EXECUTIVE SUMMARY

Welcome to this sixth edition of On the Register, an Appleby report that provides statistics and insights about company incorporation activity going on in the major offshore jurisdictions around the globe, where we do the majority of our business.

This report looks at data for the full year 2014, and follows our half-year report published six months ago. There are a number of key themes that emerge from the figures outlined on these pages. In particular:

New companies joining the registers

- The number of new offshore companies being registered has remained steady across the jurisdictions monitored, and is almost identical year-on-year.

- During 2014, Mauritius was the standout offshore jurisdiction for growth of new companies formed, up 20% on 2013's total.

- For the second year running, Seychelles has managed to incorporate more than 20,000 companies annually; of the offshore jurisdictions surveyed, only the BVI has incorporated more than this.

- The British Virgin Islands (BVI) continues to dominate offshore new company registration activity by volume, despite a 5% drop year-on-year. The BVI saw 50,834 new incorporations during the course of 2014, well ahead of its nearest comparator.

Total numbers of active companies on registers

- The total number of active companies on the offshore registers grew very slightly in 2014, up 1% on 2013. With 672,500 companies now registered offshore, we have seen a 7% growth since the recession-induced low point reached in 2009.

- Mauritius continues to lead as the offshore jurisdiction witnessing the fastest growth in total number of companies on its local register, with a 14% increase by the end of 2014. The next biggest growth (4%) came from the Cayman Islands.

- The UK, Hong Kong and China – as onshore comparators – continue to enjoy strong increases, as the global economy strengthens and the number of Asian and European companies being wound up drops. China saw a 19% growth in the number of companies on its register during 2014, while Hong Kong saw 9% and the UK 8% expansion.

- Cayman and Guernsey registries have reached record highs following a post-recession dip, and then a strong bounce back of several years of straight upward growth.

We hope you find the analysis on the following pages useful.

VOLUME OF NEW COMPANIES REGISTERED AND % CHANGE ON PREVIOUS YEAR, 2014

THE COMPANY FORMATION ENVIRONMENT

This report focuses on two key measurements:

- The number of new companies incorporated on a country's Register of Companies over a set period of time;

- The total size of a country's Register of Companies at a point in time. This figure takes into account older companies and the newly incorporated companies but excludes companies that have left the register or been dissolved.

For example: Country X has 10,000 companies on its Register at the end of 2013. Over the next year, 500 new companies are incorporated. However, at the end of 2014, the Register only has 10,300 companies on it. This shows that while 500 new companies joined in the year, 200 companies left.

NEW COMPANY INCORPORATIONS

During the course of 2014, levels of new company registrations have dropped in only two jurisdictions, with the BVI and Isle of Man down 5% and 10% respectively on 2013. There are, however, two clear hot spots of new activity where we see company creation activity looking strong, and those are Cayman and Mauritius. Mauritius led the way for new incorporation activity with a 20% increase over the previous year's total, closely followed by the Cayman Islands at 17%. Most offshore markets outperformed the onshore markets of Hong Kong and the UK, which saw 4% and 7% drop-offs respectively.

In the full year 2014 there were 93,159 new offshore company incorporations, which is almost exactly the same number as seen in 2013.

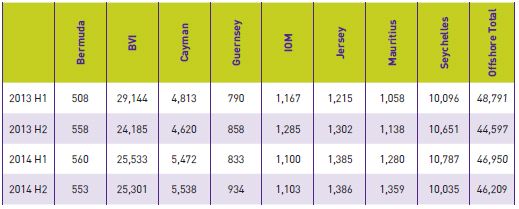

NEW INCORPORATIONS BY HALF YEAR 2013 – 2014

Mainland China remains the world's engine room of new company incorporations, with a 46% increase in new business in 2014 as compared to 2013, and a total of 3,651,000 new companies joining the record last year. Hong Kong, by contrast, saw 4% fewer registrations, with 168,091, after a steady upward trajectory over the preceding five years.

China streamlined its business registration process in March 2014, lifting restrictions on minimum registered capital, payment deadlines, down payment ratio and cash ratio of registered capital in a move aimed at encouraging start-ups and energising the economy. As a side effect, it is likely to have dampened the immediate appeal of Hong Kong as a place to incorporate a Chinese business. It will be interesting to see what effect this rule-change has on the incorporation rates of these two locations going forward.

TOTAL ACTIVE COMPANIES LISTED ON THE REGISTERS

Compared to a year earlier, most of the offshore jurisdictions have reported increases to the number of active companies on their registers of between 1% and 4%. The exceptions are BVI and the Isle of Man, where the number of active companies stayed flat in BVI, and dropped by 1% in the Isle of Man.

In total there are 672,500 companies now registered across Appleby's offshore jurisdictions, some 45,000 more than there were five years ago in the immediate aftermath of the global recession.

TOTAL ACTIVE COMPANIES LISTED ON THE OFFSHORE REGISTERS 2014*

OFFSHORE & SELECTED ONSHORE REGISTRY GROWTH

In most cases, the offshore markets continue to lag behind their onshore counterparts such as the UK, which had 8% more companies on its register by the end of 2014 compared to the previous year. Mauritius remains strong, out-performing growth levels for the UK and Hong Kong with a 14% uptick, similar to the increase seen for China year-on-year, where the register grew by 19%.

To read this Report in full, please click here.

Footnote

* Excluding Seychelles, which does not report the total size of its registry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.