Introduction

This Practice Module is made available by the Mortgage & Finance Association of Australia as a service to its members.

The Practice Module was prepared by Gadens Lawyers.

While all care has been taken in its preparation, neither the MFAA nor Gadens Lawyers accepts any liability for any loss arising from use of or reliance on this Practice Module.

These procedures focus primarily on procedures to be adopted by real estate mortgage lenders and intermediaries.

How to use this paper

This paper is divided into 9 parts.

Part 1 Overview

Part 2 The 6 Basic Rules

Part 3 Implementation Guide

Part 4 Advertisements

Part 5 Comparison Rate Schedules

Part 6 Comparison Rate Formula

Part 7 Commercial Comments

Part 8 Practical Problems

Part 9 Statements of Enforcement Policy

Part 10 Questions and Answers

The MFAA welcomes feedback on this Practice Module. Please forward suggestions to enquiries@miaa.com.au

Part 1 – Overview

- regulated continuing credit contracts;

- unregulated credit.

|

Continuing credit contracts are typically:

|

Part 2 – The 6 Basic Rules

- state that fees and charges are payable; or

- specify the amount of the fees and charges payable; or

- specify the amount of some of the fees and charges payable and state that other fees and charges are payable.

- If an advertisement specifies an interest rate, you must specify a Comparison Rate (CR).

- You must display a Comparison Rate Schedule (CRS) in premises at which:

- you display or make available for collection by members of the public copies of documents advertising consumer credit products; or

- customers may lodge applications for credit in person, or you must ensure access to the CRS on any internet site that advertises consumer credit products.

- A CRS must accompany any application for credit that is sent or given to a prospective customer.

- You are never obliged to provide a CR for a specific loan amount, but only for the loan amounts and terms specified in the legislation.

Part 3 – Implementation Guide

Here is a step by step implementation guide.

- Decide whether to ban all mention of interest rate in credit advertisements. Remember, credit advertisements means an advertisement in any form and in any place.

- Decide whether you will apply CRs to:

- regulated continuing contracts;

- unregulated loans.

Having a single system for all loans may be simpler.

- If you will have advertising material stating an interest rate, develop a template advertisement.

- Obtain software to calculate the CR.

- Identify the products for which you need a CRS.

- Identify which fees and charges you will include in the CR calculation.

- Design the CRS.

- Decide where the CRS will be "made available". Generally this will include:

- branches;

- internet sites;

- intermediaries (brokers and managers).

- If you are a broker, decide which CRSs you will display. If you deal with more than 6 credit providers, you need only display CRSs for the 6 credit providers you deal with most. Decide which products you will market for that credit provider. You do not need to display a CRS for a credit product if you do not deal with that product. Even if you don’t have to display a CRS, you must give the borrower a CRS when supplying an application form.

- Ensure your procedures provide for the relevant CRS to be given to the customer with each application.

- Change your internet site if required.

Part 4 – Advertisements

An advertisement must contain the comparison rate if it contains:

- an interest rate – s 146E; or

- amount of repayment – s 140 (because if a repayment is stated an interest rate must be stated and that will trigger s 146E).

The rules for Comparison Rates in advertisements are set out in s146E - s146I of the Act.

The Comparison Rate must be calculated for whichever of the following most closely represents the typical amount and term for the credit being advertised.

|

Amount |

Term |

Other prescribed information |

|

$250 |

2 weeks |

|

|

$1,000 |

6 months |

|

|

$2,500 |

2 years |

|

|

$10,000 |

3 years |

Secured / unsecured |

|

$30,000 |

5 years |

Secured / unsecured |

|

$150,000 |

25 years |

The credit advertisement may contain more than one Comparison Rate.

Must haves for advertisements containing an interest rate

- state that fees and charges are payable;

- or specify the amount of the fees and charges payable;

- or specify the amount of some of the fees and charges payable and state that other fees and charges are payable.

A warning may also contain a statement that the credit provider does not provide credit for an amount, or a term, or both, specified in a credit advertisement or Comparison Rate Schedule – s 33C.

