The 'What'...

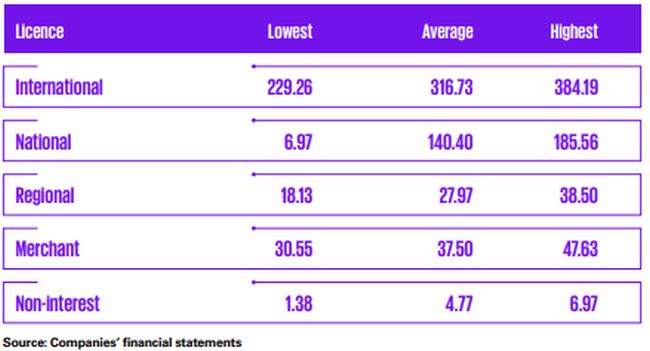

In March 2024, Nigeria's banking system regulator, the Central Bank of Nigeria (CBN) announced an increase in the capital requirements for banks operating in Nigeria across the different licence categories.

An integral part of the announcement was the definition of qualifying capital which is specified as paid-up share capital and share premium only, there by excluding the industry's significant retained earnings reserves and other forms of capital.

Banks are also required to comply with the Capital Adequacy Ratio (CAR) relevant to their licence category while trying to meet the new capital requirements.

The 'Why'...

Engine of Growth

Nigeria's banking industry has remained relatively resilient in the face of domestic and global economic headwinds over the last decade, achieving growth in capital and assets at 11% and 17% CAGR respectively in the period.

However, the performance has been against a background of sluggish economic growth, with GDP growth decelerating steadily from the 3.4% rebound in 2021 following the COVID-19 pandemic, to 2.74% in 2023.

Given the critical role of the banking sector in spurring economic activity and growth through financial intermediation, the sector is expected to be pivotal to propelling Nigeria's growth over the next few decades.

In line with the ambition of the current administration of achieving a trillion dollar economy by 2030, the CBN has highlighted the need for stronger and better capitalised banks which are better equipped to service the needs of a fast-growing economy, thus necessitating the call for recapitalisation.

The qualifying capital position of banks prior to the announcement indicates a significant capital shortfall of c.N4tn across all licence categories, with capital deficits of between 35% - 90% of the new minimum capital across the different banks.

This significant level of capital injection should spur growth in lending activities required for production, investment and consumption activities

Capital Deficit by Licence Category (₦'bn)

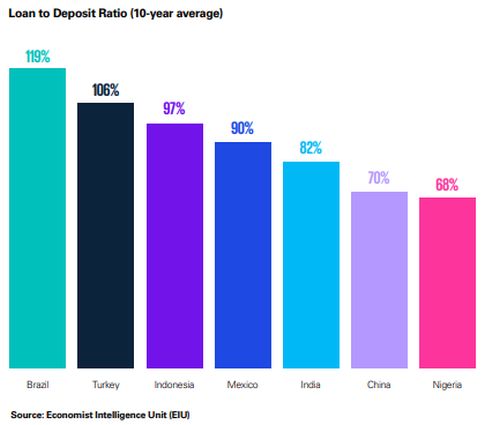

However, the effectiveness of the recapitalisation exercise for driving growth requires efficient allocation of funds to productive sectors of the economy such as Manufacturing, Retail, Agriculture as witnessed in China, Brazil, India, etc.

Nigeria's banking industry loan to deposit ratio averaged 68% over the last decade, lower than high growth emerging markets, attributable to several factors including the perceived high risk of SMEs (which constitute over 90% of formal enterprises), economic volatility and impact on lending rates, regulatory policies, etc.

Furthermore, a review of the sectoral distribution of loans indicates a narrower spread for the banking industry. Between 2014 and 2022, commercial banks disbursed c.N165tn as loans and advances, with 50% channelled to only three sectors – Oil and Gas (26.1%), Manufacturing (15.5%) and Government (8.4%), while a critical sector such as agriculture, attracted significantly less funding, with 5% of total loans.

Consequently, addressing structural issues like poor market information, weak framework for loan recovery, poor database on credit quality, etc., which currently limit lending activities to key sectors of the economy, should be undertaken in tandem with the recapitalisation programme for the effectiveness of the growth pillar of the reform agenda.

Accordingly, initiatives aimed at enhancing credit information systems, strengthening risksharing mechanisms such as credit guarantee schemes and deepening securitisation should improve access to credit for SMEs and underfunded sectors and allow the banking industry better support the broader economy and contribute to sustainable economic growth. The recapitalisation process is also expected to be a major attraction for much needed foreign direct investment. Nigeria's banking sector is one of its most sophisticated economic sectors and amongst the most developed banking markets in Africa.

The availability of investment opportunities in the sector arising from the exercise is expected to be a major draw for long term foreign investments in the country.

To view the full article click here

The opinion expressed in this article is solely personal and does not represent the views of any organization or association to which the authors belong.