- within Criminal Law, Law Practice Management, Litigation and Mediation & Arbitration topic(s)

On July 22, 2024, The Federal Tax Authority (FTA) released a public clarification regarding the definition of Related Parties for Government Entities. This clarification explains how the definition of Related Parties, as per Article 35 of the Corporate Tax Law (CT Law), applies to structures where common ownership and/or control is held by the UAE Federal Government or a Local Government (i.e. Emirate-level government).

The clarification further specifies that common ownership and/or control by a Federal or Local Government, on its own, does not establish a basis to be considered Related Parties under Article 35 of the CT Law.

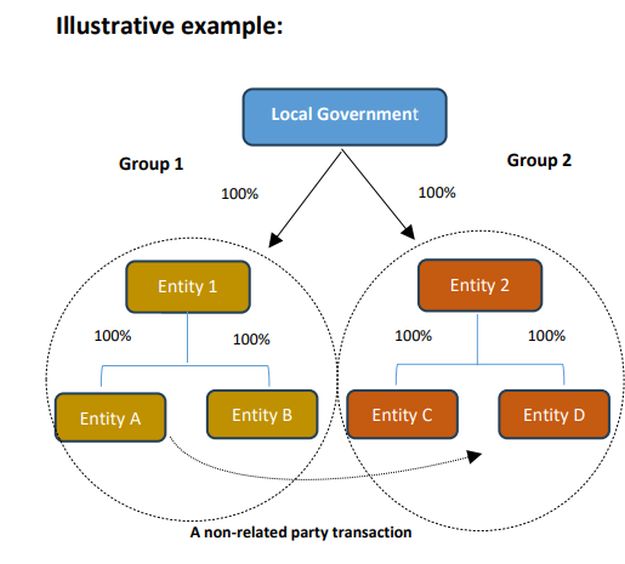

An illustrative example provided in the clarification demonstrates that entities in Group 1 are not considered Related Parties to entities in Group 2. As a result, the arm's length requirement under Article 34 of the CT Law does not apply to transactions between Group 1 and Group 2, and these transactions are not subject to transfer pricing documentation requirements.

However, entities within Group 1 (i.e. Entity 1, Entity A and Entity B) are considered Related Parties to each other, just as entities within Group 2 (i.e. Entity 2, Entity C and Entity D) are considered Related Parties among themselves.

A&M Observations

This is a welcome clarification from the FTA. Before its issuance, there was a concern that all transactions between entities in different groups under common Federal/Local Government ownership and/or control might be considered Related Parties, necessitating their reporting in the Disclosure Form (the format of which is yet to be disclosed) and documentation within the Local File.

Given that many of these transactions are likely to have been conducted on an arm's length basis, this clarification should enable groups to avoid performing a full Transfer Pricing (TP) analysis and avoid the need to collate and disclose all transactions with related government entities outside of their group.

However, it is essential to conduct a comprehensive related party analysis before applying this clarification to ensure no other factors bring the transactions within the scope of the UAE TP regulations.

Originally published by 09 August, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.