- within Energy and Natural Resources topic(s)

- within Energy and Natural Resources topic(s)

- within Strategy topic(s)

The oil and gas industry is one of the most dynamic and complex sectors of the global economy. With significant environmental, economic and geopolitical impacts, it requires specialized knowledge and proactive strategies to manage the legal landscape. Companies operating in this sector have to deal with a myriad of legal challenges to maintain operational efficiency, prevent potential legal pitfalls and ensure sustainable growth.

Moreover, the industry is constantly evolving in response to technological advances, regulatory changes and geopolitical shifts. For example, recent sanctions on oil and gas have created new challenges to which companies must quickly adapt. These events have not only disrupted supply chains but have also required a thorough re-evaluation of existing contracts and compliance strategies. Companies must remain informed and agile, ready to respond to these changes with well-designed legal strategies. In this article, we'll look at five common legal issues and offer ideas to help companies effectively move through this confusing terrain.

What are the key legal considerations when negotiating oil and gas leases?

When negotiating oil and gas leases, several critical legal factors come into play:

- Lease Terms and Duration: Ensure the lease duration matches your operational plans, considering renewal options and termination conditions, including notice periods and penalties. The primary term should be short, typically one to ten years, and leases may extend into a secondary term with production activities.

- Royalty Agreements: Clarify how royalties are calculated and paid, ideally based on the higher market value rather than net proceeds at the well. Negotiate for royalties free of drilling and production costs and include provisions for auditing production records and ensuring timely payments.

- Surface Rights: Define the extent of surface rights granted for drilling and infrastructure development. Negotiate compensation for surface use and damages, and ensure the lease includes provisions for land restoration and the location of facilities to minimize interference with surface use. Include specific compensation amounts for uses like well locations, roads, and pipelines.

- Environmental Obligations: Review environmental protection clauses, including responsibilities for site remediation and compliance with local and federal regulations. Ensure the lease specifies requirements for land restoration after production ceases, proper well plugging, and pipeline removal. Non-compliance can result in significant penalties.

- Dispute Resolution: Include clear terms for resolving disputes, specifying whether arbitration, mediation, or litigation will be used, and outline the processes for each to avoid lengthy and costly litigation.

By meticulously reviewing and negotiating these elements, companies can secure favorable terms and minimize future conflicts.

What are the immediate effects of the ban on existing oil and gas supply chains?

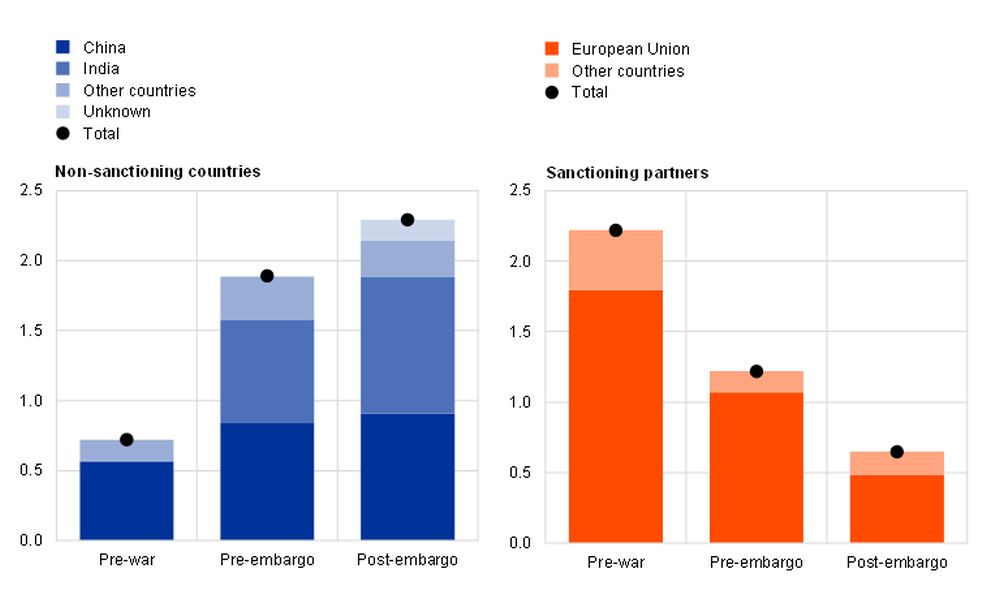

The recent oil and gas ban has changed the global oil supply pattern as shown in the figure.

