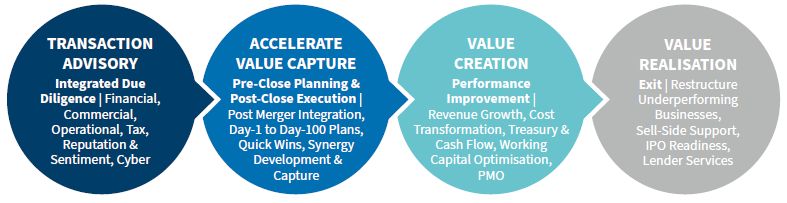

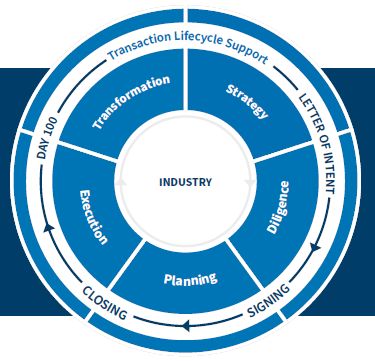

Using an industry-first approach, our senior experts work with the world's leading private equity firms, credit funds and investment banks, providing pragmatic, transaction and execution-oriented services throughout the transaction lifecycle. From origination to exit, we use knowledge-driven skill and experience, focusing on critical financial, commercial and operational opportunities to enhance enterprise value.

Our practices, as standalone offerings and comprehensive solutions, address the many interconnected issues our clients face.

OUR SOLUTIONS

OUR APPROACH

- An experienced eye scrutinising every detail with a hands-on approach to getting things done

- Fewer conflicts than many others, being free of retained audit clients, offering a more nimble response and approach better aligned to client needs

- Driven by data, facts and hypotheses

- Unique range of capabilities leveraged to deliver customised solutions, combining a variety of skills which often have to be sourced separately from multiple providers

OUR EXPERTS

- Senior teams with unparalleled global experience

- Industry expertise with strong functional skill sets

- Experts across tax, operations, valuations, investigations, financial diligence, post-acquisition disputes and communications

- Teams built around client needs that can quickly mobilise capabilities from the firm's global pool of professionals

- Affiliate network of professional advisors (ex- CEO, CFO, COO)

OUR SOLUTIONS FOR PRIVATE EQUITY FUNDS

Combining industry experience and operational expertise, FTI Consulting is a one-stop-shop for advisory and execution through all stages of a company's lifecycle.

Free from audit-based conflicts and restrictions, we can provide a 360-degree lens across all facets of the business impacted by a transaction.

Our team drives transactions from pre- to post-close, supporting growth, transformation and event driven change for private equity clients.

FTI Consulting provides a unified cross-functional team to increase revenue, grow profitability, implement cost discipline, create liquidity and provide strong financial management.

| Transaction Advisory | ||

|---|---|---|

| Letter of Intent | Due Diligence to Closing | |

| M&A Strategy & Deal Sourcing | Integrated Due Diligence | Closing Planning |

|

|

|

| Hold Period — Value Creation/Performance Improvement | ||

| Accelerate Value Capture | Value Optimisation | Value Realisation |

| First 100 Days+ | Hold Period | Exit |

|

|

|

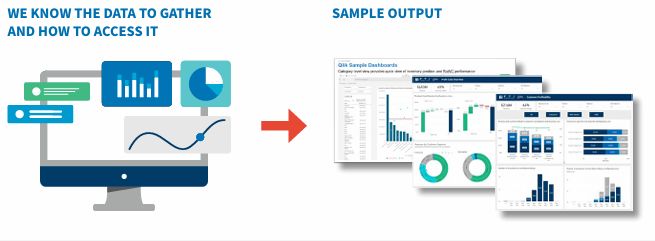

DATA & ANALYTICS

Business intelligence tools driven by data and analytics provide a single source of truth enabling identification of improvement opportunities tied directly to the P&L. Visual analytics help identify opportunity areas that will have an immediate positive impact on the bottom-line and create an action plan for rapid execution.

THE PROFIT CUBE: is a proprietary tool that FTI Consulting leverages which combines elements of cost accounting and cash flow analysis to provide a 360-degree view of which customers, products, geographies and channels DO and DO NOT generate positive contribution margin.

