CAMPAIGN FOR THE FARMED ENVIRONMENT - Set-Aside Mitigation Measures Announced

Defra has set up the CFE to give the voluntary approach time to 'prove itself'. The industry has until June 2012 to meet the targets.

Hilary Benn, Secretary of State for Environment, Food and Rural Affairs, has decided not to introduce a compulsory set-aside replacement scheme. Instead of enforcing a percentage of cultivated land to be in environmental management through cross-compliance measures, he is allowing the voluntary approach time to prove that it can recapture the environmental benefits of set-aside. This approach was advocated by the Country Land and Business Association (CLA) and National Farmers' Union (NFU).

The vehicle that will drive this forward is the Campaign for the Farmed Environment (CFE), an educational campaign that will be targeted at those who manage arable land, and those who influence farmers such as agronomists and farm consultants.

Full details of the CFE can be found at www.nfuonline.com/x38725.xml

The CFE's focus

The campaign will focus on the following three areas.

1. Environmental Stewardship

This will involve persuading those not already in Environmental Stewardship (ES) to take part in the scheme (and making sure that those already signed-up renew in 2010). In addition, it will try and influence farmers' choices of options, to ensure that the environmental benefits of set-aside are maintained. This will include working with Natural England during the current review of the ES to make selecting such options easier and more likely.

2. Non-ELS measures

For those land managers who do not wish to go into the Entry Level Stewardship (ELS), the CFE will promote a list of voluntary measures for them to adopt.

3. Existing industry initiatives

The CFE will build on existing programmes, e.g. the voluntary initiative.

The plan in action

The CFE will follow a more targeted approach based on three themes.

1. Farmland birds – with a particular focus on providing over-winter feeding habitats, summer breeding sites and late winter/spring feeding opportunities.

2. Resource protection – specifically protecting water from diffuse pollution.

3. Biodiversity – although farmland birds have been the main policy focus to date, this theme is to ensure that benefits are captured for other plant and mammal species.

The CFE will be promoted through a web-based information 'hub', leaflets and press activity. There will also be training and demonstration events. The campaign is expected to begin this autumn; it will be fully deployed in 2010, and the first targets will be measured in 2011.

Measuring its success

The CFE contains various monitoring mechanisms.

- Statistics on ELS take-up and option mixes will be collected by Natural England.

- Farmers will be encouraged to complete a voluntary record of any non-ELS management activities they are undertaking.

- In addition, the NFU will survey farmers using its call centre. Further information will be gathered through mechanisms such as the Department for Environment, Food and Rural Affairs's (Defra) Farm Practices Survey, and the Farm Business Survey.

In addition to the CFE's own milestones, Hilary Benn has set a number of targets that farmers will have to meet, including the following.

- Doubling the current take-up of infield options under the ELS to 40,000 hectares (Ha).

- Increasing the level of uncropped land by around 20,000 Ha from 2008 levels to 179,000 Ha, and improving the environmental management of at least a third (60,000 Ha) of this land.

- Undertaking voluntary environmental management on an extra 30,000 Ha of other land (i.e. land that is not in the ELS or recorded as GAEC12). The hope is that this figure may be nearer 50,000 Ha.

The industry has until June 2012 to reach these targets, with the understanding that if the voluntary approach fails a compulsory scheme will be adopted.

ANIMAL DISEASE - An update on vaccinating badgers against bovine TB, and Defra's proposals for animal disease cost sharing.

bTB vaccination areas

In the summer edition of the Agricultural bulletin, we reported that a vaccine against bovine tuberculosis (bTB) in badgers would be available for use in England next year. Defra has now announced that vaccination will begin in the worst affected areas of Staffordshire, Herefordshire, Worcestershire, Gloucestershire and Devon as part of its Badger Vaccine Deployment Project. Six areas, of up to 100km² (25,000 acres) each, have been identified.

The project will be funded by Defra, although, once the vaccine is licensed, it will be available outside these areas with the cost met by individuals. It will only be available for use by trained and licensed personnel.

