GENERAL

Regulated Structure: 24 hour authorisation process. No review of fund documents by Central Bank of Ireland (pre-submission required for funds investing in Irish property and crypto assets).

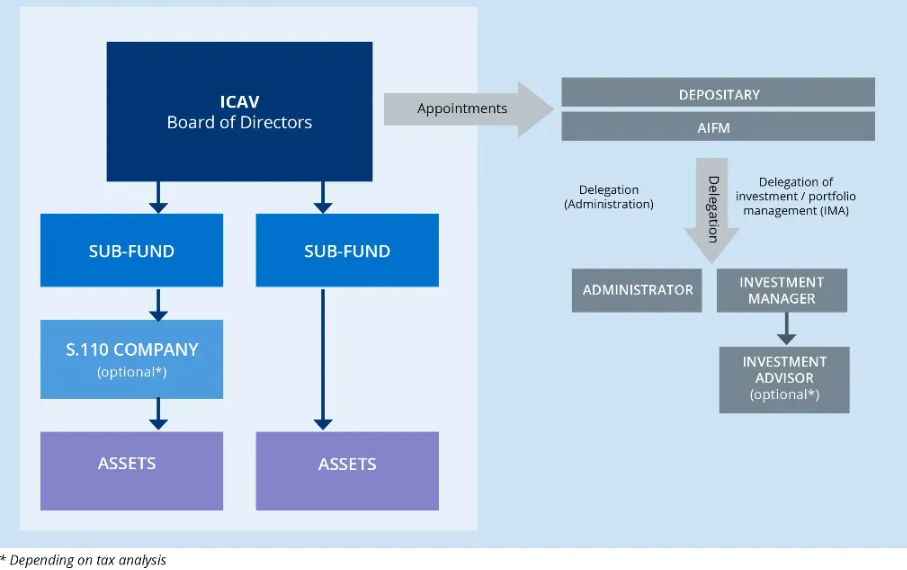

Corporate Structure: the ICAV is a corporate structure specifically designed to be used as a fund vehicle (e.g. accounts not publicly available, no AGMs).

Broad Flexibility: flexibility in relation to investment strategy & policy and not subject to any borrowing or leverage limits. All the typical mechanisms and features of a private equity fund can be accommodated (e.g. waterfalls, carried interest plans, excuse/exclusion).

Marketing Passport: ICAVs with an EU AIFM can avail of the EU marketing passport.

Track Record: proven track record as a regulated & flexible solution used by a number of high profile credit managers.

TAX

Fund level: Exempt from tax on income or gains; VAT exemptions available for provision of management services to Funds

Investor level: No Irish WHT on payments by a Fund to non-Irish resident investors and exempt Irish resident investors; No stamp duty on the issue or transfer of units in a Fund; No Irish tax on income or gains made by non-Irish resident / ordinarily resident investor

Treaty Access: Available in many cases, further facilitated by the use of a Section 110 company subsidiary where required. ICAV is specifically treated as an Irish resident under Ireland/US Tax Treaty and (subject to satisfying ownership requirements of limitation on benefits provisions) is a very efficient vehicle for US source interest income.

* Assumes the ICAV does not hold assets related to Irish land

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.