Fish and other seafood, a preferred source of animal protein for most consumers in Ghana, were traditionally consumed by smoking, salting, drying, and boiling. However, following colonialism and the growing exposure to cultures worldwide, other methods such as frying, fresh (sushi), and canning have become widely accepted. Canned fish is particularly generally accepted and consumed across the country and is a major source of protein for several Ghanaians including students. As such, a variety of canned fish (and other seafood) products such as sardines, tuna, mackerel, squid, salmon, kippers, and anchovies are consumed in the market. However, sardines, tunas, and mackerels are the most preferred options.

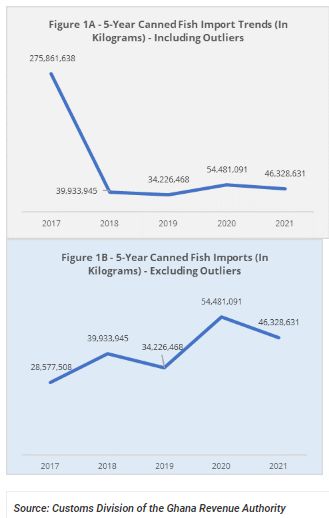

The growing acceptance of canned fish products in the Ghanaian market is seen in the steady rise in its imports and the growing number of brands introduced into the market. In the early 1990s', there were a handful of canned fish brands in the market; brands such as Titus sardines and Starkist tuna flakes were the preferred and sort after brands in most homes and on top of store shelves. Recently, however, consumers have embraced a variety of canned fish brands as several of them have been introduced into the market. The figure below highlights the import trends for canned fish products.

Figure 1: 5-year Canned Fish Imports Trends

Figure 1A and 1B shows the trend of canned fish imports in the past 5 years (from 2017 - 2021), with Figure 1A including outliers. In 2017, there was a huge import by a first-time importer that constituted more than 80% of 2017's imports. This is treated as an outlier. Without the outlier, generally, canned fish imports have been increasing steadily, as shown in Figure 1B, averaging 40.7 million kgs per year.

To view the article in full click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.