Despite the worldwide financial crisis, Poland still seems to be an attractive place for real estate investments. Moreover, proper structuring of such investment allows for significant tax savings and tax free exit scenarios. In this article, we will address one of a very efficient tax planning idea that may be used for acquisition of real estate in Poland. The idea presented below allows for a tax free disposal of not only an entire real-estate but also parts of a building or single flats as well as achieve tax free renting income.

General rules – corporate income taxation of real estate

Companies are subject to a 19% corporate income tax (CIT). There are no specific rules on the taxation of profits from real estate. For example, renting profit is taxed at a regular rate of 19%. A taxpayer is entitled to reduce taxable revenue by all costs aiming at generating or securing taxable revenues. Generally, in the case of real estate, the most significant costs are depreciation write-offs and interest on loans.

There are no specific regulations related to capital gains. Therefore, a sale of real estate as well as of shares in another company holding real estate triggers taxation on general basis. This means that, for example, a company selling real estate is obliged to recognize taxable income equal to the difference between the sale price and the net value of the sold assets.

Investment fund vehicle

So called, Closed Investment Fund (CIF) is a corporate body that may be enacted by a Investment Management Company (TFI). TFI acts as a management body of the CIF.

CIF issues investment certificates to investors for consideration of cash or assets. Such investment certificates are considered as securities under the Polish law. CIFs are entitled to invest into companies, securities or real estate. However, they are not allowed to carry any business activities. Also, it should be taken into consideration that only 20% CIF's assets may be invested to purchase the shares of one entity (i.e. CIF may acquire up to 100% of shares in at least 5 entities).

CIFs are entities fully exempt from CIT. However, they operations are subject to other taxes like VAT or transfer taxes.

Limited joint stock-partnership

Joint-stock partnership (JSP) is an entity without separate legal personality. However, JSP may carry out business activities and acquire an ownership of assets (including real estate) in its own name. JSP issues shares which are considered as securities under the Polish commercial law. JSP is also considered transparent for the corporate income tax purposes (i.e. partners and shareholders are taxed on their share in JSP's profit).

JSP consists of at least two partners – active partner and a shareholder. Active partner is responsible for all liabilities of the partnership. On the other hand, he is entitled and obliged to manage the partnership. The shareholder is not liable for any of the partnership's debts, however, he has only limited influence on JSP's activities. Both partners – the active one and the shareholder are obliged to contribute to JSP capital and they have right to profit share.

Practical example

Conjunction of CIF and JSP allows running business activities with very limited corporate income taxation. The example below illustrates the possible investment scheme.

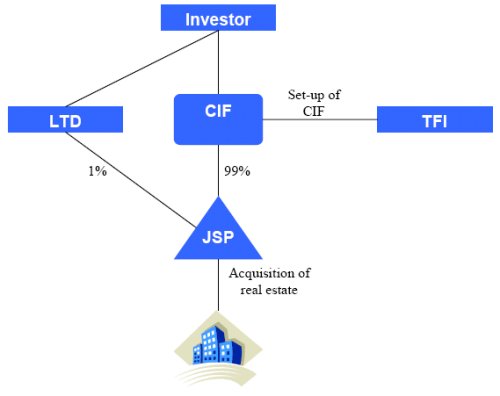

Under this structure, an independent Investment Management Company (TFI) sets up a dedicated CIF for an Investor. The Investor contributes cash to CIF in return for investment certificates. For more significant investments, the set-up of a separate TFI owned by the investor may be considered.

The investor sets-up a limited liability company (LTD) with a minimum share capital (EUR 50,000, equal to approx. EUR 15,000). This LTD is required as an active partner of JSP that will bear all potential liabilities and will manage the JSP on behalf of the Investor). As a next step, LTD – as an active partner – and CIF – as shareholder – set-up JSP. The capital of JSP is covered by LTD (1%) and CIF (99%).

JSP with the acquired funds runs business activities that may consist of purchasing real estate, carrying out developing activities, generating renting income, etc. JSP may finally sell either the entire real estate, a part of it or separate flats.

As mentioned above, JSP is a tax transparent entity. Therefore, income generated by JSP is subject to corporate taxation at the level of CIF and LTD. As CIF is exempt from the corporate income tax, profits of JSP allocated to CIF are tax free (in the example above, 99% of income would be exempt). The income allocated to LTD is taxed at the corporate income tax rate of 19% (in the example above, only 1% of income is taxable).

Exit scenario

Any disposal of assets by CIF (e.g. the sale of shares in JSP) is free of income tax at CIF.

However, a distribution of profits by CIF to the Investor triggers the withholding taxation at the rate of 19%. In the event of investment certificates redemption, the tax is paid on a difference between the historical purchase or acquisition price and the redemption price.

The above allows implementing effective tax planning opportunities of exit scenarios. Namely, under the double tax treaties concluded by Poland, the taxation rights in the case of sale of securities are allocated to the country of the seller's (the Investor's) residence (income from the sale of securities in CIF is not treated as income from real estate, even if the main CIF's activity is investing in real estate). This means that due to the provisions of thr double tax treaties, the income from the sale of investments certificates would not be subject to any tax in Poland. If the Investor is located in the country where capital gains derived from the sale of securities are not taxable, such income would not be taxed at all.

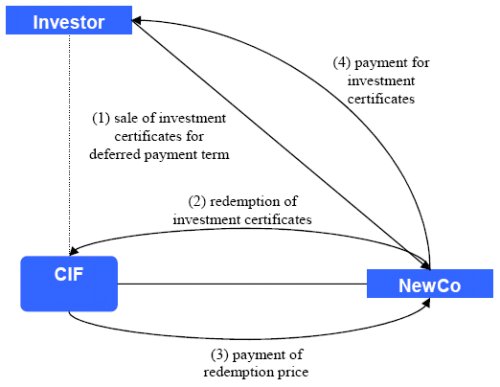

In view of the above, the effective tax planning may be achieved, if the Investor sells investment certificates in CIF to a related entity (NewCo) giving deferred payment terms (please note that the sale of securities may trigger 1% transfer tax in Poland). As a next step, the purchaser would redeem the investment certificates in CIF. In such a case, the tax is payable only on the spread between the redemption price and the purchase price from the Investor (which may be minimal or null assuming CIF's value will not increase). Subsequently, NewCo pays the debt owed to the Investor.

Conclusions and considerations

The above scheme gives effective tax planning opportunities for real estate investments, where effective corporate tax rate may be minimized. On the other hand, effective planning needs also considering other taxes such as VAT and transfer taxes.

It should be also noted that the investment into real estate was given as an example only, as the above scheme gives a wide range of possible activities of JSP (e.g. leasing, trading activities, financial services, etc.).

In practice, the structure described above is used for large investments (usually of the value over EUR 10,000,000). Nevertheless, Polish tax law offers other tax planning ideas that could be utilized also in smaller investments. For example, there is a possibility of step-up in depreciation base of new buildings (e.g. commercial centers). This planning idea will discussed in the following edition of "Into Europe".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.