her child care arrangements are disrupted

In the case of Royal Bank of Scotland Plc v Harrison the EAT decided that the unavailability of an employee's childminder, which was notified to the employee two weeks in advance, entitled the employee to take time off on the basis that it was necessary because of the unexpected disruption or termination of arrangements for the care of her dependent under section 57A of the Employment Rights Act 1996.

RBS had refused Mrs Harrison's request for time off on the basis that she had sufficient time to make alternative childcare arrangements, and had therefore given her a verbal warning for what it considered to be unauthorised absence when she took the leave anyway.

RBS argued that BERR guidance and parliamentary intention operated to restrict section 57A(1)(d) to apply only in cases of emergency.

The EAT disagreed and said that there was no specific period of time for determining whether an event was unexpected, and whether time off was necessary.

Indeed, the disruption to the care arrangements was unexpected when Mrs Harrison first learned of it. The longer the time between learning of the risk of disruption and the risk becoming fact, the more unlikely it is for the time off to be co nsidered necessary, howe ver there were other relevant circumstances in this case, such as the fact that Mrs Harrison had attempted to make alternative arrangements for her childcare.

Our view

The lesson from this case for employers is that there are no rules for deciding whether the requested time off is necessary, so each case needs to be determined on its own facts.

Relevant factors to consider are the nature of the disruption, the availability of alternatives, finances and the lapse of time, but this is not an exhaustive list. The size of the employer's resources was stated to be irrelevant.

EMPLOYMENT STATUS

Contractors held to be workers because of sham contract

In the case of Redrow Homes (Yorkshire) Limited v Mr Buckborough and Mr Sewell the EAT dismissed Redrow's appeal against the finding of the ET that the Claimants who worked as bricklayers under a sub-contract describing them as self employed were held to be workers for the purposes of the Working Time Regulations 1998 and were therefore entitled to holiday pay.

This was Redrow's second bite of the cherry following a Court of Appeal decision in 2004 in which other bricklayers had been held to be workers, and so Redrow had put their "armies of lawyers" to work on their contracts to seek to produce the result that in the future such bricklayers would not be held to be workers.

Redrow was unsuccessful again, because the ET was satisfied that it was never expected by either party, seriously or otherwise, that either of the Claimants would seek to provide a substitute or refuse the work offered, despite this being an express provision of the Contract. The right to provide a substitute and to provide other labour was inserted into the document to give the appearance of relieving Redrow of contracting with the Claimants as workers and it did not seriously reflect the relationship between the parties. The Respondent in effect wanted workers but did not want to incur the obligation to pay holiday pay. The EAT also concluded that the obligation in the contract for the Claimants to either personally lay bricks or personally to secure alternative labour to lay bricks was justifiably and correctly described by the ET as an obligation personally to perform a service for Redrow, which brought the Claimants within the definition of worker under the WTR 1998. The dominant purpose of the Contract was the personal provision of work or services, not bricklaying as Redrow had tried to argue.

Our view

The implication of this decision is that it is very difficult for employers to take on individuals as contractors without the risk of being challenged about the true nature of the contract being an employment relationship. Employers should ensure that the terms of any contractor's agreement are carefully drafted, and agreed with the individual, and the employer should gather as much evidence as possible that the individual understands the terms and agrees that their intention is to abide by the terms recorded in the contract.

STRESS

An employer's liability for its stressed employees - business risk profile increases.

In the Court of Appeal case of Dickins v 02 Plc, 02 Plc lost its appeal against the High Court decision that it was liable to Ms Dickins for psychiatric injury negligently caused by excessive stress in the course of her employment.

Ms Dickins was a Finance Manager who, following a history of stressful incidents while with O2, suffered a breakdown in her health in May 2002 having expressly warned her employers in her annual review meeting on 23 April 2002 that she was not coping and was at the end of her tether.

The Court of Appeal decided that Ms Dickins had given a clear warning to her employer of her impending illness and the breakdown in her health was therefore reasonably foreseeable.

It also held that her employer's suggestion that she seek counselling was not an adequate response.

