From the smartphones in our pockets to the appliances in our homes and electric vehicles (EVs) on our roads, lithium-ion batteries power many of the technologies we use in our daily lives.

Compact but powerful, these batteries provide convenience and mobility for consumers and form the backbone of innovation and efficiency for American businesses.

Almost three-quarters of the lithium-ion batteries imported to the U.S. last year came from China, which has developed a strategic advantage by investing heavily in battery technologies. However, these supply chains are under threat because tariffs on batteries from China have risen - and are set to rise further.

In their review of Section 301 tariffs – the statutory means by which the U.S. sets and enforces trade agreements – the Biden-Harris administration stated that the tariff on battery parts and lithium-ion batteries for EVs will increase from 7.5% TO 25% THIS YEAR.

The tariff rate on lithium-ion batteries for other items is expected to match this rise in 2026. If Donald Trump wins this November's election, tariffs could climb even higher.

As tariffs surge, American companies that import lithium-ion batteries from China must urgently reassess their supply chains. It's essential that they make strategic changes in areas including sourcing, regulatory procedures, and manufacturing to secure their future in this challenging landscape.

SHIFTING THE BATTERY SUPPLY CHAIN'S CENTER OF GRAVITY

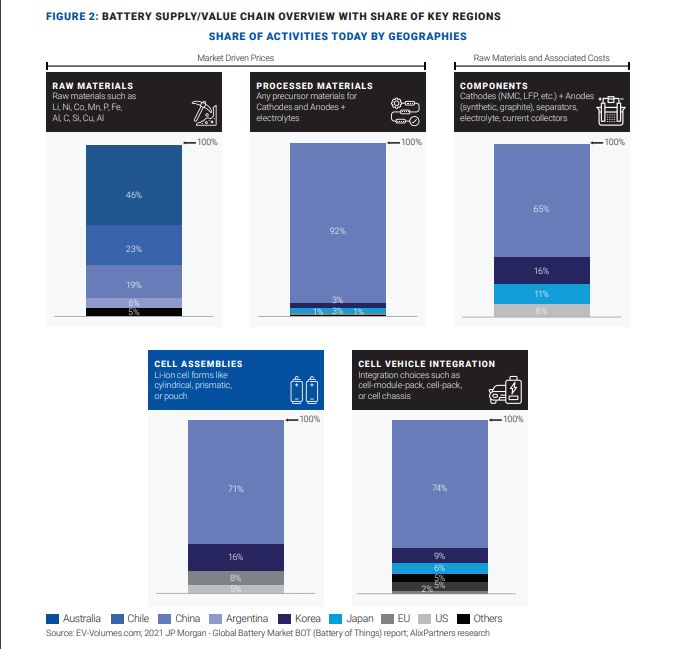

Given its early mover advantage, China currently dominates the battery cell value chain—from raw materials to processed materials, components, and cell assemblies (figure 2). It handles 92% of the world's processed materials and 71% of global cell assembly. This concentration creates a bottleneck in the supply chain, as the origin of the cell assembly determines the origin of the battery, impacting tariffs and trade compliance.

Companies need to reconsider their sourcing strategy and build resilient, stable supply chains for futuregeneration battery technologies.

Choosing new suppliers involves more than cost considerations. Companies must weigh the risks of geopolitical instability, the likelihood of delays, and the overall impact on supply chain reliability. With careful planning and strategic decision-making, companies can transition while ensuring that likely benefits outweigh potential pitfalls.

Alternative regions to consider include:

- Southeast Asia: Labor costs in Southeast Asia are relatively low, but the region faces higher freight expenses and longer lead times, which can introduce delays and logistical complexities. Supplies from less politically stable nations may not be reliable.

- Eastern Europe: Geographic proximity makes Eastern Europe an attractive option for U.S. companies wishing to diversify. However, higher labor costs, political instability, or proximity to conflict zones could pose challenges.

- North Africa: Countries such as Morocco offer lower labor costs and are developing industrial infrastructure. However, freight costs from this region are higher, and supply chain networks are less established. Companies must also navigate the political and economic uncertainties in the region.

Sourcing Critical Materials

Lithium-ion battery manufacturers depend on supplies of certain critical materials. These include cobalt, which is used to make battery cathodes. Over 70% of global cobalt supplies come from The Democratic Republic of the Congo. This reliance introduces significant geopolitical risks and the potential for supply disruptions.

Nickel, essential for certain types of lithium-ion batteries, is mainly sourced from Indonesia and the Philippines. However, nickel mining causes pollution and damages the environment. This has led to increased regulation in both countries, which is essential for sustainability but makes sourcing more complicated, as it requires significant incremental effort.

Lithium, vital for all battery types, is abundant in countries like Australia and Chile, but increasing global demand is straining supply chains.

Consequently, the use of different types of batteries is growing, with the widespread adoption of lithium iron phosphate batteries, in particular. Made without cobalt or nickel, these batteries mitigate risks and ensure a more stable supply chain for the growing EV market.

Over 70% of global cobalt supplies come from The Democratic Republic of the Congo

LEVERAGING TAX CREDITS AND OTHER REGULATORY OPTIONS

Provisions of the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, offer credits for the production of specific commodities within the U.S., including battery components, battery cells, and modules. While this option requires a strong commitment to U.S.-based production and usually takes one to two years to achieve, it can lead to long-term savings for companies.

Other options to reduce or avoid tariffs on lithium-ion batteries include evaluating the tariff classification and correctly aligning the imported goods to the correct codes, and gaining legal exemption from tariffs.

