As we have discussed in previous Tax Updates, auto-enrolment has been a popular topic recently. Between now and the end of 2017, all employers with less than 50 employees (at 30 April 2012) will need to set up a pension scheme for their employees and make employer contributions.

As a business owner you will need to select a suitable scheme for your employees, which is required to meet certain standards prescribed by law, or ensure that any existing schemes are fully compliant.

Many employers were of the misconception that auto-enrolment is simply a pensions issue. In fact, it is also a software and payroll issue. Hence, it is vital to plan well in advance.

How do I comply?

The date at which you must have an eligible scheme operational, and start making contributions, is known as your 'staging date'. This varies between employers, and is based upon your PAYE reference and the number of employees you had at 30 April 2012.

You may have already received a letter from The Pensions Regulator (TPR) informing you of your staging date but, if not, you can find it at:

www.thepensionsregulator.gov.uk/employers/staging-date.aspx

You will need your PAYE reference, which can be found on your yellow PAYE payment booklet, in order to access this information. HMRC give a guide as to where this is found on the gov.uk webpage. Alternatively, please contact your usual UHY adviser, who will be able to assist you in obtaining this information.

If you have more than one PAYE scheme (eg. one left from a previous acquisition or you have schemes for different sites/divisions) then your staging date for both schemes will be the earlier of the two.

There are a number of potential providers available and, as an employer, you will need to choose a pension provider for your employees. This is an area where we would recommend that you study the material provided by TPR and speak to us for professional advice if you have questions.

Once you have set up your scheme, you will need to certify to TPR that you have complied with your responsibilities.

What are the penalties for not doing so?

It is recommended that you commence work on setting up a suitable scheme at least nine months prior to your staging date, due to the administrative burden involved. If a suitable scheme is not operational at this date you will become liable to penalties levied by TPR. These start as a fixed penalty of £400 and can then increase with hefty daily penalties, for further non-compliance.

How do I operate an auto-enrolment scheme?

When you have set up your scheme, you will have the following obligations, amongst others.

You will be required to:

- Identify all eligible employees (this includes certain agency workers).

- Keep records of any workers/employees that have opted out (please note that as the employer you are not permitted to take any action that encourages your employees to opt out of a scheme).

- Periodically re-enrol opted out employees (the employee must therefore take action should he/she wish to opt back out again).

- Monitor employee ages and earnings on an ongoing basis to ensure all eligible employees are identified and automatically enrolled.

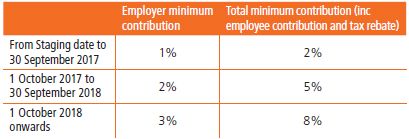

- Ensure that employee and employer contributions are correctly deducted and paid over to the pension provider. Each provider will have their own templates and information requirements for each payment to be correctly allocated. The minimum contribution rates for such schemes are in the table below.

- Communicate with staff on a regular basis regarding the pension arrangements made.

Will there be an impact on my existing software?

The 'automatic' aspect of auto-enrolment pensions will necessitate changes to your software – whether by way of an additional module from your existing payroll supplier or replacement of the entire package. Some companies are providing 'middleware' which sits between your own software and the pension provider's portal, though this is likely to be more cumbersome and less automatic than an integrated package. The important point is to review your software at the start of the process.

The next step

Setting up a new pension scheme is likely to involve additional administration over and above what is involved in your usual payroll preparation, as well as additional cost. TPR has already made it clear that it expects businesses to be fully compliant and to be able to certify as such, and that it is willing to levy substantial penalties on businesses who fail to comply.

In order to minimise the administrative burden and the risk of penalties for non-compliance, it is imperative that you act now to be clear when you are obliged to stage and to set up a suitable scheme. As we recommended earlier, you should allow at least nine months to prepare for your staging date and ensure all administration is completed in time.

For more information on setting up your auto-enrolment scheme, or to discuss the options available to you and to reduce the administrative burden, please speak to your usual UHY adviser.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.