- within Litigation, Mediation & Arbitration, Technology and International Law topic(s)

INTRODUCTION

In last year's study, we noted that securities class actions were on the rise in Canada and suggested that this new wave of filings is a reflection of the fact that class counsel seem prepared to test the new provisions of the provincial Securities Acts relating to secondary market liability.2 Although still in its infancy, the maturation process of this type of litigation continued during 2009.

Perhaps most notable in 2009, because of their potential impact on future trends in Canadian securities class actions, are the decisions of the Ontario Superior Court of Justice certifying three securities class actions, and the decision in IMAX granting leave for the plaintiffs to pursue claims under Part XXIII.1 of the Ontario Securities Act (OSA)—the first such ruling on an application to proceed with claims under the new secondary market liability provisions of the provincial Securities Acts.

There are now more than $14.7 billion in outstanding plaintiffs' claims in Canadian securities class actions.3 As we anticipated in our previous study, settlements in 2009 were well below the $890 million in total settlements observed in 2008. In 2009, six cases settled for total payments of approximately $55 million.4 In contrast to 2008, which witnessed a number of settlements involving payments of more than $20 million—Portus ($611 million), Biovail ($141 million), Hollinger ($46 million), and Atlas Cold Storage ($40 million)—the largest settlement in 2009 was $19.4 million (in Aurelian).

TRENDS IN FILINGS

New Cases

Our database includes Canadian class actions brought on behalf of a class of investors in securities.5 This includes class actions brought by investors in shares of reporting issuers, as well as those brought by investors in other securities such as mutual fund units or investment certificates offered by investment managers.

Eight new cases were filed in 2009 in relation to the following issuers:

- Allen-Vanguard Corporation

- Bear Lake Gold Ltd.

- Manulife Financial Corporation

- NovaGold Resources Inc.

- Shire International Real Estate Investment Ltd.

- Stanford International Bank, Ltd.

- Timminco Limited

- Western Coal Corporation

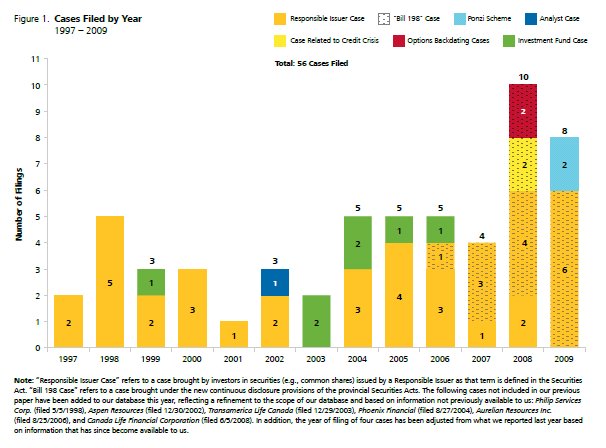

This is fewer than the 10 cases filed in 2008, but still greater than filings in previous years.6 See Figure 1.

Types Of Cases

A record six new cases filed in 2009 involve allegations of misrepresentation and/or omissions by issuers, including claims brought under the new continuous disclosure provisions.7 This brings the total number of cases filed under these new provisions to 18. These filings are confirmation of the expectation that these new provisions would result in increased litigation against reporting issuers in Canada.

2009 also saw the new wave of Canadian securities class actions reach the certification and leave application stage. In IMAX, the first case to be brought under Part XXIII.1 of the OSA, the court both granted leave to proceed under these new provisions,8 and certified the action as a class action.9 To the extent that they influence future filings, these decisions and other recent rulings on class certification (including those in CP Ships10 and Aspen11), may ultimately prove to be an inflection point for this type of litigation.

The other two of the eight new cases filed in 2009 involve allegations of so-called Ponzi schemes—Shire International Real Estate and Stanford International Bank (the latter of which includes allegations that relate to both the Stanford and Madoff scandals that made headlines in the US during 2009).12

One notable difference (so far) to the experience in the US is the absence in Canada of class action filings relating to the credit crisis. Other than two cases filed in 2008, we have seen no class action securities filings directly related to the credit crisis. This lack of filings may be a reflection of the relatively smaller impact (in terms of bailouts and bankruptcies) of the credit crisis on the Canadian financial system as compared to that in the US.