Participation in the project will be voluntary, and it is envisaged that farmers will only need to allow contractors on their land for a few nights each year. Vaccination will begin in summer 2010 and run for at least five years. Defra hopes that farmers will participate for the full five years, but they will be able to reconsider their participation at any time.

Defra will have overall responsibility for the project, although for the first three years the Food and Environment Research Agency (FERA) will manage the project until vaccination has been phased in over all of the six areas and all the contractors have been trained.

Cost sharing group

Defra has already acted on its first proposal in the latest consultation on animal disease cost sharing. The third consultation, which was detailed in the last edition of the Agricultural bulletin, proposed the creation of a new independent body for animal health in England. Defra has already announced that a new advisory group will provide guidance on how best to develop the body, which will oversee responsibility and cost sharing. The advisory group will be chaired by Rosemary Radcliffe, who oversaw the review of the Levy Board.

The group, according to Defra, has been set up after calls from the industry to have a greater say in the development of animal health policy. In making the announcement, Farming Minister Jim Fitzpatrick said that the advisory group should give "a voice to the industry at the earliest stages". But the announcement has split the farming industry.

The NFU has welcomed it as a positive step towards the industry and Government working together but others, including the Tenant Farmers Association, have said that Defra has been presumptuous and quick, hardly having had a chance to consider the responses from the consultation.

MILKING IT - Is dairy farming still profitable?

An illustration of a typical UK dairy farm suggests that milk production should be showing profit again by 2011. Is this realistic?

The economics of dairy farming are currently tight. Several farmers will lose money from milk production this year. However, there are grounds for optimism that profit will return in the future. We use a farm model, produced by Andersons, the Farm Business Consultants, to illustrate.

An illustration: Friesian Farm

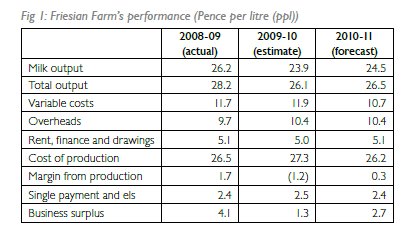

Friesian Farm is a notional 100 Ha holding in the Midlands running 150 cows. It has a liquid milk contract. The table below shows the farm's performance for the 2008-09 year based on actual returns and costs, an estimate for the current 2009-10 year, and a forecast for 2010-11.

2008-09

The profit from production was positive at 1.7 pence per litre (ppl). When support income was added, this produced a healthy business surplus of 4.1ppl. This result was better than forecast a year ago when the figure was thought likely to be 3.6ppl. This is despite the yearly average milk price being lower due to the price cuts of winter and spring. Profits were helped by higher calf and cull values, thanks to better prices in the beef sector. The Single Payment was increased by the weakness of sterling, and costs were lower than forecast – mainly due to cheaper-than-predicted feed prices during the winter.

2009-10

For the current year, the average milk price is expected to be 2.3ppl down. Although Friesian Farm has a liquid contract, the weakness in world and European dairy commodity markets has had an impact on all dairy contracts. Things might have been even worse were it not for currency changes. If the pound had stayed at 2006- 07 levels against the euro, the Intervention Milk Price Equivalent would have been down below 14ppl, rather than the 19ppl that we've seen over the past few months.

Costs are expected to rise on average, compared to last year. Although feed should be cheaper this coming winter, this spring's fertiliser has been more expensive than historically.

Overheads go up for 2008-09, as Friesian Farm is investing £80,000 in water separation and slurry storage to comply with Nitrate Vulnerable Zone regulations. This adds to the cost of production, through depreciation and higher interest charges.

2010-11

Looking to the future, there are tentative signs of recovery in milk prices. The commodity sector is currently still struggling, but by the latter part of 2010 and early 2011 it is hoped that world economic growth will be recovering – leading to better demand and prices.

In the UK, ongoing declining production should help maintain a healthy liquid premium. Friesian Farm's price is forecast to increase by only 0.6ppl yearon- year. There may be scope for greater improvement, but one worry is over the exchange rate; if the pound strengthens further it could check any uplift in UK farmgate prices.