Each pathway demands a careful assessment of the company's position, resource allocation, and future objectives. Assisted by trade experts, we advocate a balanced approach that mitigates immediate tariff impacts while positioning our clients for sustained success in an evolving regulatory landscape.

NEARSHORING AND ONSHORING: THE CASE FOR REGIONAL SUPPLY CHAINS

As companies seek to reduce dependency on overseas supply chains, particularly China, moving battery production to the U.S. domestic suppliers (onshoring) or regional allies (nearshoring) is becoming an increasingly popular strategy.

Sourcing from domestic suppliers eliminates import tariffs, cuts freight expenses, and reduces lead times from weeks to days, enabling faster responses to market demands. It can also boost supply chain resilience by reducing the risks arising from geopolitical tensions and trade disruptions, ensuring a more secure supply of goods.

Additionally, onshoring can reduce currency risk, ensuring more stable pricing and financial predictability. It also allows companies to take advantage of government incentives like the IRA, which provides tax credits for U.S.-produced battery components.

The real benefit of onshoring comes from shorter supply chains, which reduce logistics costs and environmental impact by eliminating long-distance shipping. Although onshoring can potentially lead to higher total costs due to higher labor rates, its benefits, and alignment with sustainability goals make it a compelling option as the U.S. continues to build its EV and renewable energy infrastructure.

Nearshoring can provide a cheaper alternative to onshoring. When batteries are sourced and assembled in the U.S., the overall cost of goods sold (COGS) is typically 18% to 20% higher than when sourcing from China. For example, assembling the batteries in Mexico offers a more cost-effective solution, with a roughly 4% to 6% increase in COGS. This option combines vital advantages, such as proximity and reduced geopolitical risk, but avoids significant price hikes due to labor costs.

Building Domestic Capacity: A Long-Term Vision

Lithium-ion battery manufacturing is expanding in the U.S.

In November 2023, the Biden administration announced an investment of up to $3.5 billion to strengthen domestic battery manufacturing.

According to the U.S. government's National Renewable Energy Laboratory, between 2021 and 2024, the number of raw material manufacturing facilities in the U.S. jumped from around 25 to more than 80. Over the same period, the number of companies and facilities across the entire lithium-ion battery supply chain doubled to over 800.

Companies driving this onshoring trend include KORE Power, which is constructing a lithium-ion battery factory in Buckeye, Arizona, and ENTEK, which is building a battery separator in Indiana with substantial support from the U.S. Department of Energy

Battery manufacturers SK Battery America and Ascend Elements are expanding their operations with new gigafactories and manufacturing plants, which are backed by federal grants and significant private investments.

Collaborations between major automotive and battery companies are also on the rise. For example, Ford and SK On have established a joint venture to construct battery plants in the U.S.

Developing onshore manufacturing capacity is an ambitious strategy for companies, requiring high initial costs, operational challenges, and a long wait before investment returns are realized. However, the long-term benefits make it an attractive option.

The U.S. government has incentives to encourage and support businesses taking this step. The IRA includes several provisions that support the production of batteries for EVs, including Advanced Manufacturing Production Credit. This 10-year tax credit program allows manufacturers to claim 10% of the cost of critical mineral production and electrode active material production, $35 per kilowatt-hour (kWh) of battery cell production, and $10 per kWh of battery module assembly. Additionally, it grants subsidies for batteries recycled in the U.S., regardless of their origin.

Companies can also apply for federal Investment Tax Credits, which cover up to 30% of the capital costs for building battery manufacturing facilities. Additionally, the IIJA provides significant funding and incentives to bolster the U.S. manufacturing industry.

NEW DEVELOPMENTS IN THE BATTERY INDUSTRY

Another strategy for U.S. companies is to embrace alternatives to lithium-ion batteries. Battery technology is developing rapidly, and a number of efficient, sustainable, and versatile energy storage solutions are entering the market.

Among the most promising developments are solid-state batteries, which offer enhanced safety and energy density by replacing liquid electrolytes with solid materials - making them ideal for EVs.

Cost-effective alternatives include batteries based on sodium, which is much more abundant than lithium and, therefore, an attractive option for large-scale energy storage. Lithium-sulfur batteries, which promise significantly higher energy densities, potentially extending the range of EVs, are another relatively cost-effective option.

Innovations in silicon anode batteries are also gaining traction, providing higher capacity and longer battery life in smaller, lighter packages. Meanwhile, researchers at MIT have designed a more sustainable battery that uses organic materials instead of cobalt or nickel and researchers at the Illinois Institute of Technology and U.S. Department of Energy's Argonne National Laboratory are developing a lithium-air battery that could significantly increase the range of EVs and might one day power short-haul flights and long-haul trucks.

Together, these technologies represent the forefront of the battery revolution, driving the future of energy towards more sustainable and efficient solutions.

A MULTI-FACETED APPROACH

China's primary position in the battery supply chain and rising tariffs pose growing challenges for U.S. companies, which face the critical task of adapting to new market realities. To mitigate risk and unlock new opportunities, we recommend a tailored approach, using a combination of the strategies described in this article, which include diversifying supply chains, engaging in regulatory processes, taking advantage of tax credits and other financial provisions, nearshoring production, investing in domestic manufacturing, and adopting alternatives to lithium-ion batteries.

These changes come with challenges, but they offer a pathway to greater resilience, sustainability, and innovation, ensuring that U.S. businesses remain competitive and well-positioned in the rapidly evolving global battery market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.