As the retail industry becomes increasingly competitive, it is more important than ever to get compensation right to attract, motivate and retain top talent to drive business success.

Trends in employee pay

Employee pay isn't only important to employees. Organizations also rely on compensation programs to drive business results.

Planned salary budget increases

The top factors influencing budget plans for 2025 are stabilizing inflation and a cooling labor market. This is a departure from the prevalent concerns of recent years when business leaders were contending with spiking inflation and evolving employee expectations. As a result, many organizations are preparing for 2025 budget increases that are slightly lower than that of recent years but more in line with the actual spend they've made in 2024.

Source: WTW 2024 Salary Budget Planning Survey Report – Global (December edition)

| Region | Planned increase |

|---|---|

| North America | 3.5% |

| Asia Pacific | 4.9% |

| Central & Eastern Europe | 6.2% |

| Latin America | 4.9% |

| Middle East & Africa | 4.5% |

| Western Europe | 3.4% |

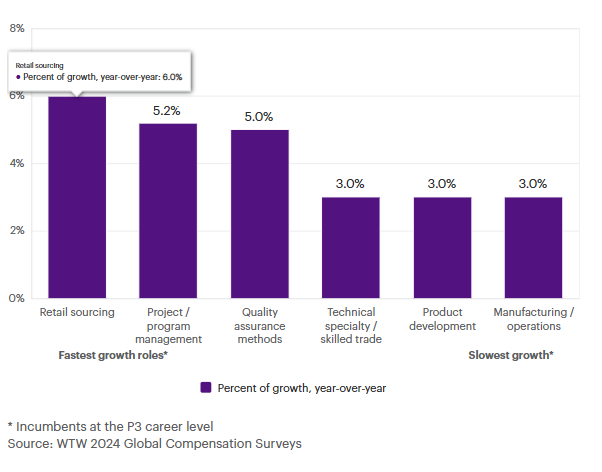

Industry disciplines and functions seeing the fastest and slowest compensation growth

Changing labor market and economic conditions as well as socio-economic trends have increased the pressure on organizations to update their pay programs, according to the results of our 2024 Pay Effectiveness & Design Survey's global results. The following charts outline the fastest and slowest growing functions by region. These trends provide insights into what retailers need to focus on to evolve with a changing market.

Top functions with the fastest and slowest growth, Canada, United States

Top functions with the fastest and slowest growth, France, Germany, Spain, United Kingdom

Top functions with the fastest and slowest growth, China, India, Japan, Taiwan

What retailers need to focus on

Adapting to market dynamics

The fastest-growing roles in North America, such as retail operations technical specialty (23.4%), general management and administration (18.9%) and technical customer support (11.4%), indicate a strong demand for technical expertise and leadership within the industry. Retailers should recognize the value of investing in these areas to stay competitive and ensure operational efficiency.

Regional variations

Compensation growth varies significantly by region. For example, technical customer support roles in France, Germany, Spain and the United Kingdom are seeing a 7.6% growth, while similar roles in North America are experiencing a 11.4% growth. Retailers operating in multiple regions should tailor their compensation strategies to reflect these regional differences and attract top talent accordingly.

Innovation and quality

Roles related to research (6.1%) and quality assurance methods (5.0%) are also seeing substantial growth in Europe and Asia Pacific, emphasizing the importance of innovation and quality control. Clients should prioritize these functions to drive product development and maintain high standards.

Challenges in traditional functions

Conversely in North America, traditional functions like finance (-12.2%), manufacturing / operations (-2.0%), and sales, marketing, and business development (-1.8%) are experiencing slower or negative growth. This trend suggests a shift in focus towards more specialized and technical roles. Retailers may need to reassess their compensation strategies for these traditional roles to retain experienced professionals while also investing in emerging areas.

Changes to base salary structure design

Most respondents to the global Pay Effectiveness & Design Survey indicated that they have already made changes or are planning or considering making changes to their base salary structure design through fundamental shifts.

Changes to base salary structure design

Compensation communication

Multiple factors are encouraging increased levels of pay program communication within organizations.

Factors affecting increased levels of pay program communication

Source: WTW 2024 Global Pay Transparency Survey

| Pay program communication drivers | Percent |

|---|---|

| Increasing regulatory requirements | 64% |

| Company values and culture | 51% |

| Environmental, social and governance / diversity, equity and inclusion agenda | 51% |

| Employee expectations | 46% |

| HR's confidence in pay programs | 42% |

| Leadership's confidence in pay programs | 38% |

International and global organizations generally approach the way they communicate pay program information on an organization-wide basis, with local variation where required.