That is not to say that there has been no litigation in Canada relating to the financial meltdown. As noted last year, the widely reported restructuring of the $32 billion Canadian Asset-Backed Commercial Paper (ABCP) market, which froze in August 2007, was completed in mid-2008. In late December 2009, regulators reached settlements with seven financial institutions which included fines totalling $138.8 million. Notably, under the terms of the restructuring plan approved by the courts, claims of note holders against the institutions that sold ABCP and other related parties cannot proceed unless the investors are able to establish fraud.

Although this restructuring was not achieved in the context of a class action litigation (and so is not captured in our database), this release from liability may well have pre-empted one or more class actions that may otherwise have been filed. Also, in December 2009, the Ontario Securities Commission commenced proceedings against Coventree Inc. in relation to its participation in the Canadian ABCP market.

Last year we suggested that certain overhanging threats of litigation against Toronto Stock Exchange (TSX)-listed companies may result in more options backdating class actions in Canada. This prediction was not borne out during 2009, as none of the newly filed cases included such claims.

Industry Sectors

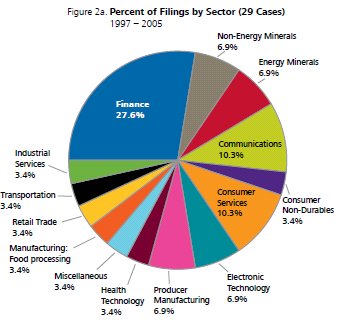

Reflecting the composition of the Canadian economy, and consistent with past filings, the majority of 2009 filings were brought in relation to securities issued by companies in the minerals and financial sectors. These included two cases brought against gold mining companies, one against a coal mining company, and three cases against issuers in the financial sector.13

Both the absolute number and the proportion of cases brought against companies in the non-energy mineral sector have increased in recent years. Twenty-six percent of all cases filed from 2006 to 2009 (i.e., seven cases) were in this sector—significantly more than the 7% (i.e., two cases) filed against companies in this sector during the nine-year period from 1997 to 2005.

The proportion of filings against financial sector companies remained roughly constant: between 2006 and 2009, eight financial sector cases represented approximately 30% of all cases filed; between 1997 and 2005, eight such cases represented roughly 28% of all cases filed. A comparison of filings by sector for these two periods is illustrated in Figure 2.

Types Of Allegations

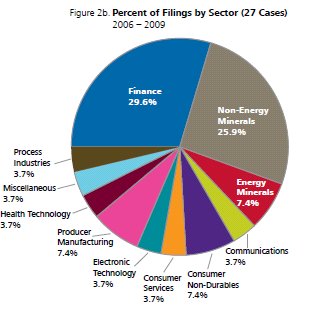

The categories of substantive allegations made in these cases have not changed significantly in recent years. The majority of allegations relate to an issuer's accounting, company-specific earnings guidance, or misrepresentations about operations.14 Although some changes in other types of allegations can be observed in Figure 3, this is more likely a function of the relatively small number of cases rather than any identifiable trend.