The availability of obtaining a reference to counselling services (considered in the case of Hatton to be an important step to limit employer liability) is not a panacea by which employers can discharge their duty of care in all cases.

In this case Ms Dickins' problems could only be dealt with by management intervention and the Court of Appeal concluded that her employer should have referred her to Occupational Health and should have sent her home.

Our view

The lesson here for employers is that if an employee has alerted them to the stress of their job and to impending illness, and nothing is done about it, this is enough to establish reasonable foreseeability of harm and the employer would be wise to take prompt and appropriate action to protect its employee from that harm. An employer cannot rely on the provision of counselling services if this is not sufficient to meet the needs in a particular case.

This case dispels to a large extent the limitations imposed on bringing stress at work claims following the case of Hatton and the message to employers is that they must remain vigilant about these claims.

DISCRIMINATION

Age discrimination in job adverts

In the case of Rainbow v Milton Keynes Council, 61 year old Ms Rainbow had over 34 years of teaching experience and was paid on one of the highest pay scales.

She agreed with the school to reduce her hours to work part-time as long as she would receive first right of refusal on extra days' supply teaching. This was instead outsourced to a cheaper agency. The school subsequently advertised a year 3 teaching job, stating that the post "would suit candidates in the first five years of their career".

Ms Rainbow requested an application pack from the school but, unlike other candidates, did not receive an application form, job description or specification and was told to send in a letter of application only.

Ms Rainbow was also told that the school wanted to appoint someone on the same pay scale as the departing permanent employee. Ms Rainbow had experience of teaching year 3 and had taught this particular class. However, her application was rejected and a teacher with four years teaching experience, on a much lower salary, was appointed.

Ms Rainbow brought direct and indirect age discrimination claims against the Council, which argued that its advert was justified by reason of cost.

Ms Rainbow's direct age discrimination claim failed but the tribunal held that the job advert and the failure to short-list Ms Rainbow for the teaching position amounted to indirect age discrimination.

The school's decision to employ someone in their first five years of teaching was cost-based, and constituted a provision, criterion or practice that disadvantaged Ms Rainbow, because it was likely that a teacher in her age group would have more than five years' teaching experience. The tribunal said that an employer is not prevented from relying on economic grounds as a justification defence but held in this case that the Council had not offered sufficient evidence of a cost-based justification.

Our view

Employers must expect that Tribunals will embark on a detailed enquiry into any economic grounds used to justify discriminatory practices before accepting their arguments, so should ensure that they have the necessary analysis/documentation in support.

Dismissed discriminating employees do not suffer discrimination

The EAT overturned an ET decision that Mr Hussain had been discriminated against on the ground of age in Live Nation (Venues) UK Ltd v Hussain.

Mr Hussain was employed by the Bristol Hippodrome as front of house manager. He had problems being managed by younger female members of staff and was dismissed by the company for his bullying behaviour.

The tribunal held that Mr Hussain had been discriminated against on the grounds of age.

However, the EAT overturned this decision, agreeing with the company that "if an employer genuinely forms the view that an employee is guilty of racism or sexism and dismisses them for that reason, it provides no scintilla of evidence that the reason for the dismissal by the company is unlawful because of sex or race discrimination against the employee. That is so even if the employer's perception is unjustified or misguided". In this case, for example, it would have been absurd to suggest that the claimant was dismissed by reason of his sex merely because the manager suspected that he was adopting a sexist attitude towards his female colleagues.

Also the EAT went on to provide further guidance as to conduct which may justify a finding of age discrimination:

- an unjustified or unreasoned belief that an employee has ageist tendencies may render a dismissal unfair, but it does not justify an inference that the reason for the dismissal is the employee's age;

- reference to an employee being 'too old to change' could, in an appropriate case, provide some basis for inferring age discrimination.

Our view

There would be a danger, if the tribunal's view had been upheld, that an employer would have difficulties dealing with a suspected discriminator because the employer could potentially be found to be discriminating.