Other income items are predicted to be lower. Slightly weaker beef prices will have an effect on cull and calf values. The Single Payment will also be lower on this farm, even if exchange rates don't move, due to the transition to the English flat-rate payment. As an aside, Friesian Farm will have to decide in 2010 whether to sign-up to another five years in the ELS scheme.

Variable costs are forecast to reduce. The winter of 2010-11 is quite some time away, but on current market trends it looks unlikely that feed prices will be much higher than for the coming winter. Cereals prices are currently looking lower than they have for some years. The bigger issue is over the protein element. The European Union (EU) needs to resolve the issue of genetically modified soya to continue to allow imports from the Americas that the European livestock industry needs.

The big reduction in costs will come if current fertiliser values are maintained until February/March 2010. Overheads are likely to be similar to the current year, although fuel prices may be picking up again by this point. Interest costs could also rise slightly as the UK base rate increases from the current low levels.

All this brings milk production marginally back into profit for 2010-11. However, support is still required to give a realistic return to the business.

The bottom line

The conclusion is that profits from producing milk need to be higher still to instil sufficient confidence for farmers to reinvest for the future.

A BIG BOOST FOR SMALL-SCALE RENEWABLES

A low carbon economy and farming – we look at how the DECC's proposals could bolster small-scale renewable power.

The Department of Energy and Climate Change (DECC) published a raft of documents just before the Summer Recess under the heading of the 'UK Low Carbon Transition Plan'. Among these were a Renewable Energy Strategy and a Consultation on Financial Incentives for Renewable Energy. The measures outlined in the consultation have the potential to provide a big boost to small-scale renewable power, including that on farms and rural estates.

Feed-in Tariffs

The Feed-In Tariffs (FIT) scheme will guarantee a fixed price for renewable electricity from plants under 5MW. There will be a fixed payment for every kW hour of electricity generated – the 'generation tariff'. In addition, a further payment will be made for electricity exported to the grid, the 'export tariff'. Obviously, any power used on site will also reduce the cost of bought-in electricity. The scheme will cover wind, solar photovoltaics, hydro, anaerobic digestion (AD), biomass and biomass combined heat and power (CHP), and non-renewable micro CHP (sub 50kW). It will start from 1 April 2010.

The aim of the FIT scheme is to make the support system simpler for smallscale producers by taking them out of the Renewables Obligation system. It also looks to provide investors in this technology with a reasonable level of return. Every electricity supplier will be required to offer FITs, so, in theory, signing up for these feed-in tariffs should be no more complicated than getting an electricity connection. The FIT payments made will then be redistributed among all licensed electricity suppliers in a central 'levelisation' process.

Renewable heat incentives

At present, road fuels and electricity produced from 'green' sources are supported, but heat is not. This is curious, as half of all energy used in the UK is for heat production. DECC will issue a consultation on support for renewable heat towards the end of 2009. However, the present consultation gives some pointers of what can be expected.

A Renewable Heat Incentive (RHI) is planned to be introduced in April 2011. It will apply to the generation of renewable heat at all scales, whether household, community or industrial. Different levels of support will be provided to different types of technology, and at different scales – i.e. smaller installations may well get greater help. The RHI will cover a wide range of technologies, including biomass, solar hot water, air and ground source heat pumps, biomass CHP, biogas produced from AD and the injection of biomethane into the gas grid.

Many farm-scale technologies have the potential to produce both heat and electricity – for example, AD and biomass CHP plants. These will be able to claim support under both the RHI and FIT.

Anaerobic digestion plan

Continuing on the theme of AD, on 15 July 2009, the Anaerobic Digestion Task group published its recommendations as to what the Government needs to do to boost uptake of AD. 'Actions' that were suggested in the report included introducing FITs and heat incentives, simplifying the regulatory framework for digestate, removing obstacles in the planning process, improving technical performance of AD equipment, and communicating the benefits of AD more widely.

Farming and low carbon

The Low Carbon Transition Plan made reference to the contribution that agriculture can make to reduce greenhouse gas emissions. The main ways that emissions can be reduced are through better fertiliser use, energy efficiency measures, better manure management, and improved livestock breeding and feeding regimes.

RURAL BUSINESSES IN THE SPOTLIGHT

Is your business prepared for HMRC's scrutiny as its spotlight focuses on rural diversification?