Long form

|

WARNING: This Comparison Rate applies only to the example or examples given. Different amounts and terms will result in different Comparison Rates. Costs such as redraw fees or early repayment fees, and costs savings such as fee waivers, are not included in the Comparison Rate but may influence the cost of the loan. |

Short form

The short form may only be used in advertisements. The long form must be used in Comparison Rate Schedules.

|

WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. |

- any annual percentage rate; and

- the amount of any repayment.

Typical advertisement

|

New Beaut Home Loans new Home Starter Loan is only 5.35% per annum! Rush in before it’s too late. The Comparison Rate based on a loan of $150,000 for 25 years is 5.37% per annum. Fees and charges may be payable. A Comparison Rate Schedule is available at the premises of New Beaut Home Loans at 27 Broker Street, Sydney. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. |

Rules for television, the internet, and other electronic display mediums

Other rules for advertisements

Decide whether to ban all mention of interest rates in credit advertisements. Remember, credit advertisements means an advertisement in any form and in any place.

Part 5 – Comparison Rate Schedule (CRS)

The rules for Comparison Rate Schedules are set out in s146J - s146Q of the Act.

The Comparison Rate Schedule must specify the comparison rate for the following amounts and terms.

|

Amount |

Term |

Comparison Rate |

|

$200 |

2 weeks |

|

|

$600 |

8 weeks |

|

|

$1,000 |

6 months |

|

|

$1,500 |

1 year |

|

|

$2,500 |

2 years |

|

|

$5,000 |

2 years |

|

|

$10,000 |

3 years |

Secured / unsecured |

|

$15,000 |

4 years |

Secured / unsecured |

|

$20,000 |

4 years |

Secured / unsecured |

|

$25,000 |

5 years |

Secured / unsecured |

|

$30,000 |

5 years |

Secured / unsecured |

|

$50,000 |

7 years |

|

|

$70,000 |

25 years |

|

|

$100,000 |

25 years |

|

|

$130,000 |

25 years |

|

|

$150,000 |

25 years |

|

|

$200,000 |

25 years |

|

|

$225,000 |

25 years |

|

|

$250,000 |

25 years |

|

|

$275,000 |

30 years |

|

|

$300,000 |

30 years |

Must haves for Comparison Rate Schedules

May haves

Rules for calculating interest rates priced for risk

Regulation 33D(3) provides that where a credit provider is calculating a comparison rate for a CRS and the credit provider does not have a set interest rate, but a rate which varies according to the risk profile of the borrower, the CRS must contain 5 comparison rates for the prescribed amount of credit.

The 5 comparison rates within the CRS are made up of:

- 1 comparison rate calculated on the basis of the average annual percentage rate charged by the credit provider, rounded to the nearest whole number; and

- 4 comparison rates calculated on plus 1%, plus 2%, minus 1% and minus 2% of that average annual percentage rate rounded to the nearest whole number.

Rules for unsuitable loan terms

Normally, a CRS must list a comparison rate for the terms specified in the above table, whether or not the credit is generally available for that term. However, if the credit provider only offers $70,000 - $300,000 for less than 25 years and only for purposes other than a home loan, the CRS must provide a comparison rate which is based on the term for which that amount of credit is actually offered rather than the prescribed term - s 33D(2).

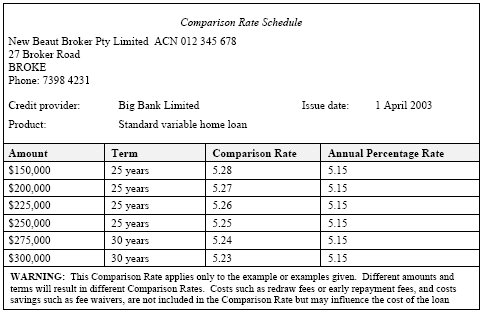

Example Comparison Rate Schedule

This example is for a finance broker and for a product where the minimum loan is $150,000.