Time To Filing

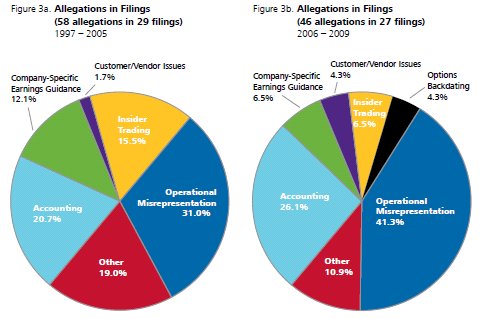

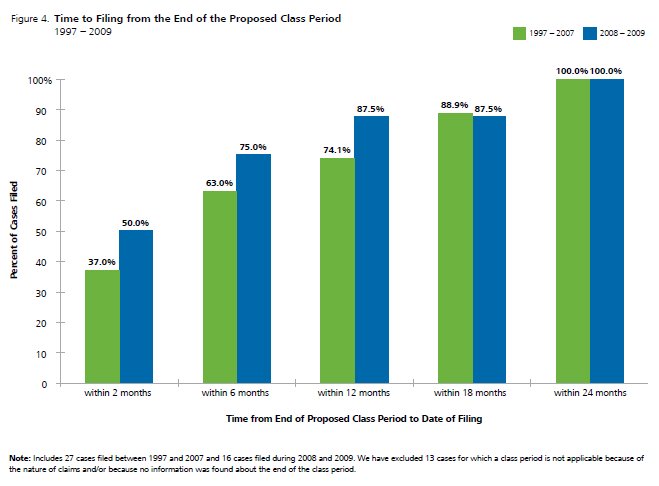

Most cases (approximately 67%) are filed within the first six months following the end of a proposed class period. Over the 13-year period from 1997 to 2009, the average time to filing from the end of the proposed class period has been approximately six months and the median four months.

During the last two years (2008 and 2009), which saw a significant increase in the number of filings, half of all cases filed were filed within two months of the end of the proposed class period. On average, these recent cases were filed within approximately five months of the end of the class period.

This is somewhat faster than the time to filing for cases filed between 1997 and 2007. Cases filed during that period were filed on average approximately seven months following the end of the class period. The median for cases filed during that period is five months.

Since there is significant variation in filing times between cases, it is unclear at this time whether this is a meaningful trend toward faster filings. For example, two cases filed in 2009 were filed almost two years after the end of the proposed class period—10 times the median (and four times the average) for cases filed in 2008 and 2009. The cumulative proportion of cases filed over time for these two periods is illustrated in Figure 4.

CAUSES OF ACTION

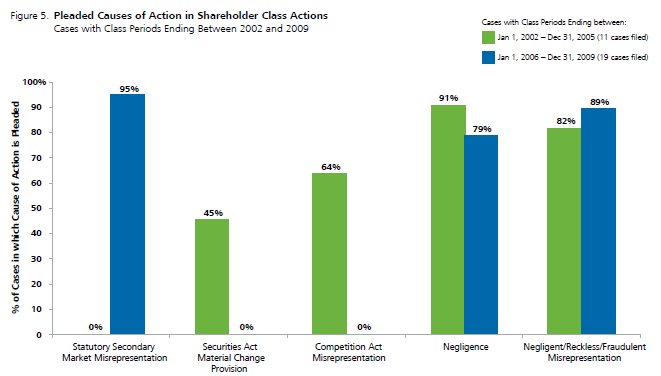

Filings in shareholder class actions continue to include both common law and statutory claims. As we discussed in our previous study, although the new statutory civil remedies for secondary market misrepresentations are expected to make it easier for class actions to proceed, statutory limits on damages provide an incentive for plaintiffs to simultaneously plead common law negligent (and/or reckless and/or fraudulent) misrepresentation.

The causes of action pleaded by plaintiffs in cases against reporting issuers reflect these statutory amendments. Prior to the Bill 198 amendments in Ontario (which came into effect December 31, 2005), statements of claim often included causes of action brought under the material change provisions of the Securities Act and/or the material misrepresentation provisions of the Competition Act. Since 2005, these causes of action have not been pleaded, while 95% of all cases involve claims under the new provisions.

On the other hand, pleadings of common law negligence and negligent, reckless, and/or fraudulent misrepresentation continue to appear in the vast majority of these cases. The trends in the causes of action pleaded in these cases are illustrated in Figure 5.

Claims of shareholder oppression and claims of conspiracy each appear in approximately 20% of all cases, with no discernable trend over the period from 1997 to 2009.

One might have expected that, as more cases are filed under the new secondary market provisions, the proportion of cases involving prospectus claims might fall. In fact, so far at least, the proportion of cases involving prospectus claims has remained roughly constant at approximately one in three.