HM Revenue & Customs (HMRC) is running a project to create a level rural playing field. HMRC is concerned that many rural taxpayers do not understand their tax obligations and so tax declarations are being made inconsistently across the sector. Together with representative bodies, HMRC has set out to educate and encourage voluntary compliance from rural taxpayers, to make sure that those paying less tax don't benefit at the expense of their more diligent neighbours.

The prospect of an HMRC enquiry is daunting for many businesses, but provided the business is in order, there is nothing to fear. Rural businesses need to be aware that HMRC is focusing on their affairs. Speaking to a professional will help to identify the tax implications for individual cases. After that, it's simply a matter of good housekeeping.

One of the first areas businesses need to look at is the employment of staff. Business owners need to establish whether the people working for them are selfemployed or employees.

There are certain criteria that HMRC will use when determining whether a person is an employee or self-employed, and the distinction will determine who is liable to collect the tax, and the level of National Insurance Contributions (NIC). HMRC considers various tests.

- Is the worker obliged to turn up when the business owner wants him/her to, or when it fits in with the rest of the individual's business activities?

- If the individual has an accident, can he/she simply send someone else in to do the work?

- Is the business owner obliged to provide work for the individual? If it's raining when the individual was due to paint fences, does the owner have a responsibility to find other work or will the individual simply find alternative work from someone else?

- Who bears the risk of the rain? If the individual who was to paint the fence doesn't get paid because the fence hasn't been painted, then he/she bears the risk. If the owner still has to pay him/her, the owner bears all the risk. If the business owner bears all the risk and has to pay the individual for sheltering from the rain, then he/she is an employee.

If the individual who bears all the risk of the vagaries of the weather is paid for painting the fence then they are likely to be self-employed.

There are various other tests to consider and advice should always be sought, as the main risk lies with the 'employer'.

A well run business should have the correct procedures in place. For example, employers need to be sure the correct forms are in place for their employees from the start of the employment through to their departure from the business, and for every instance in between. This includes the employment of students, annual tax and NIC deductions, year-end Pay As Your Earn and NIC returns, and details of benefits and expenses.

The benefits an employee receives is another area frequently reviewed by HMRC. Many businesses could potentially find themselves in hot water if they do not identify the correct treatment for the benefits they provide.

One benefit which rural businesses always need to think about is employee accommodation. The nature of the particular business needs to be considered carefully. If the employee is obliged to live in the property in order to do his/ her job properly, and it is customary in that industry for people to live in a house on site, for example a farm manager, then generally the accommodation will be tax free. However, regardless of whether the accommodation is exempt or not, electricity, heating, TV licences and other expenses met by the employer will always be liable to tax and national insurance.

A BITTER-SWEET DECISION - Pesticides and best practice

The Court of Appeal has overturned a ruling that could have compromised UK farming's ability to apply pesticides.

We reported in the 2008 November Agricultural bulletin on the High Court's ruling in a case brought by Georgina Downs. This found that the UK Government had breached EU rules on safe pesticides application.

The High Court had applied a strict interpretation of the wording of the European Directive, which effectively meant that no pesticide could be used unless it could be established that it had no harmful effect on human health.

The Court of Appeal has taken a much more risk-based approach: "The current risk-based system acknowledges that the danger posed by a substance does not just depend on how toxic it is, but is also affected by how it is used in the real world. An example often used is a cup of coffee: it contains many carcinogens, but levels are low and the body processes them naturally and effectively."

However, it is not quite a case of businessas- usual. Defra has conceded that the rules on applications may need to be tightened up to protect bystanders from pesticides. It plans to consult this autumn on a range of topics, including:

- how to give people access to farmers' records of spraying activity near their properties

- how to give prior notification of spraying activity to residents

- monitoring of how pesticides are being used

- new training requirements for operators

- what else should be included in Defra's National Action Plan.

The results of this consultation may see changes to the Pesticides Code of Practice and an update of the UK Pesticides Strategy. The industry is being urged to adopt best practice in this area, and build on existing schemes such as the NFU's Good Neighbour Initiative.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.