A Source of Truth for Profitability Analytics

- Using transaction level data to analyse profitability from several dimensions (e.g., customer, product/ SKU, geography, plant, sales channel)

- Calculates an accurate contribution margin and identifies truly avoidable costs (variable, semi-variable, fixed discretionary & non-discretionary)

- Leveraging a profit cube provides visibility into true cash contribution across multiple dimensions and insights for profit growth and cost

Design for Transformation / Improvement

- Establish the strategic blueprint

- Make product portfolio decisions

- Develop the product, market and sales solutions

- Fully develop the operating model and create the org design

- Design metrics to track progress towards goals

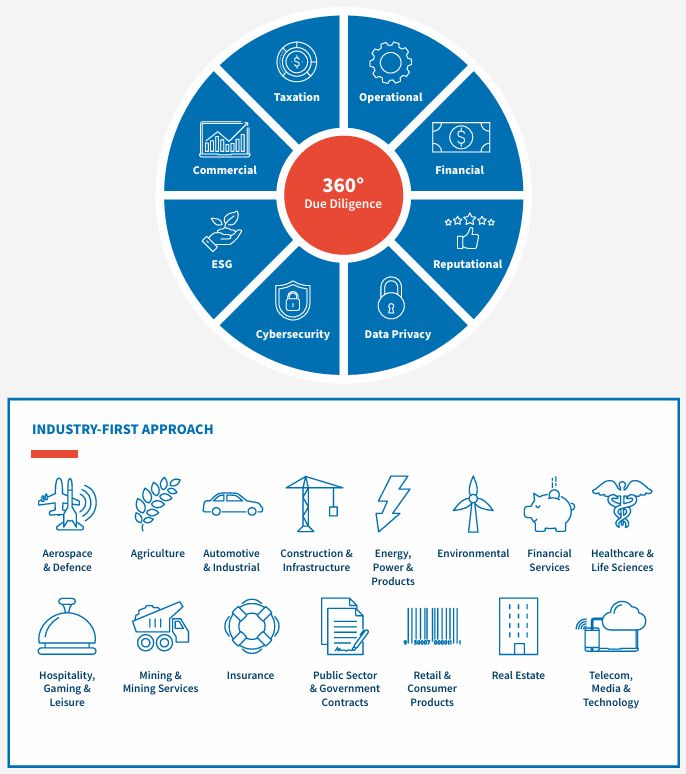

TRANSACTION SUPPORT

FTI Consulting's due diligence experts assess a wide range of risks and opportunities to help you make more informed decisions before investing. Our multi-disciplinary team understand the industry-specific challenges, opportunities and competitive environments that underpin a deal, providing you with a 360-degree view of the financial and non-financial landscape:

Cybersecurity & Data Privacy

Our experts help you understand the cybersecurity and data privacy risks in a transaction, ensuring you can quickly and defensibly identify, assess, document and mitigate risk:

- Address the compliance landscape, and assess applicability of cybersecurity and data protection laws around the globe

- Value missing or ineffective cybersecurity controls to support negotiations

- Review and assess adequacy of cybersecurity, privacy and data governance frameworks, policies and procedures

- Map data flows, and identify critical IP and key risk areas

- Penetration tests to assess the effectiveness of cybersecurity controls

- Value information assets to support negotiations

- Assess key third-party arrangements and third-party risk

- Due diligence memoranda

- Post-acquisition integration and remediation work

- Compromise assessment to identify past or ongoing malicious activities

ESG & Sustainability

Private equity firms are balancing interests from LPs, private equity-backed portfolio companies ("PortCo") and PortCo customers. They need solutions that integrate ESG and sustainability initiatives with the goals of each fund and the strategic plan for each PortCo. Proactive strategic ESG management means engaging stakeholders around business risks and opportunities and demonstrating prudent oversight.

Our ESG specialists provide the following core solutions:

- Driving ESG strategy and pre-IPO planning

- ESG and sustainability reporting

- Emissions measurement/climate risk assessment

- Risk management, due diligence and data Analytics

Reputation & Sentiment Due Diligence

Our team provides the intelligence and communication expertise you need to make informed investment decisions:

- Pre-transactional reputation and regulatory due diligence

- Sentiment risks for business including political risks, industry issues, and stakeholder sensitivities