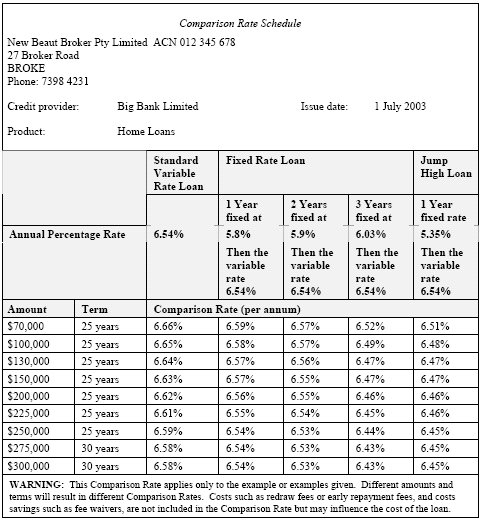

Here is an example of a CRS containing information about a number of products.

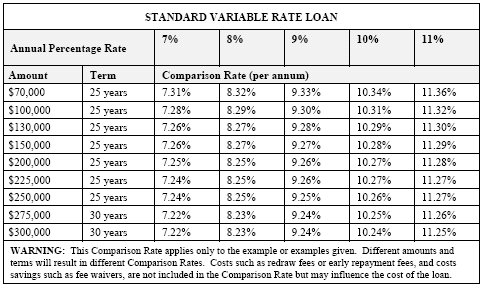

Here is an example of a CRS, that is based on a product priced for risk.

When must a CRS be provided?

CRSs must be displayed and made available at any premises of the credit provider or finance broker:

- at which the public may collect copies of documents advertising consumer credit products; or

- at which the public may lodge applications for credit in person.

If finance brokers represent more than 6 credit providers, they need only display the CRSs for the 6 credit providers with whose product the broker mainly deals. Despite this, the broker must still ensure that the relevant CRS accompanies any application for credit given to the prospective debtor (ie even if the broker doesn’t have to display that CRS).

Exemption for credit providers

Regulation 33G of the Act provides an exemption for credit providers and not brokers. A credit provider is exempt from displaying a CRS if the use of the premises is limited to:

- the display or provision of credit advertisements that do not, or information that does not, contain an annual percentage rate; or

- the distribution, or collection, or both of credit applications.

This exemption is stated to apply to organisations that conduct limited activities on behalf of a credit provider (usually a credit union), for example, providing information about the credit provider or accepting credit application forms in places such as school staff rooms or office lunch rooms.

CRS to accompany application

Because a CRS may not come to the attention of a prospective borrower as a result of CRSs being displayed, a catch all provision has been inserted which requires the CRS to accompany application forms. The CRS must be sent each time any application for credit is sent or given to a prospective borrower by a credit provider or a broker.

Internet sites

If there are advertisements for consumer credit products on the internet site or on any other public electronic system, there must be electronic access to the relevant CRS.

Part 6 – Comparison Rate Formula

Section 146R of the Act deals with calculating the Comparison Rate.

The comparison rate formula is a complex mathematical calculation, best undertaken using specialised software.

The CR must be correct to at least the nearest 100th of 1% per annum (eg 5.15% per annum).

The calculation is similar to the comparison rate calculation previously contained in the UCCC. The difference is that now establishment fees and other credit fees or charges payable before the credit is drawn down are taken into account in the calculation.

Credit fees and charges need not be included in the calculation if their imposition or amount is dependent on events that may or may not happen. This will particularly apply to early repayment fees and deferred establishment fees. For example, when calculating a comparison rate for a loan of $150,000, any ongoing monthly charge would need to be calculated for 25 years because the calculation is being made for that assumed term, however an early repayment fee would not need to be included at all.

Fees and charges need only be included if they are ascertainable when the comparison rate is disclosed. The legislation provides that fees and charges are not ascertainable if they are dependent on an event that may or may not happen. It is unclear whether this is an all-encompassing description of unascertainable. Are fees and charges unascertainable if they are definitely payable but the amount and time of payment is unknown?

It is also unclear how a CR will be calculated when the time and amount of principal advances is unascertainable (eg construction loans).

In applying the formula, reasonable approximations may be made where it is impractical or unreasonably onerous to make a precise calculation. For example, if repayments are made on a fixed day each month, it may be assumed that repayments would be made on that day each month even though the credit contract provides for a payment on the preceding or succeeding business day when the due date is not a business day.

