Crypto Market in Poland

The Polish FinTech ecosystem is experiencing rapid growth, as evidenced by the 2023 Fintech Foundation report. Poland's prominent financial services market in Central and Eastern Europe is set for expansion, attracting significant talent and investment.

As of June 14, 2024, Poland's Register of Virtual Currency Activities lists 1,175 registered VASPs. While 94% of Poles are aware of cryptocurrencies, only 6.2% possess in-depth knowledge. Cryptocurrencies are predominantly used for investment and speculation, with less frequent use for purchasing goods, services, or engaging in blockchain projects.

Cryptocurrency investments are relatively modest, with the median investment at PLN 1,000 and the average (excluding extremes) at PLN 5,149. Men are three times more likely to invest in cryptocurrencies than women, and 41% of crypto-asset owners are under the age of 34. Ownership correlates positively with education level.

What is a CASP License?

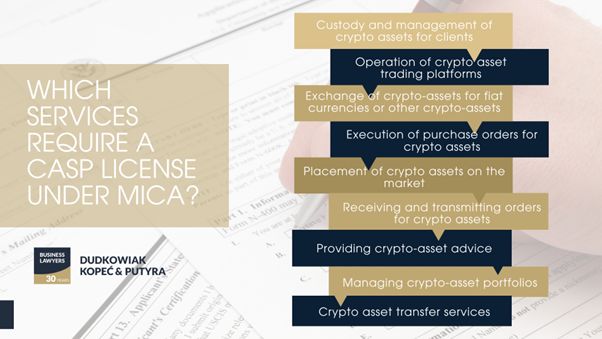

Under the Markets in Crypto-assets (MiCA) regulation, companies aiming to provide cryptocurrency services within the European Union must obtain a CASP (Crypto-Asset Service Provider) license. This license reclassifies existing VASPs (Virtual Asset Service Providers) and is required for services including:

- Custody and management of crypto assets for clients

- Operation of crypto asset trading platforms

- Exchange of crypto-assets for fiat currencies or other crypto-assets

- Execution of purchase orders for crypto assets

- Placement of crypto assets on the market

- Receiving and transmitting orders for crypto assets

- Providing crypto-asset advice

- Managing crypto-asset portfolios

- Crypto asset transfer services

A CASP license enables companies to offer their services throughout the EU. MiCA will be enforced for CASPs starting December 30, 2024.

Entities new to cryptocurrency activities must apply for a CASP license before starting operations. Existing VASPs can continue under their current license until December 31, 2025, as outlined in the draft Polish Crypto-Assets Act.

Services Provided Under a CASP License

A CASP license encompasses a broad spectrum of services related to crypto-assets. These services include:

- Custody and Administration: Ensuring the security and management of clients' crypto-assets and access methods.

- Operation of Trading Platforms: Overseeing systems that enable multiple third-party transactions in crypto-assets.

- Crypto-Fiat Exchange: Facilitating contracts for the purchase and sale of crypto-assets using traditional currencies.

- Crypto-Crypto Exchange: Managing contracts for the exchange of one crypto-asset for another.

- Order Execution: Handling purchase and sale agreements for crypto-assets on behalf of clients.

- Marketing of Crypto-Assets: Promoting and placing crypto-assets in the market to attract purchasers.

- Order Reception and Transmission: Accepting orders to buy or sell crypto-assets and forwarding them for execution.

- Crypto-Asset Advisory: Offering tailored advice on crypto-asset transactions and related services.

- Portfolio Management: Administering and managing crypto-asset portfolios as per client instructions.

- Transfer Services: Facilitating the transfer of crypto-assets between different distributed ledger addresses or accounts on behalf of clients.

The nature of the services offered influences the capital requirements needed to obtain a CASP license.

Eligibility for a CASP License

Entities eligible to provide cryptocurrency services under MiCA include:

- Companies with a CASP License under MiCA: Typically limited liability or joint-stock companies in Poland.

- Financial Institutions: Such as credit institutions, central securities depositories, investment firms, market operators, electronic money institutions, UCITS management companies, or alternative investment fund managers authorized to offer crypto-asset services.

Criteria for CASP Applicants:

- Headquarters: Have their main office in the Member State where they plan to provide crypto services.

- EU-Based Management: Have an EU-based management board with at least one director residing in the EU.

- Capital Requirements: Meet the minimum capital thresholds set by MiCA.

- Documentation: Provide all internal documentation required by MiCA, including operational and risk management plans.

- Qualified Management: Ensure management board members are reputable and experienced, with clean legal records and relevant skills.

How Does the CASP Licensing Process Look?

