- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

- within Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

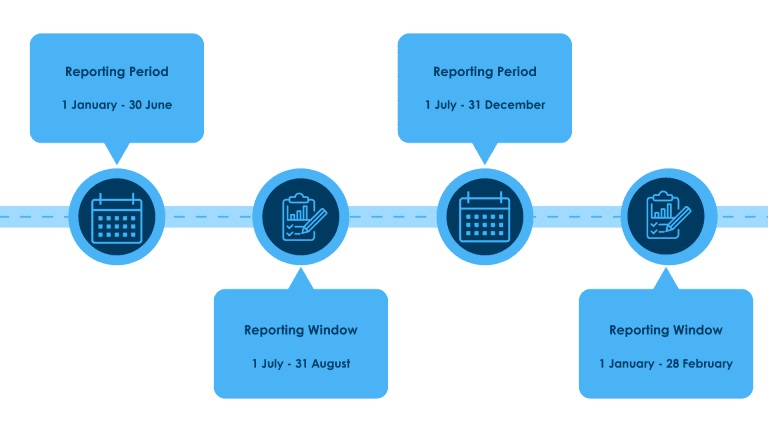

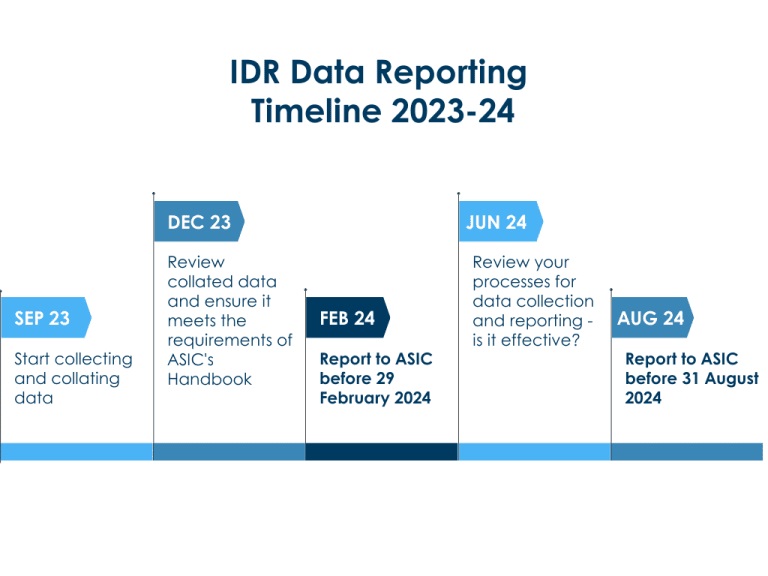

All financial firms are now required to submit their IDR data to ASIC every six months. Data is to be collected in 6 monthly reporting periods covering 1 January – 30 June and 1 July – 31 December.

The submission window for the January – June reporting period of 2024 has now opened and data is due to ASIC by 31 August 2024.

Which complaints do I need to report?

Financial firms must report IDR data to ASIC in relation to each complaint made to the firm that:

- is required to be covered by the firm's IDR procedure; and

- was made during the reporting period and was not closed at the start of the reporting period.

Complaints are closed when the firm has:

- Provided an IDR response to the complainant;

- Resolved the complaint;

- Provided an explanation or apology to the complainant.

| Reporting Period | Due Date |

| 1 July to 31 December 2023 | 29 February 2024 |

| 1 January to 30 June 2024 | 31 August 2024 |

What do I need to do?

Collect and Collate Data

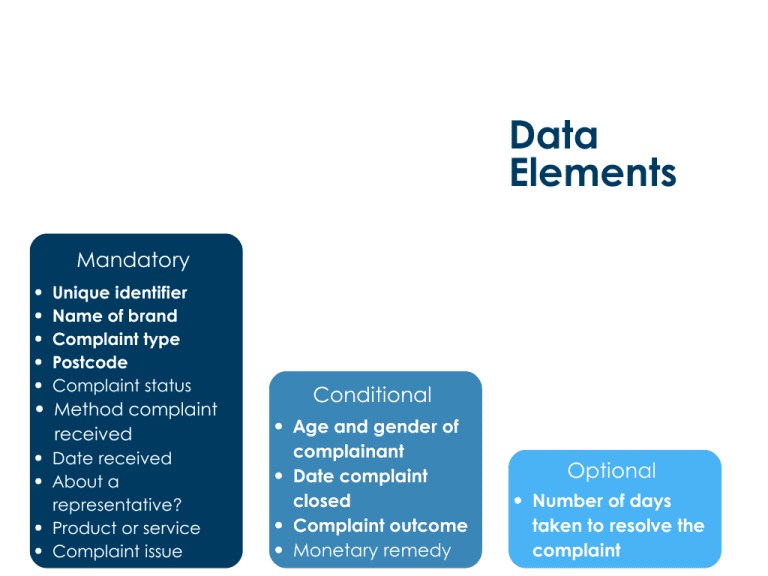

ASIC's Data Dictionary prescribes the data elements to be reported by financial firms. Financial firms should collect this information for their own internal purposes. In terms of collating the information for ASIC, the data elements are either:

- Mandatory – meaning the data must be reported;

- Conditional – meaning the data must be reported if a certain answer has been provided at another element; or

- Optional – means the firm can elect whether to report this data element.

The data elements include:

- A unique identifier;

- Name of brand the complaint is about;

- Type of complainant;

- Gender, age and postcode of complainant;

- Current status of the complaint;

- Method via which the complaint was received;

- Date complaint was received and closed (where applicable)

- Number of days taken to resolve the complaint;

- Whether the complaint is about a representative;

- Product or service that the complaint is about;

- Issue(s) raised by the complainant;

- Complaint outcome(s) (where applicable); and

- Monetary remedy provided (where applicable).

Financial firms should refer to ASIC's Data Dictionary to ensure their responses to these data elements align with ASIC's requirements, particularly in relation to the numerical codes ASIC has developed. For example, when inputting the type of complainant, ASIC has a numerical code attributable to each client type.

ASIC's Data Glossary will assist financial firms to further understand the terminology used in relation to:

- the products or services that the complaint is about;

- the issues raised by the complainant; and

- the complaint outcome.

ASIC has provided a template spreadsheet to ensure the information collated by financial firms is in the correct format and will pass ASIC's data validation process.

You can access the template report here. We suggest either:

- using this template as your complaints register; or

- reviewing your complaints register to ensure it aligns with this template.

This will help to ensure you are collecting the appropriate data for ASIC.

Report to ASIC

Financial firms are required to lodge their report via the ASIC Regulatory Portal. Even if you don't have any complaints to report, you must still lodge a nil report to ASIC. It is crucial that financial firms also review the Data Dictionary and Data Glossary, to better understand the data elements to be collected and collated, and to ensure that their reporting to ASIC uses the defined terminology and numerical codes required to pass ASIC's two stage validation process.

Background

All Australian Credit Licensees and Australian Financial Services Licensees who provide services to retail clients (including those that had no complaints in the relevant reporting period) are required to report their IDR data to ASIC.

The first reporting period runs from 1 July to 31 December 2023. Firms must lodge their data with ASIC within a two-month submission window that opens at the end of each reporting period.

ASIC may reduce the length of the submission window (e.g. to one month) once all financial firms have had time to familiarise themselves with the IDR data reporting process.

To ensure you are complying with your dispute resolution obligations, shop our Dispute Resolution and Complaints Management Policy here.

* There are already 97 large financial firms reporting their IDR data to ASIC. A second tranche of 260 financial firms reported data by August 2023. These firms are listed by name in the Instrument and we have not dealt with their requirements in this article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.