The tolerances and assumptions under s 158, s 159 and s 160 information, contracts and other documents of the UCCC apply to the calculation of the CR. Most relevantly, these tolerances are:

- s158(2)(a) – that the interest rate will not vary over the whole term;

- s158(2)(b) – if the rate is to change to a variable rate during the term, the current variable rate can be used for the calculation;

- s158(3) – all payments will be made on due date;

- s158(4) – there will be no change in credit fees and charges;

- reg 36(4) – interest charges, repayments and credit fees and charges may be overstated;

- reg 38A(1) – offset arrangements should be ignored.

[See special rule regarding government charges in Part 9].

Part 7 – Commercial Comments

The MFAA encourages its members to comply with the spirit of the legislation.

There are 3 principal areas where abuse could arise.

- Designing products so that there are a large number of unascertainable or optional charges, which need not be brought into the calculation, resulting in an understatement of the comparison rate.

- Bundling of products so that fees and charges are payable in relation to products which are not credit, thereby allowing the credit to be provided at a cheaper rate, with a consequential reduction in the comparison rate.

- Using low honeymoon rates and making unreasonable assumptions about the applicable future variable rate.

A penalty of $10,000 applies for each breach of the comparison rate provisions. The penalty is applied to the business breaching the legislation. For example, if a broker fails to display a CRS, generally the broker will be liable for the breach not the relevant lender. However, the MFAA recommends that lenders and aggregators encourage compliance by originators.

Part 8 – Practical Problems

For example it is possible, even within a standard variable rate product, different CRS’s will apply for:

- interest only for the first 1-5 years (separate schedule for each interest only period);

- fixed rates for the first 1-5 years (separate schedule for each fixed rate period).

It will be a matter of fact in each case whether each of these options amount to a separate product or are just an option within a single product.

- Where rates change there is a 7 day grace period after the change takes effect to correct credit advertisements and CRS – s146S.

- Often products are provided as a discount. For example, in order to win business, or because a customer is entitled to concessions under a customer care program, a product may be offered at a discount to its carded rate. Where this occurs, a special CRS is not required for the discount product. This is because the UCCC tolerances permit overstatements of the interest rate.

- Although the CRS may only contain prescribed information, there is no reason why a CRS cannot form part of a larger document so long as the CRS section is separately identified. This is similar to the way a financial table forms part of a credit contract although only specified information may appear in the financial table. Accordingly, it is possible for the CRS to have other material appearing before or after it in the same document so long as the CRS section is clearly identified as such.

- Basic home loans may become more attractive as they will show a lower CR. High charges can apply for various add-ons, but these optional add-on charges do not form part of the CR calculation.

- There are no specific provisions regarding telephone applications. It would seem that if an application is made verbally and no application form is ever sent to the customer, there is no need to supply CRS. However, if the telephone conversation amounts to an advertisement, the relevant comparison rate will need to be stated together with the warning.

Part 9 – Statements of Enforcement Policy

The Standing Committee of Officials of Consumer Affairs (SCOCA) has endorsed the following rules regarding enforcement of the comparison rate legislation. The rules appear in italics.

Government fees, charges and duties

"If a Government agency to which a fee or charge must be paid deals with the public only through a contracted service provider, any service charges paid to this service provider should be considered to be a government fee or charge for the purposes of the comparison rate formula."

For example if title searches, land titles or ASIC searches are obtained through a contractor, the entire fee (including the contractor’s margin) is considered to be a government charge or fee and need not be taken into calculation.

Font size

Notices under the UCCC have to be at least 10pt. This rule does not apply to the CRSs as they are not notices.

"Comparison rate schedules are not notices provided under the Consumer Credit Code."

Valuation fees

Questions have been raised regarding whether valuation fees which vary according to customer circumstances should be included in the comparison rate calculation if the exact amount of the fee to be charged is not known at the time the comparison rate is disclosed.

"Where there is no uncertainty over whether a consumer will be charged a valuation fee, but the exact amount of the fee is not known at the time a comparison rate is disclosed, a reasonable estimate of the likely valuation fee is to be included for the purposes of calculating the comparison rate."

Part 10 – Questions & Answers

A CRS must be displayed in certain premises. Can the CRS be displayed on a television set or in electronic form?