This is a common sense decision, but in dealing with discriminating employees, employers should still be careful not to make discriminatory comments or assumptions about the reasons for the employee's behavior.

Discriminatory bonus schemes

In Hartlepool Borough Council and anor v Dolphin and ors the EAT upheld the ET's decision that the Council's bonus schemes, established to encourage productivity in jobs predominantly held by male workers, were a sham. So, the Council could not rely on the schemes as a genuine material factor to justify the difference in pay between female claimants not entitled to the bonuses and their male comparators.

The female claimants in this case were employed by the Council in various roles. They brought equal pay claims, claiming that they had been denied certain bonuses paid to men allegedly performing work of equal value and/or work rated as equivalent under s.1 Equal Pay Act 1970. These bonuses were paid under schemes originating in the 1970s. The Council argued that the scheme was related to productivity and there was therefore a genuine material factor, not related to sex, which explained the difference in treatment.

The tribunal found that the schemes had been discriminatory from the outset, mainly due to the fact that the original negotiations had been progressed by male-dominated groups supported by powerful unions.

It went on to say that the bonuses had no particular link with productivity, that there was little evidence of any assessment or review of the schemes and that the Council had not considered whether the Claimants might be eligible for the bonuses. As a consequence, the schemes were considered a sham.

The EAT agreed with this decision and added that "an explanation based on the history of pay freezes in the 1970s would not give a genuine reason for the continued reliance upon the bonus schemes in 2004". It also highlighted that even though a scheme may be justified originally by the existence of a genuine material factor, that scheme can become discriminatory over time.

Our view

This case has highlighted the importance of regular reviews of bonus schemes and similar remuneration policies by employers in order to ensure fairness and equality.

Further development of "discrimination by association" in religious discrimination

In the case of Saini v All Saints Haque Centre and others, Mr Saini was an advice worker who successfully claimed discrimination on religious grounds against his Ravidassi superiors, not because he was harassed and mistreated by them because of his own faith (Mr Saini was a Hindu) but because of his manager Mr Chandel's faith (he was also a Hindu).

Mr Saini had been bullied and intimidated into providing the Advice Centre management with "ammunition" against Mr Chandel, who was subsequently dismissed on the ground of his religion.

Our view

This case demonstrates the increasingly purposive interpretation that the courts are giving to anti-discrimination legislation, following the ECJ's decision in Coleman v Attridge Law (see July/August edition of the FSI Employment Law Briefing).

Heyday challenge unsuccessful?

When age discrimination protection came into force in the UK in 2006, the UK Government included a mechanism that employers could retire employees over the age of 65 as long as a statutory retirement procedure was followed.

This provision is being challenged in the High Court by Heyday (Age Concern) and the issue has been referred to the ECJ, with their decision expected at the beginning of 2009. In September the Advocate General gave his opinion in this case recommending a finding in the UK Government's favour on the basis that the forced retirement provisions can be objectively and reasonably justified under domestic law as having a legitimate aim, and that the provisions themselves are a proportionate means of achieving such legitimate aim.

The Advocate General's opinion is not binding on the ECJ but is often a good initial indication of its future decision. If the ECJ does follow the Advocate General's opinion it would still mean a referral back to the High Court in the UK and the UK Government would be required to show that the retirement legislation can be justified as a proportionate means of achieving a legitimate aim.

Our view

The risk for UK businesses is that a successful challenge to the legislation would potentially mean that the right to retire staff compulsorily after 65 would be removed and retirement dismissals (in the past as well as in the future if the decision is given retrospective effect) would need to be justified by employers, for example, on the ground of capability, when currently such dismissals are usually non contentious as long as the statutory retirement process is followed.

Race discrimination and compensation

In the case of Abbey National PLC and Hopkins v Chagger, Mr Chagger, of Indian origin, had been selected for redundancy by Abbey National PLC and dismissed. The Employment Tribunal found in favour of Mr Chagger on each of the pleaded claims which included two race discrimination claims. Abbey National and Mr Chagger's manager appealed this decision.

The EAT dismissed Abbey National's appeal, but made some interesting findings in relation to evidence and compensation.