Russian exports of crude oil by sea (Source: European Central Bank).

These changes have several immediate implications for existing European supply chains. First, sourcing alternatives may result in temporary shortages and increased costs as they focus on new sourcing models. Contracts may need to be renegotiated to comply with new regulations and avoid penalties, adding complexity to existing agreements. Adjusting supply routes and managing logistical changes can lead to resource constraints and impact delivery times, requiring careful planning and coordination.

Price volatility is another consequence of the ban, affecting budget forecasts and financial planning. To ensure compliance with the new ban, carefully analyze and adjust your supply chain practices to bring them in line with legal requirements. Proactively managing these impacts through strategic planning and legal guidance will help you manage this transition period smoothly.

What should you consider when forming joint ventures in the oil and gas sector?

Forming joint ventures (JVs) in the oil and gas industry involves several key considerations to ensure successful collaboration and project outcomes:

- Alignment of Objectives: Ensure that all parties involved in the JV share common business goals and have similar risk tolerance levels. This includes agreeing on strategic direction, project timelines, and desired financial outcomes. Effective communication and a mutual understanding of objectives are vital for overcoming challenges and achieving success in this unpredictable industry.

- Due Diligence: Assess the financial status and operational capacity of potential partners to ensure they have the necessary resources to participate in the JV. This includes a thorough examination of their financial health, legal standing, and any potential liabilities. Due diligence helps in identifying and mitigating risks associated with the joint venture.

- Governance Structure: Define a clear governance framework that outlines decision-making processes, management roles, and dispute resolution mechanisms. Establishing a robust governance structure ensures that all parties understand their responsibilities and the procedures for making critical decisions. This structure is essential for maintaining an effective partnership and addressing any conflicts that arise.

- Capital Contributions: Clearly define how much each party will contribute financially, how profits will be distributed, and the responsibilities for covering any additional funding needs. This financial clarity is crucial for the smooth operation of the joint venture and for ensuring that all partners are on the same page regarding financial commitments and rewards.

- Exit Strategies: Establish exit strategies and conditions under which parties can withdraw or transfer their interests. This includes defining the circumstances under which a party can exit the JV, the process for valuing and transferring interests, and any restrictions on transfers. Clear exit strategies help prevent disputes and provide a framework for orderly transitions if a partner decides to leave the venture.

What is the impact of international trade policies on the oil and gas industry?

International trade policy has a significant impact on the oil and gas industry, affecting various aspects of operations. Changes in tariffs can affect the cost of importing and exporting oil and gas products, making it necessary to keep informed of tariff adjustments. Political sanctions can disrupt supply chains and limit market access, so it is important to adapt your sourcing and distribution strategies.

To ensure compliance with international trade laws, you must carefully study the regulatory requirements of each market in which you operate and adjust your practices accordingly. Trade agreements can open new markets or restrict access to existing ones, which affects strategic decisions on market entry and expansion. In addition, policies that favor or discourage foreign investment can affect capital flows and project financing. Be well informed about international trade policies and adapt strategies accordingly to maintain competitive advantage and ensure business continuity.

How to comply with environmental regulations in the oil and gas industry?

Staying compliant with environmental regulations in the oil and gas industry is critical to avoiding court fines and maintaining a positive reputation. To achieve this, you first need to understand the key regulations that apply to your operations. For example, if your business operates in Europe, it is important to understand and comply with EU directives such as the Offshore Safety Directive 2013/30/EU and the Pollution Liability Directive (2004/35/EC). Implement the best practices outlined in the European Commission's Hydrocarbons Guidelines, with a particular focus on reducing environmental impact, as well as learning the new EU Methane Regulation. Develop robust environmental management systems, including regular audits, employee training and emergency response plans.

Interaction with regulators is also important, keeping open communication will help you stay ahead of compliance requirements and address potential issues early. Utilizing technology to monitor emissions, manage waste and track compliance performance in real time can enhance your compliance efforts.

Successfully managing the complex legal landscape of the oil and gas industry requires expert advice and proactive strategies. At LINDEMANNLAW, we specialize in providing comprehensive legal services and strategic advice tailored to the unique challenges of this sector.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.