The legislation does not prohibit "displays" from being on a television screen or on a computer screen.

However, the spirit of the UCCC is for disclosure of information to customers and where in doubt as to whether you are correctly "displaying" a comparison rate schedule you should keep in mind that the purpose of the "display" is to inform potential borrowers of the relevant comparison rates. If the display is insufficient to inform potential borrowers of the CCR, it would be likely that you would be in breach of the law.

A CRS must accompany any credit application. Is a variation increasing the principal sum an application for credit and if so must it be accompanied by a comparison rate schedule?

A CRS must accompany any application form for a principal increase. However, if there is no application form issued, no CRS is required.

If a referrer such as a real estate agent only distributes general advertising about an intermediary or a lender, must CRS be displayed?

A real estate agent may in some instances be considered as a linked supplier under the Act. A linked supplier is required to display and make available for collection by members of the public copies of comparison rate schedules at any premises of the supplier if:

- the supplier displays or makes available for collection by members of the public copies of documents advertising consumer credit products; or

- or where members of the public may lodge applications for credit in person.

Generally, which fees are included or excluded from the calculation of the CR?

Fees and charges that are ascertainable when the CR is disclosed must be included in the calculation of the CR. Section 146R of the Act provides that fees and charges are not ascertainable if they are dependent on an event that may or may not happen.

The following fees are to be included in the calculation of the CR:

- Application fee;

- Administration fees;

- Settlement fees; and

- Valuation fees (if they are certain to be charged).

The following fees are not to be included in the calculation of the CR:

- Registration fees;

- Mortgage stamp duty;

- Deferred establishment fees;

- Redraw fees;

- Cheque fees;

- Principal increase fees;

- Partial release fees;

- Bpay deposit fees;

- Mortgage discharge fees;

- Break cost fees;

- Production fees; and

- Lenders Mortgage Insurance.

Valuation fees will vary according to the location of the security. Some country properties incur travelling costs from the valuer. If the fee cannot be accurately ascertained for all loans is it excluded?

The Standing Committee of Officials of Consumer Affairs (SOCA) has issued an enforcement policy relating to valuation fees. The policy states that where there is no uncertainty over whether a customer will be charged a valuation fee, but the exact amount of the fee is unknown at the time a CR is disclosed, a reasonable estimate of the likely valuation fee is to be included for purposes of calculating the CR.

Does a webpage that makes no reference to interest rates or repayment amounts have to display CRSs?

Distinct from the obligations for advertising, the legislation specifies when CRS are to be displayed on internet websites.

Under s 146K(4) of the Act:

"… a credit provider, finance broker or supplier who makes material advertising consumer credit products available on an Internet site, or on any other public electronic system, under the control of the credit provider, finance broker or supplier is to ensure that electronic access to the relevant Comparison Rate Schedule is also available to members of the public who access that material."

As a result, a credit provider, broker or supplier is required to ensure that it displays on its internet website the relevant CRS for the consumer credit products it promotes. This obligation may be satisfied by providing links to those relevant CRS.

The important question here is, which CRSs are the relevant ones. This will be determined on a case by case basis depending on the type of advertising appearing on the web site. For example:

- A site, which promotes no products at all, need not display any CRSs, as there are no relevant CRSs. Although not impossible, it is difficult to imagine a broker’s web site that did not advertise products in some way, for a site to fall into this category.

- A site which states "we can arrange good home loans for you" should display the CRS for each home loan marketed even though no specific product is mentioned. This is because all those products are promoted, and so they all become the relevant CRS. Most broker web sites would fall into this category, as the web sites would usually promote the type of credit the broker can arrange.

- A web site which promotes only specific products must display the CRS for those products.

The calculation of the CR may be different depending on how the rounding off is carried out throughout the calculation. How should the CR be calculated?

While calculating the CR, any percentage rate used should be rounded off to four decimal places, and any amount in dollars and cents should be rounded off to the nearest whole cent as permitted under Regulation 36 (1) of the Code. The end CR result should then be rounded off to two decimal points, in line with the requirement of the CR to be correct to at least the nearest 1/100th of 1% per annum.

|

Sydney |

||

|

Jon Denovan |

t (02) 9931 4927 |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.