TRENDS IN RESOLUTIONS

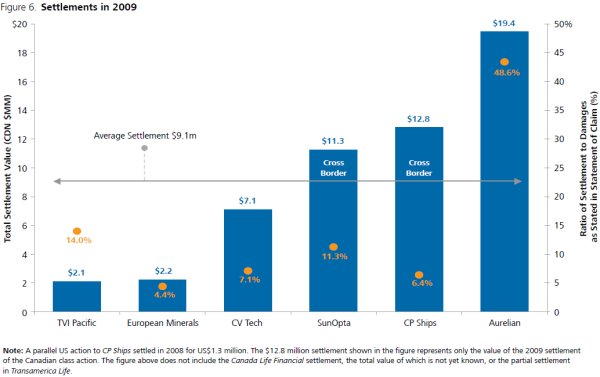

Settlements

Six cases settled during 2009 for approximately $55 million in total payments by defendants.15 This is an average of approximately $9.1 million per settlement, and a median settlement of $9.2 million—roughly similar to the median settlement value in US securities class actions.16

2009 settlements averaged 15.3% of the amount of damages claimed by plaintiffs (excluding punitive damages). The median settlement was 9.2% of the claimed amount. Both figures are generally consistent with past experience in Canadian cases. See Figure 6 below.

Since 1997, class counsel fees have averaged approximately 30% of settlements.17 If this same fraction of settlements was paid in respect to 2009 settlements, total class counsel fees in 2009 would have been approximately $16.5 million.

Cross-Border Settlements

As noted last year, and not surprisingly, cross-border cases tend to result in higher settlement values than domestic cases in terms of absolute dollars and also as a percentage of the claimed amount. The SunOpta and CP Ships cases, both resolved in 2009, are consistent with that observation.

A global settlement in the SunOpta case amounted to approximately $11 million, or 11.3% of the claimed amount. The CP Ships case also settled in 2009 for $12.8 million (after certification), following an earlier settlement of a parallel US action for US$1.3 million (in total, these settlements are approximately 7% of the claimed amount).

Largest Settlement

The largest settlement during 2009, both in terms of absolute dollar value ($19.4 million) and as a percentage of the claim (49%), was achieved in the Aurelian case.18 Although this was not a cross-border case, it did involve some uncommon facts. The claim was brought by purchasers of warrants issued by the company. The term of the warrants was to be extended if the company were to apply for and obtain a Tier One listing with the TSX Venture Exchange. Because the company did not apply for a Tier One listing, the warrants' term was not extended before expiry. Plaintiffs alleged that the company breached its duty to investors in failing to apply for a Tier One listing. Following the expiry of the warrants, the company released positive news and its stock price increased significantly. Warrant holders claimed that they should be compensated for having been denied the opportunity to exercise their warrants following the company's disclosure of positive news.

Dismissals

One case, Allen-Vanguard, was partially dismissed in 2009. In that case, plaintiffs alleged that the company made certain misrepresentations in relation to its acquisition of Med-Eng Systems Inc. and claimed damages of $75 million (plus $5 million in punitive damages). In late 2009, the company received approval from the court for its plan of reorganization under the Companies' Creditors Arrangement Act. As part of that reorganization plan, the proposed class action against the company, but not the other named defendants, was dismissed.

Time To Resolution

The time it takes from the filing of a statement of claim to either a settlement or final court ruling can vary widely over time and across cases:

- Of the 38 cases filed in 2007 or earlier, nine cases (24%) were resolved within two years (two of the nine cases were dismissed).

- Of the 34 cases filed in 2006 or earlier, 14 (41%) were resolved within three years. However, none of the nine cases filed between 2000 and 2003 were resolved within two years, and only one of these was resolved within three years.

- More recently, 26% of 19 cases filed between 2004 and 2007 settled within two years, and 47% of 15 cases filed between 2004 and 2006 settled within three years (note that cases filed in 2007 may still settle within three years).

- So far, four of the 10 cases filed in 2008 have settled. Each of these cases settled between one and one-and-a-half years after the date of filing (note that four of the six cases that have not yet settled were filed in the second half of 2008 and so have not yet reached the one-and-a-half-year mark).