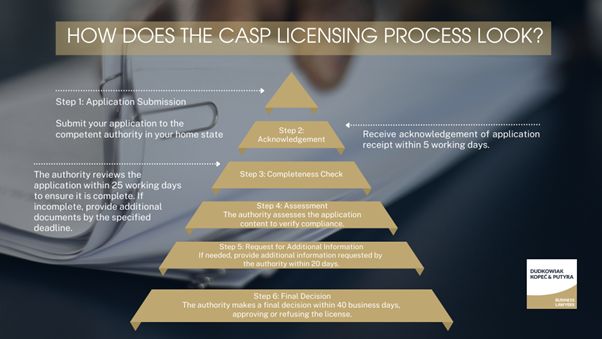

The process for obtaining a CASP license involves several steps, each crucial for ensuring compliance with regulatory requirements.

Step 1: Application Submission

The first step is to submit an application to the competent authority in your home state. For entities in Poland, this application must be sent to the Financial Supervision Authority.

Step 2: Acknowledgement

Upon receiving the application, the authority will acknowledge receipt within 5 working days. This acknowledgement confirms that your application has entered the review process.

Step 3: Completeness Check

Within 25 working days, the authority will review the application to ensure it is complete. If any documents or information are missing, the applicant will be notified and given a specific deadline to provide the necessary additional documentation.

Step 4: Assessment

Once the application is deemed complete, the authority will proceed to assess the content of the documents submitted. This step involves a detailed review to verify that all regulatory requirements are met.

Step 5: Request for Additional Information

During the assessment, the authority may identify the need for further information. If so, they will request additional details within 20 days, which may extend the overall assessment period.

Step 6: Final Decision

After the assessment is complete and all necessary information has been reviewed, the authority will make a final decision. This process is intended to conclude within 40 business days, resulting in either the approval or refusal of the CASP license.

How Much Does a CASP License Cost?

Obtaining a CASP license involves certain costs and procedural requirements. The estimated cost for the license is €4,500.

Additionally, there may be annual contributions based on the average revenue from crypto-asset services over the last three fiscal years. These contributions can be up to 0.5% of this average revenue, but not less than €750.

What Internal Procedures Are Required for a CASP License Application?

When applying for a CASP license, several internal procedures and documents are necessary, organized into key categories:

Operational and Governance Documentation:

- Program of operations.

- Governance arrangements description.

- Specific documentation for each intended service.

Risk Management and Safeguards:

- Proof of prudential safeguards.

- Internal control mechanisms for risk management, including AML/CTF.

- Procedure for segregating clients' crypto-assets and funds.

Management and Shareholder Information:

- Proof of management board's good repute and relevant experience.

- Identity and holdings of shareholders with qualifying holdings.

Technical and Customer Service Procedures:

- Technical documentation of ICT systems.

- Complaints-handling procedures.

What Are the Management and Ownership Requirements?

Management Board

Members of the management board must have a solid reputation, necessary skills, and relevant experience. The required documents include:

- A clean criminal record.

- A detailed CV.

- Statements on time commitment and past professional conduct.

Shareholders

Shareholders must also be reputable and free from convictions related to money laundering, terrorist financing, or other offenses. The required documents include:

- A clean criminal record.

- An ownership structure chart.

What Are the Capital Requirements?

The minimum capital required depends on the scope of services offered:

- Class 1 Services: €50,000 for services such as order execution, placement, transfer services, order reception and transmission, advice, and portfolio management.

- Class 2 Services: €125,000 for Class 1 services plus custody, administration, and exchange services.

- Class 3 Services: €150,000 for Class 2 services plus trading platform operation.

By adhering to these requirements, entities can effectively navigate the process of obtaining a CASP license under MiCA, ensuring compliance and the ability to offer crypto-asset services across the EU.

FAQ about obtaining a CASP license

Does a CASP license enable operations only in Poland or other Countries?

A CASP license grants passporting rights, allowing your company to provide the same services across the EU once approved in any member state, without the need for additional licensing.

How long does it take to obtain a CASP License?

The minimum time required to obtain a CASP license is approximately 3 calendar months.

Are there any transactional limitations for CASPs?

No, there are no limitations on the volume or number of transactions conducted by CASPs.

Does a Polish-Licensed CASP require a physical presence in the Host Member State?

CASPs offering cross-border crypto-asset services are not required to have a physical presence in the host Member State within the EU.

What is Reverse Solicitation under MiCA?

If a client in the EU initiates the provision of a crypto service or activity from a third-country CASP on their own exclusive initiative, the CASP does not need to obtain a license to operate within the EU.

Can I continue to provide services as a VASP after MiCA comes into force?

Yes, but only for a limited period. Companies registered in the VASP register in Poland and providing services before December 30, 2024, can continue until December 31, 2025.

However, this is an estimated date as the draft of the Polish crypto-assets act is still under legislative process. The VASP register will cease to exist on January 1, 2026.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.