How international and global organizations communicate pay program information

Trends in attraction and retention

Employee attraction and retention is one of six core objectives for pay programs in organizations around the world, especially as employees are most likely to say pay is a driver of attraction and retention, according to WTW's 2024 Global Benefits Attitudes Survey.

Drivers of attraction and retention

Source: WTW's 2024 Global Benefits Attitudes Survey

| Driver | Percent | |

|---|---|---|

| Attraction | Pay (including bonus) | 56% |

| Job security | 34% | |

| Flexible work arrangements (e.g., working remotely, flexible work hours) | 32% | |

| Retention | Pay (including bonus) | 43% |

| Job security | 39% | |

| Working environment (e.g., location, facilities) | 32% |

Average voluntary attrition rate, by region

Despite a slight cooling of the talent market, labor shortages continue. While voluntary attrition in the retail industry varies by region, there is a narrow spread as it ranges from 9.1% in Latin America and 11.4% in the Middle East and Africa.

Source: WTW 2024 Compensation Surveys

| Region | Voluntary attrition rate |

|---|---|

| North America | 9.4% |

| Asia Pacific | 10.2% |

| Central & Eastern Europe | 7.7% |

| Latin America | 9.1% |

| Middle East & Africa | 11.4% |

| Western Europe | 10.9% |

41%of organizations report labor shortages in multiple talent segments.

In-demand jobs and skills

While retail continues to evolve and prioritize technology and omni-channel strategies, the most in-demand roles are still fundamental to the industry, with sales associate ranking first in every region.

The top in demand skills including sales management and customer service management unveil a focus on customer experience in the retail industry. As the brick-and-mortar retail environment becomes more challenging, retailers are shifting their focus to delivering positive customer experiences with their brand, rather than just emphasizing products.

Source: WTW 2024 Talent intelligence Reports

| Region | In-demand jobs | In-demand skills |

|---|---|---|

| North America | 1. Sales associate 2. Pharmacy technician 3. Customer service representative |

1. Customer service management 2. Sales management 3. Compliance management |

| International | 1. Sales associate 2. Customer service representative 3. Security officer |

1. Sales management 2. Compliance management 3. Product marketing |

| Europe | 1. Sales associate 2. Retail store associate 3. Customer service representative |

1. Sales management 2. Customer service management 3. Relationship management |

Highest and lowest headcount expectations, by industry and region

Source: WTW 2024 Salary Budget Planning Survey Report – Global (December edition)

| Region | Largest planned increases | Lowest planned increases |

|---|---|---|

| Asia Pacific | Biopharma & life sciences | Retail |

| Central & Eastern Europe | Biopharma & life sciences | Construction |

| Latin America | Retail | Transportation |

| Middle East & Africa | Construction | Transportation |

| North America | Real estate | Manufacturing (non-durables) |

| Western Europe | Real estate | Retail |

Organizations are sharing pay information with job candidates

Two-thirds of organizations around the world are already or are planning / considering communicating pay rate or pay range information to job candidates, according to our 2024 Pay Transparency Survey's global results.

77%

of organizations are more likely to communicate the

hiring rate / range for the job to external job candidates.

56%

of organizations apply a consistent approach for all job levels and types to external job candidates.

Organizations with operations in locations with increased legislation tend to apply a more consistent approach across the entire enterprise when sharing pay rates and ranges with prospective employees.

Locations sharing pay rates and ranges with prospective employees:

- 86% of U.S. employers

- 63% of UK employers

- 60% of EU employers

- 58% of Canadian employers

Trends expected to shape 2025 rewards

01

Increase in worker wages and rising automation

Retailers will need to balance competitive wages with investments in automation. As wage increases become necessary to attract and retain talent, particularly in lower-wage roles, organizations might also invest in automation technologies to maintain operational efficiency and offset rising labor costs. This dual approach can help manage expenses while ensuring a motivated and efficient workforce.

02

Strategic talent management in omnichannel integration

As retailers strive for seamless integration of online and offline channels, compensation strategies will need to be aligned to attract and retain talent skilled in both digital and physical retail operations. This includes competitive salaries for roles in e-commerce, digital marketing and logistics, as well as incentives for employees who can effectively bridge the gap between in-store and online customer experiences.

03

Enhanced personalization driving compensation for data and analytics roles

The push for enhanced personalization in retail will drive demand for data scientists, analysts and AI specialists who can leverage customer data to create personalized shopping experiences. Competitive compensation packages, including higher base salaries and performance-based bonuses, will be crucial to attract and retain these high-demand professionals who are essential for implementing advanced personalization strategies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.