First, it ruled that the "reversal of the burden of proof" rules set out in s.54A of the Race Relations Act 1976 do cover race discrimination complaints brought on grounds of colour or nationality as well as on grounds of race, ethnic or national origin.

The EAT also ruled that the "stigma" risk that an unlawfully dismissed employee may find it difficult or impossible to get another job because he brought a discrimination claim against his employer is not a matter which could be reflected in compensation.

With regard to redundancy, if selection of a person for redundancy is tainted by unlawful race discrimination (or any other unlawful discrimination), then in assessing the compensation to be awarded to that person a tribunal must make a percentage estimate of the likelihood that he or she would have been selected for redundancy anyway.

Finally, the Ogden Tables can sometimes be used when calculating compensation for future loss (the Ogden tables are tables published by the Government Actuary as an aid to the calculation of damages in personal injury cases) but this should only be in cases where sophisticated calculations of long-term future loss are required and even then if the Ogden Tables are used they must be used with care and with a proper understanding of their limitations.

Our view

This case contains some practical assistance for employers defending race discrimination claims, particularly the importance of identifying the scope of a race claim (race, colour, ethnic origin and /or nationality) and assessing employee compensation appropriately.

TRIBUNAL CLAIMS

The identity of respondents in the employment tribunal claims is disclosable

The Information Commissioner has ruled that the names and addresses of Respondents in employment tribunal proceedings must be disclosed by BERR pursuant to a request made under the Freedom of Information Act 2000.

In reaching this decision the Commissioner found that BERR was not justified in its decision to withhold this information on the ground that publication would be prejudicial to the effective conduct of public affairs. Importantly BERR had not offered any evidence to suggest that the publication would damage the reputations of the organisations concerned.

Until four years ago, the case number, the date the application was received, the name and address of the applicant and respondent, the regional office dealing with the application and the type of claim brought in general terms, were all published on a Register. This Register was then abolished in 2004, and the only information made available (aside from daily lists at the tribunals) was a copy of judgments and written reasons. This was because of concerns about opportunities for unwelcome direct marketing and employee blacklisting.

Our view

The ICO's decision will apply to information gathered and held by BERR since 1 October 2004, and is likely to pave the way for further challenges to make information available again. For now, employers should be aware that the fact that tribunal claims have been made against them may become public knowledge, even if they are settled prior to a hearing.

WHISTLEBLOWING

Whistleblowing provisions protect an employee's disclosure that reveals "wrongdoing" or "failure" by any person, not just the employer

In the case of Hibbins v Hesters Way Neighbourhood Project, Ms Hibbins was a language teacher who was employed by Gloucestershire Neighbourhood Project Network and seconded to Hesters Way Neighbourhood Project (the "Project") for one day a week.

She realised, after seeing a local press report, that a potential student she had just interviewed for the Project was a suspect in a rape case. She passed his contact details to the police. As a result, the Operational and Development Manager of the Project had a strongly worded telephone conversation with her and she lodged a grievance with her main employer. She eventually resigned and brought a tribunal claim under the whistleblowing parts of the Employment Rights Act 1996 against the Project.

The decision of the tribunal was that her whistleblowing did not relate to any wrongdoing or failure by her employer and therefore the tribunal had no jurisdiction. However, the EAT upheld her appeal against this judgment. It was held that the tribunal was wrong to conclude that the whistleblowing provisions do not apply where the "wrongdoing" or "failure" was by a body which was not the employer of the person who made the disclosure. The EAT remitted the case to a different tribunal to consider the claim and the other defences put forward by the respondent.

Our view

It may be necessary for some employers to update their whistleblowing policies to include reporting failures by third parties, but certainly employers must be alert to the fact that such reports may trigger the protection of the statutory whistleblowing provisions, and they should refrain from disciplining employees in these circumstances.

