ABC Ltd, a company incorporated and managed in Switzerland and engaged in telecommunication services, is going to invest in Japan. Its Japanese operations will be both manufacturing and providing services. ABC intends to penetrate the Japanese market for telecommunication, and according to some market research carried out before, the operations will be highly profitable within a couple of years.

How to structure ABC's investment in a tax effective manner?

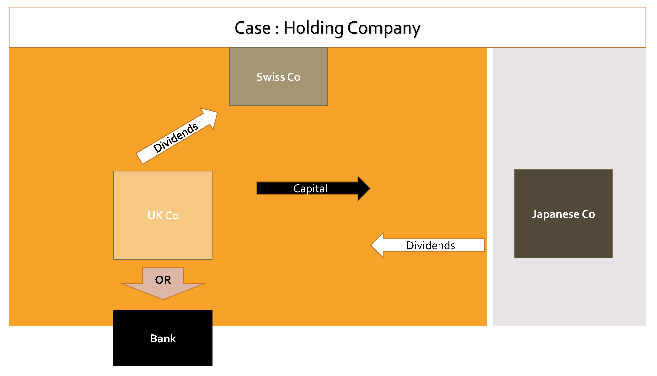

One solution could be:

Dividends paid by the Japanese subsidiary to the UK parent will not trigger Japanese withholding tax. The UK subsidiary will then transfer funds to Swiss parent without paying any withholding tax. Upon receipt of the dividends by the parent in Switzerland, additional Switzerland corporate tax may be due. As an alternative the funds could stay in UK subsidiary.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.