- Assessment of counterparty risk

- Actionable intelligence from on-the-ground sources

- Media support and communication strategy across the transaction lifecycle

END TO END DEAL LIFECYCLE SUPPORT

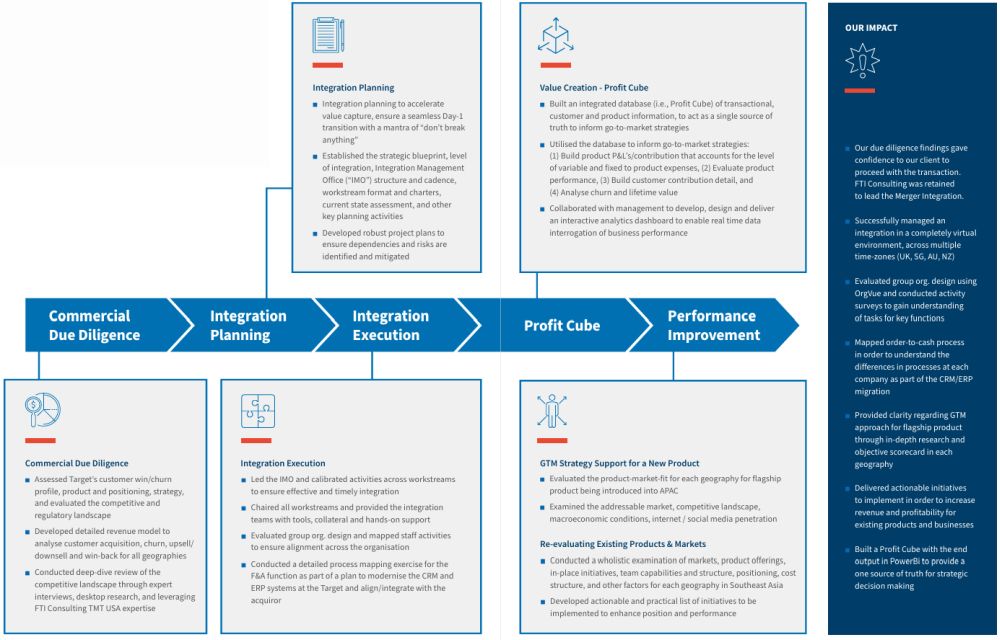

FTI Consulting was engaged as a Trusted Advisor to lead the commercial due diligence, post merger integration, and several performance improvement projects focused on value creation following the merger of two leading TMT companies.

SELECT CASE STUDIES

FINANCIAL DUE DILIGENCE FOR A PE FUND IN A $300M CAPITAL RAISE AT THE START OF COVID-19

Situation: FTI Consulting was engaged by a PE fund to provide financial due diligence services to support a potential investment in a leading Australian travel agency that had suffered significant business disruption due to COVID-19.

Role: Our work included conducting a rapid assessment of the key cash flow assumptions and cost reduction initiatives and forming a view around the forward revenue profile and running downside scenarios to support the funding request and turnaround plan.

Impact: Our findings supported the PE fund's decision to participate in the equity raise and funds were committed within 15 days of commencing our work.

BUY-SIDE DUE DILIGENCE FOR A PE FUND FOCUSING ON COST-OUT WHICH IDENTIFIED $100M (OR 25%) IN SAVINGS

Situation: FTI Consulting was engaged by a PE fund to perform buy-side due diligence on one of Australia's largest home builders for a potential transaction.

Role: We assessed the target's cost base, identified levers to reduce cost in the short, medium, and long term and developed an implementation plan based on specific initiatives across all cost categories.

Impact: Our work identified savings of ~$100M (or 25%) of the total cost base and we delivered a robust commercial and flexible business plan model to support the deal.

POST-MERGER INTEGRATION OF TWO B2B RETAIL SALES ORGANISATIONS (PLANNING & EXECUTION)

Situation: FTI Consulting was engaged by a PE fund following a second acquisition to lead the integration planning and execution to merge the two sales organisations.

Role: Our work focused on redesigning the sales organisation structure to align with the newly designed structure of the first entity and designing a differentiated customer treatment program to improve customer profitability.

Impact: Our team helped to successfully merge the two business, delivered ~11% p.a. opex savings, migrated ~5k of low-value customers to a lower-cost sales model & identified ~$35M in margin uplift from cross & up selling.

POST-ACQUISITION PERFORMANCE IMPROVEMENT WHICH IDENTIFIED & DELIVERED ~$70M IN COST SAVINGS

Situation: FTI Consulting was engaged by a PE fund to lead a costout program for a major Australian hospital group that was negatively impacted by COVID-19.

Role: Our team identified a range of cost-saving and revenue enhancement initiatives and helped deliver these initiatives by leading the Program Management Office and calibrating activities across multiple workstreams.

Impact: Our work helped to rightsize the cost base and deliver ~$70M in annualised savings across two phases. This ultimately increased the asset value by ~$500M and provided a more attractive investment case to support a significant debt refinancing.

CARVE OUT REQUIRING VALUE CREATION PLAN - PROFIT CUBE & CUSTOMER / PRICING ANALYTICS

Situation: FTI Consulting was engaged by a PE fund to lead the post-acquisition performance improvement of a large Australian B2B retail business.

Role: Our scope was to improve EBITDA by focusing on sales, product and margin initiatives. A Profit Cube was built to drive early insights from data and became foundational for all workstreams

Impact: Our work identified agreed initiatives to deliver ~$50M in annual profit uplift (both revenue and cost). Included churn, cross sell & pricing models supporting a set of customer treatments to maximize value.

POST-ACQUISITION PERFORMANCE IMPROVEMENT & LEAD SALE ADVISOR OF AN AUSTRALIAN SWIMWEAR BRAND

Situation: FTI Consulting was engaged by a PE fund to support the rebuild of an iconic Australian swimwear brand which was acquired out of insolvency and looked to refocus its strategy from bricks and mortar to digital.

Role: Our work focused on transforming the business by reducing costs, helping grow revenues, increasing visibility around cash and liquidity and improving governance and controls to ultimately help get the business ready for sale.

Impact: Our team successfully sold the business in July 2023 following a public sale campaign which included interest from multiple international buyers and investors.

Download the full brochure here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.