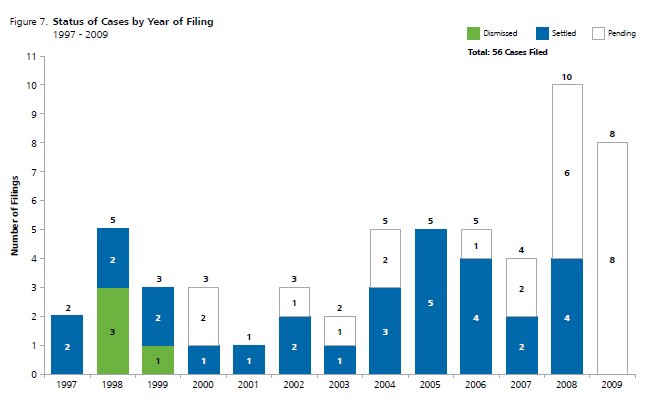

PENDING CASES

The net effect of eight newly filed cases and the resolution of five previously pending cases during 2009 leaves 23 pending cases in our database.19 Most of these cases were filed during the last three years (as one would expect), but there are still some outstanding cases that were filed nearly 10 years ago. The status of cases by year of filing is illustrated in Figure 7 below.20

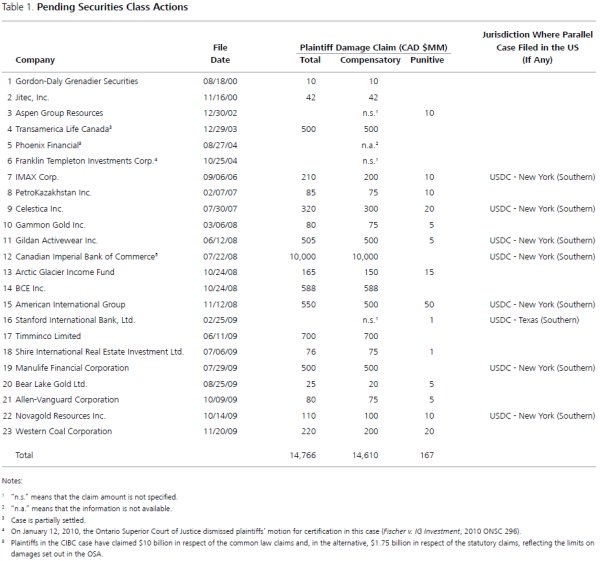

As at the end of 2009, these 23 pending cases represent more than $14.7 billion in claims. The $10 billion claim against CIBC represents about 70% of these outstanding claims. Eight of these cases (including the CIBC case), that together represent more than $12.1 billion in claims, have corresponding parallel actions filed in the US. These cases are listed in Table 1.

Table 1 does not include cases filed in the US against Canadian companies for which (so far) there are no corresponding Canadian actions. Examples of these cases include a case relating to Nortel filed during 2009, a new case against Canadian Superior Energy (which had been the subject of a previous cross-border class action that settled in 2006), a case against Fairfax Financial filed in 2006, and cases brought by shareholders and noteholders of Livent Inc., which were filed in 1998 and 1999 and remain outstanding.

LOOKING FORWARD

Canadian securities class action litigation continued to develop in 2009. Rulings of the courts on contested motions for certification and the first application for leave under the new Part XXIII.1 of the OSA during 2009 may set the tone for 2010.

Settlements during 2009 were significantly lower than settlements in 2008, although billions of dollars in claims remain outstanding.

Things to look for in 2010 and beyond include:

- additional rulings from the courts in these cases, including possible appellate court decisions;

- the pace and extent of the economic recovery, if any, that will take hold during 2010;

- the requirement that Canadian public companies transition from Canadian GAAP to the International Financial Reporting Standards in preparing their financial statements beginning in 2011, with retrospective financial statements required for 2010; and

- any changes in corporate governance practices and other actions of Canadian issuers in light of (the perception of) a growing threat of significant litigation.

We will also watch with interest to see if more cases related to the credit crisis or options backdating will emerge or whether those issues are now behind us—at least as far as securities class actions are concerned.

Footnotes

1. Mr. Berenblut is a Senior Vice President and Mr. Heys is a Vice President at NERA Economic Consulting. The authors thank Stephanie Plancich, David Tabak, and Robert Patton for helpful comments on earlier drafts of the paper, and Svetlana Starykh, Valentina Petkova, Tara Singh, Siddartha Krishnan, and other NERA researchers for their assistance.