KEY LEGISLATIVE CHANGES

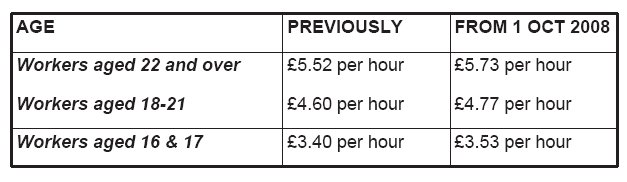

Changes to the minimum wage

The National Minimum Wage Regulations 1999 (Amendment) Regulations 2008 came into force on 1 October 2008 and changed the minimum rates as follows:

Maternity leave and the provision of non-pay benefits

The Maternity and Parental Leave etc and the Paternity and Adoption Leave (Amendment) Regulations 2008 provide that employees whose babies are due on or after 5 October 2008 are entitled to their non pay benefits (including those within a salary sacrifice scheme) throughout both their ordinary maternity leave and additional maternity leave e.g. health cover, gym membership, company car provision and contractual holiday. Also, businesses now have to take an employee's period of compulsory maternity leave (a two week period immediately following the birth of the baby) into account when calculating discretionary bonuses. See the July/August edition of the FSI Employment Law Briefing for further details.

Short term agency workers entitled to SSP

The Fixed-term Employees (Prevention of Less Favourable Treatment) Regulations 2002 provide that, from 27 October, agency workers on contracts of less than three months are now entitled to Statutory Sick Pay.

Employers' liability insurance certificates

From 1 October, The Employers' Liability (Compulsory Insurance) (Amendment) Regulations 2008 amends The Employers' Liability (Compulsory Insurance) Regulations 1998 to require an employer who has been issued with an employers' liability insurance certificate to display one or more copies of it at each place of business at which he employs any relevant employee of the class or description to which such certificate relates. However, this can be achieved as long as the certificate is "made available in electronic form and each relevant employee to whom it relates has reasonable access to it in that form". In addition, employers no longer have to retain their employers' liability insurance certificate for 40 years.

Immigration points system

The new points-based immigration system is being implemented in stages and Tiers 2 and 5 of the system came into force in November 2008. Tier 2 applies to skilled migrants with job offers who are coming to the UK to fill a gap in the UK labour market and Tier 5 applies to those travelling temporarily to the UK primarily for non-economic reasons. Employers wanting to employ migrant workers will need to have a valid licence to become the sponsor of such workers.

ON THE HORIZON...

Repealing Statutory Dismissal and Disciplinary Procedures and the Statutory Grievance Procedures

As explained in the July/August issue of the FSI Employment Law Briefing, the statutory dismissal and grievance procedures will be repealed in April 2009 by the Employment Act 2008 which has received Royal Assent.

These procedures will be replaced by the ACAS Code of Practice on Disciplinary and Grievance Procedures which has been published in draft form and can be downloaded from the ACAS website.

Although this new Code of Practice is not statutory, it does provide a power for an Employment Tribunal to increase any award by up to 25% if an employer unreasonably fails to follow the Code. The Code is awaiting approval by Parliament and we will provide updates on this and further details of the new Act in subsequent briefings.

Stronger penalties for health and safety offences

The Health & Safety (Offences) Act 2008 comes into force on 16 January 2009. It does not create any new offences, but raises the maximum penalties available to the courts in respect of many established health and safety offences.

The new Act will create further criminal penalties including maximum sentences of a term of imprisonment of 12 months for a conviction in the Magistrates Court and 2 years for conviction in the Crown Court for a breach by employees, employers and directors of most of the offences under the Health and Safety at Work etc Act 1974. The Act will increase the maximum penalty available in the Magistrates Court to £20,000 for the majority of health and safety offences.

Tips and the national minimum wage The Department for Business, Enterprise & Regulatory Reform is to launch a public consultation on the proposals to prevent all tips from being used to count towards the national minimum wage. The changes are expected to come into force in 2009.

Annual increase in employment tribunal compensation limits

The annual increase in compensation limits has just been published (for dismissals and other trigger events occurring after 1st February 2009).

The key increases are:

- compensatory award: £63,000 to £66,200

- a 'week's pay': £330 to £350

- maximum redundancy payment: £9,900 to £10,500

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.