2. Mark L. Berenblut, Bradley A. Heys, and Svetlana Starykh, "Trends in Canadian Securities Class Actions: 1997-2008, Canada Strikes its Own Course—Class Action Filings on the Rise," NERA Economic Consulting, January 2009.

3. The claims against CIBC account for $10 billion of this total.

4. Two other cases also settled or partially settled during 2009 and are not included in this total. These are discussed further below.

5. In compiling filing data, we have sought information on all unique class actions brought by investors in securities. We report a single filing where multiple causes of action have been commenced in respect of substantially similar facts.

6. In our 2008 paper, we reported nine cases filed in 2008. We have since refined the definition of relevant cases, resulting in the inclusion in our database of six additional cases. This change results in the inclusion of the Canada Life Financial Corporation case, filed 6/5/2008, and five additional cases that were filed in years prior to 2008. These are listed in the note to Figure 1, below.

7. Part XXIII.1 of the Ontario Securities Act and similar provisions under other provincial Securities Acts.

8. Silver v. Imax Corporation, et al., O.S.C.J., decision of K. van Rensburg J. (re Motion for Leave Under s.138.8 of the Ontario Securities Act), December 14, 2009. (Court File No. CV-06-3257-00). ("IMAX Leave Application")

9. Silver v. Imax Corporation, et al., O.S.C.J., decision of K. van Rensburg J. (re Rule 21 Motion and Motion for Certification), December 14, 2009. (Court File No. CV-06-3257-00).

10. McCann v. CP Ships Limited, et al., O.S.C.J., decision of Rady J., June 3, 2009. (Court File No. 46098CP). A similar action in Quebec was certified in 2008. A US action was previously settled. The certification motion in the BC action was pending when all Canadian actions were settled.

11. Allen v. Aspen Group Resources Corporation, et al., O.S.C.J., decision of G.R. Strathy J., December 4, 2009 (Court File No. 02-CV-241587CP).

12. Other alleged Ponzi schemes also made headlines in Canada (e.g., the case related to the Institute For Financial Learning in Alberta). Although class actions have been initiated in some of these cases (in addition to criminal charges), many do not involve investments in a security and are not included in our database.

13. We code cases based on the industry sector of the issuer of the securities that are the subject of the litigation, as reported by FactSet Research Systems Inc.

14. Most securities class actions involve multiple allegations. In 56 cases filed in Canada from 1997 through 2009, there are a total of 104 allegations. Where we have not been able to obtain a copy of the statement of claim, we have coded allegations based on news stories and/or complaints filed in parallel actions in the US (if any).

15. Settlements were also reached in two other cases during 2009: a settlement of the Canada Life Financial case, and a partial settlement of the Transamerica Life case. No information is available regarding the value of the settlement in Canada Life Financial, which, it appears, will be based on actual claims made by class members. A partial settlement in Transamerica Life for $52 million relates to claims of excess management fees charged by the defendants; claims relating to class members' investment in certain funds have not yet been resolved.

16. Stephanie Plancich and Svetlana Starykh, "Recent Trends in Securities Class Action Litigation: 2009 Year-End Update," NERA Economic Consulting, December 2009, p. 1. (Excluding the settlement of the IPO securities laddering cases, the median settlement in US cases for 2009 is $9 million. Median settlements in 2007 and 2008 were similar.)

17. Our database includes fees information for 13 cases from 1997-2009, including two cases that settled in 2009.

18. The partial settlement of the Transamerica Life case for $52 million exceeds the settlement in Aurelian, but since it is both partial settlement and relates specifically to allegations of excess management fees, we have not included this amount in the discussion above. The partial settlement in that case is approximately 10% of the amount claimed.

19. Of the total of 56 cases in our database, 23 are pending, 29 have settled, and four have been dismissed.

20. Although we report Phillips Services as a dismissed case (originally filed in 1998) based on the decision of the Ontario Superior Court in 2001 (Menegon v. Phillip Services Corp., 2001 CanLII 28396), we understand that a new claim was made during 2003. This new claim was made by a different plaintiff, but is in relation to substantially similar facts. The plaintiff in this case is represented by the same counsel as in the original case. We have not reported this as a new filing for 2003.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.